I. Analysis of news

Short-term pressure factors

Fed policy expectations: The market's expectations for the Fed to maintain high interest rates have strengthened (especially after the release of April CPI data), and the strengthening of the US dollar has suppressed gold prices.

US-China trade easing: The rebound in risk appetite has weakened the safe-haven demand for gold, but the impact is limited, and we need to pay attention to subsequent progress.

Global inflation signal: If US inflation data (such as PCE) falls in the future, it may ease hawkish expectations and provide support for gold.

Long-term support factors

Geopolitical risks: Potential risks such as the situation in the Middle East and the conflict between Russia and Ukraine still exist, and safe-haven buying may return at any time.

Central bank gold purchase demand: Central banks of various countries (especially emerging markets) continue to increase their holdings of gold, which has long-term support for gold prices.

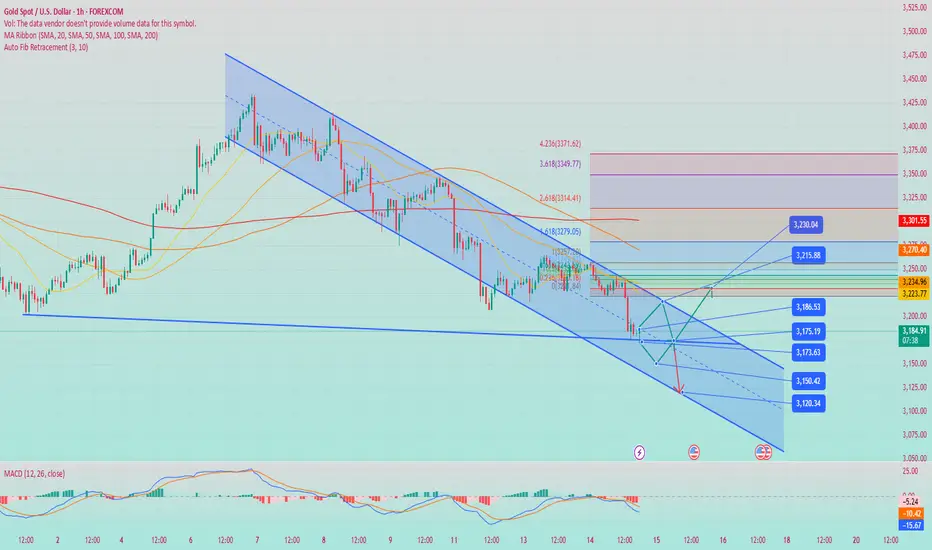

II. Technical analysis

Daily level

Short-selling dominance: The big negative line fell below the lower Bollinger track, MACD dead cross and large volume, RSI is close to oversold (42.99), and there may be a rebound correction in the short term, but the trend is bearish.

Key positions:

Resistance: 3200-3210 (top and bottom conversion position), 3230 (5-day moving average).

Support: 3170-3160 (short-term psychological barrier), 3140 (March low).

4-hour level

Downward channel continuation: moving averages are arranged in short positions, MACD crosses below the zero axis, but be alert to the possibility of bottom divergence.

Operation signal: If it rebounds to around 3200 and is under pressure, you can arrange short orders. If it falls sharply to below 3160 without breaking, you can lightly position and bet on a rebound.

3. Operation strategy

Short-term:

Short orders: Enter the market in the 3200-3210 area, stop loss above 3220, target 3170-3160.

Long orders: Try to stabilize around 3160, stop loss below 3150, target 3180-3190 (quick in and out).

Mid-term: If it falls below 3160, look down to 3140-3120; if it stands at 3230, short orders need to be cautious.

IV. Risk Warning

Focus on data:

US April PPI (May 14), retail sales (May 15), speeches by Fed officials.

Sudden news of geopolitical situation may trigger short-term sharp fluctuations.

Position management: The current volatility is amplified, and it is recommended to hold a light position + strict stop loss.

V. Summary

Gold is subject to the hawkish expectations of the Fed in the short term, and the technical side is short-term dominant, but it is necessary to be vigilant against rebound corrections after oversold. Investors need to respond flexibly based on data and events, give priority to high-altitude and cautiously buy at the bottom. In the medium and long term, global economic uncertainty and central bank gold purchase demand will continue to provide support for gold.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.