XAUUSD 09/07–Gold Faces Uncertainty Ahead of FOMC Rate Decision

📰 Key News:

Morgan Stanley: The minutes of the Fed meeting may highlight increasing divisions within the committee. The recent dot plot indicates a clear divide within the Federal Reserve.

Citi: The minutes of the Fed meeting could suggest that the threshold for interest rate cuts is lowering. Citi analysts believe the minutes from June's meeting could be more dovish than Powell's press conference after the June rate meeting.

$7 Billion “Flight” from US Treasuries: Following the shocking jobs data, the hopes for a Fed rate cut in July have been shattered.

📉 Technical Analysis Insight:

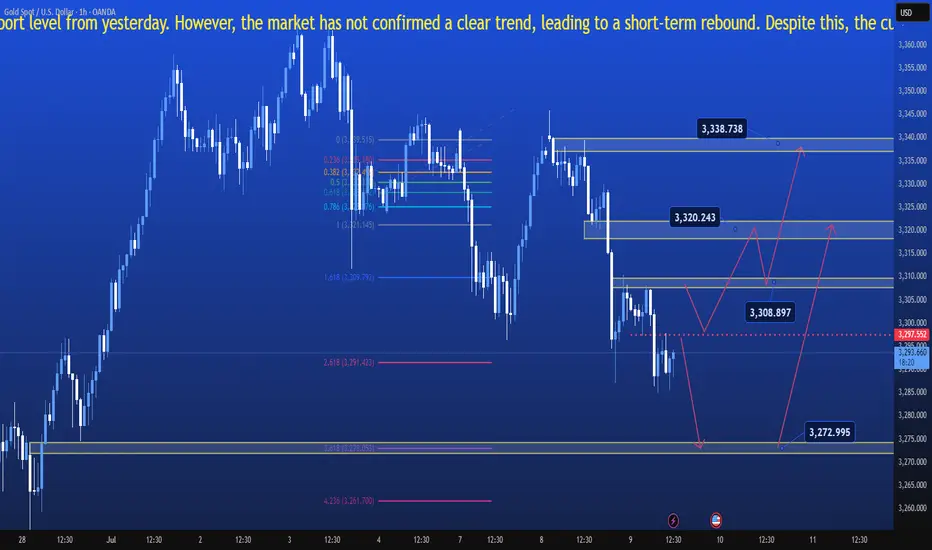

Gold experienced a sharp drop as soon as today’s Asian session opened, breaking through the 3287 support level from yesterday. However, the market has not confirmed a clear trend, leading to a short-term rebound. Despite this, the current medium-term trend remains downward, and today’s trading strategy will prioritise sell positions.

🔻 Key Support and Resistance Levels:

Resistance: 3297.7 – 3303 – 3308 – 3310.4 – 3330 – 3339.5

Support: 3285 – 3275 – 3244.3

🎯 Trading Plan for 09/07:

🔴 SELL SCALPING (Short-Term):

Entry: 3309 – 3311

Stop Loss: 3315

Take Profit: 3300 → 3293

🔴 SELL ZONE (Zone Trading):

Entry: 3318 – 3320

Stop Loss: 3324

Take Profit: 3310 → 3286 → 3270

🟢 BUY ZONE (Zone Trading):

Entry: 3270 – 3272

Stop Loss: 3265

Take Profit: 3286 → 3295 → 3310

⚠️ Important Notes:

The market is currently consolidating, and with critical price levels approaching, volatility may increase. Be mindful of unusual price movements and adjust your strategy accordingly.

📰 Key News:

Morgan Stanley: The minutes of the Fed meeting may highlight increasing divisions within the committee. The recent dot plot indicates a clear divide within the Federal Reserve.

Citi: The minutes of the Fed meeting could suggest that the threshold for interest rate cuts is lowering. Citi analysts believe the minutes from June's meeting could be more dovish than Powell's press conference after the June rate meeting.

$7 Billion “Flight” from US Treasuries: Following the shocking jobs data, the hopes for a Fed rate cut in July have been shattered.

📉 Technical Analysis Insight:

Gold experienced a sharp drop as soon as today’s Asian session opened, breaking through the 3287 support level from yesterday. However, the market has not confirmed a clear trend, leading to a short-term rebound. Despite this, the current medium-term trend remains downward, and today’s trading strategy will prioritise sell positions.

🔻 Key Support and Resistance Levels:

Resistance: 3297.7 – 3303 – 3308 – 3310.4 – 3330 – 3339.5

Support: 3285 – 3275 – 3244.3

🎯 Trading Plan for 09/07:

🔴 SELL SCALPING (Short-Term):

Entry: 3309 – 3311

Stop Loss: 3315

Take Profit: 3300 → 3293

🔴 SELL ZONE (Zone Trading):

Entry: 3318 – 3320

Stop Loss: 3324

Take Profit: 3310 → 3286 → 3270

🟢 BUY ZONE (Zone Trading):

Entry: 3270 – 3272

Stop Loss: 3265

Take Profit: 3286 → 3295 → 3310

⚠️ Important Notes:

The market is currently consolidating, and with critical price levels approaching, volatility may increase. Be mindful of unusual price movements and adjust your strategy accordingly.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.