Hello everyone 👋

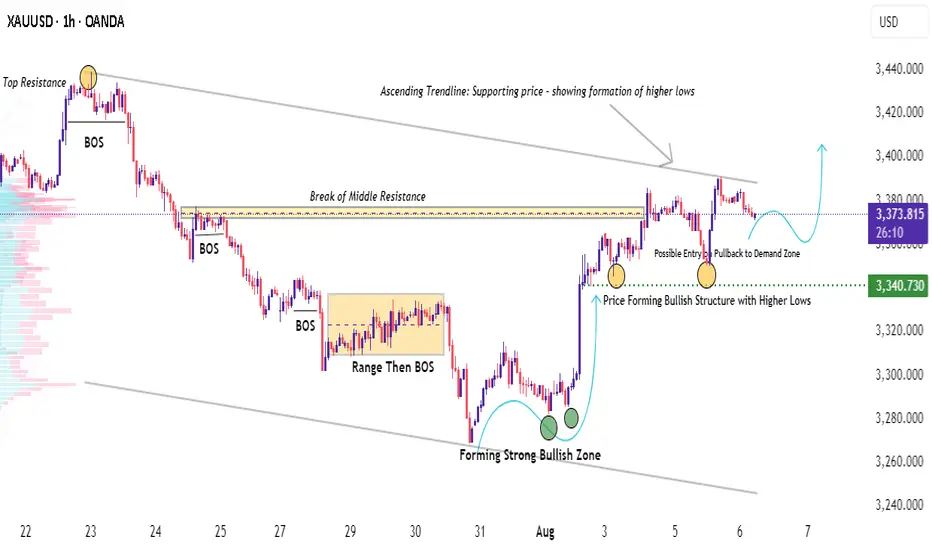

Gold (XAUUSD) is showing a clean bullish structure on the 1H timeframe.

After breaking multiple BOS levels, price has respected a key demand zone twice and is now forming a potential higher low within the zone.

🔹 BOS confirmations

🔹 Volume Profile support

🔹 Price rejection wicks

🔹 Bullish internal structure forming

A bounce from the support zone and continuation above recent highs can trigger the next bullish leg. Watching for clean confirmation above the last BOS to enter long.

📈 Logic Behind Bullish Setup:

Break of Structure (BOS): Multiple BOS levels show clear shift to bullish market structure.

Volume Profile: High volume node at the base indicates strong buyer interest.

Demand Zone: Price tested the demand zone twice with long rejection wicks.

Ascending Trendline: Supporting price – showing formation of higher lows.

Market Sentiment: Buyers defending key support confirms institutional interest.

📌 Always wait for confirmation & manage risk!

Gold (XAUUSD) is showing a clean bullish structure on the 1H timeframe.

After breaking multiple BOS levels, price has respected a key demand zone twice and is now forming a potential higher low within the zone.

🔹 BOS confirmations

🔹 Volume Profile support

🔹 Price rejection wicks

🔹 Bullish internal structure forming

A bounce from the support zone and continuation above recent highs can trigger the next bullish leg. Watching for clean confirmation above the last BOS to enter long.

📈 Logic Behind Bullish Setup:

Break of Structure (BOS): Multiple BOS levels show clear shift to bullish market structure.

Volume Profile: High volume node at the base indicates strong buyer interest.

Demand Zone: Price tested the demand zone twice with long rejection wicks.

Ascending Trendline: Supporting price – showing formation of higher lows.

Market Sentiment: Buyers defending key support confirms institutional interest.

📌 Always wait for confirmation & manage risk!

Trade active

Bias: Bullish

Reason: Entry taken after price respected demand zone and confirmed BOS on 1H. Structure remains bullish with higher lows forming. Targeting continuation toward next resistance.

Risk managed – SL below recent low.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

📈 Robert FX Assets | Verified Forex Analyst

📊 Smart Signals | XAUUSD | Risk Management

📬 Join Free Channel: t.me/RobertFXAssets

📊 Smart Signals | XAUUSD | Risk Management

📬 Join Free Channel: t.me/RobertFXAssets

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Robert FX Assets | Verified Forex Analyst

📊 Smart Signals | XAUUSD | Risk Management

📬 Join Free Channel: t.me/RobertFXAssets

📊 Smart Signals | XAUUSD | Risk Management

📬 Join Free Channel: t.me/RobertFXAssets

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.