📌 Core view: Strong shock, mainly low-long

✅ Trend direction: Bullish in the short term, obvious technical bullish signals, and optimistic market sentiment.

✅ Key support/resistance:

Support level: 3375 (breakthrough to support), 3360 (strong support).

Resistance level: 3400 (psychological barrier), 3430 (this week's target).

🔍 News analysis

Positive factors:

Weak US dollar: The US dollar index fell, boosting the attractiveness of gold.

Safe-haven demand: Geopolitical and economic uncertainties support gold prices.

Potential risks:

If the US dollar rebounds or market risk appetite picks up, gold may be under short-term pressure.

📊 Technical analysis

1. Daily level

Moving average system: MA5-MA10 golden cross, prices stand firm on the short-term moving average, indicating that bulls are dominant.

MACD: The upward momentum column is enlarged, the fast and slow lines are golden crosses, and the upward momentum is enhanced.

KDJ: Diverging upward, not overbought, and there is still room for upward movement.

Trend judgment: Overall bullish, target 3400-3430.

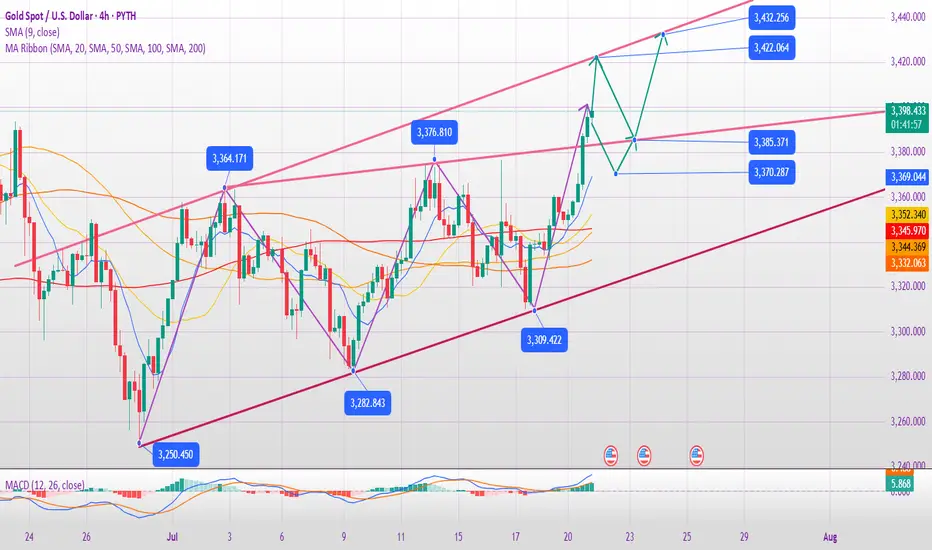

2. 4-hour level

Bollinger Bands: The upper rail opens upward, and the price runs along the upper rail, showing strength.

MACD: The golden cross continues, the momentum column is enlarged, and the buying power is sufficient.

Moving average arrangement: MA5/MA10 golden cross, supporting the upward price.

Short-term key position: 3375 (turned into support after breaking through).

3. 1-hour level

Moving average support: The price always runs above MA20, and the short-term callback is limited.

Momentum indicator: KDJ is blunted at a high level, and short-term corrections need to be vigilant, but the trend has not changed.

🎯 Trading strategy for today

🔵 Main strategy: long on pullback

Ideal entry point:

3370-3375 (breakthrough to support range).

3360 (strong support, more stable).

Target: 3390→3400→3430 (take profit in batches).

Stop loss: below 3360 (prevent false breakthrough).

🔴 Secondary strategy: chase long on breakthrough (aggressive)

Condition: After the price stabilizes at 3400, follow up with a light position.

Target: 3430, stop loss 3385.

⚡ Risk warning

If it falls below 3360, the short-term may turn to shock and the strategy needs to be adjusted.

Pay attention to US market data and the trend of the US dollar.

📌 Summary

Trend: short-term bullish, mainly low-long, pay attention to the breakthrough of the 3375-3400 range.

Key risk control: 3360 is the watershed between long and short, and wait and see if it falls below.

(⚠️ Reminder: Market volatility intensifies, strictly stop loss, avoid heavy positions!)

Trade active

Gold intraday trading analysis and trading strategy (July 22)

📌 Current market background

Weakened US dollar + falling US bond yields → Support short-term strength in gold prices.

Uncertainty in the trade situation (negotiation deadline approaching on August 1) → Risk aversion is rising, and gold benefits.

Technical aspect: Yesterday's big positive line broke through the key resistance of 3375-3380, but there is still pressure at the 3400 mark. It rose and fell in the early trading, indicating that it may enter a shock correction in the short term.

📊 Technical Analysis & Key Points

1. Support and Resistance

✅ Key Support:

3380-3385 (4-hour middle rail + trend line support)

3375 (top and bottom conversion position, if it falls below, it may fall back to 3360-3370)

3350-3360 (Daily MA5 support, strong defense zone)

✅ Key Resistance:

3400-3405 (psychological barrier, if it breaks through, it will look at 3420-3430)

3420-3425 (4-hour upper rail pressure)

3430-3435 (channel upper edge, strong pressure zone)

2. Trend Judgment

Short-term trend: more shocks, but beware of callbacks before 3400 is effectively broken.

Key Observation Points:

If it stands firmly at 3380-3385 → it may attack 3400 again.

If it falls below 3375 → it may fall back to 3360-3370, but the overall trend is still expected to fluctuate upward.

📌 Today's trading strategy

🔵 Low-to-long opportunity (main idea)

3385-3387 light position long (4-hour trend support)

Stop loss: below 3380

Target: 3400 → 3410 (breakthrough to see 3420)

Logic: Short-term correction is in place, 3380-3385 support is effective, and the US market rebound can be betted.

3365-3370 steady long (daily MA5 support)

Stop loss: 3355

Target: 3385 → 3400

Logic: If it falls back deeply, it is still an opportunity to buy low, and 3350 is not broken and still expected to fluctuate upward.

🔴 High-altitude opportunity (auxiliary strategy)

3417-3420 short (4-hour upper rail pressure)

Stop loss: 3425

Target: 3400 → 3385

Logic: The pressure above 3400 is obvious, and you can try to pull back the short position for the first time.

3430-3435 band short (strong pressure on the upper edge of the channel)

Stop loss: 3440

Target: 3410 → 3390

Logic: If it is extremely pulled up, you can arrange a band pullback.

⚠️ Risk warning

If it directly breaks through 3400 and stands firm → Give up the short position, and chase the long position when it falls back to 3390-3395, with a target of 3420-3430.

If it falls below 3375 → Short-term weakness, pay attention to the support of 3360-3370, and then go long after stabilization.

The key to the trend of the US market: If it cannot break below 3380, it may rise directly.

📌 Summary

✅ Main strategy: 3385-3387 low long, stop loss 3380, target 3400-3410.

✅ Alternative strategies:

3365-3370 long (stable)

3420 short short (first touch)

3430 short (extreme pull-up)

⚠️ Note: Gold is still in a volatile upward structure, but before 3400 is effectively broken, avoid blindly chasing highs, and wait for a pullback to buy lows.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.