Gold 11/07 - Bullish Trend Confirmed

📰 Fundamental News:

The world's largest gold ETF, SPDR Gold Trust, has increased its holdings by 1.44 tonnes compared to the previous day, bringing the total holdings to 948.81 tonnes.

The market anticipates a higher possibility of rate cuts in September, though this has not yet been fully priced in.

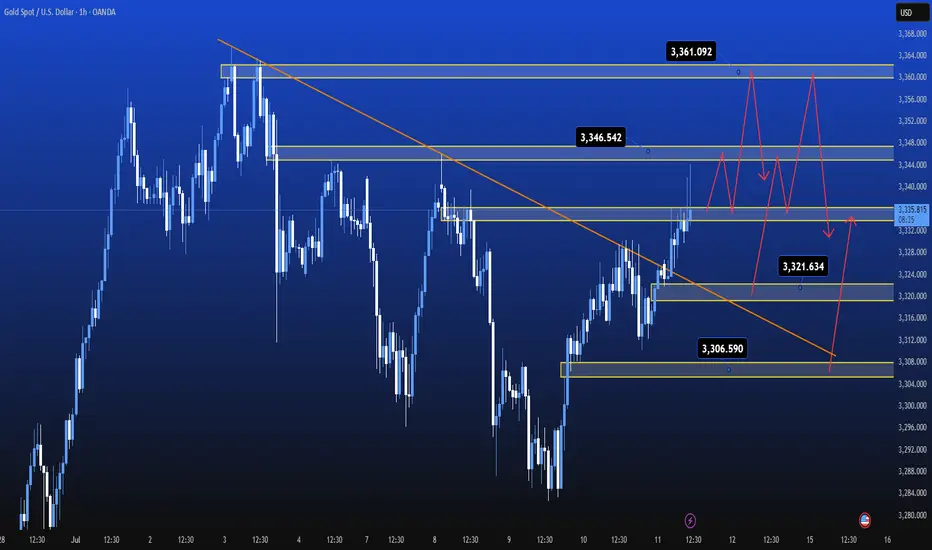

Gold has broken through the trendline, confirming that the current bullish trend remains strong. There are no signs of a pullback to take liquidity during today’s Asian session, indicating strong buying pressure. Our strategy is to continue buying in areas with lower liquidity and to look for scalping sell opportunities when price reaches key Fibonacci Extension levels.

📉 Technical Analysis:

Gold continues to show strength by breaking through the trendline, further confirming the strong bullish momentum. There has been no significant pullback during the Asian session, indicating that buying pressure remains intact. Our strategy is to continue buying in areas with lower liquidity and to scout for scalping sell opportunities at Fibonacci Extension levels.

🔻 Key Support and Resistance Levels:

Resistance: 3322 – 3337 – 3345 – 3356

Support: 3315 – 3302 – 3290

🎯 Trade Scenarios:

🔵 Buy:

Entry: 3319 – 3322

Stop Loss (SL): 3315

Take Profit (TP): 3322 – 3337 – 3345 – 3356

Entry: 3306 – 3308

Stop Loss (SL): 3302

Take Profit (TP): 3317 – 3322 – 3337 – 3356

🔴 Sell:

Entry: 3345 – 3347

Stop Loss (SL): 3351

Take Profit (TP): 3340 – 3322

Entry: 3360 – 3362

Stop Loss (SL): 3366

Take Profit (TP): 3356 – 3340 – 3322

⚠️ Note:

With the current strong bullish trend, maintaining a buy strategy at lower price levels and scalping at key Fibonacci Extension levels will help maximise profits. Ensure to monitor key support and resistance levels to protect profits and manage risk.

Wishing you successful trading this weekend!

📰 Fundamental News:

The world's largest gold ETF, SPDR Gold Trust, has increased its holdings by 1.44 tonnes compared to the previous day, bringing the total holdings to 948.81 tonnes.

The market anticipates a higher possibility of rate cuts in September, though this has not yet been fully priced in.

Gold has broken through the trendline, confirming that the current bullish trend remains strong. There are no signs of a pullback to take liquidity during today’s Asian session, indicating strong buying pressure. Our strategy is to continue buying in areas with lower liquidity and to look for scalping sell opportunities when price reaches key Fibonacci Extension levels.

📉 Technical Analysis:

Gold continues to show strength by breaking through the trendline, further confirming the strong bullish momentum. There has been no significant pullback during the Asian session, indicating that buying pressure remains intact. Our strategy is to continue buying in areas with lower liquidity and to scout for scalping sell opportunities at Fibonacci Extension levels.

🔻 Key Support and Resistance Levels:

Resistance: 3322 – 3337 – 3345 – 3356

Support: 3315 – 3302 – 3290

🎯 Trade Scenarios:

🔵 Buy:

Entry: 3319 – 3322

Stop Loss (SL): 3315

Take Profit (TP): 3322 – 3337 – 3345 – 3356

Entry: 3306 – 3308

Stop Loss (SL): 3302

Take Profit (TP): 3317 – 3322 – 3337 – 3356

🔴 Sell:

Entry: 3345 – 3347

Stop Loss (SL): 3351

Take Profit (TP): 3340 – 3322

Entry: 3360 – 3362

Stop Loss (SL): 3366

Take Profit (TP): 3356 – 3340 – 3322

⚠️ Note:

With the current strong bullish trend, maintaining a buy strategy at lower price levels and scalping at key Fibonacci Extension levels will help maximise profits. Ensure to monitor key support and resistance levels to protect profits and manage risk.

Wishing you successful trading this weekend!

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.