Analyzing the provided charts for Gold Spot (XAUUSD) across multiple timeframes, we observe a consistent pattern of institutional activity and market structure. Starting from the daily (1D) chart, there is a clear uptrend with recent bullish momentum, indicating a phase of accumulation and upward pressure. The 4-hour (4H) and 1-hour (1H) charts show a continuation of this bullish sentiment with recent pullbacks likely serving as liquidity hunts to gather more buy-side interest.

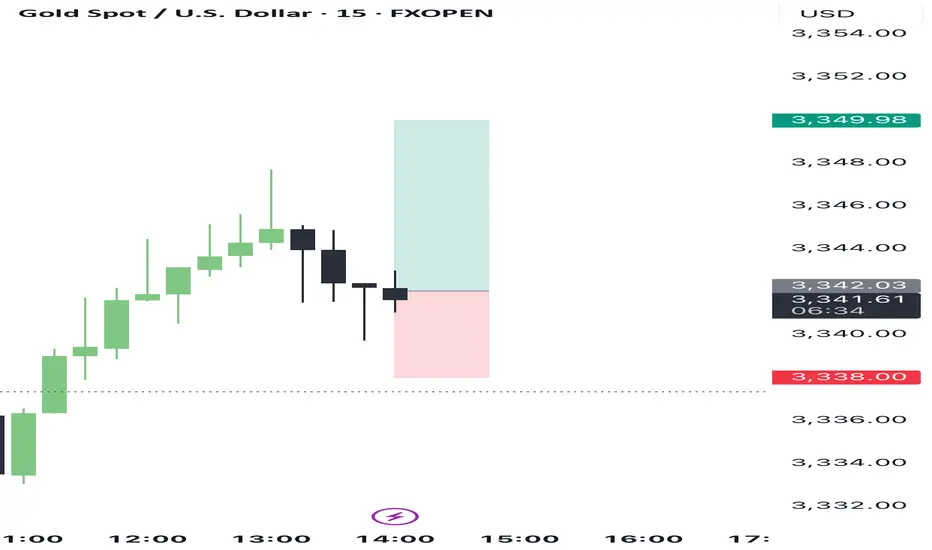

The 15-minute (15M), 5-minute (5M), and 1-minute (1M) charts provide a granular view of the intraday price action, revealing short-term volatility and retracements, which are typical in scenarios where institutions are actively managing positions and possibly accumulating on minor pullbacks.

INSTITUTIONAL THESIS:

Institutions appear to be in an accumulation phase, using pullbacks to engineer liquidity before continuing the bullish trend. The recent price action across all timeframes suggests a preparation for a further upward move, targeting previous highs and possibly extending new highs.

LEARNING POINT:

The current setup exemplifies "Intraday Order Block Mitigation" where minor pullbacks to key intraday levels are used by institutions to accumulate positions before continuing the trend.

SIGNAL: BUY

SYMBOL: XAUUSD

ENTRY PRICE: $3,341.85

STOP LOSS: $3,338.00

TARGET PRICE: $3,350.00

CONDITION: Buy limit order at $3,341.85 following a minor pullback confirming a continuation of bullish momentum.

RATIONALE:

Market Structure: Bullish continuation on daily and intraday timeframes.

Order Blocks: Entry near recent intraday mitigation block.

Liquidity: Entry after pullback suggests absorption of sell-side liquidity.

Momentum: Consistent bullish candles indicating strong buying pressure.

STRATEGIES USED: Intraday OB Mitigation, Accumulation Phase Trading

URGENCY: MEDIUM

TIMEFRAME: Short-term

CONFIDENCE SCORE: 85%

RISK/REWARD RATIO: Risk=$3.85, Reward=$8.15, Ratio=1:2.1

Risk Calculation:

Risk = Entry Price - Stop Loss = $3,341.85 - $3,338.00 = $3.85

Reward Calculation:

Reward = Target Price - Entry Price = $3,350.00 - $3,341.85 = $8.15

Ratio Calculation:

Ratio = Reward ÷ Risk = $8.15 ÷ $3.85 ≈ 2.12

Given the calculated risk/reward ratio of approximately 1:2.12, this trade setup is valid and adheres to the minimum 2:1 criterion. The trade is recommended based on the current market structure, institutional activity, and favorable risk/reward balance.

The 15-minute (15M), 5-minute (5M), and 1-minute (1M) charts provide a granular view of the intraday price action, revealing short-term volatility and retracements, which are typical in scenarios where institutions are actively managing positions and possibly accumulating on minor pullbacks.

INSTITUTIONAL THESIS:

Institutions appear to be in an accumulation phase, using pullbacks to engineer liquidity before continuing the bullish trend. The recent price action across all timeframes suggests a preparation for a further upward move, targeting previous highs and possibly extending new highs.

LEARNING POINT:

The current setup exemplifies "Intraday Order Block Mitigation" where minor pullbacks to key intraday levels are used by institutions to accumulate positions before continuing the trend.

SIGNAL: BUY

SYMBOL: XAUUSD

ENTRY PRICE: $3,341.85

STOP LOSS: $3,338.00

TARGET PRICE: $3,350.00

CONDITION: Buy limit order at $3,341.85 following a minor pullback confirming a continuation of bullish momentum.

RATIONALE:

Market Structure: Bullish continuation on daily and intraday timeframes.

Order Blocks: Entry near recent intraday mitigation block.

Liquidity: Entry after pullback suggests absorption of sell-side liquidity.

Momentum: Consistent bullish candles indicating strong buying pressure.

STRATEGIES USED: Intraday OB Mitigation, Accumulation Phase Trading

URGENCY: MEDIUM

TIMEFRAME: Short-term

CONFIDENCE SCORE: 85%

RISK/REWARD RATIO: Risk=$3.85, Reward=$8.15, Ratio=1:2.1

Risk Calculation:

Risk = Entry Price - Stop Loss = $3,341.85 - $3,338.00 = $3.85

Reward Calculation:

Reward = Target Price - Entry Price = $3,350.00 - $3,341.85 = $8.15

Ratio Calculation:

Ratio = Reward ÷ Risk = $8.15 ÷ $3.85 ≈ 2.12

Given the calculated risk/reward ratio of approximately 1:2.12, this trade setup is valid and adheres to the minimum 2:1 criterion. The trade is recommended based on the current market structure, institutional activity, and favorable risk/reward balance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.