Machine Learning Algorithms for Forex Market AnalysisMachine Learning Algorithms for Forex Market Analysis

Machine learning is transforming the currency trading landscape, offering innovative ways to analyse market trends. This article delves into how machine learning algorithms are reshaping forex trading. Understanding these technologies' benefits and challenges provides traders with insights to navigate the currency markets potentially more effectively, harnessing the power of data-driven decision-making.

The Basics of Machine Learning in Forex Trading

Machine learning for forex trading marks a significant shift from traditional analysis methods. At its core, machine learning involves algorithms that learn from and provide signals based on data. Unlike standard trading algorithms, which operate on predefined rules, these algorithms adapt and improve over time with exposure to more data.

Machine learning forex prediction algorithms analyse historical and real-time market data, identifying patterns that are often imperceptible to the human eye. They can process a multitude of technical and fundamental factors simultaneously, offering a more dynamic approach to analysing market trends.

This capability can allow traders to make more informed decisions about when to buy or sell currency pairs. The increasing availability of market data and advanced computing power has made machine learning an invaluable tool in a trader's arsenal.

Types of Machine Learning Algorithms in Forex Trading

In the realm of forex trading, various machine-learning algorithms are utilised to decipher complex market patterns and determine future currency movements. These algorithms leverage forex datasets for machine learning, which encompass historical price data, economic indicators, and global financial news, to train models for accurate analysis.

- Support Vector Machines (SVMs): SVMs are particularly adept at classification tasks. In forex, they analyse datasets to categorise market trends as bullish or bearish, helping traders in decision-making.

- Neural Networks: These mimic human brain functioning and are powerful in recognising subtle patterns in market datasets. They are often embedded in forex forecasting software to determine future price movements based on historical trends and fundamental data.

- Linear Regression: This straightforward approach models the relationship between dependent and independent variables in forex data. It's commonly used for its simplicity and effectiveness in identifying trends.

- Random Forest: This ensemble learning method combines multiple decision trees to potentially improve analysis accuracy and reduce overfitting, making it a reliable choice in the forex market analysis.

- Recurrent Neural Networks (RNNs): Suited for sequential data, RNNs can be effective in analysing time-series market data, capturing dynamic changes over time.

- Long Short-Term Memory (LSTM) Networks: A specialised form of RNNs, LSTMs are designed to remember long-term dependencies, making them effective tools for analysing extensive historical forex datasets.

Benefits of Machine Learning in Forex Trading

Machine learning offers significant advantages for forex analysis. Its integration into forex prediction software may enhance trading strategies in several key ways:

- Real-Time Data Analysis: Algorithms excel in analysing vast amounts of real-time data, which is crucial for accurate forex daily analysis and prediction.

- Automated Trading: These algorithms automate the buying and selling process, which may increase efficiency and reaction speed to market changes.

- Enhanced Market Understanding: It helps in dissecting historical market data, providing a deeper understanding for informed decision-making.

- Accuracy in Analysis: Software powered by machine learning offers superior analysis abilities, leading to potentially more precise and timely trades.

- Risk Reduction: By minimising human error and maintaining consistency, machine learning may reduce trading risks, contributing to a safer trading environment.

Challenges and Limitations

Machine learning in currency trading, while transformative, comes with its own set of challenges and limitations:

- Data Quality and Availability: Accurate machine learning analysis depends on large volumes of high-quality data. Forex markets can produce noisy or incomplete data, which can compromise the reliability of the analysis and signals.

- Complexity and Overfitting: Developing effective algorithms for forex trading is complex. There's a risk of overfitting, where models perform well on training data but poorly in real-world scenarios.

- Interpretability Issues: Machine learning models, especially deep learning algorithms, can be "black boxes," making it difficult to understand how decisions are made. This lack of transparency can be a hurdle in regulatory compliance and trust-building.

- Regulatory Challenges: Currency markets are heavily regulated, and incorporating machine learning must align with these regulatory requirements, which can vary significantly across regions.

- Cost and Resource Intensive: Implementing machine learning requires significant computational resources and expertise, which can be costly and resource-intensive, especially for smaller trading firms or individual traders.

The Bottom Line

Machine learning represents a paradigm shift in forex trading – it may offer enhanced analysis accuracy and decision-making capabilities. While challenges like data quality, complexity, and regulatory compliance persist, the benefits of advanced algorithms in understanding and navigating market dynamics are undeniable. For those looking to trade forex, opening an FXOpen account could be a step towards a wide range of markets, lightning execution and tight spreads.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Machinelearning

Behind the Curtain: Top Economic Influencers on ZN Futures1. Introduction

The 10-Year Treasury Note Futures (ZN), traded on the CME, are a cornerstone of the fixed-income market. As a vital benchmark for interest rate trends and macroeconomic sentiment, ZN Futures attract institutional and retail traders alike. Their liquidity, versatility, and sensitivity to economic shifts make them a go-to instrument for both speculation and hedging.

In this article, we delve into the economic forces shaping ZN Futures’ performance across daily, weekly, and monthly timeframes. By leveraging machine learning, specifically a Random Forest Regressor, we identify the most impactful indicators influencing Treasury futures returns. These insights can help traders fine-tune their strategies and navigate the complexities of this market.

2. Product Specifications

Contract Size:

The standard ZN Futures contract represents $100,000 face value of 10-Year Treasury Notes.

Tick Size:

Each tick corresponds to 1/64 of 1% of par value. This equals $15.625 per tick, ensuring precise pricing and manageable risk for traders.

Margins:

Approximately $2,000 per contract (changes through time).

Micro Contract Availability:

While the standard contract suits institutional traders, the micro-sized Yield Futures provide a smaller-scale option for retail participants. These contracts offer reduced tick values and margin requirements, enabling broader market participation.

3. Daily Economic Drivers

Machine learning models reveal that daily fluctuations in ZN Futures are significantly influenced by the following indicators:

Building Permits: A leading indicator of housing market activity, an increase in permits signals economic confidence and growth. This optimism often puts upward pressure on yields, while a decline may reflect economic caution, boosting demand for Treasuries.

U.S. Trade Balance: This metric measures the difference between exports and imports. A narrowing trade deficit typically signals improved economic health, leading to higher yields. Conversely, a widening deficit can weaken economic sentiment, increasing Treasury demand as a safe-haven asset.

China GDP Growth Rate: As a global economic powerhouse, China’s GDP growth influences global trade and financial flows. Strong growth suggests robust international demand, pressuring Treasury prices downward as yields rise. Slower growth has the opposite effect, enhancing Treasury appeal.

4. Weekly Economic Drivers

When analyzing weekly timeframes, the following indicators emerge as significant drivers of ZN Futures:

Velocity of Money (M2): This indicator reflects the speed at which money circulates in the economy. High velocity signals robust economic activity, often putting upward pressure on yields. Slowing velocity, on the other hand, may indicate stagnation, increasing demand for Treasury securities.

Consumer Sentiment Index: This metric gauges the confidence level of consumers regarding the economy. Rising sentiment suggests stronger consumer spending and economic growth, often pressuring bond prices downward as yields rise. Conversely, a decline signals economic caution, favoring safe-haven assets like ZN Futures.

Nonfarm Productivity: This measures output per hour worked in the nonfarm sector and serves as an indicator of economic efficiency. Rising productivity typically reflects economic strength and may lead to higher yields, while stagnation or declines can shift sentiment toward Treasuries.

5. Monthly Economic Drivers

On a broader monthly scale, the following indicators play a pivotal role in shaping ZN Futures:

Net Exports: This metric captures the difference between a country’s exports and imports. A surplus indicates strong global demand for domestic goods, signaling economic strength and driving yields higher. Persistent deficits, however, may weaken economic sentiment and increase demand for Treasuries as a safe haven.

10-Year Treasury Yield: As a benchmark for longer-term borrowing costs, movements in the 10-Year Treasury Yield reflect investor expectations for economic growth and inflation. Rising yields suggest optimism about future economic conditions, potentially reducing demand for Treasury futures. Declining yields indicate caution, bolstering Treasury appeal.

Durable Goods Orders: This indicator measures new orders placed with manufacturers for goods expected to last three years or more. Rising orders signal business confidence and economic growth, often leading to higher yields. Conversely, a decline in durable goods orders can indicate slowing economic momentum, increasing Treasury demand.

6. Applications for Different Trading Styles

Economic indicators provide distinct insights depending on the trading style and timeframe:

Day Traders: Focusing on daily indicators like Building Permits, U.S. Trade Balance, and China GDP Growth Rate to anticipate short-term market movements. For example, an improvement in China’s GDP Growth Rate may signal stronger global economic conditions, potentially driving yields higher and pressuring ZN Futures lower.

Swing Traders: Weekly indicators such as Velocity of Money (M2), Consumer Sentiment Index, and Nonfarm Productivity could help identify intermediate trends. For instance, rising consumer sentiment can reflect increased spending expectations, potentially prompting bearish positions in ZN Futures.

Position Traders: Monthly metrics like Net Exports, 10-Year Treasury Yield, and Durable Goods Orders may offer a macro perspective for long-term strategies. A sustained increase in durable goods orders, for instance, may indicate economic expansion, influencing traders to potentially adopt bearish sentiment on ZN Futures.

7. Conclusion

The analysis highlights how daily, weekly, and monthly economic indicators collectively influence ZN Futures. From more immediate fluctuations driven by Building Permits and China GDP Growth Rate, to longer-term trends shaped by Durable Goods Orders and the 10-Year Treasury Yield, each timeframe provides actionable insights for traders.

By understanding these indicators and incorporating machine learning models to uncover patterns, traders can refine strategies tailored to specific time horizons. Whether intraday, swing, or long-term, leveraging these insights empowers traders to navigate ZN Futures with greater precision.

Stay tuned for the next installment in the "Behind the Curtain" series, where we examine economic drivers behind another key futures market.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Behind the Curtain: Economic Indicators Shaping Corn Futures1: Introduction

Corn Futures (ZC), traded on the CME, play a vital role in global markets, particularly in the agriculture and food industries. As a commodity with widespread applications, Corn Futures are influenced by a multitude of factors, ranging from seasonal weather patterns to broader economic trends. Understanding these influences is critical for traders seeking to navigate the market effectively.

In this article, we leverage machine learning, specifically a Random Forest Regressor, to identify key economic indicators that have historically correlated with Corn Futures' price changes. By analyzing daily, weekly, and monthly timeframes, we aim to provide a clearer picture of how these indicators potentially shape market behavior and offer actionable insights for traders.

The findings are presented through visual graphs highlighting the top economic indicators across different timeframes. These insights can help traders fine-tune their strategies, whether for short-term speculation or long-term investment.

2: Understanding the Key Economic Indicators

Economic indicators provide a glimpse into various facets of the economy, influencing commodity markets such as Corn Futures. Using the Random Forest model, the following indicators emerged as significant for Corn Futures on different timeframes:

Daily Timeframe:

Oil Import Price Index: Reflects the cost of importing crude oil, impacting energy costs in agriculture, such as fuel for equipment and transportation.

Durable Goods Orders: Tracks demand for goods expected to last three years or more, often signaling broader economic activity that can influence commodity demand.

Natural Gas Prices: Critical for the production of fertilizers, which directly impacts corn farming costs.

Weekly Timeframe:

China GDP Growth Rate: Indicates global demand trends, as China is a major consumer of agricultural products.

Housing Starts: Reflects construction activity, indirectly influencing economic stability and consumer behavior.

Corporate Bond Spread (BAA - 10Y): A measure of credit risk that can signal changes in business investment and economic uncertainty.

Monthly Timeframe:

Retail Sales (YoY): Gauges consumer spending trends, a crucial driver of demand for corn-based products.

Initial Jobless Claims: Acts as a measure of labor market health, influencing disposable income and consumption patterns.

Nonfarm Productivity: Indicates economic efficiency and growth, impacting broader market trends.

By understanding these indicators, traders can interpret their implications on Corn Futures more effectively.

3: How to Use This Information

The timeframes for these indicators provide unique perspectives for different trading styles:

Daily Traders: Indicators like the Oil Import Price Index and Natural Gas Prices, which are highly sensitive to short-term changes, are valuable for high-frequency trading strategies. Daily traders can monitor these to anticipate intraday price movements in Corn Futures.

Swing Traders (Weekly): Weekly indicators, such as the China GDP Growth Rate or Housing Starts, help identify intermediate-term trends. Swing traders can align their positions with these macroeconomic signals for trades lasting several days or weeks.

Long-Term Traders (Monthly): Monthly indicators, such as Retail Sales and Nonfarm Productivity, provide insights into overarching economic trends. Long-term traders can use these to assess demand-side factors impacting Corn Futures over extended periods.

Additionally, traders can enhance their strategies by overlaying these indicators with seasonal patterns in Corn Futures, as weather-related supply shifts often coincide with economic factors.

4: Applications for Risk Management

Understanding the relationship between economic indicators and Corn Futures also plays a critical role in risk management. Here are several ways to apply these insights:

Refining Entry and Exit Points: By correlating Corn Futures with specific indicators, traders can potentially time their entries and exits more effectively. For example, a sharp rise in the Oil Import Price Index might signal increased production costs, potentially pressuring corn prices downward.

Diversifying Trading Strategies: Leveraging daily, weekly, and monthly indicators allows traders to adapt their strategies across timeframes. Short-term volatility from energy prices can complement long-term stability signals from broader economic metrics like GDP Growth.

Mitigating Uncertainty: Tracking indicators such as Corporate Bond Spreads can provide early warnings of economic instability, helping traders hedge their Corn Futures positions with other assets or options.

Seasonal Hedging: Combining indicator-based insights with seasonal trends in Corn Futures can enhance risk-adjusted returns. For instance, aligning hedging strategies with both economic and weather-related factors could reduce downside exposure.

5: Conclusion

The analysis highlights how diverse economic indicators shape Corn Futures prices across multiple timeframes. From daily volatility influenced by energy costs to long-term trends driven by consumer spending and productivity, each indicator provides unique insights into market dynamics.

Traders can use this framework not only for Corn Futures but also for other commodities, enabling a more data-driven approach to trading. The combination of machine learning and economic analysis presents opportunities to refine strategies and improve outcomes in the competitive world of futures trading.

Stay tuned for the next article in this series, where we delve into another futures market and its relationship with key economic indicators.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

A New President's Potential Impact on Oil Prices1. Introduction

The U.S. presidential election in 2024 is set to bring new leadership, with a new president guaranteed to take office. As history has shown, political transitions often have a profound effect on financial markets, and crude oil is no exception. Traders, investors and hedgers are now asking the critical question: how will WTI Crude Oil futures react to this change in leadership?

While there is much speculation about how a Democrat versus a Republican might shape oil policy, data-driven insights provide a more concrete outlook. Using a machine learning model based on key U.S. economic indicators, we’ve identified potential movements in crude oil prices, spanning short, medium, and long-term timeframes.

2. Key Machine Learning Predictions for Crude Oil Prices

Short-Term (1 Week to 1 Month):

Based on the machine learning model, the immediate market reaction within the first week following the election is expected to be minimal, with predicted price changes below 2% for both a Republican and Democratic win. The one-month outlook also suggests additional opportunity.

Medium-Term (1 Quarter to 1 Year):

The model shows a significant divergence in crude oil prices over the medium term, with a potential sharp upward movement one year after the election. Regardless of which party claims the presidency, WTI crude oil prices could potentially rise by over 40%. This is in line with historical trends where significant price shifts occurred one year post-election, driven by economic recovery, fiscal policies, and broader market sentiment.

Long-Term (4 Years):

Over the course of the full four-year presidential term, the model predicts more moderate growth, averaging around 15%. The data suggests that, while short-term market movements may seem reactive, the long-term outlook is more balanced and less influenced by the winning party. Instead, economic conditions, such as interest rates and industrial activity, will have a more sustained impact on crude oil prices.

3. Feature Importance: The Drivers Behind Crude Oil Price Movements

The machine learning model's analysis highlights that crude oil price movements, especially one year after the election, are primarily driven by economic indicators, rather than the political party in power. Below are the top features influencing crude oil prices:

Top Economic Indicators Influencing Crude Oil:

Fed Funds Rate: The most significant driver of crude oil prices, as interest rate policies affect everything from borrowing costs to overall economic growth. Changes in the Fed Funds Rate can signal shifts in economic activity that directly impact oil demand apart from the US Dollar itself.

Labor Force Participation Rate: A critical indicator of economic health, a higher participation rate suggests a stronger labor market, which supports increased industrial activity and energy consumption, including crude oil.

Producer Price Index (PPI): The PPI reflects inflation at the producer level, impacting the cost of goods and services, including oil-related industries.

Consumer Sentiment Index: A measure of the general public's outlook on the economy, which indirectly influences energy demand as consumer confidence affects spending patterns.

Unit Labor Costs: An increase in labor costs can signal inflationary pressures, which could lead to changes in oil prices as businesses pass on higher costs to consumers.

This study exclusively uses U.S. economic data, excluding oil-related fundamentals such as OPEC+ supply and demand information, in order to focus on the election’s direct impact through domestic economic channels.

Minimal Influence of Political Party on Price Movements:

Interestingly, the machine learning model suggests that the political party of the newly elected president has a relatively low impact on crude oil prices. The performance of WTI crude oil appears to be more closely tied to macroeconomic factors, such as employment data and inflation, than the specific party in power.

These findings emphasize the importance of focusing on economic fundamentals when analyzing crude oil price movements for longer term exposures, rather than solely relying on political outcomes.

4. Historical Analysis of Crude Oil Price Reactions to U.S. Elections

Looking back over the last two decades, the performance of crude oil post-election has varied, depending on global conditions and the economic policies of the newly elected president.

Notable Historical Movements:

George W. Bush (Republican): In his 2000 election, crude oil dropped nearly 50% within a year, reflecting the broader economic fallout from the bursting of the dot-com bubble and the events of 9/11. In contrast, his 2004 re-election saw oil prices climb 21.5% within a year, driven by the Iraq War and increasing global demand for energy.

Barack Obama (Democratic): After his 2008 election, crude oil prices surged by 33.8% within one year, partly due to economic recovery efforts following the global financial crisis. His 2012 re-election saw more modest growth, with an 8.3% rise over the same period.

Donald Trump (Republican): His election in 2016 coincided with a moderate 23.8% increase in crude oil prices over one year, as the U.S. ramped up energy production through fracking, contributing to global supply increases.

Joe Biden (Democratic): Most recently, crude oil prices skyrocketed by over 100% in the year following Biden’s 2020 victory, driven by post-pandemic economic recovery and supply chain disruptions that affected global energy markets.

5. WTI Crude Oil Contracts: CL and MCL Explained

When trading crude oil futures, the two most popular contracts offered by the CME Group are WTI Crude Oil Futures (CL) and Micro WTI Crude Oil Futures (MCL). Both contracts offer traders a way to speculate or hedge on the price movements of crude oil, but they differ in size, margin requirements, and ideal use cases.

WTI Crude Oil Futures (CL):

Price Fluctuations: The contract moves in increments of $0.01 per barrel, meaning a $10 change for one contract.

Margin Requirements: As of recent estimates, the margin requirement for trading a CL contract is around $6,000, though this can fluctuate depending on market volatility.

Micro WTI Crude Oil Futures (MCL):

Price Fluctuations: 10 times less. The contract moves in increments of $0.01 per barrel, meaning a $1 change for one contract.

Margin Requirements: 10 times less, around $600 per contract.

Practical Application:

During periods of heightened market volatility—such as the lead-up to and aftermath of a U.S. presidential election—traders can use both CL and MCL contracts to navigate expected price fluctuations. Larger traders might use CL to hedge against or capitalize on significant price movements, while retail traders may prefer MCL for smaller, controlled exposure.

6. Conclusion

As the 2024 U.S. presidential election approaches, crude oil traders are watching closely for market signals. While political outcomes can cause short-term volatility, the machine learning model’s predictions emphasize that broader economic factors will drive crude oil prices more significantly over the medium and long term.

Whether a Democrat or Republican wins, crude oil prices are expected to see a potential increase, particularly one year after the election. This surge, driven by factors such as interest rates, labor market health, and inflation, suggests that traders should focus on these economic indicators rather than placing too much weight on which party claims the presidency.

7. Risk Management Reminder

Navigating market volatility, especially during a presidential election period, requires careful risk management. Crude oil traders, whether trading standard WTI Crude Oil futures (CL) or Micro WTI Crude Oil futures (MCL), should be mindful of the following strategies to mitigate potential risks:

Use of Stop-Loss Orders:

Setting predefined exit points, traders can avoid significant drawdowns if the market moves against their position.

Leverage and Margin Control:

Overexposure can lead to margin calls and forced liquidation of positions in volatile markets.

Position Sizing:

Adjusting position sizes according to risk tolerance is vital especially during uncertain periods like elections.

Hedging Strategies:

Traders might consider hedging their crude oil positions with other instruments, such as options or spreads, to protect against unexpected market moves.

Monitoring Economic Indicators:

Keeping a close watch on key U.S. economic data can provide valuable clues to future crude oil futures price movements.

By using these risk management tools effectively, traders can better navigate the expected volatility surrounding the 2024 U.S. election and protect themselves from significant market swings.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

How can AI help to improve algorithmic trading strategies?AI is transforming the field of algorithmic trading, which involves using computer programs to execute trades based on predefined rules and strategies. AI can help to improve algorithmic trading performance and efficiency by providing advanced data analysis, predictive modeling, and optimization techniques. In this article, we will explore some of the ways that AI can enhance algorithmic trading and some of the challenges and opportunities that lie ahead.

One of the main advantages of AI in algorithmic trading is its ability to process and interpret large and complex data sets in real-time. AI algorithms can leverage various sources of data, such as market prices, volumes, news, social media, sentiment, and historical trends, to identify patterns, correlations, and anomalies that may indicate trading opportunities. AI can also use natural language processing (NLP) and computer vision to extract relevant information from unstructured data, such as text, images, and videos.

Another benefit of AI in algorithmic trading is its ability to learn from data and adapt to changing market conditions. AI algorithms can use machine learning (ML) and deep learning (DL) techniques to train on historical and live data and generate predictive models that can forecast future market movements and outcomes. AI can also use reinforcement learning (RL) techniques to learn from its own actions and feedback and optimize its trading strategies over time.

A further aspect of AI in algorithmic trading is its ability to optimize trading performance and reduce costs. AI algorithms can use mathematical optimization methods to find the optimal combination of parameters, such as entry and exit points, order size, timing, and risk management, that can maximize profits and minimize losses. AI can also use high-frequency trading (HFT) techniques to execute trades at high speeds and volumes, taking advantage of small price fluctuations and arbitrage opportunities. AI can also help to reduce transaction costs, such as commissions, fees, slippage, and market impact, by using smart order routing and execution algorithms that can find the best available prices and liquidity across multiple venues.

However, AI in algorithmic trading also faces some challenges and limitations that need to be addressed. One of the main challenges is the quality and reliability of data. AI algorithms depend on accurate and timely data to perform well, but data sources may be incomplete, inconsistent, noisy, or outdated. Data may also be subject to manipulation or hacking by malicious actors who may try to influence or deceive the algorithms. Therefore, AI algorithms need to have robust data validation, verification, and security mechanisms to ensure data integrity and trustworthiness.

Another challenge is the complexity and interpretability of AI algorithms. AI algorithms may use sophisticated and nonlinear models that are difficult to understand and explain. This may pose a problem for traders who need to monitor and control their algorithms and regulators who need to oversee and audit their activities. Moreover, AI algorithms may exhibit unexpected or undesirable behaviors or outcomes that may harm the traders or the market stability. Therefore, AI algorithms need to have transparent and explainable methods that can provide clear and meaningful insights into their logic and decisions.

However, there are also ethical and social implications of AI in algorithmic trading. AI algorithms may have an impact on the market efficiency, fairness, and inclusiveness. For example, AI algorithms may create or amplify market inefficiencies or distortions by exploiting information asymmetries or creating feedback loops or cascades. AI algorithms may also create or exacerbate market inequalities or exclusions by favoring certain groups or individuals over others or by creating barriers to entry or access for new or small players. Therefore, AI algorithms need to have ethical and social principles that can ensure their alignment with human values and interests.

In conclusion, AI is a powerful tool that can help to improve algorithmic trading strategies and performance by providing advanced data analysis, predictive modeling, and optimization techniques. However, AI also poses some challenges and risks that need to be addressed by ensuring data quality and reliability, algorithm complexity and interpretability, and ethical and social implications. By doing so, AI can create a more efficient, effective, and equitable algorithmic trading environment for all stakeholders.

Options flow predicting moves on Derivatives (Futures)Options have been and are an important instrument on the financial market for a trader trading Intraday Futures. Therefore, while exploring the mechanics of the option market over the last several months, as a result of work, indicators were created that load data from Quandl and then look for patterns that may herald a change of direction on the derivative market - in this case Futures Contracts. There are two main types of Options:

CALL - allow their owner to buy a given product in the future at a predetermined price (Strike Price)

PUT - allow you to sell this product at a predetermined price (Strike Price)

By observing the market volumes of both types of Options, we can observe the sentiment of investors. The key factors are which volume (call or put) prevail in the volume and the dynamics of the volume - what is the trend on volume, whether the difference between them increases or decreases. In addition, the Put / Call Ratio analysis allows you to confirm or negate the signals from the Option volume. The Ratio indicator behaves inversely to the price movement - in the case of a bearish sentiment, we expect the ratio to increase, and in the case of bullish sentiment - the indicator should decrease. If the Ratio follows the price in the same direction, it is an anomaly.

Of course, the mere observation of the Option volumes and the Put / Call ratio is not sufficient, as the Options Market is a much more complicated activity. It is worth including in the calculations such factors as Expiration Date, Bonus Amount, option type (In the Money, Out of Money or At the Money). Not each of the factors is equally important, therefore the key is additionally the appropriate selection of the weighting factors. For this purpose, due to the multitude of data, it is worth using Machine Learning, which I also do by saving the resulting data in a dataset in Quandl and displaying the data in TradingView using Pine Script.

Below are some additional examples from recent sessions on ES showing the predictive nature of the Option sentiment, often preceding major movements in the ES index (during the spot session):

First, from the left, the session from November 15 is shown and an opportunity to play Short. On the right, the session from November 16 and an opportunity to play the Long position this time.

Session from November 10, where we first got the Bull's signal, and at the top we got a warning signal of traffic reversal and the possibility of entering Short:

And one of my favorite moves on November 3:

Examining expired Machine Generated Signals.Examining expired Machine Generated Signals.

www.signalclub.io

IXB Short ! 72.39%, OCT19 WK2

=> Up from.. 76.82 to.. 74.63

DG Long ! 61.73%, OCT19 WK2

=> Up from.. 160.97 to.. 164.

ALK Long ! 61.73%, OCT19 WK2

=> Up from.. 63.51 to.. 67.52.

UGAZ Long ! 61.73%, OCT19 WK2

=> Down from.. 14.96 to.. 12.38. MISSED.

This is one of the Past Signal published for 2nd WK, OCT.

(Effective Date Oct 6~11)

Indicators Input Window Length - Problems And SolutionsIntroduction

Most technical indicators possesses a user defined input window length, this input affect the indicator output and for a long time, have been the cause of many innovations in technical analysis.

In this post i want to discuss the effects and particularities of indicators inputs window length, the challenges they introduce in trading and their effect when paired with machine learning forecasting models, i hope this post will be easy to read, let me know if you had difficulties understanding it.

Speed And Efficiency Problems

An input window length can involve the number of data processed by the indicator, therefore higher window length's will process more data, which result in a slower computation time, therefore in high-frequency/algorithmic trading where response time matter, maximizing the profitability might be made at the cost of the indicator response time, and even if computerized trading has been praised for its speed, small lag times can actually affect your strategy, therefore one might enter a trade at a different value than the targeted price.

Note : High frequency trading (hft) is a commonly mistaken term, one might believe that hft require the trader to open and close a large number of trades in a short amount of time, in reality hft is related to the "rate at which data is processed".

Solution - Efficient Data Processing

Solutions have been proposed in order to make certain tools more efficient. For example the simple moving average is a common tool that is the basis of many other indicators, its calculation involve summing the length last data points and diving this sum by length . In signal processing, such tool require what is called "memory", the data points must be stored in order for them to be processed, this is extremely inefficient and slow, therefore alternatives have been proposed, one of them is still mainly used in technical analysis today and is called the exponential moving average (ema), the process of computing an exponential moving average is called exponential averaging, and has the form of :

ema = sc*input+(1-sc)*(past ema value)

where sc is called the smoothing constant where 1 > sc > 0 . We only need 2 data values in order to perform this computation, lets denote a moving average of period length sma(input,length) , we can estimate it using exponential averaging with sc = 2/(length+1) . The computation time of the exponential moving average is way lower than the one of the sma . This is the most elegant and efficient estimation of the simple moving average.

The exponential moving average is the simplest "IIR Filter", or infinite response filter, those filters are as well extremely efficient since they use recursion. Exponential averaging is also the core of many adaptive indicators. In my experience, recursion will always let you create extremely efficient tools.

Window Length And Optimization Problems

Optimization is a branch of mathematics that help us find the best parameters in order to maximize/minimize a certain function, and thanks to computers this process can be made faster. Optimizing technical indicators during backtesting involve finding the input window length (set of inputs if there are more than 1 input) that maximize the profit of a strategy.

The most common approach is brute forcing, in which we test every indicator inputs window length combination and keep the one that yield the best results. However optimization is still computationally intensive, having 2 indicators already involve a high number of combinations. This is why it is important to select a low number of indicators for your strategy. But then other problems arise, the best input window length (set of inputs) might change in the future. This is due to the fact the market price is non-stationary and one of the reasons technical indicators are looked down.

In order to deal with this problem, we can propose the following solutions :

Use indicators/Information with no input window length -> Vwap/Volume/True Range/Cumulative Mean...etc.

Study the relationship between the optimal input window length and price evolution -> Regression analysis

Forecast the optimal input window length -> Forecasting

The last two are extremely inefficient, kinda nightmarish, and would be time consuming if one use a serious backtesting procedure. However the first solution is still appealing and might actually provide a efficient result.

Machine Learning Forecasting - Performance And Technical indicators Input Window Length Dependency

Technical indicators outputs can be used as inputs for machine learning algorithms. We could think that we also need to optimize the input window length of the indicators when using machine learning (which would lead to high computations time, machine learning already involve optimization of a high number of parameters), however a research paper named "Forecasting price movements using technical indicators: Investigating the impact of varying input window length" by Yauheniya Shynkevicha, T.M. McGinnitya, Sonya A. Colemana, Ammar Belatrechec and Yuhua Li highlight an interesting phenomenon, the abstract tell us that :

"The highest prediction performance is observed when the input window length is approximately equal to the forecast horizon"

In short, if you want to forecast market price 14 step ahead with a machine learning model, you should use indicators with input window length approximately equal to 14 as inputs for the model in order to get the best performance. This would allow to skip a lot of optimizations processes regarding the technical indicators used in the model. They used 3 different type of ML algorithms, support vector machine (svm) , adversarial neural networks (ann) and k nearest neighboring (knn) , which reinforce their conclusion.

In the paper, we can see something interesting with the indicators they selected as inputs, they used : A simple moving average, an exponential moving average, the average true range, the Average Directional Movement Index, CCI, ROC, RSI, %R, stochastic oscillator.

First thing we can see is that they used the exponential moving average instead of the wilder moving average for certain calculations, which i think is a good choice. We can also see they used many indicators outputting the same kind of information, in this case we often talk about "Multicollinearity", for example :

The CCI, ROC, RSI, %R, Stochastic output similar information, all remove the trend in the price, the CCI and ROC are both centered around 0 and the %R, RSI and stochastic oscillator around 50. The SMA and EMA also output similar information.

In technical analysis this practice is often discouraged since the indicators will output the same kind of information, this lead to redundancy. However such practice has been seen a lot in machine learning models using technical indicators. Maybe that a higher amount of multicollinearity between indicators allow to strengthen the relationship between the forecast horizon and the indicators input window length.

Conclusion

We talked (a lot) about indicator inputs window length, what problems they cause us and how we can find solutions to those problems. Also we have seen that the forecasting performance of ML models can be higher when they use indicators outputs with input window length equal to the forecasting horizon. This can make to make the process of forecasting financial market price with ML models using technical indicators more efficient.

ML is a recurring subject in financial forecasting, those algorithms offer the hope to make technical indicators more useful, and indeed, technical indicators and ML models can benefits from each others, however it is sad to observe that classical indicators are mainly used instead of newer ones, but its also encouraging in the sense that more research can be done, using newer material/procedures.

Thanks for reading !

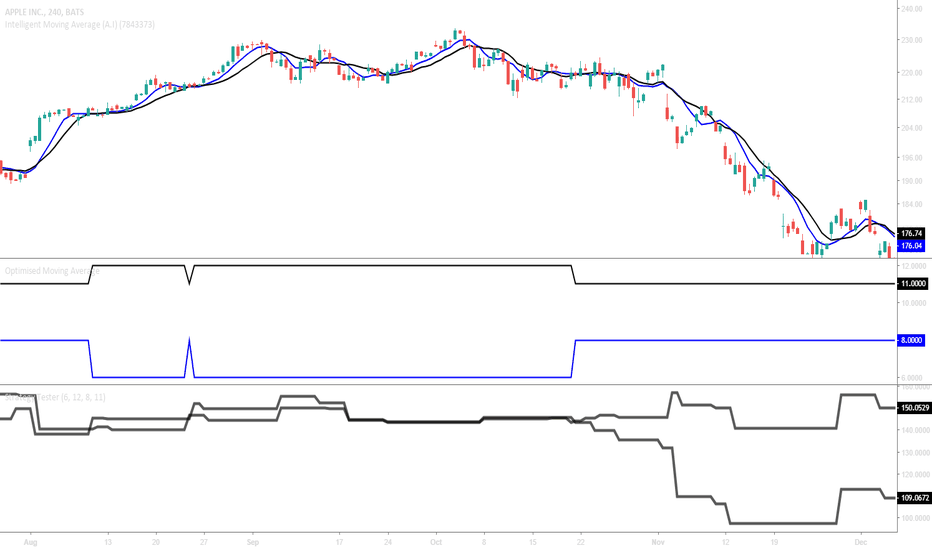

High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Futures.

There are 2 distinctive dotted lines labelled as

1. AI Day Resistance

2. AI Day Support

These 2 signals are generated by machine learning AI robots as a high probability trade setup where to long or short.

If price action was above the AI Day resistance line AND price closed above Pivot Point R1 line, the ideas is to long and take profit at Pivot R2 line

OR

If price action was below the AI Day support line AND price closed below Pivot Point S1 line, the ideas is to short and take profit at Pivot S2 line

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.