2020

INVESTING STRATEGIES IN THE GigEconomy: VALUE-RSP & MOMENTUM-SPYShort and well-detailed idea on Value vs Momentum investing? ; Series on investing- Dec 28th, 2019

What's the Equal-value weighted(RSP) vs Market-cap weighted, top heavy(SPY) ratio useful for?

- Simply for discussing how two of the most well known investment strategies have performed in the recent years.

There's many books written on this topic, but I will try to keep this post as short as possible.

1. First things first, here's the whole chart.

As expected, in downturns, large caps should perform outperform small caps, simply because of the lower risk. People tend to park their money in safe well-diversified stocks, when the systematic risks become too high. Vice-versa, in normal cycles and economic expansions, due to the higher betas, small caps outperform large caps. This was understandable for the short liquidity cycles in 2011-2012, and 2015-2016, which I discuss in my previous idea on liquidity cycles,

But what about post 2016? There was a few rate hikes, but at the same time both fiscal and monetary expansion, that gave an above average GDP growth. Interestingly enough, the RSP/SPY ratio, almost has perfect correlation with the treasuries spread(yield curve, US10Y-US03M). Nonetheless, momentum strategy kept outperforming value investing. The question is why?

2. One of the answers is of course, the rise in the gig-economy and automation. Small business, even listed small caps, simply can't compete anymore . Whenever a company has a competitive edge(i.e instagram) it gets acquired by the time it becomes too threatening . Unfortunately, the end product of this trend, I would argue has been overall lower market competitiveness. The second answer to the same question, is because of the rise of ETF's and ETF investing . In simple terms, ETF's magnify momentum outcomes . Buy high, sell higher. Greater up-trends, but at the same time greater down-trends!

3. Will the momentum outperforming trend continue in the future? As this trend has been going on for few years, it's very hard to tell how far the gig-economy will expand. Lately, there's been support for the idea to break up big-tech, but this will just takeaway the competitive edge that the U.S economy has over the world. Nevertheless, history has shown consistently, that trends typically revert to their mean, and as we head into the next decade there's a high probability that value investing will once again perform well.

To sum up this idea, with all said, I am taking the contrarian view. I think that we are entering into a speculative bubble. Obviously, things are looking quite well right now. Every-time, there's a minor chance of a market sell-off, the FED steps in with more liquidity. At last, the market will wake up at some point after the 2020 election (perhaps 2021-2022), and finally realize that there's no growth and no fundamentals supporting these high valuations (P/E consistently above historical average).

This is my view on value and momentum investing. If you are interested in a discussion, simply write a comment or send me a private message. Thanks for the continuous support!

-Step_ahead_ofthemarket-

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up and follow is greatly appreciated!

For reference, fundamental investing is doing even worse than value investing.

Disclosure: This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

The 2020 OUTLOOK: Broad Market Analysis and Guidance (Part 4/4)The 2020 Outlook: Series on Equities , part (4/4); Dec 28th, 2019

Very simple and straight forward chart. Obviously, very unlikely that it'll completely follow the drawn structure, but here are the few things that I am expecting in 2020.

1. It will be a slow year. Mostly because of all of the election noise, smart money will be waiting on the outcome of the elections. The importance of the elections, is that it's one of the most polarized election in recent history. It will basically be a coin-toss whether, we will have a sell-off post elections or not. Either-way, speculators will kick in 2020, and volatility should rise . Momentum is still bullish.

2. Global macro trends have bounced and are somewhat recovery. I am waiting to see whether the recovery will continue in Q1 and Q2 before I completely dismiss any bearish ideas . Corporate profits have recovered(fred.stlouisfed.org), but they still do not support the current valuation(P/E well above historical average).

3. As of now, "Not QE" balance sheet expansion program by the FED, is planned to be cancelled in January, but options are open for further action. Post QT, liquidity is still low, and the yield curve is flat. Expecting further accomadative monetary policy, perhaps even an actual QE-4 announcement by May.

4. The trade/cold war is HERE TO STAY. It's not going away! It will be prolonged, until most US companies move their supply chains out of China. This will dramatically decrease global growth in the short run . In fact, I think upon announcement of Phase I, it'll be a good sell news.

This is it for 2019, happy New year! It's been a year full of events, developments and progress. Hoping for an even better 2020. Wishing everyone better health, better relationships and of course, larger trading P/L's!

This is it on my series on the 2020 Outlook. Make sure to check the previous parts, charts and discussions are welcome! Thank you for the continuous support and feedback!

Investing Strategies: Momentum vs Value Investing

Liquidity Significance:

For those of you interested in investing in GOLD:

-Step_ahead_ofthemarket-

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up and follow is greatly appreciated!

Disclosure: This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

SILVER/USD POSSIBLE BULL RUN AHEAD!!!With Christmas in the rear view mirror & the Trade war Phase 1 status Gloomy along with SPX / DJI reaching respective ATHs , OANDA:XAGUSD is looking extremely bullish especially after the recent break out. 22$/Ounce is a possibility.

Happy Trading & A Happy New Year.

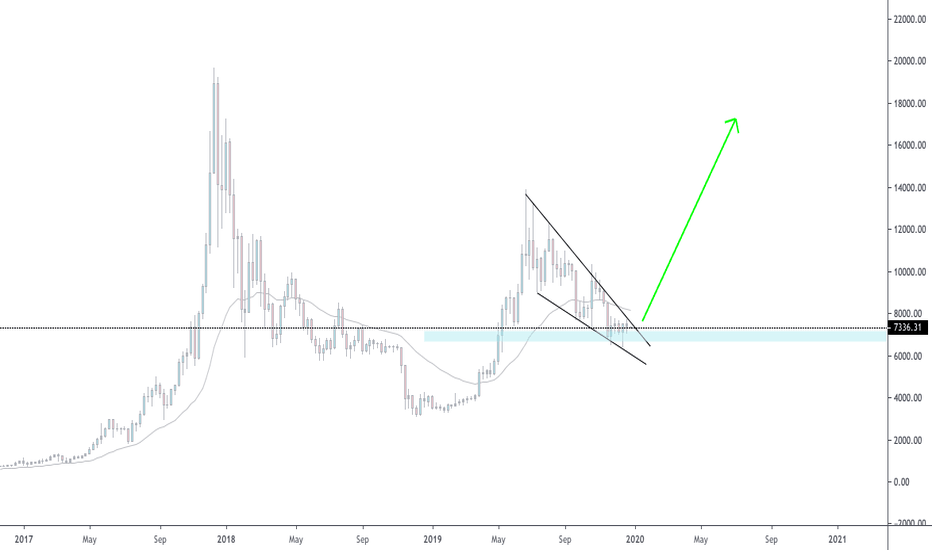

The bulls began bouncing... the bears at 7200.7200 is anchored(strong-strong resistance below), now looking for a 7300-7400 confirmation...

All timeframes are screaming BUY signals but the 4H-1D(expecting them in a day or to).

Just one or two more (1-2%) corrections and the bulls will be set free for the corRrRrRida!

Something big is coming...

The 2020 GDX OUTLOOK>>YIELDS|STOCKS|FED Policy& GOLD>>(Part 2/4)Short Analysis on GDX/Gold in 3 bullet points; Series on Commodities and the 2020 outlook - 21st of December 19'

Before I get into the analysis, wishing you all Happy holidays! Here's the simpler version of the chart:

1. Few key takeaways: Despite that the current resistance at ~31 is holding , the breakout in GDX is eminent . The question is of the timing . From part 1/4 analysis on yields(Ref #5) it seems that yields are looking somewhat bullish. Of course, this is based on the assumption that "Not QE" will continue and eventually QE-4 will be announced . Nevertheless, this means that equities will continue to be bullish, even in sectors such as materials (Ref #6). If we get another series of rate cuts, GDX could breakout as early as Q2 of 2020. For further discussion on QE and monetary policy, visit part (1/4) on Treasury yields:

2. Recently there has been somewhat of a small bounce in PMI's . This was expected as the global monetary policy stance of CB's took a dovish turn in 2019, and the easing environment affects the real economy with a lag . Taking this into consideration, $GOLD may continue the horizontal path that it is currently on. This bounce in the macro data may be very dependent on the outcome of the trade negotiations , which hopefully we will find more about in January.

3. Not expecting gold to make new highs in the first half of 2020 . As the election cycle unfolds, there should be more volatility depending on the election circumstances. It's still very early, but it doesn't look good for the Democrats, in which case a breakout in both GDX and GOLD may be postponed . It's all labelled on the chart.

To sum up, based on more accommodating monetary policy, the bottom line in GDX should hold above 27$. The horizontal range (27-31.25) should sustain before we get a breakout triggered by either the election cycle or potential economic shocks . This is a perfect iron condor trade setup . Materials as a sector has been very under-weighted and hasn't performed well, compared to the cyclicals . As the global economic slowdown continues, it seems that there isn't any downside in holding gold as a stock market hedge . Either way, balance sheet expansion favors all assets, especially substitutes for the dollar- gold.

Tried my best to keep it short and simple, this it for GDX and GOLD.

-Step_ahead_ofthemarket-

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up and follow is greatly appreciated!

References & Disclosure:

1. FED rates Super-cycle 1980's-

2. Dollar/Yuan breakdown, trade progress and tariffs:

3. Previous Gold chart:

4. XAUXAG, Gold aginst Silver ratio:

5. Treasuries and QE:

6. XLB Sector, US materials:

Disclosure: This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

2020 LOG-Bullish Targets for TESLA: {Momentum Strategy+EW Count}Update on Tesla since my last post ; Series on equities and the 2020 outlook - 26th of December 19'

My last analysis(Ref #1) on Tesla, and what has changed so far?

1. As the Christmas rally unfolds, it has been a blessing to Tesla . From my last chart, obviously Tesla broke to new highs and my chart undershot with my conservative target of 344-365 . To be fair, very few, if any, were expecting new all time highs from Tesla by the end of 2019 . In addition to the progress on the trade talks, secured financing and the progress on the Chinese factory , have been really adding fuel to Teslas' bull run. Log charting in combination with pitchfork seems to work better for Tesla as a highly volatile, growth stock. This time I excluded the elections noise and made the Tesla trading tree much simpler.

Updated Tesla Tree, combining fundamentals and technicals

2. And then there's the short covering(twitter.com). Overall, short interest dropped from around their peak at ~30%, to less than 20% - continuing their downward spiral. Of course, this shows confidence in the stocks performance. As mentioned on the chart, now that these news are priced in, the question is, what are some of the anticipated news and events and how they'll affect the stock price?

3. The answer to this question has three parts: Tesla's Q4 earnings, trade negotiations progress and FED policy . Next earnings are important, mostly for the reason of consistency. Two years in a row, Tesla seems to have breakout Q3 earnings, and then has proceeded to under-perform. In terms of trade negotiations, almost certainly that they are here to stay. Depending on their outcome, which will be highly correlated to all the macro factors, it might curb Tesla's demand slightly. Nevertheless, Tesla's expansion in China and Europe, decreases their operating risk by improving their production margin and operating cycle. I'm not going to discuss FED's policy in this post, but for anyone interested, they can visit my previous post on treasuries and QE-4(Ref #2).

I will sum up the analysis by breaking down some of the technicals. At the top of the pitchfork channel, Wave (3) target of 445 might be the next profit taking point in the current momentum strategy. I am expecting a slow January as the earnings season unfolds, simultaneously with the trade negotiations outcome. Currently, it's practically impossible to have a sense of the EW variation and extensions that Tesla will take. As it stands the best case scenario would be in the range of 620-640$. Teslas' Q4 earnings call in February, will give the path for the price action and the sense for the potential summer of 2020 targets.

Current wave count on the weekly :

This is it for Tesla, I tried to keep it short and failed. Any comments with your charts and feedback are very welcome!

-Step_ahead_ofthemarket-

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up and follow is greatly appreciated!

References and Disclosure:

1. Analysis on Q3 earnings:

2. Treasuries and QE-4:

Disclosure : This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

Gold biggest bullish trend in Historythe primay trend that reversed at $1920 would have completed its 0.618 % retracement at $1586. the secondary trend which reversed at 1557 has already completed it 0.38 % retracement at $1445. so all the trend will be bullish after $1586.

if gold touch the price of $1586 after breaking all resistance in its path than it means recession has come in simple word economic crisis 2020 and gold is ready to touch $2000, $3000 and $4003

www.facebook.com

www.instagram.com

twitter.com

ORBEX: Look at Yields for Further Clues in Equities!Equities keep climbing higher on the back of renewed trade and Brexit optimism and also on the back of monetary policy decisions! Interest rates are on hold, but the Fed did cut three times in 2019!

Will the surge continue into 2020? And if yes, when can we expect the massive sell-off everyone’s been talking about to take place?

ake a pick as we near the end of a cautious year!

Timestamps

DXY 4H 02:10

SPX 4H 04:10

US Yields 06:10

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

Possible $DJIA roadmap through electionThe 1995-2003 price/action looks very similar to the Trump Term 1 chart. This means we are close to a top (chart is log, so still possibly 30k), but predicts a small crash at the election, and then something larger when policy is changed (tax hikes? rate increases?)