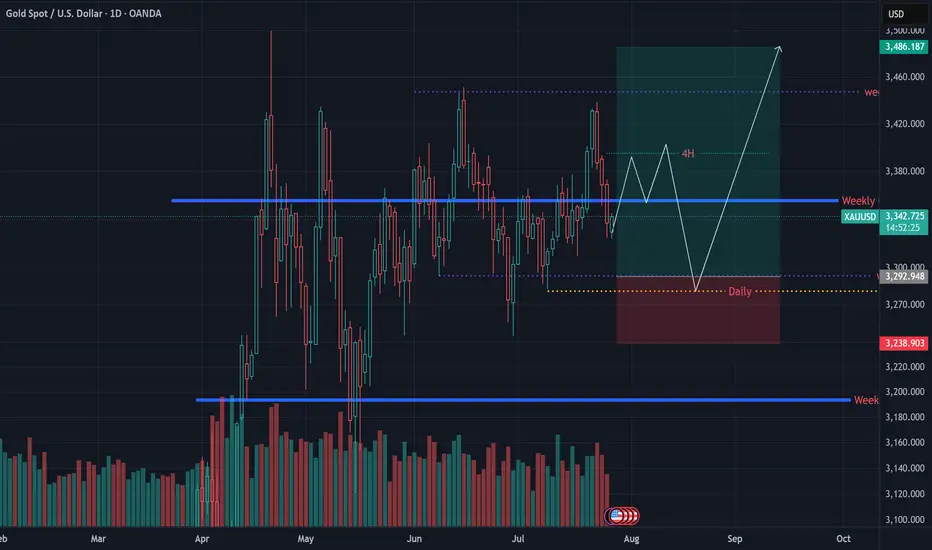

Last week, we marked the 3320–3330 zone as a potential buy-entry area. However, mid-term order flow pushed price above 3400 before reaching that level.

Toward the end of the week, a sell-off slightly weakened buyer confidence, and we now anticipate more cautious re-entries around the 3300–3290 region.

📈 The broader trend remains bullish for mid and long-term traders.

For scalpers trading against the trend, we recommend sticking to minor bearish pullbacks only, and managing risk tightly.

🔻 The 3390–3400 range offers a potential 300+ pip short opportunity for risk-averse sellers.

🟠 Risk-tolerant traders might consider holding shorts until the 3300 zone is tested.

⚠️ Key Insight: Given the liquidity build-up at 3400, if the price returns to this level, there’s a strong chance we’ll see a breakout above the previous high.

Toward the end of the week, a sell-off slightly weakened buyer confidence, and we now anticipate more cautious re-entries around the 3300–3290 region.

📈 The broader trend remains bullish for mid and long-term traders.

For scalpers trading against the trend, we recommend sticking to minor bearish pullbacks only, and managing risk tightly.

🔻 The 3390–3400 range offers a potential 300+ pip short opportunity for risk-averse sellers.

🟠 Risk-tolerant traders might consider holding shorts until the 3300 zone is tested.

⚠️ Key Insight: Given the liquidity build-up at 3400, if the price returns to this level, there’s a strong chance we’ll see a breakout above the previous high.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.