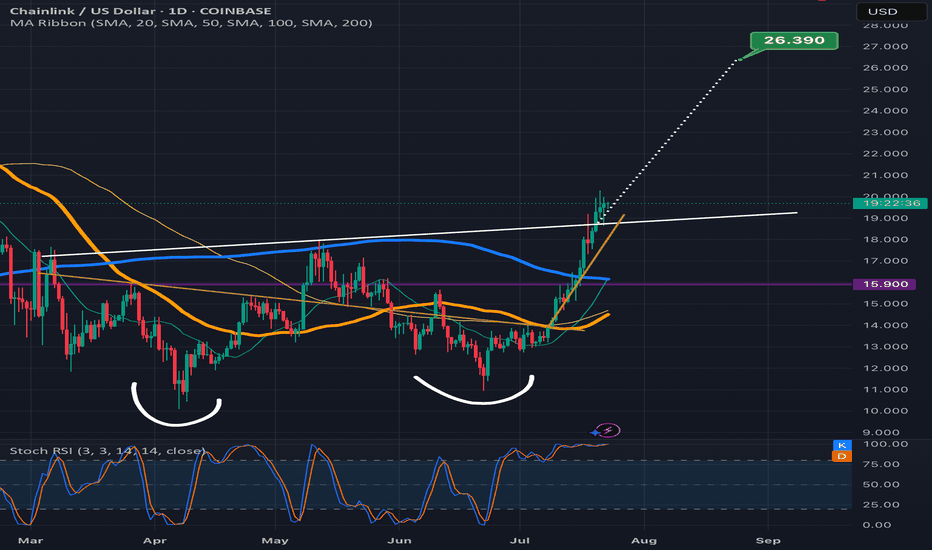

1daychart

Chainlink climbing the measured move line staircaseLooks like Chanlink is ready to confirm the double bottom breakout here as the past few candles have already started to climb up the measured move line like a staircase.Always possible for a dip back below the neckline at this point but probability slightly favors the readout being validated instead for now. *not financial advice*

FLRUS breaking above the invh&s necklineNice it confirms the breakout the target is around 3 cents. Could always dip back below the neckline a time or two before that happens, but considering how it feels lke we are finally confirming an altseason here with bitcoin dominance taking a big dump probability highly favors an eventually validation of this breakout on flr. *not financial advice*

ABT can potentially 4x in value reading up from the wedge its inThe smaller pink dotted measured move line is for the inv h&s pattern its formed inside the wedge with the top trendline of the wedge doubling as the invh&s pattern’s neckline. Hitting that smaller target is more or less a 2x from current price action. If we hit the full falling wedge target that’s a 4x from where it is currently. *not financial advice*

Btcusd breaking above cup and handle necklineIf it confirms the bullish breakout the target is 150k. Also by breaking above 116k and solidifying that level as strong support, we will trigger an even bigger inverse head and shoulders pattern (not shown here) with a breakout target around 208k! I will provide a link below to the chart I posted of that pattern. Thanks for reading, liking, and following. *not financial advice*

Ethusd breaking above invh&sEthusd chart has a similar set upas the total2 chart, a cup and handle that is breaking up from a smaller inverse head and shoulders that will complete the handle to the cup. Ethereum actually has two potential to trendlines for its cup and handle and I wouldn’t be surprised if both are valid. The breakout target for the inverse head and shoulder pattern will take price action above both of them. Once we solidify the top trendline for the cup and handle patterns as support the breakout target for it is $7161. Ethereum just recently had a golden cross on the daily which adds to the probability the inverse head and shoulder pattern breakout will be validated. *not financial advice*

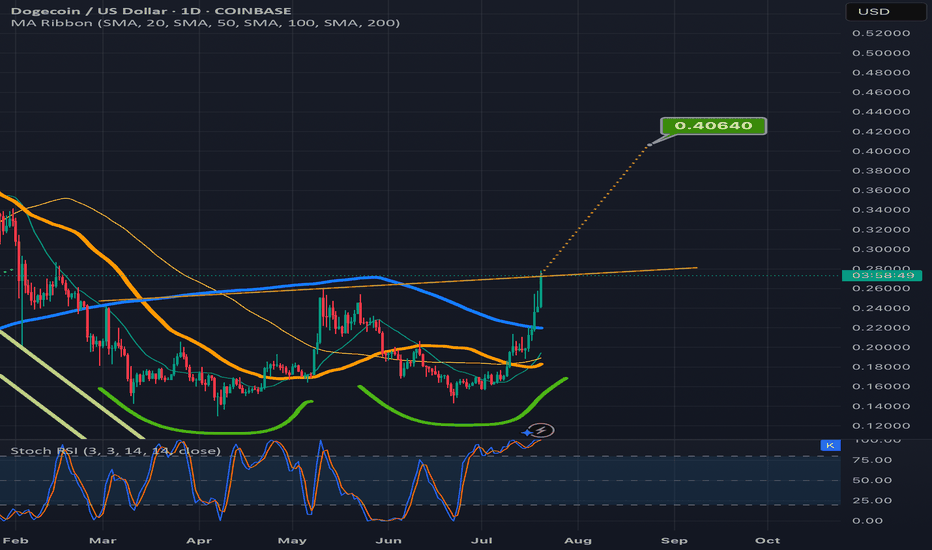

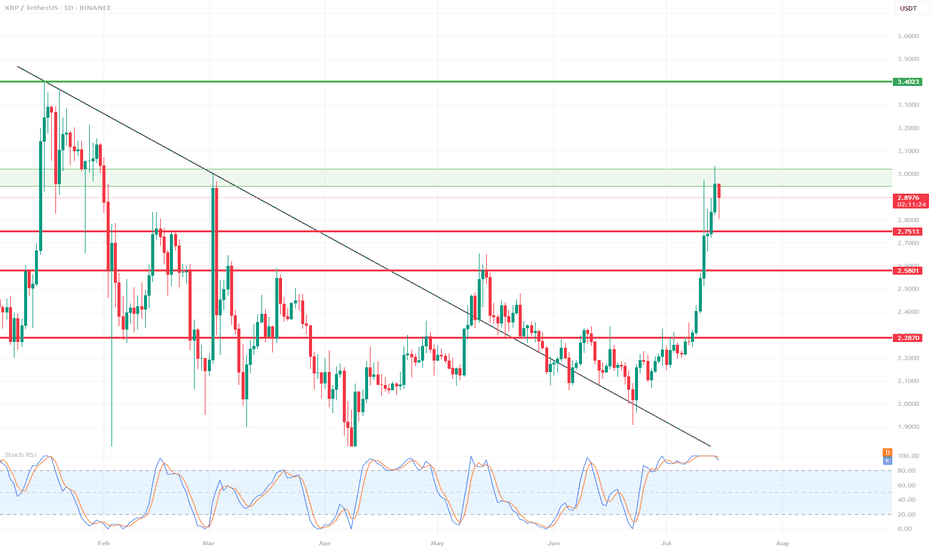

XRP 1D Chart Review📊 Support and Resistance Levels:

🔼 Resistance:

$2.95 - $3.02 – currently being tested, a local resistance zone. Price slightly rejected.

$3.40 – another strong resistance level from the previous high (visible on the left side of the chart).

🔽 Support:

$2.75 – the closest, recently broken support level.

$2.58 – another local support level.

$2.28–$2.30 – a very strong support zone that has been tested multiple times.

📈 Pattern and Momentum:

A breakout from a wedge-shaped downtrend with very high volume and long bullish candles indicates strong demand.

We are currently observing a correction/rejection at $3.02 – a possible short-term pullback.

🔄 Oscillator – Stochastic RSI:

The Stochastic RSI oscillator is in the overbought zone (near 100) – indicating possible consolidation or correction.

The curves are starting to curve downwards – a potential signal for a slight correction in the coming days.

🧠 Scenarios:

✅ Bullish (continued growth):

If the $2.95–$3.02 level is broken strongly and confirmed (e.g., by a daily candlestick closing above it), the target will be $3.40.

In this case, a quick rally to $3.40 is possible without major obstacles.

⚠️ Bearish (correction):

If the $3.02 zone holds as resistance, the price could retrace to $2.75 (the first local support).

If downward pressure persists, $2.58 could be tested.

📌 Summary:

XRP is in a strong uptrend after breaking out of long-term resistance.

In the short term, overbought prices on the Stoch RSI could trigger a correction to $2.75.

Key resistance: $3.02 – breaking it could signal further gains towards $3.40.

It's worth monitoring price reaction in this zone and candlestick confirmation.

ETH/USDT 1D🔍 ETH/USDT - technical analysis (1D interval):

📉 Price: 2478 USDT (-4.36%)

🔧 Resistance:

• SMA 200 (green): ~ 2589

• Resistance zone: ~ 2715 → 2880 USDT

• SMA 100 (blue): ~ 2500 (just rejected)

🔧 Support:

• SMA 50 (red): ~ 2434 - currently tested

• Strong support: 2373, 2314, 2223 USDT

📊 indicators:

• MacD: freshly intersected, but the momentum is weakening

• RSI: ~ 45 - neutral/weak, under 50 (no bull strength)

• Trend: Still in the downward channel (yellow trend lines)

⸻

⚠️ Conclusions:

• Price rejected from 2500 (SMA 100) and flies down.

• If 2434 falls, a further discount is possible to 2373–2314.

• Lack of bulls with key resistance - the inheritance scenario dominates.

• Watch behavior at 2434 - this is now a key level.

BTC with potential for $115,000/$120,000🔍 Market structure (Price Action)

📈 Trend:

The market previously formed higher highs (HH) and higher lows (HL) – a classic uptrend.

Then there was a correction and a lower high (LH) and lower low (LL) appeared – a potential change in the trend to a downtrend.

The last two lows are again HL (Higher Lows) – suggesting an attempt to return to the uptrend.

🔄 Key support and resistance levels

✅ Resistance (green horizontal lines):

117.469 – local resistance and potential breakout target from the current range.

115.802 – confirmed resistance from previous consolidations.

111.814 – strong local resistance (LH – Lower High formed there).

109.341 – current resistance, the price is currently testing it.

🛑 Support (red horizontal lines):

105.370 – local support, price reacted at this level in recent days.

102.650 – important support, level of previous HL.

100.095 – consolidation level before breaking out upwards.

98.213 – last LL – very important level in the context of defending the structure.

🧭 Structure of peaks and troughs

HH: Higher High – confirmed the previous uptrend.

LH: Lower High – first warning about changing the structure to down.

LL: Lower Low – confirmed a potential change to downside.

HL (x2): two more higher lows – suggest a possible return to growth.

📊 Stochastic RSI (at the bottom of the chart)

The oscillator is currently in the overbought zone (>80), approaching a downward crossover.

It suggests a possible short-term halt in growth or correction.

But in strong trends it may "stick" to the upper range.

📌 Potential scenarios:

🟢 Bullish:

If the price breaks above 109.341, it may test 111.814 and then 115.802.

Continuation of the HL → HH formation will confirm a trend reversal and further growth.

🔴 Bearish:

If the price does not stay above 109k and breaks below 105.370, there is a risk of a test of 102.650 and lower.

A break of 100.095 and especially 98.213 will negate the growth structure.

🧠 Conclusions:

The market is at a key decision point - HL formation vs. resistance zone.

Buyers' strength will be confirmed only after breaking 111-112k.

Stochastic RSI warns of potential pullback or consolidation.

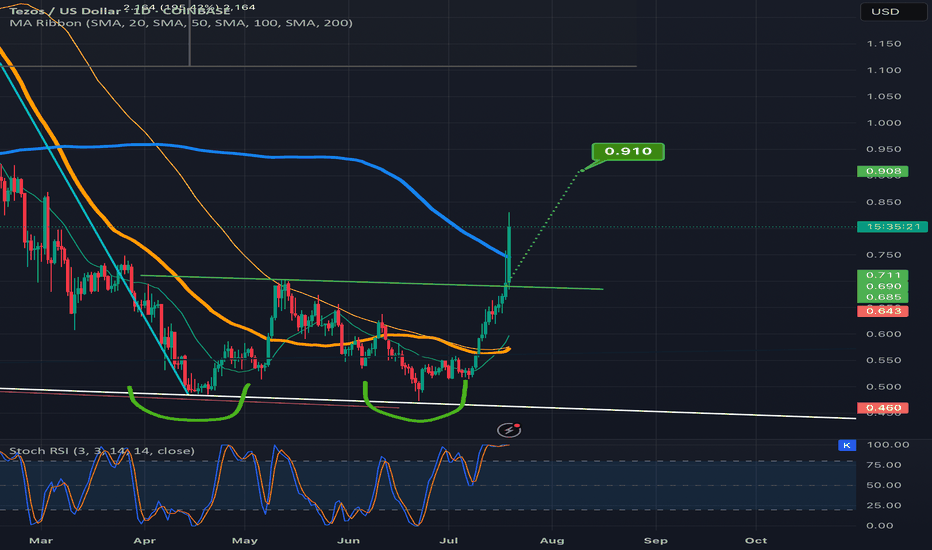

XRP/USD – Technical Analysis (1D)📊 XRP/USD – Technical Analysis (1D)

Current Price:

• Buy: 2.1554 USD

• Sell: 2.1553 USD

⸻

🧭 Trend & Structure

• Price is moving within a rising channel (orange lines).

• It’s currently trading closer to the lower trendline, suggesting potential support.

Resistance Levels (green lines):

• 2.3197

• 2.4404

• 2.5570

• 2.7300 (channel top)

Support Levels (red lines):

• 2.1467

• 2.0461

• 1.8772

• 1.7444 (key support)

⸻

📈 Indicators

RSI (Relative Strength Index)

• Hovering around the 50 level → neutral momentum.

• No strong divergence observed – RSI is moving with price.

Stochastic Oscillator

• %K has crossed %D upward → short-term bullish signal.

• Nearing the overbought zone (above 80) → a pullback could occur soon.

⸻

📌 Interpretation

• Price is testing the 2.15–2.16 zone, which has acted as both support and resistance in the past.

• A break above 2.32 could open the door toward 2.44 and 2.55 USD.

• A drop below 2.04 USD could lead to retesting 1.87 or even 1.74 USD.

• Overall trend: neutral to bullish, supported by the rising channel.

🎯 Trading Ideas

• Long Entry: Break and close above 2.32 USD with volume → targets: 2.44 / 2.55

• Short Entry: Breakdown below 2.04 USD → targets: 1.87 / 1.74

BTC/USD 1DHello everyone, let's look at the 1D BTC chart to USD, in this situation we can see how the 3rd peak formed us and we are currently fighting to maintain the price or a potential output up if we do not see a try to break out, you can expect a stronger relief.

However, let's start by defining goals for the near future the price must face:

T1 = 108376 $

T2 = 110473 $

Т3 = 112061 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 105444 $

SL2 = 103637 $

SL3 = 100644 $

SL4 = 98285

Looking at the RSI indicator, we see

As we entered the upper part of the indicator again, however, there is still a place to try to grow.

SOL/USD🔹 Trend direction

Current short-term trend: down

Price below key moving averages:

SMA50 (green) ≈ 154.84

SMA200 (blue) ≈ 168.79

Price ≈ 142.49 – below both, confirming weakness.

🔹 Supports and resistances (key levels)

✅ Supports:

142.00–143.50 – current level where price is struggling (multiple price reactions).

131.00 – strong support, last low (June 18).

119.00 / 116.00 / 113.00 – next supports from previous consolidations.

95.61 – deep support if market breaks down.

❌ Resistances:

148.00–150.00 – local resistance, coinciding with the red SMA (short-term resistance).

154.84 – resistance (SMA50).

162.00 – resistance (SMA200).

183.00 – main resistance from the May peak.

218.55 – very strong resistance from March.

🔹 Technical indicators

📉 MACD:

MACD line < signal, negative histogram → bearish signal.

No signs of bullish strength.

📉 RSI:

RSI ≈ 41.31 – close to the oversold zone, but not there yet (below 30).

RSI trend also downward.

🔹 Formations and trend lines

Broken support line after the April-May bullish structure (white trend line).

The previous bearish trend line (yellow) was broken in April, but the momentum did not hold.

A lower high and lower low may be forming now – a classic bearish structure.

🔹 Potential scenarios

🔻 Bearish:

Breakout of 142 → test of 131 → possible drop to 119/116.

Staying below SMA50 and MACD still negative = high chance of continuing declines.

🔼 Bullish:

Recovery of 148–150 needed → only then a chance to test 154 and SMA50.

RSI close to oversold = possible local technical bounce, but not reversing the trend.

📌 Conclusions / Summary

General trend: Bearish (down).

Sentiment: Negative, no confirmed signals of strength.

If level 142 breaks - next test will be at 131.

A strong breakout above 150-154 is needed to talk about a change in structure.

BTC/USD 1D Chart📊 1. Technical formation: Downtrend channel marked with orange lines

Upper trend line (resistance): ~108,200 – 110,000 USD

Lower trend line (support): ~98,455 – 97,000 USD

➡️ Such a formation usually ends with a breakout. The direction of the breakout will be key – currently, the price is testing the upper resistance line.

💵 2. Support and resistance levels

📈 Resistance:

108.202 – currently tested

112.037 – psychological level

114.816 – local top

📉 Support:

105.300 – SMA 50 + local support

103.424 – local lows

100.510 – key psychological support

98.455 – lower edge of the triangle

📉 3. Moving averages (SMA)

SMA 50 (green): currently as dynamic support (~105.300)

SMA 200 (blue): far below the price (~96.000), inactive in the short term

SMA 20 (red): price broke through it upwards – a signal of bullish strength

➡️ A bullish crossover took place between SMA 20 and SMA 50 → bullish signal.

📉 4. MACD (Momentum)

MACD line is approaching the intersection with the signal line from below.

The histogram is becoming less and less red → a potential intersection and a bullish crossover signal may occur any day now.

📉 5. RSI (Relative Strength Index)

Currently: 57.19

RSI is rising and approaching the overbought zone (70), but it is not overheated yet.

Exceeding 60 would be a signal of further bullish strength.

🔍 6. Volume and context

There is no volume marking on the candles, but:

The current bullish candle is strong and breaks through the key averages (SMA 20, 50).

This indicates buyer activity with technical support.

🟢 Bullish scenario (if a breakout occurs up)

A breakout above 108.200 with a close of the daily candle could open the way to:

112.037 (next resistance)

then even 114.816

🔴 Bearish scenario (false breakout)

A rejection from 108.200 and a drop below 105.300 → a possible return to:

103.424 or even 98.455 (lower triangle line)

Detailed technical analysis of the ETH/USD chart🧭 General Context (1D, Long-Term):

The chart covers the period from approximately September 2023 to June 2025.

ETH/USD has gone through a complete cycle: growth → decline → correction → potential consolidation/accumulation.

🔹 Market Structure (Price Action)

🔸 Trends:

November 2023 – March 2024: strong uptrend, ETH reaches highs around $4,000+

March 2024 – February 2025: clear downtrend ending with a local low around $1,600

February 2025 – May 2025: dynamic rebound – probable trend change (new higher low + higher high)

May – June 2025: currently consolidating between ~$2,400–2,800

📉 Key Support and Resistance Levels

Type Level Notes

🔴 Resistance ~2,800 – 2,900 Local high, many candles with shadows rejected from above

🟡 Resistance ~3,200 – 3,400 Beginning of strong declines from 2024

🟢 Support ~2,300 – 2,400 Local lows in June 2025

🟢 Strong support ~1,600 – 1,800 Final market low of March 2025 (possible accumulation phase)

📊 Technical indicators

✅ Stochastic RSI (at the bottom of the chart):

Currently in the oversold zone (~0–20) → may signal a potential bottom / buying opportunity

Red-blue lines are starting to wrap upwards → possible rebound

Recent crossovers of the indicator corresponded to local price movements

🔍 Technical formations

⚠️ Possible formations:

Double Bottom: February–March 2025 → classic trend reversal formation

Rising Channel: from March 2025 to present – prices are moving in a slightly rising channel

Current consolidation may be a bull flag (continuation after the increase)

📌 Summary – scenarios

🟢 Bullish scenario:

Breakout of resistance ~2,800 → possible test of levels 3,200 – 3,400 USD

Confirmation of a higher low → continuation of the uptrend

Stochastic RSI in the oversold zone → potential for an uptrend

🔴 Bearish scenario:

Drop below 2,300 USD → possible return to the area of 1,800–1,600 USD

Breakout of the structure of higher lows

Confirmation that the increase was only a correction

🧠 Final conclusions

Currently, ETH/USD is in a key decision zone: after a strong rebound, the market is resting.

Stochastic RSI suggests a potential upside impulse, but requires confirmation by a breakout of resistance.

For traders: 2,800 (resistance) and 2,300 (support) are worth watching.

For investors: 1,600–1,800 could be considered a long-term accumulation zone.

SOLUSD 1D Chart Review1. Main Trend

Downward Channel: Price moving in wide, downward channels (black trend lines), which means that the medium and long term remains bearish.

The upper trend line is a strong dynamic resistance, the lower one – support.

2. Key Horizontal

Resistance (Resistance):

$168.32: Strong resistance level, which it has responded to many times in the past.

$183.55: Another important resistance, confirmed by historical highs.

$218.85: Further resistance with an interval obligation.

$248.30: Very strong, long-term resistance (far from the current price for now).

Support (Support):

$144.23: actually occurs close to this support – very level.

$130.99: Another potential level where price could look for a rebound.

$114.74: Strong support, last bastion of bulls near March/April low.

3. Price action (Price action)

Last candles emitted pullback from downtrend line and down to support area of $144.23.

that any attempt to grow above trend line is limited by sellers.

$144.23 level currently existing short-term support - its loss may be available in case of $131 or possibly existing.

4. Indicator

Stochastic RSI (at the bottom of the chart):

Stochastic RSI indicator stated that airlines (blue and orange) were in power (overbought) in recent devices, but suddenly started to turn down.

Currently occurs in neutral zone, however application of protection (oversold). In case of threat occurrence now, it may suggest risk of attack, but it is not yet decided.

It is worth noting whether to go to the area of 20 and start turning back - in case of a necessary necessity.

5. Scenarios for the days

Bullish (growth):

Maintaining support at 144.23 USD and hitting the downtrend line (around 160-165 USD).

Breaking the trend line and resistance at 168.32 USD will give a signal to load in the area of 183-218 USD, but for the tenth time it seems to be less important, attention given the market structure.

Bearish (fall):

Breaking support at 144.23 USD and closing below on the daily candle - the next target to 131 USD, and then 114 USD.

The downtrend channel is still working against the bulls.

6. Summary

Main trend: downtrend.

Price: Close to support, but the risk of you leaving a big one.

Key horizontals: $144.23 (short-term support), $168.32 (main resistance).

Stochastic RSI: Heading towards oversold zone, but not yet giving a clear conclusion about a breakout.

Recommendation: Observe the application of price at $144.23 and the behavior of Stochastic RSI. In case of a breakout - it is possible that they will occur.

XRP/USD🔍1. Trend and Key Levels

General trend

In the medium term: We see a clear downtrend, marked by two wide blue trend lines (the upper line from the peak around $3.3, the lower from the local lows).

Recent weeks: Consolidation in a wide range between $2.72 and $1.98, with frequent attempts to break out.

📌2. Support and resistance levels

Green lines (resistance):

$3.16 — the historical peak of this wave, very strong resistance.

$2.72 — another strong resistance, around which the price was rejected several times.

$2.46 — local resistance, currently the price is below this level.

Red lines (support):

$1.98 — very important support, tested several times already.

$1.56 — lower support, coinciding with the lower line of the downtrend channel.

3. Market formations and structure

Declining channel: Wide channel marked by two blue lines. Price is moving in its lower half.

Short-term descending triangle: Visible at current levels – local peaks are getting lower, and support is around USD 1.98.

Volume: Volume advantage visible on descending candles.

📊4. Indicators

RSI

Currently around 40 — No clear advantage of the buyer side, slightly below the neutral zone. RSI does not give a signal of overbought or oversold.

RSI-based MA — Oscillates below the level of 50, which confirms the downtrend.

MACD

MAD and signal lines are below zero, without clear divergence.

Histogram: Slight advantage of bears – there is no signal to reverse the trend yet.

🧠5. Near-term scenarios

Bullish

Condition: Breakout above the local downtrend line (~$2.20–$2.25) and return above $2.46.

Target: $2.72 (test of resistance), further move possible to $3.16 in case of strong gains.

Bearish

Condition: Breakout and close below $1.98.

Target: $1.56 (main channel support), and even lower – lower channel line.

Sideways scenario

Further consolidation possible in the range of $2.46–$1.98, until a breakout from this range occurs.

📊6. Sentiment and summary

Medium-term trend: Down.

Buyers are weak, RSI low, MACD does not give a rebound signal yet.

Key level to watch: 1.98 USD – if it falls, the next stop is 1.56 USD.

Only a return above 2.46 USD may give the first signals of a trend change.

🧠Recommendation

For long-term players: Be careful, do not blindly catch the bottom.

For speculators: Play for a rebound only with a short stop below 1.98 USD.

For investors: Wait for a signal confirming a breakout from the channel or a clear divergence on the indicators.