✅ Technical Analysis:

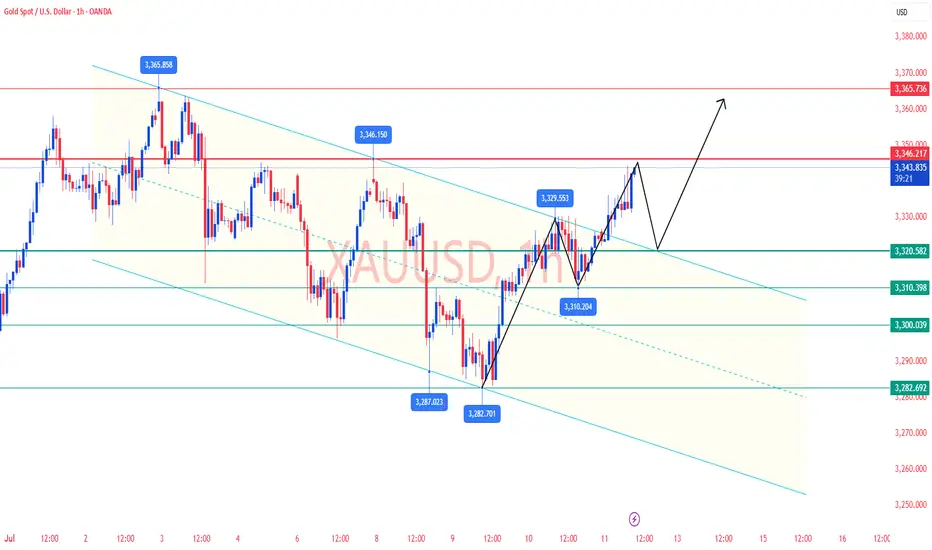

🔸Gold is currently trading within the 3310–3346 range, with a short-term bias toward the upside. After testing 3310 twice yesterday, prices rebounded quickly, indicating strong buying interest below. If the European session sees a breakout and stabilization above 3330, further upside toward 3346 or even 3365 is possible. However, if prices fail and drop below 3310, gold may return to a weaker structure and head toward the 3282–3280 support zone.

🔸 On the 4-hour chart, gold is holding above the middle Bollinger Band, signaling a mildly bullish tone. The Bollinger Bands are narrowing, suggesting a potential breakout toward the upper band. On the 1-hour chart, moving averages are turning upward, breaking the previous downtrend. A candle close above 3330 limits downside correction and offers room for further gains.

🔴 Key Resistance Levels: 3345 / 3365

🟢 Key Support Levels: 3310 / 3300 /3282

⚠️ Key Inflection Level: 3330 (Short-term bullish/bearish pivot)

✅ Intraday Strategy Reference:

🔰If gold breaks and holds above $3330 during the European session, aggressive traders may enter light long positions targeting 3346–3365, with a stop loss at 3315.

🔰If prices face resistance around 3345–3346, consider short entries, with a stop above 3350 and targets back to 3315–3307.

🔰If the 3310 support fails, gold may turn bearish, with downside targets at 3282–3275.

🔰Conservative traders can consider entering long around 3315 with a stop loss at 3307, targeting 3345.

✅ Gold is currently at the tail end of a consolidation range and may soon break out of key technical levels. Traders are advised to control position sizes, remain flexible, and closely monitor U.S. dollar movements, Fed-related statements, and geopolitical developments for potential impacts on gold prices. For real-time trading signals and personalized guidance, feel free to contact me for one-on-one support.

🔸Gold is currently trading within the 3310–3346 range, with a short-term bias toward the upside. After testing 3310 twice yesterday, prices rebounded quickly, indicating strong buying interest below. If the European session sees a breakout and stabilization above 3330, further upside toward 3346 or even 3365 is possible. However, if prices fail and drop below 3310, gold may return to a weaker structure and head toward the 3282–3280 support zone.

🔸 On the 4-hour chart, gold is holding above the middle Bollinger Band, signaling a mildly bullish tone. The Bollinger Bands are narrowing, suggesting a potential breakout toward the upper band. On the 1-hour chart, moving averages are turning upward, breaking the previous downtrend. A candle close above 3330 limits downside correction and offers room for further gains.

🔴 Key Resistance Levels: 3345 / 3365

🟢 Key Support Levels: 3310 / 3300 /3282

⚠️ Key Inflection Level: 3330 (Short-term bullish/bearish pivot)

✅ Intraday Strategy Reference:

🔰If gold breaks and holds above $3330 during the European session, aggressive traders may enter light long positions targeting 3346–3365, with a stop loss at 3315.

🔰If prices face resistance around 3345–3346, consider short entries, with a stop above 3350 and targets back to 3315–3307.

🔰If the 3310 support fails, gold may turn bearish, with downside targets at 3282–3275.

🔰Conservative traders can consider entering long around 3315 with a stop loss at 3307, targeting 3345.

✅ Gold is currently at the tail end of a consolidation range and may soon break out of key technical levels. Traders are advised to control position sizes, remain flexible, and closely monitor U.S. dollar movements, Fed-related statements, and geopolitical developments for potential impacts on gold prices. For real-time trading signals and personalized guidance, feel free to contact me for one-on-one support.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.