XAUUSD WEEKLY OUTLOOK (07–11 JUL): GOLD GAINS MOMENTUM FROM U.S. POLITICAL NEWS

📰 MACRO OVERVIEW

This week starts with hot political headlines in the U.S., as Elon Musk officially announced the formation of a new political party – the “American Party” – aiming to challenge the traditional two-party system. This introduces potential political instability, which may boost gold as a safe-haven asset.

Last week’s economic data was not strong enough to weigh on gold, especially as the U.S. market remained largely inactive during Friday’s holiday session.

📉 TECHNICAL ANALYSIS – PLAN REMAINS UNCHANGED

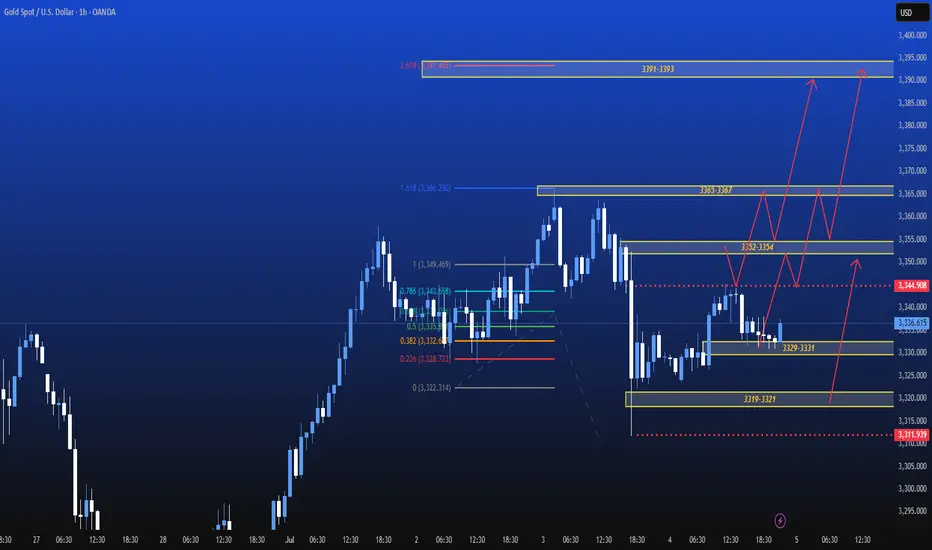

Gold maintains a bullish structure after rebounding from the 3331 area. Our Buy entry from early this week has moved in the right wave, with current profits exceeding 60 pips.

As there are no clear reversal signals and the technical setup remains intact, we’ll keep our trading plan unchanged for the week.

🎯 TRADING PLAN

✅ BUY THE DIP – Trend-Following Setup

Entry 1: 3329 – 3331 (Active, hold position)

Entry 2: 3319 – 3321 | SL: 3315 | TP: 3328 – 3338 – 3350

⚠️ SELL SCALPING – Reaction-Based

Entry 1: 3352 – 3354 | SL: 3358 | TP: 3342 – 3330

Entry 2: 3365 – 3367 | SL: 3371 | TP: 3355 – 3342 – 3338

📌 CONCLUSION

This week could see unexpected volatility due to political factors and post-holiday sentiment.

We continue to prioritise buying in line with the primary trend and stick to our original trading plan.

Watch price behaviour closely at support and resistance zones to optimise profits.

📰 MACRO OVERVIEW

This week starts with hot political headlines in the U.S., as Elon Musk officially announced the formation of a new political party – the “American Party” – aiming to challenge the traditional two-party system. This introduces potential political instability, which may boost gold as a safe-haven asset.

Last week’s economic data was not strong enough to weigh on gold, especially as the U.S. market remained largely inactive during Friday’s holiday session.

📉 TECHNICAL ANALYSIS – PLAN REMAINS UNCHANGED

Gold maintains a bullish structure after rebounding from the 3331 area. Our Buy entry from early this week has moved in the right wave, with current profits exceeding 60 pips.

As there are no clear reversal signals and the technical setup remains intact, we’ll keep our trading plan unchanged for the week.

🎯 TRADING PLAN

✅ BUY THE DIP – Trend-Following Setup

Entry 1: 3329 – 3331 (Active, hold position)

Entry 2: 3319 – 3321 | SL: 3315 | TP: 3328 – 3338 – 3350

⚠️ SELL SCALPING – Reaction-Based

Entry 1: 3352 – 3354 | SL: 3358 | TP: 3342 – 3330

Entry 2: 3365 – 3367 | SL: 3371 | TP: 3355 – 3342 – 3338

📌 CONCLUSION

This week could see unexpected volatility due to political factors and post-holiday sentiment.

We continue to prioritise buying in line with the primary trend and stick to our original trading plan.

Watch price behaviour closely at support and resistance zones to optimise profits.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+ECLXdyR7Q4YyM2Rl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.