XRPUSD 4H BUMP & RUN SHORT STRATEGYBump and Run Trading Strategy – Sell Rules

The Bump and Run trading strategy is one of the best reversal trading strategies that you’ll probably ever need to learn. The psychological reason why the Bump and Run reversal is such a powerful pattern is because it takes advantage of the result of excessive speculation. This propels the price too swiftly to the extreme which leads to a reversal.

Moving forward, we present the sell-side rules of the Bump and Run trading strategy:

Step #1: Wait until you can identify an uptrend (lead-in) and then an acceleration of that uptrend (Bump)

We’re breaking down the Bump and Run chart pattern into several steps. The first step is to identify an uptrend and then an acceleration of that uptrend. These two components of a trend constitute the first part of the Bump and Run Reversal.

*Note: A valid Bump and Run chart pattern has the first section of the trend drifting upwards very slowly and in the second part of the trend we need to see momentum picking up and the uptrend moving to the extreme.

Step #2: Draw the lead-in trendline that connects the lows during the first stage of the trend and draws a second trendline connecting the lows during the uptrend acceleration stage

The way you draw the trendline can be a subjective matter because there are several ways to do it and neither of them is better than the other. Ultimately, it all comes down to your experience and understanding of the price action.

Step #3: Sell Entry 1 at the break and close below the first Trendline , Sell Entry 2 at the break and close below Lead-in Trendline .

In order to maximize our potential profits we like to implement a two entries technique as follows:

Sell Entry 1 once the first trendline is broken. For confirmation of a valid breakout, we like to wait for the candle close below the trendline .

Sell Entry 2 once the Lead-in trendline is broken. Wait for confirmation of a valid breakout we like to wait for the candle close below the trendline .

During this stage, the market is in the process of reversal and the “Run” component of the Bump and Run chart pattern is formed.

The Run phase is identified when the price falls and breaks below the Lead-in trendline which also confirms that we’re in the process of reversing the previous trend.

The next logical thing we need to establish for the Bump and Run trading strategy is where to take profits.

Step #4: Take profit at the Lead-in trendline starting point

The ideal profit target for the Bump and Run trading strategy is at the Lead-in trendline starting point. In other words, take profits at the exact same level you use to draw your Lead-in trendline .

We encourage you to experiment different take profit strategies because the Bump and Run chart pattern can also lead to a severe reversal that can be the starting point of a big bearish trend .

Step #5: Place initial SL above the swing high created by the uptrend acceleration. Second SL placed above the Lead-in trendline breakout candle

Since we’re splitting our trade into two trades, we’re going to have two protective stop losses. The initial stop loss is placed just above the swing high created by the uptrend acceleration phase.

The second protective stop loss is placed above the candle that breaks the Lead-in trendline .

We’re adopting a very conservative approach here because if we truly have a reversal we consider that the market should not look back. In this regard, we keep our SL very tight.

We also recommend that once your second entry gets triggered to move your initial stop loss in the exact location as the SL2. This will guarantee you that even if you get stopped out on your second entry you’ll still be left with some profits.

*Note: The above was an example of a SELL trade… Use the same rules – but in reverse – for a BUY trade, but this time we’re going to use the inverse Bump and Run reversal.

4h

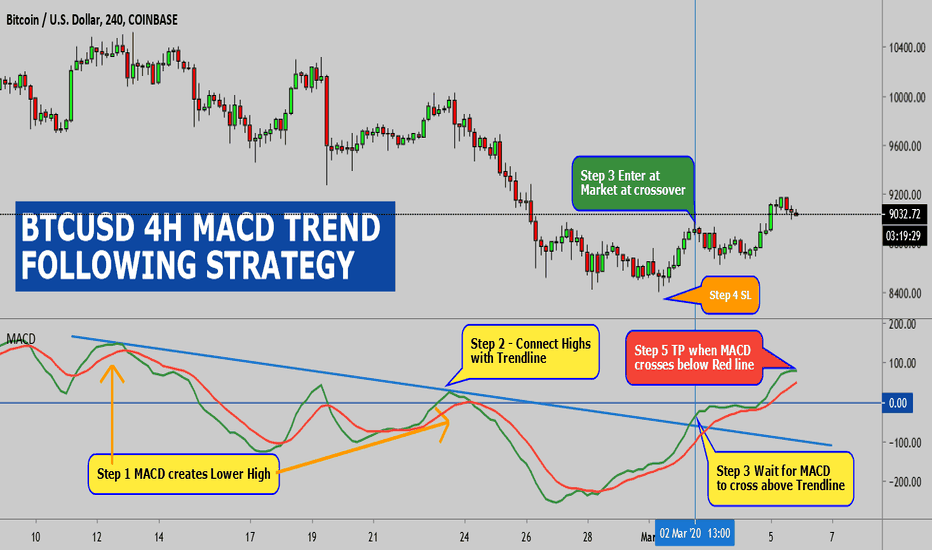

BTCUSD 4H MACD TREND FOLLOWING STRATEGY(Rules for A Buy Trade)

Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point.

The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a chart and must be higher than all previous swing high points. While a lower high happens when the swing point is lower than the previous swing high point.

Step #2: Connect the MACD line swing points that you have identified in Step #1 with a trendline.

At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. Look at the price action now and compare it to our MACD trendline we drew early. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear.

But, at this point, we’re still not done with the MACD indicator, which brings us to the critical part of our MACD Trend Following Strategy.

Step #3: Wait for the MACD line to break above the trendline. (Entry at the market price as soon as the MACD line breaks above).

When the MACD line (the blue line) crosses the signal line (the orange line) it’s an early signal that a bullish trend might start. However, if trading would be that easy we would all be millionaires, right? And that’s the reason why our MACD Trend Following Strategy is so unique. We’re not only waiting for the MACD moving averages to cross over but we also have our other criteria for the price action to break aka the trend line we drew early.

This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come together. If you were to trade just based on the MACD crossover over time you’ll lose money because that’s not a reliable strategy. But if you use the MACD indicator along with other criteria such what this strategy tells you to do, you will find great trade entries on a consistent basis.

Step #4: Use Protective Stop Loss Order. (Place the SL below the most recent swing low).

Now, that you already know how to enter a trade at this point you have to learn how to manage risk and where to place the SL. After all, a trader is basically a risk manager.

You want to place your stop loss below the most recent low, like in the figure below. But make sure you add a buffer of 5-10 pips away from the low, to protect yourself from possible false breakouts.

Basically, a good entry price means a smaller stop loss and ultimately it means you’ll lose a lot less comparing it with the profit potential, so a positive risk to reward ratio.

Step #5: Take Profit when the MACD crossover happens in the opposite direction of our entry.

Knowing when to take profit is as important as knowing when to enter a trade. However, we want to make sure we don’t use the same trading technique as for our entry order. When the MACD line (the blue line) produces signal line crossovers (the orange line) we want to close the position and take full profits.

Before taking profits, it’s important to wait for the candle close – either the 4h or the daily candle – depending on the time frame you trade so you make sure the MACD crossover actually happens.

Note** The above was an example of a buy trade using the MACD Trend Following Strategy. Use the exact same rules – but in reverse – for a sell trade.

BTC/USD OUTLOOK GRIM? LOWER MTFA ENGLISHNOVICE SPECULATION:

Well, BTC is migrating to the lower end of 8! Where will we go!

On this chart, you can see multiple opportunities for high volume trading, or entries for a long term short.

As this month closes, we may see a retrace to 9, but my personal opinion is we are going to continue to drop to 8.3 to <7.

As always, it is hard to analyze where we go since, generally speaking, we are always combatting whales and exchanges *one in the same usually* so watch out for the weekly and daily time frames.

LOGIC BEHIND SHORT:

-Paper trading, so I feel no pain or regret, thus can safely make speculative paper trades on such a chart.

-Bitcoin formed a double top on the 4H

-Normal bouncing around, as usual.

-Be careful out here...You could short and wake up to a 11k BTC.

TRADE AT YOUR OWN RISK

The BEST Timeframe to Trade ForexYou got into trading for one reason and one reason only. To change your life. For freedom, for freedom to do the things you want to do. To spend time doing what you want to do when you want to do it.

NOT to be a slave to the screen. Not to stare at the charts all day.

And here is the thing. If that is what was required, to stare at the charts for hours at a time watching each tick, then you would do it. You would do whatever it takes to succeed.

The thing is and I want you to pay attention to what I am going to say right now because it is very important, the very thing you are doing is actually the thing preventing you from success. You are spending too much time watching the markets and taking way too many trades.

Trade less. Avoid the noise. Take strong signals with a different mindset and increase your win ratio and profitability.

BTCUSDT 4H DOUBLE DEATH CROSS LONG TRADE STRATEGYThe double death cross strategy employs one more moving average that will help you anticipate when the death cross signal will occur. The third moving average is the 100-day MA, which is a medium-term MA situated between the other two moving averages.

Step #1: Wait for the 50-day EMA to cross below the 100-day EMA. The two moving averages also need to converge with the price action. You can read more about day trading price action here.

If we get the crossover of the 50-day MA (blue line) and 100-day MA (orange line) at the same time the price is testing those moving averages like it’s doing on the GBP/USD chart below, that’s the best-case situation for trade because we can define the risk.

The rule you need to keep in mind is that when the MAs converge with the price you have to get ready for the ride because it is going to get BUMPY!

Step #2: Multiple entry strategy: Sell1 when we close below 50-day MA and 100-day MA. Sell2 when we break and close below 200-day MA.

Using multiple entries to improve your average entry price can be the best way to approach the death cross signal. Scaling into a position is our preferred trading method when looking to capture a large price move in a currency pair.

The fact that the price was near the death cross signal, it created tension in the market that eventually will lead to a sharp move to the downside.

We pull the trigger on the first half of the trade once we close below the 50-day and 100-day moving averages.

If at the moment when the death cross developed we’re already trading slightly below the two moving averages, sell at the market the moment we close below.

The second half of our position is entered once we break and close below the 200-day moving average.

**Note: It’s important to remember that the success of the death cross signal relays on this simple trade secret that price and the two moving averages need to converge.

Keep it 'simple stupid' is not just a simple aphorism, but it’s an old truth that can make the difference between losing and making money trading.

Step #3: Hide your protective Stop Loss above 50-day MA and 100-day MA

The most important thing we need to define when trading is our risk. If you want to be a profitable trader you really need a limited risk. This is the type of death cross trades that we want to pull the trigger on.

If the price were to move back above those moving averages, we can safely assume this is yet another false trade signal. In this trade case scenario, we’re risking a little and our reward is potentially much bigger.

So, the best place to hide your protective stop loss is above the 50-day MA and 100-day MA.

Step #4: Choose your own Take Profit strategy or use this Two-step process for the take profit strategy: Mark on your chart the high of the candle when the 50-day MA crossed below 200-day EMA. Take profit when this high is broken.

Our take profit strategy might seem a little bit complex, but once we break down the steps you need to follow, it will make more sense why we’ve chosen this approach.

The first thing you have to do is to remember what we said at the beginning of the article which is that when the price doesn’t converge with the two MAs this is a death cross false signal.

In the example below, we can observe this type of price action.

Now all you have to do is to mark the high of the candle when the death cross happened and take profit as soon as the high gets broken.

**Note: The above was an example of a SELL trade using the death cross strategy. Use the same rules for a BUY trade – but in reverse, in which case we have the golden cross trading strategy.

Conclusion - Death Cross Stocks

Following the death cross trade signal can be a very efficient approach to identify bearish sentiment in the market. If you want to switch from short-term trading and try capturing larger trends the double death cross trading strategy can help you achieve your goals.

You must know that the death cross definition is universally applicable to any other asset classes. We can have a death cross crypto or a death cross gold the same way we can have a death cross S&P 500. Capturing and detecting bearish trends can be a hard task because downtrends are typically different than bullish trends. However, the double death cross strategy gives you a systematic way to tackle bearish trends.

BTCUSD 4H STRIKE TRADER ELITE (STE) LONG TRADEStrike Trader Elite Indicator (STE) shows Entry Signal Level

Strike Trader Elite Indicator shows Stop Loss Level

Strike Trader Elite Indicator shows Take Profit Level

Strike Trader Pulse Indicator shows Histogram crossover

PM me is you have any questions I can help you with about the STE Indicator

ETHEREUM CLASSIC 4H ASCENDING TRIANGLE LONG TRADEAscending Triangles are repeatable trading chart patterns.

Ascending chart patterns will have a directional bias depending on the previous incoming trend.

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

What ever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of average volume for a full position size.

b - If 75% of average volume then ½ position size. (To find 75% of Volume

look at the charts volume settings – divide smaller # into larger # = 75%+)

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

USDCAD MARKET ANALYSIS 4H TIMEFREAMEShort opportunity on USD/CAD. Wait for price to make a momentum breakout of trendline & turning points before entering short.

SL 45 PIPS & TP 90 PIPS ( 1:2 RRR) | FIRST TP IS RBS ZONE, MONITOR PRICE AT THAT ZONE. IF BREAKOUT HOLD SELL. IF CRS FORMED EXIT TRADE

Why I want to take a short trade on this pair?

1. USD index is bearish @ going downtrend

2. All XXX/USD pairs already going downtrend but not USD/CAD

3. Breakout of a trendline will indicates seller is in strength

4. Price is in resistance zone

5. Breakout of low turning points also indicate seller is in strength

FOR AGRESSIVE ENTRY CAN ENTER THE TRADE IF CANDLESTICK REVERSAL SIGNAL FORMED AT THE RESISTANCE AREA.

TRADE AT YOUR OWN RISK. IF YOU HAVE ANY OTHER OPINIONS FEEL FREE TO SHARE HERE! THANK YOU! :D (This is my first trade ideas published, need feedback TQ!)