Fundamentals:

The positive signals from the China-US negotiations have eased the market's concerns about the US economic recession, and the weakening of risk aversion has stimulated a sharp pullback in gold. Market funds are no longer eager to seek safe-haven assets, so they withdraw their funds from gold and turn to risk markets.

Technical aspects:

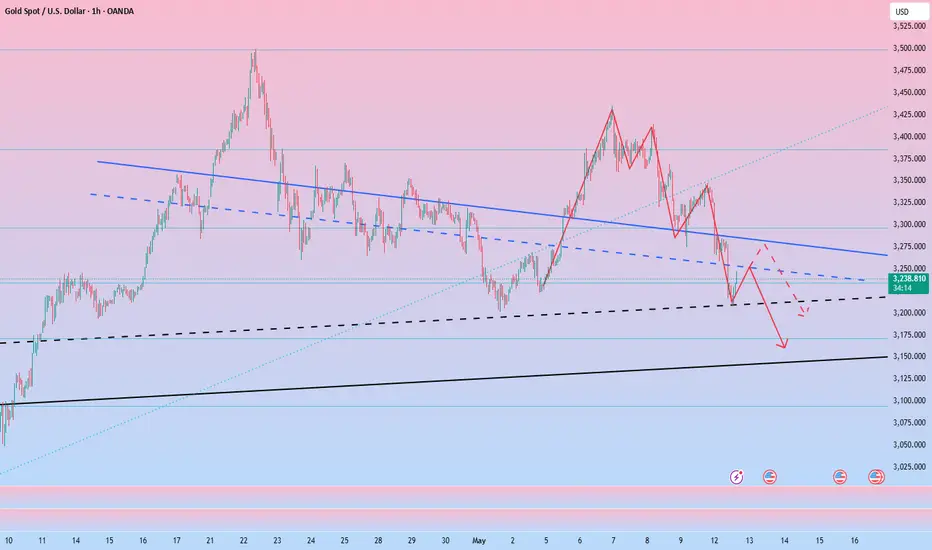

The gold price plummeted by $110 during the day. Although it has rebounded slightly at present, the overall rebound momentum is relatively weak. The upper 3280-3290 area is currently the main short-term suppression level, followed by the 3240-3250 area. If the rebound in this area is not broken, you can continue to short gold, and the shorts may continue to reach new lows; focus on the support of the 3200 mark below. If 3200 is not broken, then the bulls may try to counterattack and fill the upper gap; if gold falls below 3200, gold will continue to fall to the area around 3170.

Trading strategy:

1. Consider shorting gold after it rebounds to the 3245-3255 area, TP: 3220

2. Consider going long on gold after it continues to fall to the 3180-3170 area, TP: 3220;

3. If gold stabilizes above 3200, we can consider going long on gold around 3200 in advance.

The positive signals from the China-US negotiations have eased the market's concerns about the US economic recession, and the weakening of risk aversion has stimulated a sharp pullback in gold. Market funds are no longer eager to seek safe-haven assets, so they withdraw their funds from gold and turn to risk markets.

Technical aspects:

The gold price plummeted by $110 during the day. Although it has rebounded slightly at present, the overall rebound momentum is relatively weak. The upper 3280-3290 area is currently the main short-term suppression level, followed by the 3240-3250 area. If the rebound in this area is not broken, you can continue to short gold, and the shorts may continue to reach new lows; focus on the support of the 3200 mark below. If 3200 is not broken, then the bulls may try to counterattack and fill the upper gap; if gold falls below 3200, gold will continue to fall to the area around 3170.

Trading strategy:

1. Consider shorting gold after it rebounds to the 3245-3255 area, TP: 3220

2. Consider going long on gold after it continues to fall to the 3180-3170 area, TP: 3220;

3. If gold stabilizes above 3200, we can consider going long on gold around 3200 in advance.

Trade active

Today's first transaction has been completed. Although the lowest price of gold only fell back to around 3207 and started to rebound before it touched 3200, so I did not go long gold in time. However, the highest price of gold has just rebounded to around 3247, reaching the short selling target as scheduled : 3245-3255 area; I just shorted gold above 3245 as planned, and just chose to close the position manually near 3234. Our first transaction today continued to end with a profit, continuing our winning streak!Trade closed: target reached

Gold is relatively calm at present, but as gold rebounds, a certain support strength has been revealed below; and the negative news in the short term has already appeared, and gold needs to rebound at the technical level. So I think we can try to go long on gold in the 3235-3225 area, and expect gold to continue to rebound to the 3250-3260 area, or even the 3280-3290 area.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.