Gold market analysis: The oscillation pattern continues, beware of the risk of a correction

Fundamental Overview

Federal Reserve policy divergence: The minutes of the June meeting showed that only a few officials supported the July rate cut, and most decision makers were still worried about the inflationary pressure brought by Trump's tariff policy, which suppressed the market's expectations for loose policies by 410.

The strong dollar suppressed gold prices: The US dollar index hovered at a two-week high, weakening the attractiveness of gold to overseas buyers, and the short-term upside was limited by 13.

Divergence in safe-haven demand: Although there is still uncertainty in trade frictions (such as the threat of a 50% copper tariff), the market's pursuit of safe-haven assets has cooled down, and the growth rate of gold ETF holdings has slowed down by 78.

Technical analysis

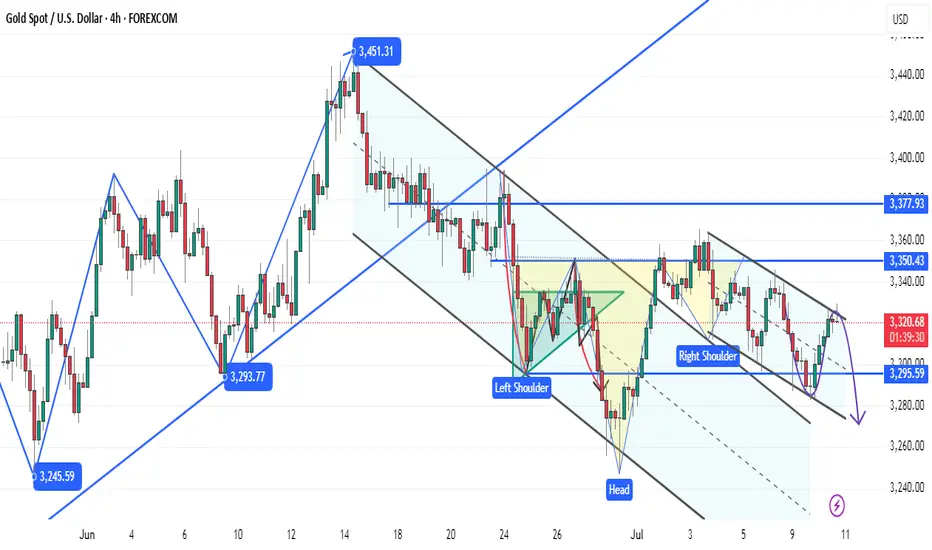

Daily level: Yesterday's closing was a small positive line with a lower shadow, but it failed to change the overall oscillation pattern, and the key range is still 3282-3345. The Bollinger Bands did not open, and the decline did not continue, but the rebound momentum was also insufficient. It is necessary to pay attention to whether 3345 can be broken through to confirm the trend reversal.

4-hour level: It is still in the oscillating downward channel since 3365. Yesterday's rebound stood on the middle track, MACD red column increased, and the short-term was strong. The key resistance is 3345. Before it is broken, it is still regarded as a corrective rebound rather than a trend reversal signal.

1-hour level: Bollinger bands diverge upward, but the K-line has not formed a unilateral rise, and MACD top divergence warns of callback risks. Short-term support is 3310-3306. If it falls below, it may retest the low point of 3282.

Trading strategy (bearish view)

Short-term rebound short:

3330-3340 area can be tested under pressure, stop loss 3350, target 3310-3300.

If it breaks through 3345, the short position will be stopped and wait and see, waiting for a higher position (such as 3360) to layout again.

Be cautious about buying low (short-term only):

3310-3313 light long position, stop loss 3303, target 3325-3330 (quick in and quick out).

Key breakout strategy:

Break down 3300 → confirm the continuation of the callback, target 3280-3260.

Break up 3345 → short exit, wait for confirmation of the retracement before considering chasing long.

Personal opinion

Although the short-term technical side shows rebound momentum, the fundamentals lack strong catalysts (such as expectations of rate cuts or a surge in risk aversion), coupled with the strong US dollar, the upside space of gold is limited. If 3345 fails to break through effectively, the gold price may test the 3280 support again, or even drop to 3250 (the lower track of the daily triangle). It is recommended to focus on high altitude and be cautious about the rebound.

Fundamental Overview

Federal Reserve policy divergence: The minutes of the June meeting showed that only a few officials supported the July rate cut, and most decision makers were still worried about the inflationary pressure brought by Trump's tariff policy, which suppressed the market's expectations for loose policies by 410.

The strong dollar suppressed gold prices: The US dollar index hovered at a two-week high, weakening the attractiveness of gold to overseas buyers, and the short-term upside was limited by 13.

Divergence in safe-haven demand: Although there is still uncertainty in trade frictions (such as the threat of a 50% copper tariff), the market's pursuit of safe-haven assets has cooled down, and the growth rate of gold ETF holdings has slowed down by 78.

Technical analysis

Daily level: Yesterday's closing was a small positive line with a lower shadow, but it failed to change the overall oscillation pattern, and the key range is still 3282-3345. The Bollinger Bands did not open, and the decline did not continue, but the rebound momentum was also insufficient. It is necessary to pay attention to whether 3345 can be broken through to confirm the trend reversal.

4-hour level: It is still in the oscillating downward channel since 3365. Yesterday's rebound stood on the middle track, MACD red column increased, and the short-term was strong. The key resistance is 3345. Before it is broken, it is still regarded as a corrective rebound rather than a trend reversal signal.

1-hour level: Bollinger bands diverge upward, but the K-line has not formed a unilateral rise, and MACD top divergence warns of callback risks. Short-term support is 3310-3306. If it falls below, it may retest the low point of 3282.

Trading strategy (bearish view)

Short-term rebound short:

3330-3340 area can be tested under pressure, stop loss 3350, target 3310-3300.

If it breaks through 3345, the short position will be stopped and wait and see, waiting for a higher position (such as 3360) to layout again.

Be cautious about buying low (short-term only):

3310-3313 light long position, stop loss 3303, target 3325-3330 (quick in and quick out).

Key breakout strategy:

Break down 3300 → confirm the continuation of the callback, target 3280-3260.

Break up 3345 → short exit, wait for confirmation of the retracement before considering chasing long.

Personal opinion

Although the short-term technical side shows rebound momentum, the fundamentals lack strong catalysts (such as expectations of rate cuts or a surge in risk aversion), coupled with the strong US dollar, the upside space of gold is limited. If 3345 fails to break through effectively, the gold price may test the 3280 support again, or even drop to 3250 (the lower track of the daily triangle). It is recommended to focus on high altitude and be cautious about the rebound.

Trade active

Gold tested the 3320-3330 range several times today, showing an overall horizontal consolidation pattern, with a temporary balance of long and short momentum. Before the US market, the market traded cautiously, waiting for new catalysts (such as speeches by Fed officials or economic data) to break the deadlock.Technical structure

Support level: 3320 (top of the hourly channel) - if it falls below, it will confirm a return to a downward trend, with bears dominating.

Resistance level: 3330 (short-term suppression), with stronger resistance at 3335-3340 (previous high and Fibonacci retracement level).

Big cycle trend: The daily line is still in a weak shock, and the rebound high point gradually moves down, indicating that the bulls lack momentum.

Personal opinion (bearish)

After the short-term rebound of gold, the bulls have shown signs of fatigue:

3330 has not been broken after multiple tests, indicating strong selling pressure above;

MACD momentum slowed down, and RSI was close to neutral (no oversold support);

The US dollar remained stable, the Fed's interest rate cut expectations were delayed, and gold lacked upward drive.

In terms of operation, I prefer the high-altitude strategy:

Entry: short in the 3335-3340 area

Stop loss: 3350 (if it breaks through, the short position will be invalid)

Target: 3320 (if it falls below, look at 3300, or even 3280)

Key risk: If the US market suddenly avoids risk (such as geopolitical conflicts or weak economic data), it may rise briefly, but as long as it does not break 3350, it is still considered a high-altitude opportunity.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.