Market Overview

Gold (XAU/USD) has opened the session strong, trading above the key $3,300 psychological level amid continued US Dollar weakness. Investors remain cautious amid growing geopolitical tensions and global market uncertainty, pushing demand for safe-haven assets higher.

---

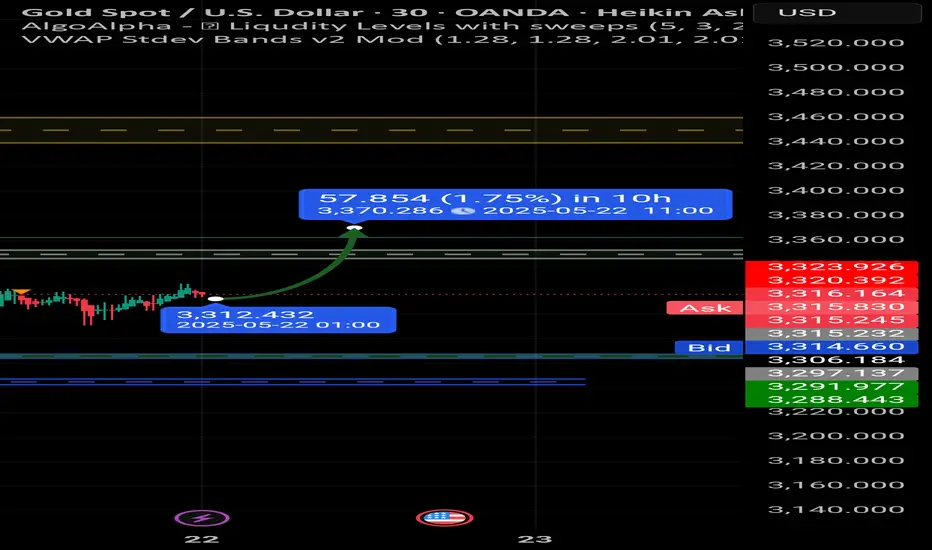

Technical Outlook (5-Minute Timeframe)

Current Price: ~$3,304.80

Trend: Short-term bullish above VWAP

Support Levels:

$3,295

$3,281 (20 EMA)

$3,266 (lower trendline of rising channel)

Resistance Levels:

$3,310 (local breakout level)

$3,324

$3,368

Indicators:

RSI (14): ~53 – Neutral-to-bullish

Moving Averages: Price is above both 50 and 200 EMAs – confirms bullish momentum

---

Trade Scenarios

Scenario 1: Long Position (Breakout Play)

Entry: On breakout and hold above $3,310

Stop Loss: $3,295

Take-Profit Targets:

TP1: $3,324

TP2: $3,368

Scenario 2: Short Position (Pullback or Breakdown)

Entry: On breakdown below $3,281

Stop Loss: $3,295

Take-Profit Targets:

TP1: $3,266

TP2: $3,240

---

Outlook for Next 4 Hours

Expected volatility: 10–15 USD (normal session), up to 25–30 USD with news catalysts.

Watch for fundamental triggers (economic data or Fed commentary) that could impact market direction.

---

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always manage your risk accordingly.

Analysis by mohsen mozafari nezhd

Gold (XAU/USD) has opened the session strong, trading above the key $3,300 psychological level amid continued US Dollar weakness. Investors remain cautious amid growing geopolitical tensions and global market uncertainty, pushing demand for safe-haven assets higher.

---

Technical Outlook (5-Minute Timeframe)

Current Price: ~$3,304.80

Trend: Short-term bullish above VWAP

Support Levels:

$3,295

$3,281 (20 EMA)

$3,266 (lower trendline of rising channel)

Resistance Levels:

$3,310 (local breakout level)

$3,324

$3,368

Indicators:

RSI (14): ~53 – Neutral-to-bullish

Moving Averages: Price is above both 50 and 200 EMAs – confirms bullish momentum

---

Trade Scenarios

Scenario 1: Long Position (Breakout Play)

Entry: On breakout and hold above $3,310

Stop Loss: $3,295

Take-Profit Targets:

TP1: $3,324

TP2: $3,368

Scenario 2: Short Position (Pullback or Breakdown)

Entry: On breakdown below $3,281

Stop Loss: $3,295

Take-Profit Targets:

TP1: $3,266

TP2: $3,240

---

Outlook for Next 4 Hours

Expected volatility: 10–15 USD (normal session), up to 25–30 USD with news catalysts.

Watch for fundamental triggers (economic data or Fed commentary) that could impact market direction.

---

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always manage your risk accordingly.

Analysis by mohsen mozafari nezhd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.