USDCHF, last move for 2018. Rdy for 2019Finally a completion of a 3 level moves for USDCHF! Last week, the analysis point us towards a drop in USDCHF for week 52, and fortunately it did end up a lot lower with a new level 3 zone. This three level downward moves did throw me off a little with the high of level 2 zone getting to same level as zone 1, it triggered my paranoia of a high/low rest. Currently we only see half of the W being formed therefore I have yet to put a rectangle on the level 3 zone.

For week 1 of 2019, ideally a candlestick pattern to push the price up so to confirm a complete W shape before we can take a good long position. With the absence of a complete reversal formation, long can also be entered at a smaller position. You can build up the long positions with longer monitoring frequency.

If you have shorted in week 52, you would have net a good profit before the market closes. I changed my outlook of USDCHF to a long from short in week 51. However, do note that level usually stops at three but not always they will end off at three zones. For USDJPY, we have seen the fourth zone in week 52.

Be flexible, stay open and be ready to take on positions on the other side! Hope your 2018 has been great and continue the great work in 2019!

If you have any thoughts on USDCHF's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like this analysis, and follow me for my weekly updates!

2018

USDCHF, Week 51's analysis. Short in week 52?Week 51 has seen USDCHF dropping back to Week 49's low. As with week 50's analysis, a level 2 uptrend was spotted, and I do not feel comfortable that it will continue to rise even though it was at a level 2 up trend. So indeed, when market opens on week 52, it went down straight on monday, and ended the week somewhere in the middle of week 51's weekly range.

So what can we expect in week 52?

I am now seeing it at a level 2 bearish trend , and I am confident that it will continue to drop further. The rise back up on friday gave shorter a chance to enter short at a better price, and I placed multiple small entries too.

The current identified level 2 downtrend showed the high of level 2 zone reached back up to level 1 zone, with a lower low at level 2 zone. This might be a process of High/Low reset, as we are approaching the end of the year, with many traders going on holiday, I won't be surprised if next week still range within the high and low of level 2 downtrend.

If we further identified a High/Low rest, then we will need to forget about the level counting, and wait for a reversal pattern before we continue a new level count on either the up or down trend.

Conclusion

As of now, I am expecting a drop to the low of level 2 zone made in week 51. However, stay alert and open, be flexible to change side if market changes. Have a profitable week 52!

If you have any thoughts on USDCHF's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like and share this analysis, and follow me for my weekly updates!

GBPUSD, week 51 analysis - where to in week 52?Week 51 continued its upward expectation that we had in week 50's analysis. It reached a bullish level 2, and largely confined itself to a limited range of about 80 pips between its weekly high and low. If you long, you will be in profit for the first half of the week, similar to EURUSD . It was surprising to me that the break to level 2 was just a minor one. I was expecting about 50 to 80 pips break above the high of level 1. (The high and low of the zone can be seen at the box drawn)

That being said, as it was approaching the end of the year, the market usually gets choppy for a little while as a lot of traders are on holiday. Even though week 51 has moved itself to a bullish level 2 zone, there is something interesting that I spotted. If you look at the zone, we can see multiple tries to retouch the high of level 2 zone. The attempt to retouch the high during the later part of week 51 was unsuccessful, it did not reach the high as compared to the first half of the week. That signaled me to be cautious in building up my position in GBPUSD in week 52. Even though I am in the view that we should continue to long, that failed attempts to retouch the high has made me wary of the strength of the bull trend.

Instead, the same can be said for the multiple touches, trying to retouch the low of level 2 zone which proved unsuccessful as well. However, because we have identified the trend as bullish , it is more of a red flag for not breaking the high, than not breaking the low. It is obvious too that the price is not ranging.

For week 52, we might witness false breakouts or a continuation of the bullish trend to level 3. I certainly hope to see an upward break of 50 to 80 pips upwards as I am holding long contracts.

If you have any thoughts on GBPUSD's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like and follow me for my weekly updates!

EURUSD week 51 analysis, expectations for week 52Yes, if we followed week 50's analysis, we would have ended our first four trading day in profit, as it rises as expected. However, friday would have trapped long traders or clear off their profit. There is a micro 3 level trend that pushes EURUSD upwards which ended with a triple top and followed to drop about 100 pips just on friday alone. The move might have scared many long traders out and attract shorts in the process. I am however in the view that the movement of week 51 is in a bullish level 2 zone.

From the analysis of week 50, we saw a big consolidation, followed by a rise in week 51. The long in week 51 did push the price above the level 1 zone of EURUSD , however, it fell back down into the level 2 zone. It did not form a lower low than the level 1 zone which might suggest a high/low reset like what we see in USDCHF . We are still seeing the price movement following the bull trend level counting. However, we might be seeing a more volatile up and downward swing in each consolidation zone, rather than fast trades before week 49. Traders who are going in long should be wary and lower their contract sizes to manage the risk exposure. I am currently holding a small long position as well, and I expect week 52 to be moving upwards.

1.136 is actually a refraction zone where prices have either break upwards or downwards. So this price zone +/- 20 pips is a potential area for the price to turn back on its bullish track. Since we also identified the overall trend as a bullish one.

For long entry, it can be build up since the prices have dropped, however, as always, stay flexible and alert. Be ready to exit if things are not in accordance with the plan.

If you have any thoughts on EURUSD's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like and share this analysis, and follow me for my weekly updates!

USDJPY, week 51 analysis, big winner!USDJPY has proved to be the biggest winner amongst the four pairs that we have analyzed in week 50. I caught the first drop till level 2. I missed the drop from level 2 to level 3 because I was expecting a longer consolidation. If you have shorted in week 51, congrats to you for a very profitable week.

USDJPY ended the week with consolidation at level 3, I am unsure if it will go on to level 4 instead. Using the usual form of analysis, we should expect a reversal at this level, and we have also seen a reversal pattern of W. However, I am unsure why I am not very confident about this reversal, thus, I will be waiting for a retouch to the low of level 3 zone with the correct candlestick combination before I go in long for USDJPY .

According to my analysis, we can expect a reversal or upward move for USDJPY . My personal opinion would be for us to wait and see the movement coming ahead. If its a persistent downtrend, it can extend way below level 3. I am personally not too confident of the rise, however, from my knowledge and experience of using my trend analysis, my personal hunch can be wrong at times. Therefore, you can wait for a candlestick pattern near the low of level 3 consolidation or you can try and refrain from trading in week 52 and wait for a clearer picture.

If you have any thoughts on USDJPY's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like and follow me for my weekly updates!

USDJPY, week 50 analysis, a beautiful trend movementI love the movement of USDJPY in week 50, it moved quickly and completed the whole trend levels. USDJPY started with a W, moving upwards fast during the opening hours in week 50, and never looked back. Through week 50, it managed to create all the consolidation zones on the H1 and went on to create a reversal M on its level 3, and only moved away to form a level 1 downtrend a few hours before the close of the market on Friday.

I managed to enter a couple of profitable trades when USDJPY is in its level 2 and 3. I exited the short from its level 3 before the close of the markets as I do not want any unpleasant surprises and gap during the opening of the market in week 51. I am maintaining a bearish outlook for this pair, I will be finding the short opportunities in the coming week.

Such movement of the USDJPY can wipe out traders who made their decision(s) partly or hugely on the correlations between currency pairs. For example, we generally know that USDJPY and EURUSD has an inverse relationship; one moves up, and the other one down and vice versa. In week 50, EURUSD constrained itself to a range of roughly 170 pips, staying at level 1 consolidation uptrend, and even break below the obvious support line in its level 1 zone, which it made a pullback before market closure. However, we did not see USDJPY engaging on similar price movement, instead, it made a full 3 levels uptrend. EURUSD consolidated, while USDJPY made a clear trend movement. This is a great example of how trading on correlations between pairs can hamper your outlook, trade entries, and profitability.

However, many of us are susceptible to such focus on correlations, so I circumvent such focus by focusing on 1 pair at a time, and only enter when candlestick patterns, overall trend views are clear to me.

With the price movements of USDJPY in week 50, I am confident to suggest us taking the bearish view and find good opportunities to enter short in USDJPY. You can do it in stages, breaking up contract sizes into smaller portion if you are not too confident or unsure about its movement in week 51. For me, I am going to build up contact sizes when the market opens.

If you have any thoughts on USDJPY's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like and share this analysis, and follow me for my weekly updates! If you would like to see how I enter and manages my trade, it would be shared on Twitter (@xunnobi) and StockTwits (@xunnobi)

EURUSD, week 50 analysis for week 51, profitable conslidation. Week 50 sees the whole week in zone 1, with a full range of roughly 170 pips movement through Monday to Friday. I did a couple of long and short within this consolidation and fortunately, it is wide enough for day traders like to me net a profitable week by trading EURUSD, GBPUSD, USDJPY and, USDCHF.

The analysis points us towards a bull trend, even though the low of zone 1 did go back to the low that reversal W has touched. Such price movements have happened before when the level 1 zone went back up to the low/high of the preceding W/M. Such moves would have made the long exited or started shorting, and tempt the shorters to increase their position. Either way, big contracts would have been entered and piled up in such a situation when the consolidation lasted for a couple of weeks in a big range from between 120 pips to 200 pips.

From the chart, we can see an extended zone 1 which lasted for 3 weeks. Within that zone, if you are day trading or following micro trends, there would be many long and short opportunities lying around for us to pick. You need to combine the H1 chart with the M15 chart and trade on a daily basis to capture the movements. If you are trading on an H4 or D1 chart, chances are you would have taken lesser trades, but remain profitable on a bullish outlook.

With the price movements, trend and chart patterns, I am in the view of continuing to look out for buying opportunities characterized by price levels and candlestick patterns. Breakout traders would have shorted as price broke below 1.13042, however, do note that it went back to zone 1 before the closure of the market on Friday. With such pullback, I caution against shorting. Stay flexible to changes in trend, and make the necessary change in outlook if needs arise.

If you have any thoughts on EURUSD's movement for the coming weeks, please share them below, I look forward to learning and staying profitable together. Please help me like and share this analysis, and follow me for my weekly updates! If you would like to see how I enter and manages my trade, it would be shared on Twitter (@xunnobi) and StockTwits (@xunnobi)

GBPUSD, Week 50 analysis, a long for week 51Week 49's analysis of GBPUSD pointed us towards a long with a level 3 zone and an identified W shape. However, in week 50, we see it fell 282 pips, I was in for long, and it wiped me off 10% of my account's equity. I got out on Monday and did some short-term trades in Tuesday and I finally long it on Wednesday. Together with other pairs, I managed to achieve roughly 17% week on week returns.

Week 50's Wednesday see a completion of W shape, which sends the pair upwards of 210 pips and ended the week back at 1.25801, prior to moving up to 1.25801, the price bounced off at 1.25286, which gives us confidence that the first V might be formed, which explained why I placed a level 1 zone after the W. That gave me comfort to say that the H1 trend has changed to a bull trend, from a previous bearish trend which lasted a couple of weeks.

Even though the analysis points towards a new bull trend which started from Wednesday in Week 50, we still need to stay flexible and mindful of the announcement that would be coming in week 51. Manage the position size carefully and a reasonable stop loss based on pips, price, or pattern break would be helpful for traders in the short term.

I will look for opportunities to long when the market opens in week 51 and hopefully, this long trade can last for a while upwards.

Share your thoughts below, and we can all learn together. Please help me to like and share this post, and also follow me for weekly analysis on forex pairs! Thank you!! =)

USDCHF, week 49's analysis, pending consolidation for week 50Week 49 ended with no significant price movement during NFP, I did not enter long, however, my view was NFP is going to bring USDJPY and USDCHF upwards.

From my analysis, it seems that USDCHF has broken down to level 2 from its level 1 zone, which reached a high back to level 3, M reversal zone. That did paralysed my outlook for a while because it made me rethink if level 3 and level 1 is the same zone or different. However, I decided to separate them because of the break of low from level 3 zone to level 1 zone.

It seems that USDCHF is going to consolidate for a while in level 2, or perhaps it can go straight down when market opens next week. Since I am a day trader, I am going to wait and see how this pair plays out. if it is going down straight, probably I will be looking for a pull back before entering a short one this pair.

Amongst the four most traded pairs for myself, I am taking comfort on long for GBPUSD, EURUSD, and short for USDCHF.

Even though USDJPY is currently seen to be on its level 3 reversal zone with an incomplete W reversal pattern, it is at most a 50% chance that it will rise. Given that it can go to level 4, 5 or more in a persistent market movement.

Please help me to like and share my trading ideas if it provides some insights for you. Remember to follow for my weekly analysis! Thank you!! =)

Bitcoin 2k ScenarioI had to repost my idea because I accidentally violated the rules in my previous post. Sorry for being redundant. Thanks for your patience.

Please don't trade based on my technical analysis alone. This is only meant to provide you with new ideas and new insight to improve your own unique approach to trading. I don't expect to accurately predict what the price will do. I just enjoy imagining different scenarios that could happen. Enjoy!

As you know, Bitcoin has been consolidating for most of the year, and earlier this month we finally broke the pattern to the downside. I like to refer to this pattern as a "low base" formation. What do you call it? Leave a comment and let me know.

Bitcoin entered into the 2018 low base formation with a 70% drop, from 20k to 6k. It's typical when a consolidation pattern breaks to duplicate the original move, so it's very possible that the break will be another 70% leg down, which puts us at 2k. I personally believe that if we hit 2k, it will be a bottom, and it will rally back up very quickly. I like to say "The market won't give you a lot of time to buy the bottom or sell the top." Also, I think it would be fitting for the market to destroy the December bulls, just like it did to the November bulls, and then come back and destroy the January bears. What about you, what's your opinion? Let me know.

If you appreciate the insight, let me know by leaving a thumbs up and following me.

Cheers!

Bitcoin Almanac 2018-2020Hey guys!

This is what I think might happen from 2018 to 2020.

I believe Bitcoin may touch down on the critical trend lines as seen in the chart, sometime in late December or the beginning of 2019.

From now until that happens, I think we'll just see sideways action from Bitcoin, with Altcoins increasing in value.

As we can see, volume is also reducing, further drawing the point of sideways action til Bitcoin touches down on the major trend line.

Good luck,

and Remember,

Patience is paramount!

Deutsche Bank ($DBK): Weekly - Default Risk before year 2020 This is the real market risk, the most obvious contagion to date that will most likely cause the next financial crisis because of the amount of debt that the bank holds within the banking system when this stock moves down the market also follows.

Technically below that trendline and Deutsche Bank moves towards default and 0.11€

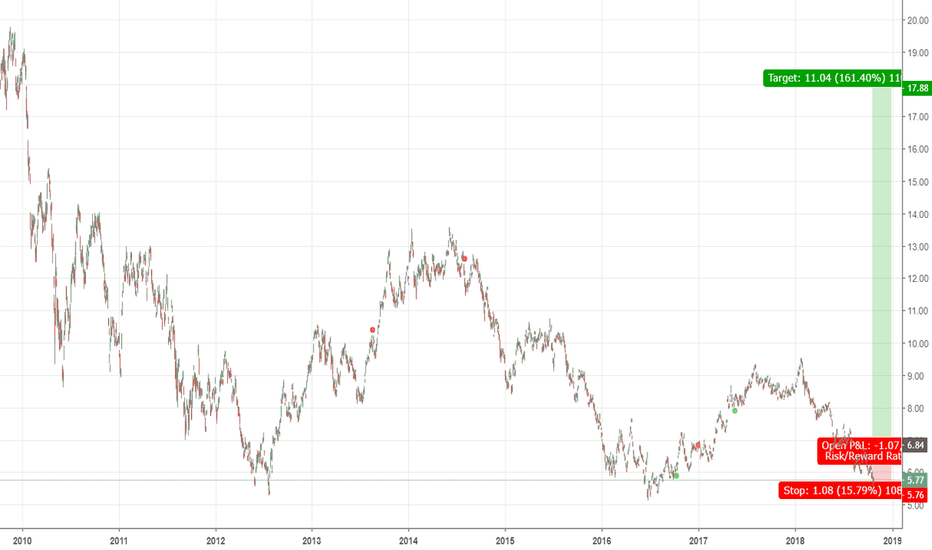

VIPS - LONG Opportiunity by Abdolreza SadreddiniVIPS - Vipshop Holdings Limited has very good potential for long term profit if bounce back and close a daily candle above $7.10.

Obviously, the stop loss would be set under knee the lowest point and TP will be over $30.00 in long term.

Setting a buy stop at $7.10 would be a smart move.

Market Report by Abdolreza Sadreddini

BBVA -Long Opportiunity- By Abdolreza SadreddiniBBVA - Banco Bilbao has very good potential for long term profit if bounce back and close a daily candle above $6.80.

Obviously, the stop loss would be set under knee the lowest point and TP will be over $25.00 in long time.

Setting a buy stop at $6.80 would be a smart move.

Market Report by Abdolreza Sadreddini

Sorry SPX trendline failure! 2008 is back2018 is the new 2008... Trend line failure on spx is a early indicator of a ABC correction ... overvalued tech stocks right and left due to silicon valley hype bubble ...

I don't make these calls lightly... and I totally understand the implications ... but as a analyst I have to call it as I see it

If crypto holds strong than I will be viewing is has a safe haven for lots of this money ...

also I could always be wrong! infact I hope I am because many people would be negativity effected by a crash like this ... but shit... this doesn't look like a healthy drop in any way and market structure is very bearish

Start saving and investing 50% of your income ... and invest into stable low risk assets and do some higher risk investing into stuff like crypto .. then when we are nearing the bottom of stocks again at the 50% retracement (some tech stocks may retrace 80% depending how bubbley they are) but most should do a test of the .618 level and .50 level ... but if you save some of your income you will have cash on the sidelines to buy the dip! because big picture stock market is very bullish.. its just that over valued tech stocks created a bubble ... SPX will not! do a 80% retrace though to be clear a 30 - 40% drop is the WORST I am expecting for the major indices.

anyways stay safe and stay profitable out there

BITCOIN FOR CHRISTMAS! BITCOIN EXPLOSION DECEMBER 2018!Early prediction for Christmas!!! OH OH OH!

Is santa giving presents to good people that waited and didn't mess around with alts, pump and dumps, bitmex and ICOs for fast profits???? I guess only who has Bitcoin will know. Check down the technical analysis below HO HO!

Only after 17TH of december we will know oh oh!

In the logarithmic scale we are still inside the descending traingle. If we continue in the same historic path of this year of tops and bottoms, now with low volume , we can assume that the fibonacci levels will be respected like before. As we approach the 100 weekly moving average the tension will replace the sideways movement with chopiness and volatility of uncertainty.

If the prices continues sideways, its only after the 17th of December that we will probably clash with the 100 weekly moving average and decide where to go. If the 100 weekly MA supports strongly with volume and momentum up, after crossing the 6800 we can be bullish . Assume also that the opposite can occur down the 5800.

Only make decisions if the trend gets strong. Otherwise it can trap you on the wrong decision! Critical resistance and support levels are the infamous 800's!!! There is always more probability of bullish movement in any market and also depends if you believe or not in Bitcoin . Check where the smart money is going!!

Have a Merry Christmas!

BTC 10th OCT 2018 - Signs For Bullish MoveHuge move for bitcoin expected. Those are my main TA sign for a bullish move

1. Double Dip in RSI & $ price ($5750-$6000).

2. Consolidation, BTC went almost stable.

3. Curve trend movement, correction seems done.

_________________________________________________________

Very buy, because expecting it would go much lower, might be the new wishful thinking in this.

Stay positive, buy the future, dont see it as an investment only.

_________________________________________________________

#doggonacci