Gold has limited safe-haven support, and the opportunity to short at high levels is emerging

[Brief analysis of fundamentals]

Short-term safe-haven support

Trump said that he would impose a 10% tariff on small countries, which caused market concerns, and the gold price rebounded slightly to $3,342.

However, the tariff intensity is mild (only slightly above 10%), and the risk aversion sentiment is limited, which is difficult to change the weakness of gold.

The strong suppression of the US dollar

The US CPI in June hit the largest increase since January, pushing the US dollar index to 98.70 (a three-week high), and the US Treasury yield rose simultaneously.

As an interest-free asset, gold is sensitive to a high interest rate environment and is under obvious pressure in the short term.

Market sentiment is neutral and bearish

Although tariff uncertainty provides support, the technical strengthening of the US dollar + the cooling of the Fed's interest rate cut expectations have made gold weak.

[Key technical signals]

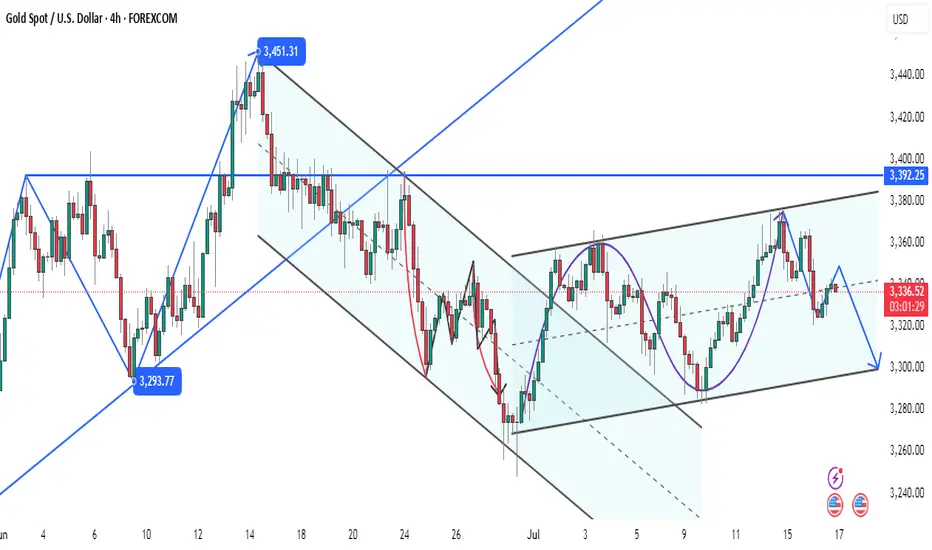

Daily level: Long-term attack, shorts accumulate strength

Structure: Continuous high-level fluctuations, multiple tests of the 3375-3380 resistance failed, and the daily line closed with a large upper shadow, confirming the selling pressure.

Moving average: Although the 55-day moving average (3222) has not been broken, the short-term moving average (5-day, 10-day) crosses downward, suggesting a risk of a correction.

Key position:

Resistance: 3365 (previous high conversion position) → strong resistance 3380 (trend line suppression)

Support: 3320 (yesterday's low) → break to see the psychological barrier of 3300

4-hour level: oscillate downward, rebound to short

Form: 3375 double tops fall back, the current middle track (3350) turns into dynamic resistance, MACD crosses below the zero axis.

Operation logic:

Aggressive short: enter the 3355-3365 area, stop loss 3380, target 3320→3300.

Conservative short: wait for the rebound to around 3360 to show a stagflation signal before intervening.

[Personal trading strategy: mainly short at highs]

Direction preference:

Bearish! Gold failed to attack several times. The strong dollar + technical breakout signal, if 3380 is not broken, the bears will dominate.

Entry and risk control:

Current price 3342: If the European session rebounds to 3355-3365, open shorts in batches, stop loss 3385, target 3320→3300.

Unexpected breakthrough of 3380: Manual stop loss, wait and see whether it is a false breakthrough.

Key reminder:

Pay attention to US retail sales data in the evening. If the dollar rises again, gold may accelerate its decline.

If the 3300 mark is broken, it will open up space to 3280 (200-day moving average).

[Summary]

Gold is trapped in the shackles of "strong dollar + weak safe-haven", and the technical rebound is weak. It insists on high altitude below 3380. Short-term volatility intensifies, but the trend is bearish. Be patient and wait for sniping opportunities after the rebound is weak!

[Brief analysis of fundamentals]

Short-term safe-haven support

Trump said that he would impose a 10% tariff on small countries, which caused market concerns, and the gold price rebounded slightly to $3,342.

However, the tariff intensity is mild (only slightly above 10%), and the risk aversion sentiment is limited, which is difficult to change the weakness of gold.

The strong suppression of the US dollar

The US CPI in June hit the largest increase since January, pushing the US dollar index to 98.70 (a three-week high), and the US Treasury yield rose simultaneously.

As an interest-free asset, gold is sensitive to a high interest rate environment and is under obvious pressure in the short term.

Market sentiment is neutral and bearish

Although tariff uncertainty provides support, the technical strengthening of the US dollar + the cooling of the Fed's interest rate cut expectations have made gold weak.

[Key technical signals]

Daily level: Long-term attack, shorts accumulate strength

Structure: Continuous high-level fluctuations, multiple tests of the 3375-3380 resistance failed, and the daily line closed with a large upper shadow, confirming the selling pressure.

Moving average: Although the 55-day moving average (3222) has not been broken, the short-term moving average (5-day, 10-day) crosses downward, suggesting a risk of a correction.

Key position:

Resistance: 3365 (previous high conversion position) → strong resistance 3380 (trend line suppression)

Support: 3320 (yesterday's low) → break to see the psychological barrier of 3300

4-hour level: oscillate downward, rebound to short

Form: 3375 double tops fall back, the current middle track (3350) turns into dynamic resistance, MACD crosses below the zero axis.

Operation logic:

Aggressive short: enter the 3355-3365 area, stop loss 3380, target 3320→3300.

Conservative short: wait for the rebound to around 3360 to show a stagflation signal before intervening.

[Personal trading strategy: mainly short at highs]

Direction preference:

Bearish! Gold failed to attack several times. The strong dollar + technical breakout signal, if 3380 is not broken, the bears will dominate.

Entry and risk control:

Current price 3342: If the European session rebounds to 3355-3365, open shorts in batches, stop loss 3385, target 3320→3300.

Unexpected breakthrough of 3380: Manual stop loss, wait and see whether it is a false breakthrough.

Key reminder:

Pay attention to US retail sales data in the evening. If the dollar rises again, gold may accelerate its decline.

If the 3300 mark is broken, it will open up space to 3280 (200-day moving average).

[Summary]

Gold is trapped in the shackles of "strong dollar + weak safe-haven", and the technical rebound is weak. It insists on high altitude below 3380. Short-term volatility intensifies, but the trend is bearish. Be patient and wait for sniping opportunities after the rebound is weak!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.