XRP has been stuck in a trading range around $3.50 for the past 5 days, offering multiple trade opportunities within the chop.

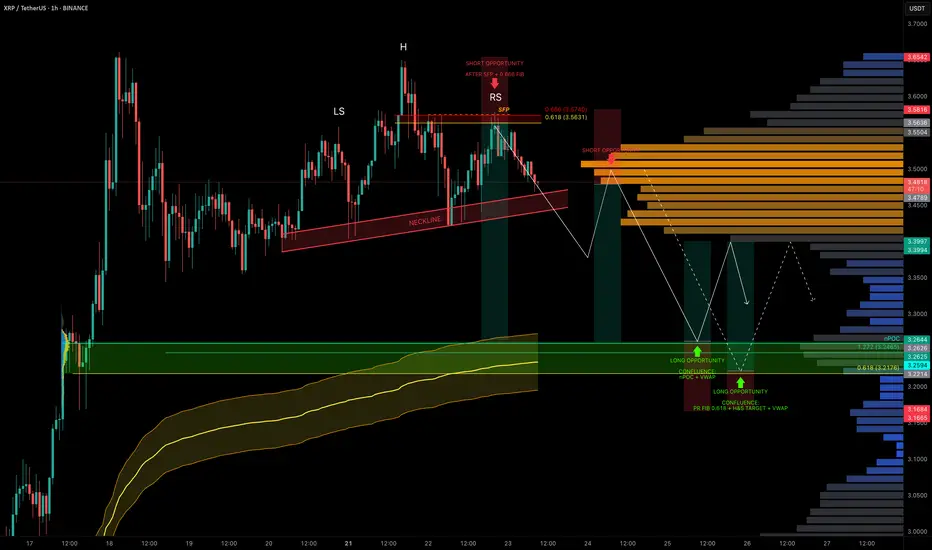

A notable short was triggered after a swing failure pattern (SFP) at the 0.666 fib retracement level near $3.563.

Now, with liquidity building to the downside, we’re watching closely for the next high-conviction setups.

🧩 Current Structure & Short Setup

🔴 Short Opportunity (Triggered):

🟢 Long Setup:

Watching for a high-probability long around:

This zone offers strong confluence and could act as the next launchpad.

Long Trade Plan:

✍️ Plan: Set alerts near the lows and react to price action at the zone — don’t front-run, let structure confirm.

💡 Pro Tip: Trade the Confluence, Not the Emotion

High-probability trades come from confluence, not guessing.

This setup combines nPOC, TBFE, VWAP, fib levels, and classical market structure (H&S) to map precise zones for both longs and shorts.

Let price come to you and wait for confirmation — especially in a rangebound environment where liquidity hunts are frequent.

Final Thoughts

We’re still rangebound, but liquidity is building below.

Keep an eye on the $3.26–$3.22 support zone for long entries and the H&S neckline for short breakdown confirmation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

A notable short was triggered after a swing failure pattern (SFP) at the 0.666 fib retracement level near $3.563.

Now, with liquidity building to the downside, we’re watching closely for the next high-conviction setups.

🧩 Current Structure & Short Setup

🔴 Short Opportunity (Triggered):

- SFP + 0.666 fib retracement at $3.563 led to rejection.

- Market now shows a head & shoulders pattern forming.

- Target: $3.2176 (0.618 fib retracement).

- Trigger: Watch for a neckline break + retest for short confirmation.

- Stop-loss: Above the right shoulder.

🟢 Long Setup:

Watching for a high-probability long around:

- $3.26 → nPOC + 1.272 TBFE

- $3.23 → anchored VWAP bands

This zone offers strong confluence and could act as the next launchpad.

Long Trade Plan:

- Entry Zone: potential entries between $3.26–$3.22, price action needed for confirmation

- Stop-loss: Below swing low at $3.1675

- Target (TP): ~$3.40

✍️ Plan: Set alerts near the lows and react to price action at the zone — don’t front-run, let structure confirm.

💡 Pro Tip: Trade the Confluence, Not the Emotion

High-probability trades come from confluence, not guessing.

This setup combines nPOC, TBFE, VWAP, fib levels, and classical market structure (H&S) to map precise zones for both longs and shorts.

Let price come to you and wait for confirmation — especially in a rangebound environment where liquidity hunts are frequent.

Final Thoughts

We’re still rangebound, but liquidity is building below.

Keep an eye on the $3.26–$3.22 support zone for long entries and the H&S neckline for short breakdown confirmation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

Trade closed: target reached

XRP dropped like a rock, the short trade setup played out beautifully 💥There was only a minor bounce into the long zone before continuation down.

Patience paid off =)

🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.