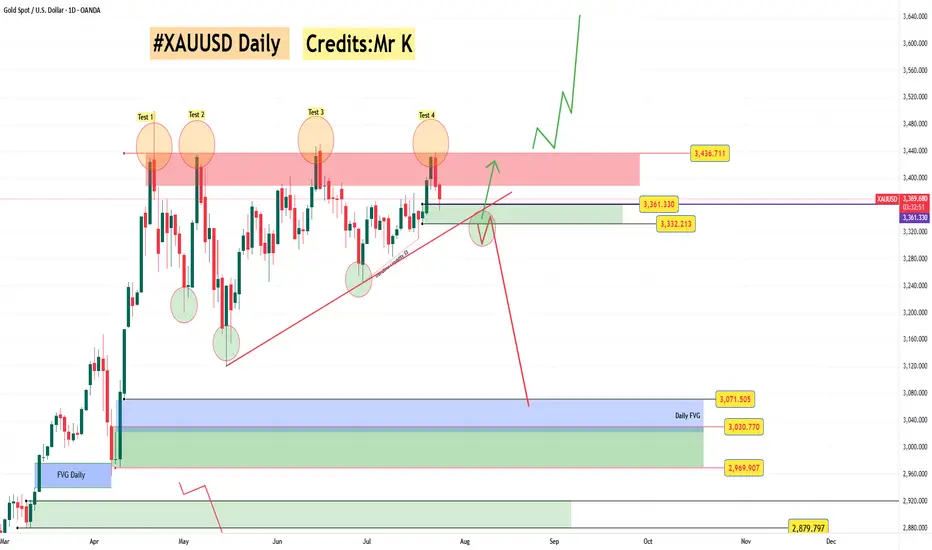

📊 **#XAUUSD – Daily Higher Time Frame Analysis**

🕵️♂️ On the **daily chart**, gold has consistently **failed to sustain above the 3450 zone**, with **no daily candle closing** above this key level.

📉 In fact, price has faced **rejection from 3450 nearly 5 times**, each followed by **strong selling pressure**.

🔄 However, from the **second rejection onwards**, price has been forming **higher lows**, indicating underlying **bullish structure** and is currently **respecting the daily trendline**.

📌 **Today’s H6 demand zone**, already marked in our analysis, acted as a **strong support**, triggering a bounce. This zone is part of the **daily demand area** — so **today’s daily candle close will be crucial**.

---

🔻 **Bearish Scenario**:

* If price **fails to hold** and **closes below 3360**, we may enter a **bearish phase** on the higher timeframe.

* Below **3360–3330**, there is **no major daily support**, so a **weekly close below 3330** could trigger a **sharp drop toward 3071–3000**.

---

🔺 **Bullish Scenario**:

* On the flip side, **price is showing rejection** from support and if we get a **bullish H4 or H6 close above 3400**, we may see a move back toward **3450**.

* Notably, the **3450 level has been tested 4 times**. Any level tested more than 3 times becomes **weaker**, increasing the **likelihood of a breakout** on the next attempt.

🎯 **Swing Trading Plan**:

If we get a **fully bullish H4 candle close above 3400**, we will look to enter a **buy trade**.

📍 *Stop loss and target will be shared upon setup activation.*

📅 **Stay alert!** Today's daily close will set the tone for the next big move.

🕵️♂️ On the **daily chart**, gold has consistently **failed to sustain above the 3450 zone**, with **no daily candle closing** above this key level.

📉 In fact, price has faced **rejection from 3450 nearly 5 times**, each followed by **strong selling pressure**.

🔄 However, from the **second rejection onwards**, price has been forming **higher lows**, indicating underlying **bullish structure** and is currently **respecting the daily trendline**.

📌 **Today’s H6 demand zone**, already marked in our analysis, acted as a **strong support**, triggering a bounce. This zone is part of the **daily demand area** — so **today’s daily candle close will be crucial**.

---

🔻 **Bearish Scenario**:

* If price **fails to hold** and **closes below 3360**, we may enter a **bearish phase** on the higher timeframe.

* Below **3360–3330**, there is **no major daily support**, so a **weekly close below 3330** could trigger a **sharp drop toward 3071–3000**.

---

🔺 **Bullish Scenario**:

* On the flip side, **price is showing rejection** from support and if we get a **bullish H4 or H6 close above 3400**, we may see a move back toward **3450**.

* Notably, the **3450 level has been tested 4 times**. Any level tested more than 3 times becomes **weaker**, increasing the **likelihood of a breakout** on the next attempt.

🎯 **Swing Trading Plan**:

If we get a **fully bullish H4 candle close above 3400**, we will look to enter a **buy trade**.

📍 *Stop loss and target will be shared upon setup activation.*

📅 **Stay alert!** Today's daily close will set the tone for the next big move.

K

Join Our Free Telegram Group

t.me/MrKCharts

If You Need Personalized SIgnals Specilaized With 2:1 RR for Propfirm Than Dm Us At t.me/Kseljuk

Join Our Free Telegram Group

t.me/MrKCharts

If You Need Personalized SIgnals Specilaized With 2:1 RR for Propfirm Than Dm Us At t.me/Kseljuk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

K

Join Our Free Telegram Group

t.me/MrKCharts

If You Need Personalized SIgnals Specilaized With 2:1 RR for Propfirm Than Dm Us At t.me/Kseljuk

Join Our Free Telegram Group

t.me/MrKCharts

If You Need Personalized SIgnals Specilaized With 2:1 RR for Propfirm Than Dm Us At t.me/Kseljuk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.