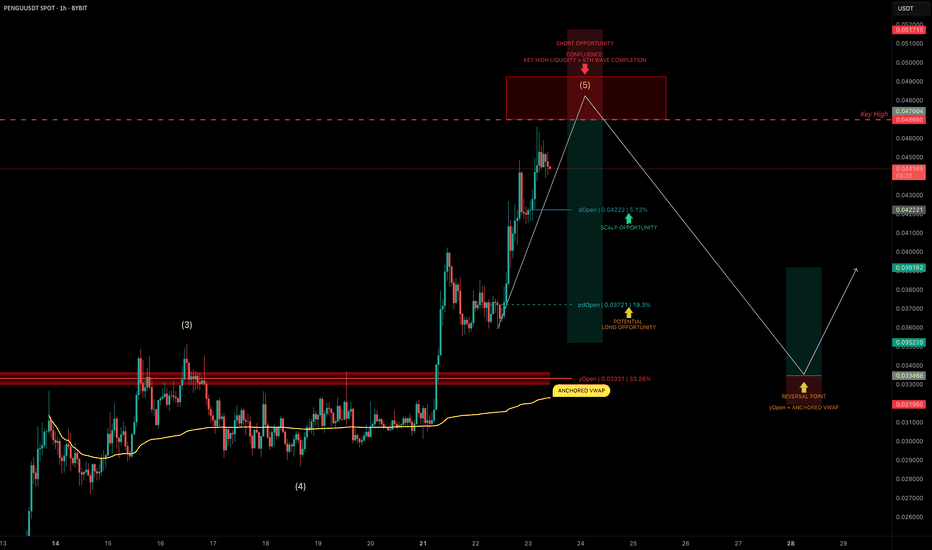

PENGU Topping Out? Targeting 30% Downside After Liquidity SweepPENGU has had an explosive run, but it now looks to be nearing completion of wave 5 of its current Elliott impulse.

We’re approaching a key high at $0.04698, a likely liquidity grab zone — and potentially a great area to position for a short trade.

🧩 Short Setup Overview

➡️ Wave 5 Completion Incoming:

Price is showing signs of exhaustion as it approaches $0.04698, where liquidity is likely stacked above the previous high.

➡️ SFP Trigger Zone:

Watch for a swing failure pattern (SFP) at $0.04698 — confirmation for a potential short entry.

➡️ Psychological Resistance:

The $0.05 level also sits just above — a classic psychological barrier that may get tapped or wicked into.

🔴 Short Trade Setup

Entry: After a confirmed SFP at $0.04698–$0.05

Target (TP): Yearly Open (yOpen) — potential move of ~30%

Stop-loss: Above post-SFP high

R:R: Excellent asymmetry if setup confirms

🛠 Indicator Note

In this analysis I'm using my own indicator called "DriftLine - Pivot Open Zones ", which I recently published.

✅ It helps highlight key open levels, support/resistance zones, and price structure shifts — all critical for confluence-based trade planning.

Feel free to check it out — you can use it for free by heading to my profile under the “Scripts” tab.

💡 Educational Insight: How to Trade Wave 5 Liquidity Sweeps

Wave 5 tops often trap late longs, especially when paired with psychological levels and key highs.

➡️ Patience is key — wait for a rejection pattern or SFP before entering.

➡️ Liquidity sweeps first — then the move.

Final Thoughts

PENGU is pushing toward $0.04698–$0.05, but this may be its final move up before correction.

With the yearly open as a logical target, and clear confluence via DriftLine, this setup offers a clean short opportunity — if confirmation comes.

Stay sharp, let price lead, and trade the reaction — not the prediction.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

5wavestructure

Elliott wave theory. Already 5 waves done!Looking for Impulse Down.

EurAud Wave 1,2,3,4 & 5 done, Will it go on to finish waves A, B, and C? I am anticipating wave C will be completed as well. Elliott wave theory. Make sure you have your own rules on RR and follow them. This is just a trading idea to help you gain better knowledge. If you have any question ask me in comments.

Learn & Earn!

Wave Trader Pro

UasCad 5 wave done now lets go for ABCWhat I see!

Looking for Impulse down.

UsdCad completed wave 1,2,3,4, & 5 now its waiting to move down to complete wave abc. Make sure you have your own rules on RR and follow them. This is just a trading idea to help you/ give better knowledge. If you have any question ask me in comments.

Learn & Earn!

SPX- surprise Rally aheadThe 5 th wave fall on 3rd Nov'22 had not moved down the index significantly.

hence we must recall the wave count that ,the correction (5 wave downfall ) is completed in the form of a neutral triangle abcde.

Provided the low of 3rd Nov'22 (3698) respected(should not break).

If this is so, until 11th Nov, all 5 waves of Expanding triangle A,B,C,D,E has been completed, and a new recovery wave ABC (3 waves)will start.

This may begin with a santa claus rally from 14th Nov'22

$TSLA Is Still Likely Heading Down To $38.60 From HereThis is an Update/Reminder of a Previous Similar Bearish Idea I had on $TSLA before the stock split. I'v felt that it is necessary to post a fresh updated readjusted chart to account for the post-split price action. If you want to compare this chart with the original chart check the Related Ideas Section Below.

$TSLA as we look at it today continues to Bearishly Diverge at the PCZ of this Logscaled Bearish AB=CD and has formed a Bearish Head and Shoulders Pattern at the Highs. The target pre-split was $38.60 but post-split i can now seet going all the way down to even $13 or lower, however to be conservative i will continue to target $38.60

The ART of profit booking I am posting a chart for educational purpose using S&p 500 index with heikinAshi candle and elliott waves

trading is an art of buying at low and selling at high, looks easy to do? if so why more people loosing and big players minting money?

trading is a money making process when the crowd has extreme interest in one direction(buy /sell).

when everyone in the street is buying, it is the RIGHT time to sell.

The ART of profit booking without harming buyers(they don't know what's happening) is described in the chart.

Because if they knew in advance then to whom the seller has to sell?

Actually speaking the BULLS AT THE BEGINING OF THE TREND NOW BECOME BEARS!

SELVAM BE, MBA

option trader

$TSLA Likely Heading Down To $38.60 From HereTSLA has had 5 waves upwards and within these waves has formed somewhat of a Logscale AB=CD Harmonic Pattern. The minimum targets for these AB=CD patterns are typically back down to the C level which in the case for TSLA should take us down to around $38.60.

As far as the Technicals go we have the MACD beginning to curl down and will be crossing bearish soon and the RSI has shown extreme amounts exhaustion at these levels; Lastly we have a confirmed Evening Star Doji Visible on the Monthly Chart.

Everything simply just points down for TSLA.

Bearish momentum (BTC) $42,999 within 24 hours (5 wave count)Hello traders,

if history repeats itself with waves 1 & 2 we will end up at $42,999 for wave 3 before heading to $44,666 to complete wave 4 before the last wave 5 down to approximately $41,555.

Next update will be when I'm flipping long.

Please like/comment to show your support for my daily technical analysis and updates.

👍

AMAZON - MY FORECASTAfter an ABC correction Amazon finished wave 2 at the 61.8 retracement. Amazon broke the wave 1 high and confirmed further bullish price action:

Minimum target for this impulse is around 3800. Main target between 161.8% & 176% extension. From there i expect a corrective movement (wave 4) before we can aim for prices above 4000!

5TH WAVE ENDED ALREADY! HOW LOW CAN IT GO?I AM SEEING MANY WAVE COUNTS PREDICTING AN INCOMING 5TH WAVE!

FROM MY COUNT HOWEVER THIS IMPULSIVE MOVE HAS ENDED!

WAS THE CORRECTION TO 3148.33$ PART (A) OF AN (ABC) CORRECTION? PERHAPS A (WXY) RUNNING FLAT?

IS THIS THE THIRD WAVE OF AN IMPULSIVE MOVE DOWN?

STAY TUNED :)

BTC uptrendwell guys BTC seems not completed its 5waves uptrend yet. so if the chart I draw is validate the last wave (5) should act like that after the last ABC correction(the green one) done at the red box area.

I am waiting to see if it is true . let me know if U agree or disagree.

wish the best luck :)

CME Gaps and BTC Correction?!!!There are two new CME gaps and BTC appears to be finishing the fifth impulse wave before an ABC correction. This makes sense since the correction would fill both CME gaps (BTC like to fill CME gaps pretty quickly after they are made before taking off again).

If there is a strong rejection around were we are now I will consider an ABC correction is in play at which point, if it is validated, BTFD!

Thanks friends, and before you go please smash the like and follow if you are not already doing so.

NOT FINANCIAL ADVICE. I AM NOT A FINANCIAL ADVISER. I CAN BE A FREAKING MONKEY AT A ZOO THAT LEARNED HOW TO TYPE FOR ALL YOU KNOW, LOL. SO DON'T FORGET, ALWAYS, ALWAYS, ALWAYS DO YOUR OWN RESEARCH!

USD/JPY -- 400 pip sell off??USDJPY has continuously been supplied by 105.000 for quite sometime now, every bounce that has came from 105.000 has produced a Lower High in price.

The 109.709 level is the high close of 2019, and has consistently held price below. I believe this big bullish push back into the high this week could be a very big "Fakeout".

**Multiple Confluence levels** 5 Wave Structure completed, 3rd touch of the downtrend, triangle, etc. I am sure there are many different chart formations that can be found bearish in this structure. I won't waste time trying to identify them.

I will be looking to see if we get some rapid volatility back at the 109.700 psychological level, and look for a sell stop on any daily inside bars to minimize my exposure from any bull trap spikes above the 109.709 level.

Disclaimer: I stand behind my analysis 100% of the time. you should trade this set up the way that you know how to trade it, not based on me simply saying price will fall 400+pips from the 109.709 level.

ORBEX: EURUSD - Correction Likely To End Soon! Then Going For 5?EURUSD could move a tad higher to complete minor wave 4 near 1.1145 before continuing lower. The said level is the 1.618% FE of wave 1/2 correction and also the 50% FR of minor waves 2/3.

Look for a valid breakout below 1.099 for medium-terms shorts but keep a cautious eye on short-term longs as the correction could end soon.

Should prices move above 1.1194 it should be received as an early sign of invalidation.

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

S&P 500 - Buying at the end of the 5th wave lowerTrade Idea

The rally has posted an exhaustion count on the weekly chart.

Broke the sequence of 6 negative daily performances.

The overnight rally has been sold into and there is scope for further bearish pressure going into this morning.

A break of bespoke support at 2799, and the move lower is already underway.

The bias remains mildly bullish but there is scope for a move in either direction at the open.

Preferred trade is to buy on dips.

Entry: 2725

Stop: 2705

Target 1: 2914

Target 2: 2930