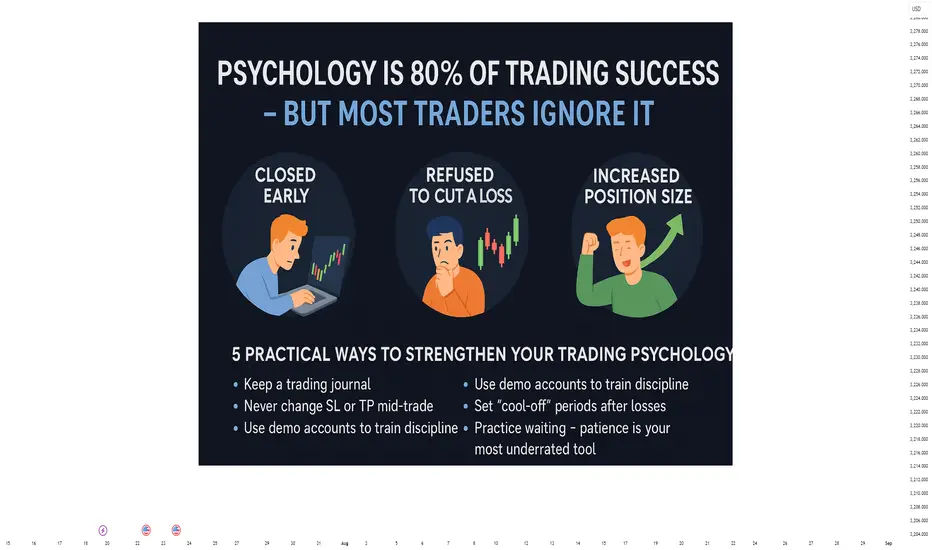

Psychology Is 80% of Trading Success – But Most Traders Still Ignore It

Have you ever followed a perfect setup… and still lost money?

You entered at the right level.

The trend was clear.

Confirmation was solid.

But you closed the trade too early.

Or held onto a losing trade far too long.

Or took a revenge trade just to “get it back.”

This isn’t a strategy problem – it’s a psychological one.

💡 Most traders don’t fail due to poor analysis – they fail because they lose control of themselves

Let’s break down three real-world scenarios that almost every trader has experienced at some point:

🎯 1. Closing profitable trades too early – fear of giving it back

Example:

You long XAUUSD from 2360, targeting 2375.

As price hits 2366, you panic and exit early, fearing a reversal.

Later, the price hits 2375 without you.

➡️ This is classic loss aversion — where the fear of losing small gains outweighs the logic of sticking to your plan.

🎯 2. Holding onto losers – hoping the market will turn

Example:

You short EURUSD expecting a pullback, but price breaks resistance and climbs.

Instead of cutting your losses, you widen your stop and hold on.

The loss grows, and you exit in frustration.

➡️ This is denial – refusing to admit you're wrong, letting hope override discipline.

🎯 3. Increasing risk after a winning streak – “I can’t lose” mindset

Example:

After two wins, confidence spikes. You double your position size, despite a weaker setup.

One loss later – your previous gains are wiped out.

➡️ This is overconfidence bias – common after wins and extremely dangerous to consistency.

📊 Technical knowledge accounts for 20% of success – the remaining 80% lies in mindset and behaviour

You can:

Understand market structure

Use advanced indicators

Develop a robust strategy

But if you:

Ignore your stop-loss

Trade out of boredom or revenge

Break rules when under pressure

Then your edge disappears.

Your system becomes irrelevant if your psychology breaks down.

🧠 5 Practical Ways to Strengthen Your Trading Psychology

✅ Keep a trading journal – especially note your emotions

Ask yourself: “Was this trade part of my plan, or based on impulse?”

✅ Never adjust SL or TP mid-trade

Stick to your original parameters. Trust your plan, not your feelings.

✅ Use demo accounts to practise discipline, not just execution

Treat them like live accounts. Emotions will surface if you're honest.

✅ Pause trading after consecutive losses

Two losses in a row? Step away for 24 hours. Protect your decision-making clarity.

✅ Learn to wait – no trade is often the best trade

Patience is a trader’s secret weapon. Pros trade less, but with precision.

🔁 Trading isn’t about predicting the market – it’s about managing yourself within it

A 55% win-rate system can make you consistent profits

If you’re disciplined, calm, and structured.

But…

A 70% win-rate system can still blow your account

If your emotions are calling the shots.

🎯 Final Thought:

Financial markets don’t reward traders with the best strategy.

They reward those who stay rational under pressure.

You don’t need to be the smartest person in the room.

You don’t need a complex system.

But you do need emotional control, patience, and trust in your process.

Knowledge helps you spot the trade. Psychology helps you survive it.

🔔 If you found value in this, follow me for more content on trading mindset, discipline, and long-term consistency – because true success begins in the mind.

Have you ever followed a perfect setup… and still lost money?

You entered at the right level.

The trend was clear.

Confirmation was solid.

But you closed the trade too early.

Or held onto a losing trade far too long.

Or took a revenge trade just to “get it back.”

This isn’t a strategy problem – it’s a psychological one.

💡 Most traders don’t fail due to poor analysis – they fail because they lose control of themselves

Let’s break down three real-world scenarios that almost every trader has experienced at some point:

🎯 1. Closing profitable trades too early – fear of giving it back

Example:

You long XAUUSD from 2360, targeting 2375.

As price hits 2366, you panic and exit early, fearing a reversal.

Later, the price hits 2375 without you.

➡️ This is classic loss aversion — where the fear of losing small gains outweighs the logic of sticking to your plan.

🎯 2. Holding onto losers – hoping the market will turn

Example:

You short EURUSD expecting a pullback, but price breaks resistance and climbs.

Instead of cutting your losses, you widen your stop and hold on.

The loss grows, and you exit in frustration.

➡️ This is denial – refusing to admit you're wrong, letting hope override discipline.

🎯 3. Increasing risk after a winning streak – “I can’t lose” mindset

Example:

After two wins, confidence spikes. You double your position size, despite a weaker setup.

One loss later – your previous gains are wiped out.

➡️ This is overconfidence bias – common after wins and extremely dangerous to consistency.

📊 Technical knowledge accounts for 20% of success – the remaining 80% lies in mindset and behaviour

You can:

Understand market structure

Use advanced indicators

Develop a robust strategy

But if you:

Ignore your stop-loss

Trade out of boredom or revenge

Break rules when under pressure

Then your edge disappears.

Your system becomes irrelevant if your psychology breaks down.

🧠 5 Practical Ways to Strengthen Your Trading Psychology

✅ Keep a trading journal – especially note your emotions

Ask yourself: “Was this trade part of my plan, or based on impulse?”

✅ Never adjust SL or TP mid-trade

Stick to your original parameters. Trust your plan, not your feelings.

✅ Use demo accounts to practise discipline, not just execution

Treat them like live accounts. Emotions will surface if you're honest.

✅ Pause trading after consecutive losses

Two losses in a row? Step away for 24 hours. Protect your decision-making clarity.

✅ Learn to wait – no trade is often the best trade

Patience is a trader’s secret weapon. Pros trade less, but with precision.

🔁 Trading isn’t about predicting the market – it’s about managing yourself within it

A 55% win-rate system can make you consistent profits

If you’re disciplined, calm, and structured.

But…

A 70% win-rate system can still blow your account

If your emotions are calling the shots.

🎯 Final Thought:

Financial markets don’t reward traders with the best strategy.

They reward those who stay rational under pressure.

You don’t need to be the smartest person in the room.

You don’t need a complex system.

But you do need emotional control, patience, and trust in your process.

Knowledge helps you spot the trade. Psychology helps you survive it.

🔔 If you found value in this, follow me for more content on trading mindset, discipline, and long-term consistency – because true success begins in the mind.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.