Good morning, everyone!

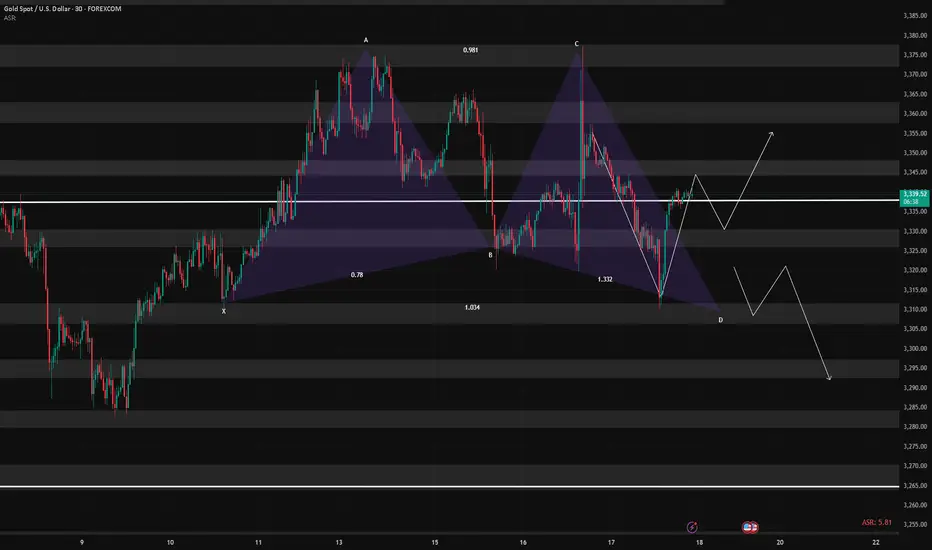

Yesterday, gold broke below the 3337 support after consolidating there, driven lower by bearish data, and eventually reached the 3323–3312 support zone. A rebound followed, and price has now returned above 3323, which also aligns with the daily MA60.

📌 Key Levels to Watch Today:

Resistance: 3343 / 3352–3358

→ A sustained break above 3343 opens the door for a potential move toward 3366 / 3372–3378;

Support: 3323 / 3312

→ If price remains capped below resistance and weekly close is under 3323, it will signal bearish structural pressure for the medium term.

📌 Trading Strategy:

Trade flexibly within the range of 3358–3343–3332–3323–3312

📌 Important Reminder:

If today’s closing price is below 3323, and you're planning to hold positions over the weekend, it’s safer to lean short. While we can’t predict weekend news, technically, bears have the upper hand, so risk control is essential.

Yesterday, gold broke below the 3337 support after consolidating there, driven lower by bearish data, and eventually reached the 3323–3312 support zone. A rebound followed, and price has now returned above 3323, which also aligns with the daily MA60.

📌 Key Levels to Watch Today:

Resistance: 3343 / 3352–3358

→ A sustained break above 3343 opens the door for a potential move toward 3366 / 3372–3378;

Support: 3323 / 3312

→ If price remains capped below resistance and weekly close is under 3323, it will signal bearish structural pressure for the medium term.

📌 Trading Strategy:

Trade flexibly within the range of 3358–3343–3332–3323–3312

📌 Important Reminder:

If today’s closing price is below 3323, and you're planning to hold positions over the weekend, it’s safer to lean short. While we can’t predict weekend news, technically, bears have the upper hand, so risk control is essential.

Trade active

Gold is currently forming a bullish structure on the 30-minute chart, indicating short-term upward momentum.📌 Key Level to Watch:

3343 is a critical resistance.

→ A confirmed breakout and stabilization above this level

→ Could lead to a push toward the 3352–3358 resistance zone, where some selling pressure may emerge.

Trade closed: target reached

📌 Support area:Initial support: 3352-3348 / 3343

Strong support (retracement position after breaking through 3378): 3363 / 3358–3352

📌 Resistance area:

Current main resistance: 3358 (key observation position today)

Upward target after breakthrough:

First target: 3366

Secondary target area: 3372–3378 (previous high)

Strong resistance target: 3386–3392 (suppression of daily structure)

I’ve created a channel where I’ll be posting market analysis and trading signals.

Feel free to join—it makes it easier to follow updates, and you can also contact me directly if you have any questions.

t.me/+h6RM5RdP6X9hNmI8

Feel free to join—it makes it easier to follow updates, and you can also contact me directly if you have any questions.

t.me/+h6RM5RdP6X9hNmI8

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I’ve created a channel where I’ll be posting market analysis and trading signals.

Feel free to join—it makes it easier to follow updates, and you can also contact me directly if you have any questions.

t.me/+h6RM5RdP6X9hNmI8

Feel free to join—it makes it easier to follow updates, and you can also contact me directly if you have any questions.

t.me/+h6RM5RdP6X9hNmI8

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.