7.18 Gold Analysis

Perspective of Long and Short Powers

▶ The core of short-selling suppression

The resilience of the US economy is highlighted: both consumer data and the job market are improving, strengthening the Fed's position of maintaining high interest rates, and the continued strength of the US dollar directly suppresses gold;

Hawkish policy expectations: Fed officials frequently release "maintain restrictive interest rates" signals, weakening market expectations of interest rate cuts.

▶ Potential momentum of bulls

Inflation risk aversion demand lurks: The Trump administration imposes a 50% tariff on imported copper. If the negotiations with Japan fail, it may push up global inflation, and the hedging value of gold is highlighted;

Central bank gold purchases support: The global central bank's continued reserve increase trend has not changed, and China has increased its holdings for 8 consecutive months, building long-term support;

Technical buying intervention: The $3,300 mark has repeatedly verified the effectiveness of support, attracting low-cost funds to enter the market.

Trading strategy

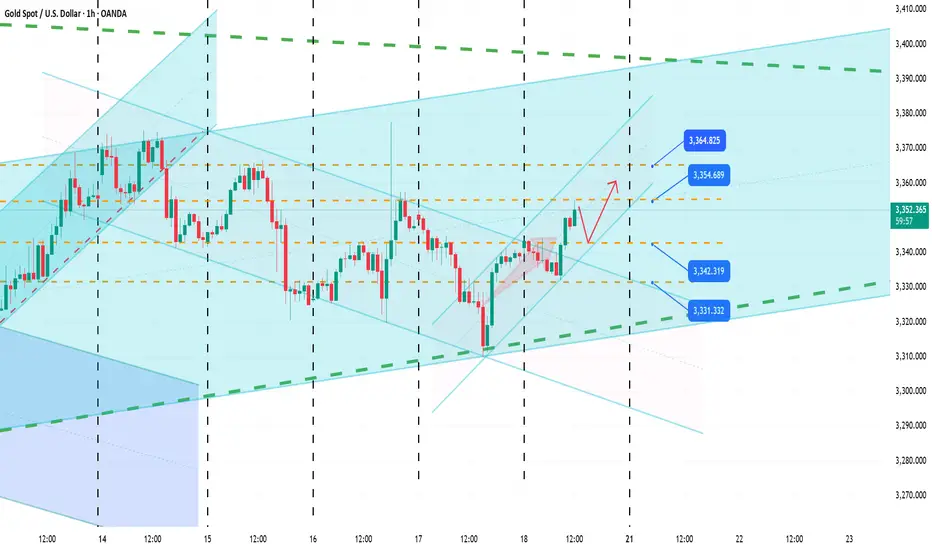

Sell: Try short with a light position near $3355, set the stop loss strictly above $3363, and target $3345;

Buy: Layout long orders near $3340, set the stop loss at $3315, and target $3355→3360.

Key reminder: Gold is currently in a decisive battle at the life and death line of $3300-3375, and market volatility is about to increase. Stick to high-altitude and low-long before the breakthrough, and decisively follow the trend after the break. Be alert to the instantaneous fluctuations during the release of US market data, and position holders need to plan risk control plans in advance.

Trade carefully and control risks! I wish you a smooth transaction!

Perspective of Long and Short Powers

▶ The core of short-selling suppression

The resilience of the US economy is highlighted: both consumer data and the job market are improving, strengthening the Fed's position of maintaining high interest rates, and the continued strength of the US dollar directly suppresses gold;

Hawkish policy expectations: Fed officials frequently release "maintain restrictive interest rates" signals, weakening market expectations of interest rate cuts.

▶ Potential momentum of bulls

Inflation risk aversion demand lurks: The Trump administration imposes a 50% tariff on imported copper. If the negotiations with Japan fail, it may push up global inflation, and the hedging value of gold is highlighted;

Central bank gold purchases support: The global central bank's continued reserve increase trend has not changed, and China has increased its holdings for 8 consecutive months, building long-term support;

Technical buying intervention: The $3,300 mark has repeatedly verified the effectiveness of support, attracting low-cost funds to enter the market.

Trading strategy

Sell: Try short with a light position near $3355, set the stop loss strictly above $3363, and target $3345;

Buy: Layout long orders near $3340, set the stop loss at $3315, and target $3355→3360.

Key reminder: Gold is currently in a decisive battle at the life and death line of $3300-3375, and market volatility is about to increase. Stick to high-altitude and low-long before the breakthrough, and decisively follow the trend after the break. Be alert to the instantaneous fluctuations during the release of US market data, and position holders need to plan risk control plans in advance.

Trade carefully and control risks! I wish you a smooth transaction!

❤️I am a trading researcher focusing on the gold field.

❤️If you are looking for direction, welcome to follow me.

👉t.me/+CW0VWaiEB59hMmJh

❤️If you are looking for direction, welcome to follow me.

👉t.me/+CW0VWaiEB59hMmJh

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

❤️I am a trading researcher focusing on the gold field.

❤️If you are looking for direction, welcome to follow me.

👉t.me/+CW0VWaiEB59hMmJh

❤️If you are looking for direction, welcome to follow me.

👉t.me/+CW0VWaiEB59hMmJh

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.