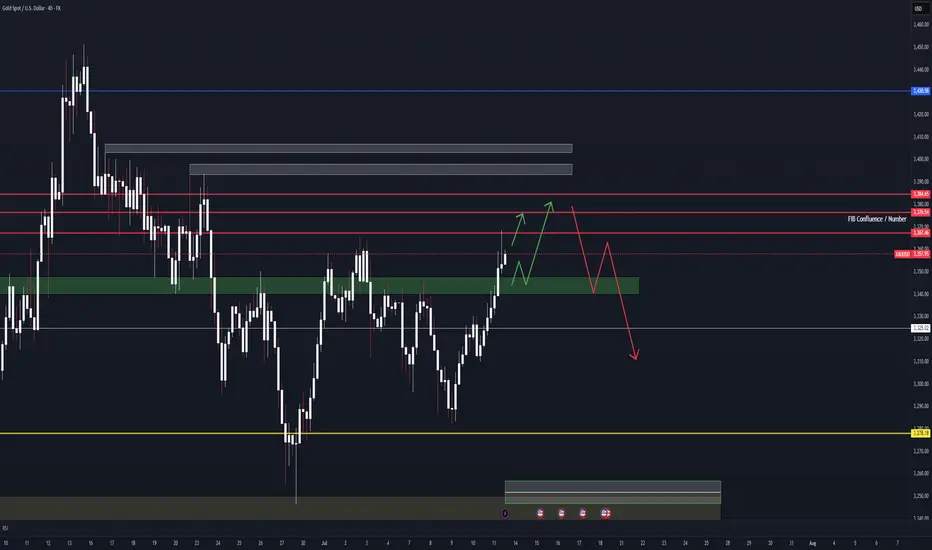

The only news I am focusing on this week is the mighty CPI coming up this week. With oil & energy prices creeping higher, I expect CPI to come in just in line to prediction or slightly elevated, though nothing too drastic, this keeps us in a higher-for-longer rate environment, fueling a DXY bullish bounce and keeping the Gold bears in play. If the data surprises, we’ll adjust accordingly and trade accordingly.

If the numbers land in line with forecasts: No real surprises, market already priced in. In this case, the outlook is neutral to slightly bearish.

If below forecast, a weaker CPI print could increase the odds of an early rate cut. That will likely weaken the dollar, which is good for $Gold. So, this will lead to bullish sentiment for $XAUUSD.

Will also watch RISK ON/OFF Sentiment

If the numbers land in line with forecasts: No real surprises, market already priced in. In this case, the outlook is neutral to slightly bearish.

If below forecast, a weaker CPI print could increase the odds of an early rate cut. That will likely weaken the dollar, which is good for $Gold. So, this will lead to bullish sentiment for $XAUUSD.

Will also watch RISK ON/OFF Sentiment

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.