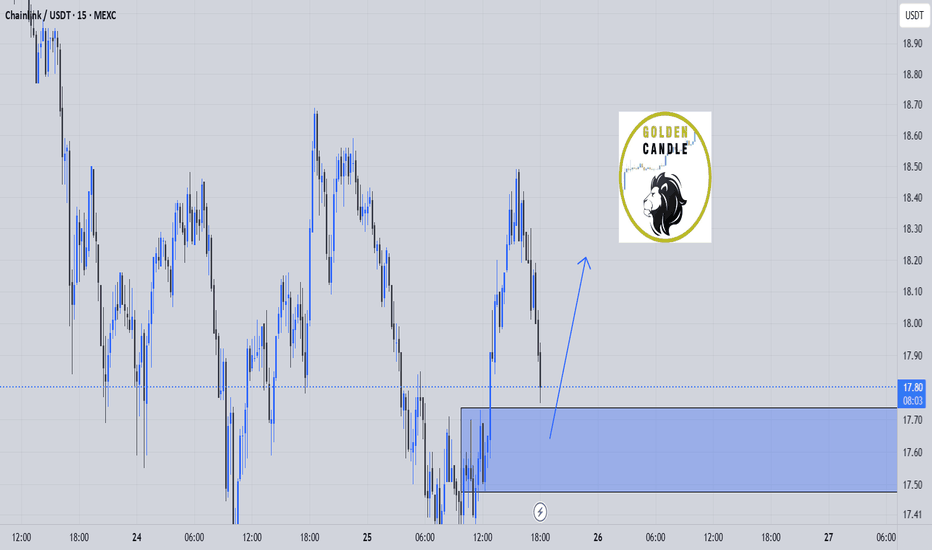

link buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

15min

BUY opportunity on USDCHF M15

Please do not trade as my analysis might be incorrect.

I encourage constructive feedback.

If you did trade, make sure the drawing is respected, don't use exact values as they might differ from a broker to another.

Explanations:

MIN - last minimum point

MAX - last maximum point

BOS - break of structure

SMS - shift in market structure

SL - stop loss

TP - take profit

RR - risk reward

OB - order block

OB (15) - order block (based on M15) timeframe

#LAYERUSDT remains weak — expecting further downside!This is a quick trade designed for a fast entry and exit with profit.

📉 SHORT #LAYERUSDT from $0.6780

🛡 Stop Loss: $0.6840

⏱ 15M Timeframe

✅ Overview:

➡️ #LAYERUSDT remains in a downtrend, trading near $0.6780, which could act as a short entry point.

➡️ POC (Point of Control) at $0.7316 confirms a high liquidity zone above the current price, indicating strong selling pressure.

➡️ The price failed to hold above the previous consolidation zone and continues downward.

➡️ If the price breaks below $0.6780, a further decline is expected, targeting lower support levels.

⚡ Plan:

➡️ Enter short upon breaking $0.6780, confirming the downward trend.

➡️ Risk management via Stop-Loss at $0.6840, protecting against a false breakout.

🎯 TP Targets:

💎 TP1: $0.6690

🚀 #LAYERUSDT remains weak—expecting further downside!

📢 #LAYERUSDT is under strong selling pressure. If the price breaks $0.6780, increased momentum may push it toward $0.6690. However, if it reclaims $0.6840, a short-term rebound could occur.

#BNBUSDT forecast for a long move📉 LONG BYBIT:BNBUSDT.P $589.70

🛡 Stop Loss: $588.50

⏱ 1H Timeframe

📍 Overview:

➡️ BYBIT:BNBUSDT.P continues to move within an ascending channel, gradually recovering after a local correction.

➡️ P OC (Point of Control) at $588.10 indicates a high-interest zone, from which price has rebounded multiple times.

➡️ The key resistance zone is around $592.45 , where the first profit target is set.

➡️ Holding above the current level could trigger further upside movement towards $596.00, strengthening the bullish momentum.

⚡ Plan:

➡️ Considering a LONG entry at $589.70, with a Stop Loss at $588.50 .

➡️ A breakout above $592.45 will confirm buyer strength and pave the way for $596.00.

➡️ Increased volume at the current level suggests institutional interest, increasing the probability of scenario execution.

🎯 TP Targets:

💎 TP 1: $592.45

💎 TP 2: $596.00

📢 BYBIT:BNBUSDT.P maintains a bullish structure despite temporary pullbacks.

📢 Key focus should be on price action at $592.45 – a breakout here will solidify the bullish case.

📢 Monitoring volume dynamics is crucial – increased buying activity will reinforce the uptrend.

🚀 BYBIT:BNBUSDT.P remains strong – expecting a move towards $596.00 upon breakout of key levels!

15M GOLD CHART ANALYSISHi Traders,

Check out our 15M Analysis

As per our chart layout analysis, our analysis has played out perfectly last 2 days. The EMA5 crossed and held above various levels, crossing 2715 target and breaking through the resistance level as well. We highlighted that the next directional move would be confirmed once the EMA5 crossed and locked above weighted levels—and that’s exactly what happened.

To make it easier for you, we’ve added entry levels, and take profit targets (TP1, TP2, TP3). These levels align seamlessly with the EMA5 crossing and holding above each level, which will determine the next target. The golden circle indicates specifically where EMA5 has crossed and locked above the weighted levels and worked out perfectly.

Currently, the price is moving between two weighed levels, with a gap above at 2755 and a gap below at 2748. We need to see the EMA5 cross and lock on either of these levels to confirm the next range.

Remember to focus on buying dips. Our updated levels and weighed zones will help track downward movements and capitalize on upward bounces.

Continue to buy dips at our support levels, targeting 10-20 pips per trade. Each level structure typically provides bounces within this range, making it ideal for precise entry and exit opportunities.

BULLISH TARGET

2762

EMA5 CROSS AND LOCK ABOVE 2715 WILL OPEN THE FOLLOWING BULLISH TARGET

2731 DONE

EMA5 CROSS AND LOCK ABOVE 2731 WILL OPEN THE FOLLOWING BULLISH TARGET

2741 DONE

EMA5 CROSS AND LOCK ABOVE 2741 WILL OPEN THE FOLLOWING BULLISH TARGET

2748 DONE

EMA5 CROSS AND LOCK ABOVE 2748 WILL OPEN THE FOLLOWING BULLISH TARGET

2755

EMA5 CROSS AND LOCK ABOVE 2755 WILL OPEN THE FOLLOWING BULLISH TARGET

2762

BEARISH TARGETS

2696

EMA5 CROSS AND LOCK BELOW 2741 WILL OPEN THE FOLLOWING BEARISH TARGET

2720

EMA5 CROSS AND LOCK BELOW 2720 WILL OPEN THE FOLLOWING BEARISH TARGET

2701

EMA5 CROSS AND LOCK BELOW 2701 WILL OPEN THE FOLLOWING BEARISH TARGET

2688

As always, we’ll keep you updated throughout the week with regular insights on how we’re managing active ideas and setups. Thank you all for your continued support, including your likes, comments, and follows – we truly appreciate it!

TheQuantumTrader

eth sell setup"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BTCUSD AUTOBOT 15minThis is a description of the 15min BTC AutoBot strategy written in Pine Script, which is designed for automatic trading on the Bitcoin (BTC) market. It uses Exponential Moving Averages (EMAs) and allows the bot to make trades based on specific conditions without requiring manual intervention. The bot can only be used with a webhook, ensuring automated execution. Below is an explanation of each part of the script:

Overview:

Timeframe: The strategy works on the 15-minute chart for Bitcoin.

Trade Type: It uses two EMAs (25 and 200) to decide when to buy (Long) or sell (Short).

Risk Management: Take Profit and Stop Loss are configurable as percentages, helping automate risk management.

User Inputs:

shortEmaLength: The length of the shorter EMA (default = 25).

longEmaLength: The length of the longer EMA (default = 200).

takeProfitPct: Percentage for take profit (default = 1%).

stopLossPct: Percentage for stop loss (default = 0.5%).

These inputs allow users to configure the strategy according to their preferences.

EMA Calculations:

shortEma: The 25-period EMA is calculated on the close price of the asset.

longEma: The 200-period EMA is also calculated based on the close price.

Conditions for Trade Signals:

Long (Buy) Condition: When the 25 EMA crosses above the 200 EMA, a "buy" signal is generated (crossover).

Short (Sell) Condition: When the 25 EMA crosses below the 200 EMA, a "sell" signal is generated (crossunder).

Entry and Exit Conditions:

Long Entry: When the buy signal occurs (crossover), the bot enters a long position at the current market price.

Take Profit: The take profit price is calculated as the entry price plus the configured percentage.

Stop Loss: The stop loss price is calculated as the entry price minus the configured percentage.

The bot automatically exits the position when the take profit or stop loss levels are reached.

Short Entry: When the sell signal occurs (crossunder), the bot enters a short position at the current market price.

Take Profit: The take profit price is calculated as the entry price minus the configured percentage.

Stop Loss: The stop loss price is calculated as the entry price plus the configured percentage.

The bot automatically exits the position when the take profit or stop loss levels are reached.

Key Features:

Automated Execution: The bot can only be used with a webhook, meaning all trades are executed automatically based on the defined conditions.

No Manual Trading: This strategy is designed for automation, with no need for manual intervention.

Risk Management: Configurable take profit and stop loss settings help manage risk effectively.

How It Works:

Once configured, the bot will continuously monitor the price and the two EMAs on the 15-minute chart.

Whenever the crossover or crossunder conditions are met, the bot will automatically place a buy or sell order, respectively.

The bot will then monitor the price and exit the position when the take profit or stop loss levels are reached.

This setup ensures that trades are executed in a fully automated manner, making it ideal for users who prefer to have a bot manage their trades according to set conditions.

BTC Can fall on 15minShort-Term Trades: Look for buying opportunities around the support level (56,940.8) but be cautious of the overall bearish trend.

Long-Term Perspective: Given the downward trendline, it might be wise to wait for a clear breakout above the resistance level (59,134.5) before considering long-term position

AUDUSD | 15m Trade Plan | Intraday15m: Can observe BoS and Swing Low

The price is now consolidating.

Plan A: As soon as the market takes buy-side liquidity, take a short position, followed by a 15m bearish confirmation.

Plan B: As soon as the market takes sell-side liquidity, take a long position, followed by a 15m bullish confirmation.

Plan C: Take a flip entry accordingly.

Do not deviate from the process; take entries in the 15m kill zones.

AUDUSD | Trading Plan | 15m15m:

A bearish Break of Structure (BoS) is clearly visible after the buy-side liquidity sweep.

I've marked the bearish leg and identified a valid supply zone.

I'm now waiting for a sell-side liquidity sweep to enter a long position until market mitigates the above supply zone.

After the supply zone is mitigated or buy-side lq sweep, will wait for a bearish confirmation appears on the 15m chart, I'll look for a short position again.

"Primarily, we need to focus on opportunities during kill zones and ignore any setups outside of these times."

Long-Term Position on BTC Using CRYPTOCHEATER BTC 15min IndicatoToday, I am making the decision to go long on Bitcoin (BTC) on the 15-minute chart, based on the signals from my CRYPTOCHEATER BTC 15min indicator.

Action Plan:

Opening Position: Enter a long position at the current market price.

Stop-Loss: Set a stop-loss below the MA20 to minimize potential losses.

Take-Profit: The target value will be determined based on price dynamics and resistance levels.

Note: Trading cryptocurrencies involves a high level of risk, and each trader should conduct their own analysis before making trading decisions.

GBPUSD SELL IDEAFX:GBPUSD

The weekly, daily and 4h are overall bearish, with price having retraced to the Daily key resistance area in confluence with the 50% Fibonacci retracement level. entry is based on the 1h bearish engulfing candlestick at daily resistance and also a break of bullish countertrend, retest and bearish engulfing candlestick structure on the 15 min and 30 min timeframes