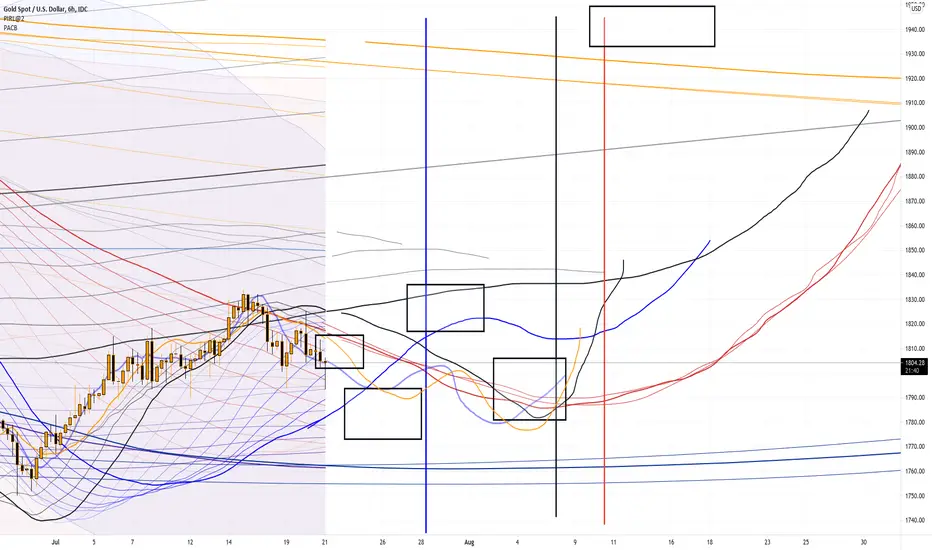

THERE ARE 3 UPCOMING EVENTS THAT ARE EXTREMELY CRUCIAL TO THE TIMING OF THIS SPIKE.

Notes:

1. Blue vertical line is FOMC, 7/28.

2. Black line is NFP, 8/6.

3. Red line is CPI, 8/11.

4. First of all, there may or may not be another mini spike before we go down to my expectation of a low PRIOR TO 7/28 FOMC.

5. Therefore, high AFTER 7/28-8/1.

6. In the unlikely case that a high (1825-ish) happens before FOMC, then FOMC would be rug pull (THIS IS A GIANT WRENCH IN OUR PLANS).

7. However unlikely it may be, IN THIS CASE WE WOULD HAVE TO REASSESS FED FUNDAMENTALS bc that implies a REAL CHANGE IN MONETARY POLICY.

8. If the swing happen like I am expecting (LOW PRIOR TO FOMC, SPIKE ON FOMC), there SHOULD BE another relative low PRIOR TO NFP.

9. This would be the last chance for a STRONG ENTRY.

10. For those that are ultra conservative, and want to see price action after NFP...

>>IT IS HIGHLY RECOMMENDED TO TAKE THE ENTRY PRIOR TO CPI (WHICH IS 8/11) ON 8/9 OR 8/10 (BC 8/7 AND 8/8 IS A WEEKEND).

11. As it stands target is 1925-1950 by 8/18.

12. Again for the purpose of our 50-100x trade plan, please do not buy options UNTIL I SPECIFICALLY ANNOUNCE IT.

13. I have a change of mind in term of acceptable risk for pre-FOMC entries.

14. It should be only 1 ENTRY, 50% OF FUNDS, AT THE MONEY, JAN XX, 2022 EXPIRATION, we will buy either 7/26 or 7/27.

15. This eliminates shenanigans risk that have tendency to to occur around MAJOR INFLECTION POINTS LIKE THE NEXT 2 WEEKS.

16. ALL FOR NOW.

Notes:

1. Blue vertical line is FOMC, 7/28.

2. Black line is NFP, 8/6.

3. Red line is CPI, 8/11.

4. First of all, there may or may not be another mini spike before we go down to my expectation of a low PRIOR TO 7/28 FOMC.

5. Therefore, high AFTER 7/28-8/1.

6. In the unlikely case that a high (1825-ish) happens before FOMC, then FOMC would be rug pull (THIS IS A GIANT WRENCH IN OUR PLANS).

7. However unlikely it may be, IN THIS CASE WE WOULD HAVE TO REASSESS FED FUNDAMENTALS bc that implies a REAL CHANGE IN MONETARY POLICY.

8. If the swing happen like I am expecting (LOW PRIOR TO FOMC, SPIKE ON FOMC), there SHOULD BE another relative low PRIOR TO NFP.

9. This would be the last chance for a STRONG ENTRY.

10. For those that are ultra conservative, and want to see price action after NFP...

>>IT IS HIGHLY RECOMMENDED TO TAKE THE ENTRY PRIOR TO CPI (WHICH IS 8/11) ON 8/9 OR 8/10 (BC 8/7 AND 8/8 IS A WEEKEND).

11. As it stands target is 1925-1950 by 8/18.

12. Again for the purpose of our 50-100x trade plan, please do not buy options UNTIL I SPECIFICALLY ANNOUNCE IT.

13. I have a change of mind in term of acceptable risk for pre-FOMC entries.

14. It should be only 1 ENTRY, 50% OF FUNDS, AT THE MONEY, JAN XX, 2022 EXPIRATION, we will buy either 7/26 or 7/27.

15. This eliminates shenanigans risk that have tendency to to occur around MAJOR INFLECTION POINTS LIKE THE NEXT 2 WEEKS.

16. ALL FOR NOW.

Note

*** IF ALL WORK OUT, WE EXIT THE JAN 2022 OPTIONS ON 7/30 OR 8/2, PROBABLY 7/30. THE EXTRA FUNDS WOULD BE USED FOR INSURANCE SHOULD OUR POST-NFP PLANS DON'T WORK OUT. ***Note

*** IT IS MY EXPECTATION THAT ALL THIS WORK OUT AS PLANNED. I HAVE ZERO REASON TO BELIEVE OTHERWISE AT THIS POINT IN TIME. ***Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.