HTF direction LTF execution Hello traders

-In this example, we have explained the high probability setup after a reaction from a strong supply zone.

- Here, we have an entry after the reaction from the supply zone, which we will break down in detail in the following steps;

1) We can see that the price is in a downtrend, and supply has full control.

2) The price moves towards the supply zone, and make liquidity

3) In one move, the price picks up liquidity, and we see a good reaction from the supply zone.

4) An impulsive reaction from the supply zone tells us that we have a strong supply zone and we can expect a downtrend

5) After the reaction from the supply zone, we see a nice momentum, and then the price starts to pullback to our entry.

6) The price creates liquidity, that's another positive confirmation we see here.

7) We currently have everything we want to see, and the price from our entry is expected to continue impulsively towards the downtrend

- It is very important to read the PA in detail in order to understand the psychology behind the PA and to more easily recognize your high probability setup.

-Other people do not look at the market the way we do. They do not look at everything in detail. They don't know that this is necessary because if they do not understand the language of the market, they will have a lot of problems.

-It is hard, it requires time and hard work, and you need to be eager and well disciplined.

-Once we learn the language of the market and the way it communicates with us, we will always be able to understand what the market is saying to us.

- Don't forget to leave a like, if you have any questions, write us below in the comments.

HTF

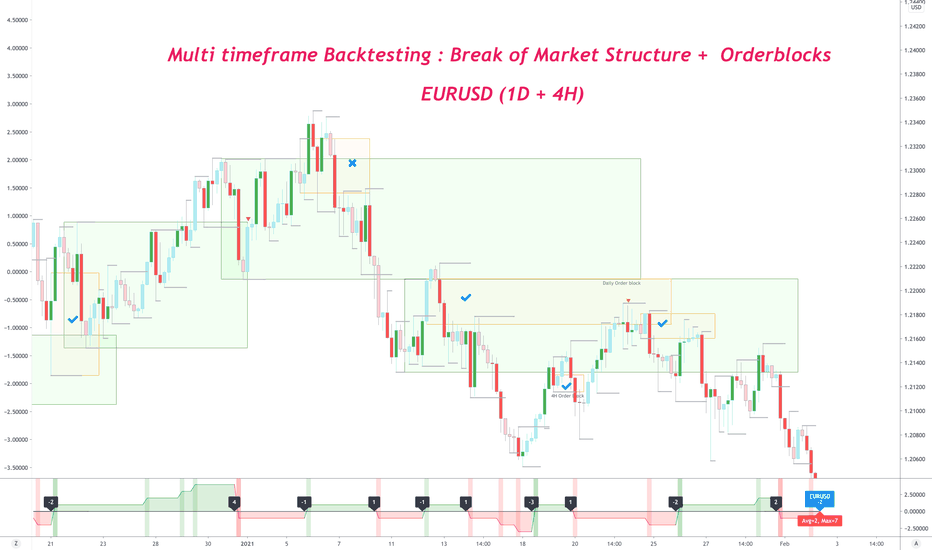

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

Pine Script: Live and non-repainting HTF Moving AveragesHello Everyone,

While using "Security" function for Higher Time Frames (htf) you must accept "Repainting" issue or better you must use previous day data such "security(syminfo.tickerid, 'D', close , lookahead=barmerge.lookahead_on)" that's best normally (or barmerge.lookahead_off). But the problem is (as you can see) it uses previous day data, and this causes latency.

So how to draw LIVE and NON-REPAINTING HTF moving averages?

Until the last candle of higher time frame all is fine and no repaint issue. when it came to last candle of HTF and if we use real data, (because of we can not know the future) while price is changing it starts drawing on each candle of current period without correcting old ones (this is repaint issue). it needs to calculate number of curent times frame candles for higher time frame and must change all points as in that period as you can see in the video (non-repainting one).

we have "50 lines" limitation in current Pine version. we hope to have unlimited lines in next version.

This work is completely experimetal.

btw Thanks to all Pine Platform Developers, They are doing very good job!

Enjoy!