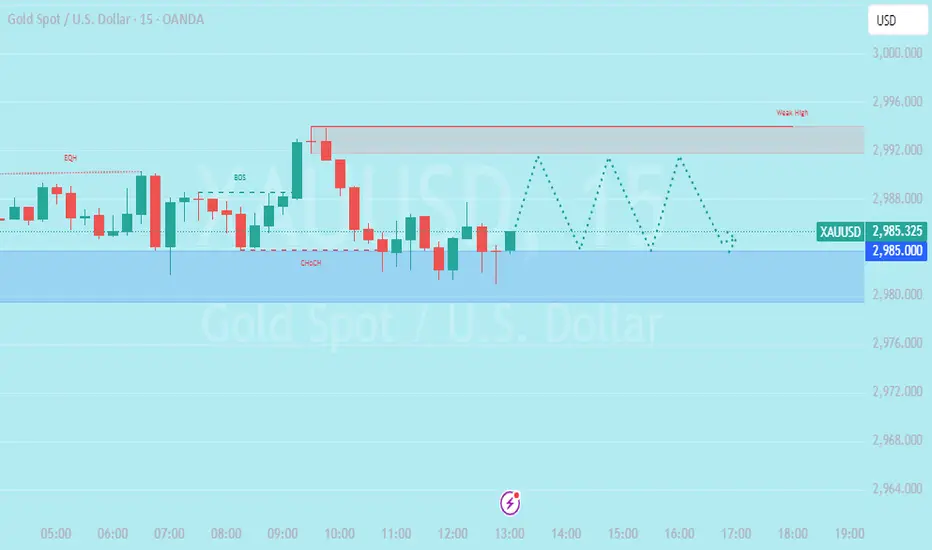

🔹 1. Market Structure: Consolidation (Range-Bound)

The price is bouncing between a demand zone (blue area) and a resistance zone (weak high).

No strong breakout above or below key levels = Sideways Market (Range).

BOS (Break of Structure) & CHOCH (Change of Character) show uncertainty.

🔹 2. Liquidity & Key Levels

✅ Equal Highs (EQH) → Liquidity above 2,990 (price might sweep it before reversal).

✅ Weak Highs → If price fails to break above, it may continue ranging.

✅ Demand Zone (Blue Area @ 2,980-2,984) → Buyers stepping in here, preventing a strong downtrend.

🔹 3. Possible Market Scenarios

📌 Scenario 1: Bullish Breakout

If price breaks above 2,988-2,990, it may target 2,996-3,000.

A liquidity grab above weak highs could trigger a breakout.

📌 Scenario 2: Bearish Rejection & Range Continuation

If price rejects 2,988, it may stay within the range (2,980-2,988).

A breakdown below 2,980 could lead to a further drop.

📌 Scenario 3: Fakeout & Trap

Price spikes above 2,990, grabs liquidity, then reverses back into the range.

🎯 Trading Plan for Sideways Market

💡 Best Strategy for Ranging Market:

✅ Buy near demand zone (2,980-2,984), Sell near resistance (2,988-2,990).

✅ Avoid breakout trades until a strong confirmation occurs.

✅ Look for liquidity grabs before price makes a real move.

🔥 Final Thoughts

Right now, XAU/USD is ranging between demand (~2,980) and weak highs (~2,988-2,990).

Wait for a clear breakout or trade within the range for scalping opportunities.

The price is bouncing between a demand zone (blue area) and a resistance zone (weak high).

No strong breakout above or below key levels = Sideways Market (Range).

BOS (Break of Structure) & CHOCH (Change of Character) show uncertainty.

🔹 2. Liquidity & Key Levels

✅ Equal Highs (EQH) → Liquidity above 2,990 (price might sweep it before reversal).

✅ Weak Highs → If price fails to break above, it may continue ranging.

✅ Demand Zone (Blue Area @ 2,980-2,984) → Buyers stepping in here, preventing a strong downtrend.

🔹 3. Possible Market Scenarios

📌 Scenario 1: Bullish Breakout

If price breaks above 2,988-2,990, it may target 2,996-3,000.

A liquidity grab above weak highs could trigger a breakout.

📌 Scenario 2: Bearish Rejection & Range Continuation

If price rejects 2,988, it may stay within the range (2,980-2,988).

A breakdown below 2,980 could lead to a further drop.

📌 Scenario 3: Fakeout & Trap

Price spikes above 2,990, grabs liquidity, then reverses back into the range.

🎯 Trading Plan for Sideways Market

💡 Best Strategy for Ranging Market:

✅ Buy near demand zone (2,980-2,984), Sell near resistance (2,988-2,990).

✅ Avoid breakout trades until a strong confirmation occurs.

✅ Look for liquidity grabs before price makes a real move.

🔥 Final Thoughts

Right now, XAU/USD is ranging between demand (~2,980) and weak highs (~2,988-2,990).

Wait for a clear breakout or trade within the range for scalping opportunities.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.