Description

Now, price is hovering around equilibrium, facing resistance from a FVG/IMB zone, suggesting that this move up was likely a liquidity run, not true bullish intent.

With:

> Bias: Bearish

Short-Term Target: FVG around 3,325

Long-Term Target: Retest of key support ~3,244

Invalidation: Clean break and hold above 3,350–3,360 zone

#Gold #forex #XAUUSD #GOLD #analysis #ICT #SMC #FVG #MSS

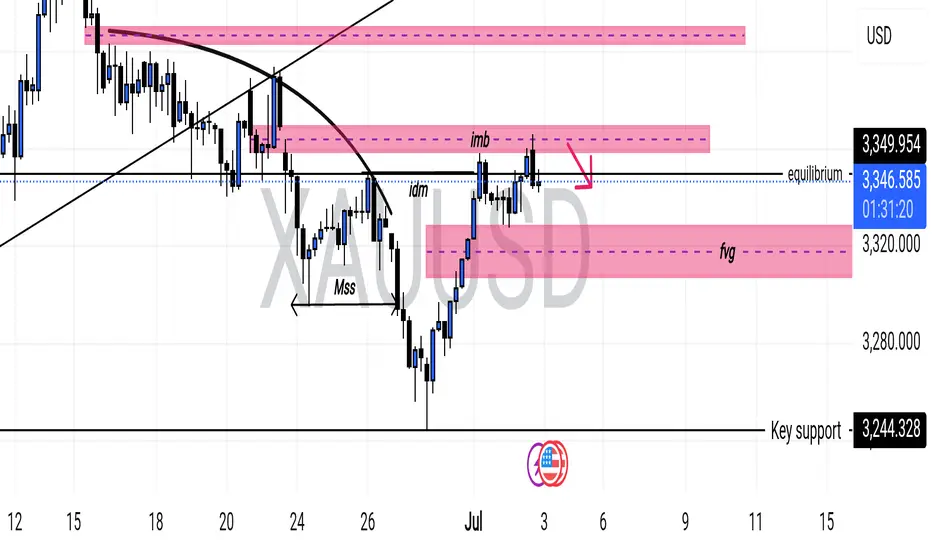

- Price has recently pushed above equilibrium, tapping into a buy-side imbalance (IMB) zone. This move appears to serve as inducement, pulling in breakout traders just above a previous structure, where liquidity likely resides.

- Earlier, the market printed a clear bearish Market Structure Shift (MSS), followed by a return to a key support level (3,244), which formed a hammer candle — a possible short-term liquidity engineering move.

Now, price is hovering around equilibrium, facing resistance from a FVG/IMB zone, suggesting that this move up was likely a liquidity run, not true bullish intent.

With:

- MSS already formed,

- IDM (internal draw on liquidity) targeted,

- and price reacting from imbalance above EQ,

- This zone may act as a high-probability turning point for a short opportunity, especially if lower timeframes start breaking structure again to the downside.

> Bias: Bearish

Short-Term Target: FVG around 3,325

Long-Term Target: Retest of key support ~3,244

Invalidation: Clean break and hold above 3,350–3,360 zone

#Gold #forex #XAUUSD #GOLD #analysis #ICT #SMC #FVG #MSS

🔥 Live Signals | Gold | Crypto

👉 t.me/NexoTrades3

Trading involves risk. Always do your own analysis before making financial decisions.

👉 t.me/NexoTrades3

Trading involves risk. Always do your own analysis before making financial decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥 Live Signals | Gold | Crypto

👉 t.me/NexoTrades3

Trading involves risk. Always do your own analysis before making financial decisions.

👉 t.me/NexoTrades3

Trading involves risk. Always do your own analysis before making financial decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.