Gold short-term analysis: mainly long on pullback

Core driving factors

Fed policy suppression: Although officials have recently released dovish signals, strong US retail sales and employment data support the expectation of "higher interest rates for longer", limiting the upside of gold.

Risk aversion support: Trump's tariff policy concerns are rising. If the tariff increase is implemented before August, it may stimulate safe-haven buying and push gold prices to break through the range of fluctuations (3300-3366).

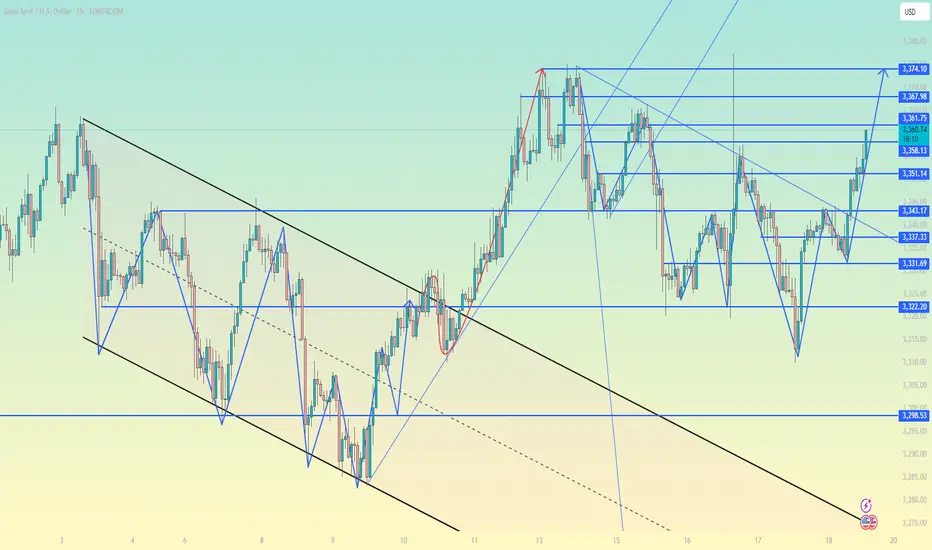

Technical signals

Key breakthrough: 4-hour 3340 middle track, hourly chart breaks through the downward trend line, European session continues to rise, and US session is expected to rise again.

Support/resistance:

Long order entry: 3344-3340 (trend line support + middle track), stop loss below 3335.

Target: 3365-3375, 3400 can be seen after the breakthrough.

Operation strategy

Low-to-long: Stabilize near 3344 and go long, strictly stop loss 3335.

Beware of risks: If the U.S. data is stronger than expected (such as PPI, hawkish speech by the Federal Reserve), it may suppress gold prices and we need to guard against false breakthroughs.

Core driving factors

Fed policy suppression: Although officials have recently released dovish signals, strong US retail sales and employment data support the expectation of "higher interest rates for longer", limiting the upside of gold.

Risk aversion support: Trump's tariff policy concerns are rising. If the tariff increase is implemented before August, it may stimulate safe-haven buying and push gold prices to break through the range of fluctuations (3300-3366).

Technical signals

Key breakthrough: 4-hour 3340 middle track, hourly chart breaks through the downward trend line, European session continues to rise, and US session is expected to rise again.

Support/resistance:

Long order entry: 3344-3340 (trend line support + middle track), stop loss below 3335.

Target: 3365-3375, 3400 can be seen after the breakthrough.

Operation strategy

Low-to-long: Stabilize near 3344 and go long, strictly stop loss 3335.

Beware of risks: If the U.S. data is stronger than expected (such as PPI, hawkish speech by the Federal Reserve), it may suppress gold prices and we need to guard against false breakthroughs.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.