Gold fluctuates upward, focusing on key support and resistance

[Market Review]

Gold maintained a fluctuating upward pattern as expected on Friday, with a low of $3,333 and then stabilized and rebounded, reaching a high of $3,361, and finally closed at around $3,350.

[Fundamental Analysis]

The weak dollar provides support for gold prices, and the decline in U.S. Treasury yields enhances the attractiveness of gold

Geopolitical risks continue: tensions in the Middle East, expectations of escalating trade frictions between the United States and Europe

Federal Reserve policy differences: expectations of rate cuts and rumors of Powell's stay or departure affect the market

IMF warns of global economic risks, and risk aversion remains high

[Technical Analysis]

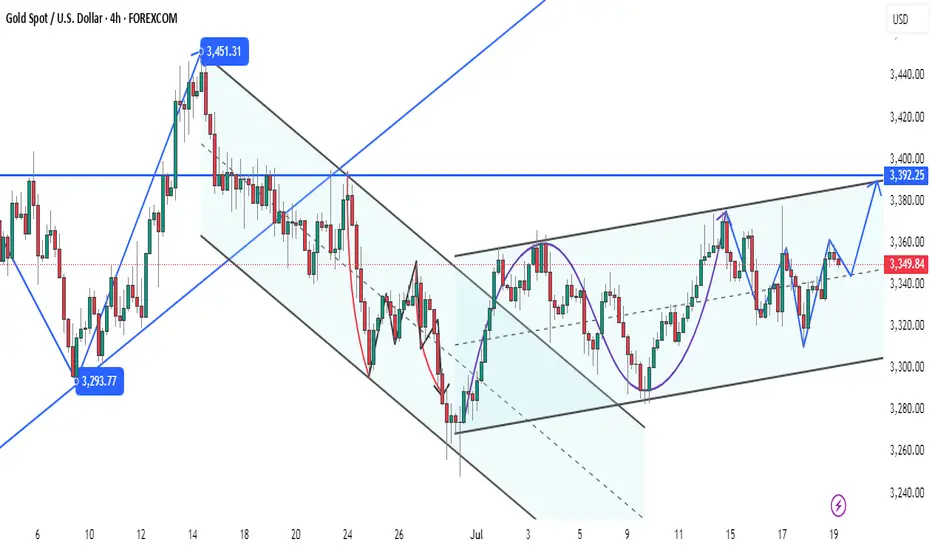

The 4-hour chart shows:

Key support: 3340-45 (short-term), 3310 (strong support)

Main resistance: 3380 (upward space will be opened after breaking through)

MACD The indicator is in golden cross, but KDJ enters the overbought zone, and there may be a need for a short-term correction

[Operation strategy]

Build long positions in batches when the price falls back to the 3335-43 range, add positions at 3320-25, and stop loss below 3313

Look at the 3370-75 target range first, and continue to hold if it breaks through 3380

Try shorting with a light position when it touches 3380 for the first time, stop loss at 3385, and target 3350

[Risk warning]

Pay attention to changes in geopolitical news over the weekend

Beware of unexpected hawkish remarks by Fed officials

The trend of US bond yields may cause short-term fluctuations

[Market Review]

Gold maintained a fluctuating upward pattern as expected on Friday, with a low of $3,333 and then stabilized and rebounded, reaching a high of $3,361, and finally closed at around $3,350.

[Fundamental Analysis]

The weak dollar provides support for gold prices, and the decline in U.S. Treasury yields enhances the attractiveness of gold

Geopolitical risks continue: tensions in the Middle East, expectations of escalating trade frictions between the United States and Europe

Federal Reserve policy differences: expectations of rate cuts and rumors of Powell's stay or departure affect the market

IMF warns of global economic risks, and risk aversion remains high

[Technical Analysis]

The 4-hour chart shows:

Key support: 3340-45 (short-term), 3310 (strong support)

Main resistance: 3380 (upward space will be opened after breaking through)

MACD The indicator is in golden cross, but KDJ enters the overbought zone, and there may be a need for a short-term correction

[Operation strategy]

Build long positions in batches when the price falls back to the 3335-43 range, add positions at 3320-25, and stop loss below 3313

Look at the 3370-75 target range first, and continue to hold if it breaks through 3380

Try shorting with a light position when it touches 3380 for the first time, stop loss at 3385, and target 3350

[Risk warning]

Pay attention to changes in geopolitical news over the weekend

Beware of unexpected hawkish remarks by Fed officials

The trend of US bond yields may cause short-term fluctuations

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.