$SPY $SPX OLD CHART BAR PATTERN COVID CRASH NOW!!!!Holy crap.... I just came across an old chart and literally in the nick of timeI tell you. All I'm going to say is... I'm a pattern chart trader and this is the COVID bar pattern attached to our daily from like a year ago almost and I loaded up an old layout to do work and boom... here we are... Good LUCK ... Not sure what the trigger will be but we are here.

AAPL

$QQQ Dead Cat to 10 WMA, then lower. Buy $496, Sell $514 What I see here is a double top on the weekly just like 2022. I can see our last 9 count in 2022 produced a 30% rally to the top. After the rally several months of sideways movement until we break trend. If we are Indeed Repeating the 2022 TOP. Then we have a harsh year ahead of us. As I said in previous posts, we should close February at the low of January. I have KRE falling out next week so I'm skeptical about what's going on. We've got DOGE checks and what not, who knows. I'm extremely bearish and I do believe we will bounce into a rejection this next week, then fall even further the week of 3/14. I will update day by day. For now, $496 will be my Buy. and $514 will be the Sell. Take Care Yall.

APPLE Trading Opportunity! SELL!

My dear subscribers,

This is my opinion on the APPLE next move:

The instrument tests an important psychological level 244.56

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 234.19

My Stop Loss - 250.52

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

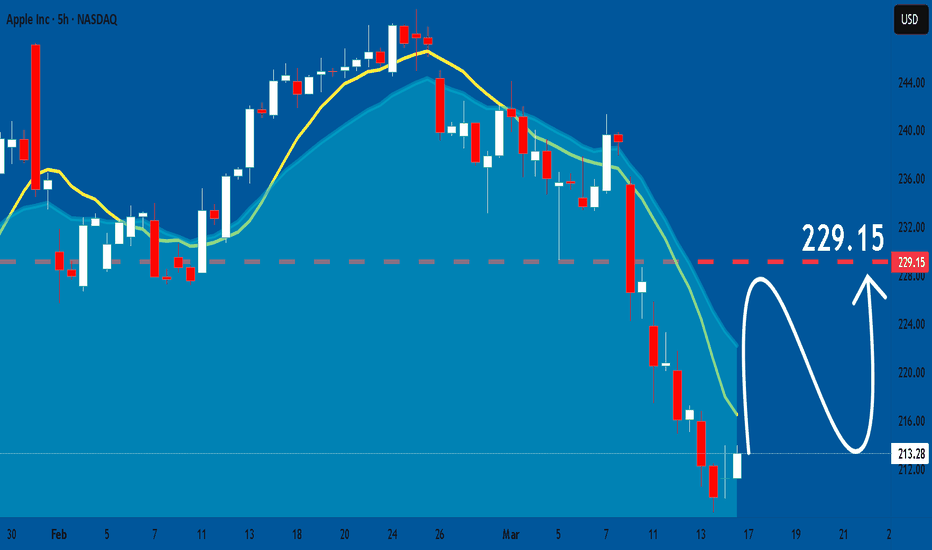

APPLE The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for APPLE below:

The instrument tests an important psychological level 213.28

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 227.02

Recommended Stop Loss - 205.96

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

$QQQ WARNING! April Fool's Market a Joke this year at SUB $400Is this happening? I'm going to have to bet my money on yes. I have been doing this for a long time. Pattern Chart Trading . This has a high probability of happening imo. Is it absolute? Of course not. Is it better to be prepared? Absolutely. Now for the technicals of it.. I'm trying to do better with this...

If we take a bearish perspective on the fib from the previous high in December , and the most previous lower low mid January , we have ourselves at the 1.61 Golden Pocket below. I have a Bullish perspective if we hold here and move above the 1.00 Fib Level, mid January Lows at $499.70 . Last defense would be a 50% retracement to the .786 FIB at the $508 area. Currently, I expect a rally to the 50 day SMA for a retest, then a SLAM to $380s in April . This is the possibility. Take it with a Grain of Salt. The possibility is there. I have one Bullish outlook.. I will post after this...

AAPL (Apple): Has a Large Correction Begun? More Downside Ahead?On this chart, we are currently tracking the potential beginning of a larger downtrend, which could be a larger-degree Wave 4 correction. It is possible that a larger-degree third wave topped in December 2024 at $260, and for now, I am assuming this is the case. While further confirmation is needed, the price has already broken below our first signal line, which supports the idea that a larger decline has begun—unless the next rally develops into a clear impulse structure.

At the moment, the price appears to be in the late stages of Wave C of Circle Wave A to the downside. Immediate resistance sits between $220 and $224, and only a break above $224 would indicate that Circle Wave B to the upside may have already started.

One important note: Circle Wave B could technically overshoot to the upside, meaning that if Circle Wave A completed as a three-wave pullback, we could even see a new high in the next bounce before the larger downtrend continues. This is something to keep an open mind about, as it is still early to confirm a substantial top on the long-term chart.

For now, as long as resistance at $224 holds, the assumption remains that Circle Wave A needs one more low before a stronger bounce occurs.

APPLE: Expecting Bullish Continuation! Here is Why:

Looking at the chart of APPLE right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AAPL BULLS ARE GAINING STRENGTH|LONG

AAPL SIGNAL

Trade Direction: long

Entry Level: 213.28

Target Level: 232.17

Stop Loss: 200.88

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAPL: Apples Are On Sale! Buying More!Technicals:

When the chart hits just right, something are left best unexplained.

Look at this month's chart's last reddish color down price bar in Apple's stock (AAPL). Do you see a collapse in it's stock? Or does it just look like it took a brief pause and giving you a chance to buy more "apples" at a discounted price. 🙂

Monthly:

Weekly:

Equal legs + 50% fib pullback + cloud support+ uHd

Daily:

ExDiv1 at equal legs

".....accelerating growth in the money supply is historically correlated with broadening stock performance. As smaller companies have easier and less expensive access to capital, they can invest more in their own growth initiatives. That leads to stronger returns investors typically expect from smaller companies in normal economic environments and more S&P 500 constituents outperforming the overall index. One of the easiest ways to invest in that trend reversal is to buy an equal-weight index fund like the Invesco S&P 500 Equal Weight ETF. The equal-weight index balances every component of the S&P 500 equally. This means the amount you'll invest in the biggest mega-cap stocks is the same as the smallest members of the index. Each quarter, the index's managers rebalance it, and new constituents are added, while others leave." (www.fool.com)

I think that is the safest bet for where to set aside and allocate your money every month towards if you don't want to worry about being a market wizard and a savant.

However, Apple and Nvidia are still good businesses to invest in.

APPLE, will we see 200$ again ?Hello traders, Hope you're doing great. What are your thoughts about NASDAQ:AAPL ?

for upcoming weeks, I expect an upward correction at first and after that I expect a SELL OFF situation in the market that causes a huge drop in stock market, my first Target is 200$.

This post will be Updated.

Trade Safe and have a great week.

APPLE Buy opportunity on the 1W MA50.Apple Inc. (AAPL) has been trading within a 2-year Channel Up since the January 03 2023 bottom and in the past 3 months (December 26 2024) has been forming the latest Bearish Leg. On Tuesday this Leg broke below its 1W MA50 (red trend-line) for the first time in 10 months (since May 08 2024), which is the strongest buy signal since the April 19 2024 Higher Low bottom of the Channel Up.

As you can see, even the 1D RSI pattern is similar with the one that made the October 26 2023 1W MA50 test. That was also on the 0.618 Fibonacci retracement level from the respective previous Low.

As a result, it is now highly likely to see a rebound, especially if the 1W candle closes above the 1W MA50, to test the previous High and 1.0 Fib at $260, like the December 14 2023 High did.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AAPL - Bearish IdeaAAPL has been moving consistently up the green solid line, finding support over and over again

Will this continue? (white circle)

If not will we see a break down to a lower trend line (dotted line) This dotted trend line extends further back on the Monthly timeframe which I can't really show on this Weekly timeframe

I am bearish

Apple (AAPL) Share Price Drops Over 7% in Two DaysApple (AAPL) Share Price Drops Over 7% in Two Days

As previously reported, AAPL shares had their worst January since 2008, but the challenges for investors have continued. The Apple (AAPL) stock chart shows that:

- Yesterday, the price dropped below $218 during trading—the lowest level since September last year.

- Compared to Friday’s closing price, the decline over the first two days of this week amounted to approximately 7.7%.

Why Has AAPL Stock Fallen?

Yesterday, we noted that bearish sentiment was prevailing in the stock market, leading the Nasdaq 100 index into correction territory. Market conditions were further dampened by news that Apple had delayed the release of an AI-powered update for its digital assistant, Siri 2.0, increasing selling pressure.

What Could Happen Next?

Technical Analysis of Apple (AAPL) Stock

Key price reversals, marked with red dots, outline a downward channel (shown in red). The median line, which previously acted as support (indicated by an arrow), has now been broken, suggesting that bears may expect it to act as resistance going forward.

From a bullish perspective, the lower boundary of the red channel, reinforced by the September low around $214, could serve as an area where selling pressure might ease—if AAPL continues to decline.

AAPL Share Price Forecast

According to TipRanks:

- 18 out of 33 surveyed analysts recommend buying AAPL stock.

- The average 12-month price target for AAPL is $251.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Is Apple's Empire Built on Sand?Apple Inc., a tech titan valued at over $2 trillion, has built its empire on innovation and ruthless efficiency. Yet, beneath this dominance lies a startling vulnerability: an overreliance on Taiwan Semiconductor Manufacturing Company (TSMC) for its cutting-edge chips. This dependence on a single supplier in a geopolitically sensitive region exposes Apple to profound risks. While Apple’s strategy has fueled its meteoric rise, it has also concentrated its fate in one precarious basket—Taiwan. As the world watches, the question looms: what happens if that basket breaks?

Taiwan’s uncertain future under China’s shadow amplifies these risks. If China moves to annex Taiwan, TSMC’s operations could halt overnight, crippling Apple’s ability to produce its devices. Apple’s failure to diversify its supplier base left its trillion-dollar empire on a fragile foundation. Meanwhile, TSMC’s attempts to hedge by opening U.S. factories introduce new complications. If Taiwan falls, the U.S. could seize these assets, potentially handing them to competitors like Intel. This raises unsettling questions: Who truly controls the future of these factories? And what becomes of TSMC’s investments if they fuel a rival’s ascent?

Apple’s predicament is a microcosm of a global tech industry tethered to concentrated semiconductor production. Efforts to shift manufacturing to India or Vietnam pale against China’s scale, while U.S. regulatory scrutiny—like the Department of Justice’s probe into Apple’s market dominance—adds further pressure. The U.S. CHIPS Act seeks to revive domestic manufacturing, but Apple’s grip on TSMC muddies the path forward. The stakes are clear: resilience must now trump efficiency, or the entire ecosystem risks collapse.

As Apple stands at this crossroads, the question echoes: Can it forge a more adaptable future, or will its empire crumble under the weight of its design? The answer may not only redefine Apple but also reshape the global balance of tech and power. What would it mean for us all if the chips—both literal and figurative—stopped falling into place?

$SPY Short Term Bullish atm.. idea for BullsWell... seeing is we hit my target, I thought I might bless the Bulls with a little bit of Eye Candy.... This is what you want...

The Fib breakdown of the Golden Pocket above at the 1.61... we hit the retracement... and now back to the .78

We hold here and it can get bullish quick.

Bearish Path in Next post... otherwise we make a lower high and fall to $525 and fast.

APPLE Buyers In Panic! SELL!

My dear followers,

This is my opinion on the APPLE next move:

The asset is approaching an important pivot point 245.60

Bias - Bearish

Safe Stop Loss - 251.37

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 235.33

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

$SPY $SPX Pullback to Gap Fill? I've been waiting for a rocket to AMEX:SPY $630 but my monthly tells me that February wants to close red. Here is my daily with a fib that we cant seem to hold above although today we did close above once I have been waiting patiently in this box unlike others, I have constantly reiterated, don't try to be a hero inside of the box. Now that the Box seems to be pushing towards the upside, I can't help but notice we continue printing bearish candles regardless of direction. Today we closed with a Hangman, which begs the question, could we perhaps lean bearish for two of the most bearish weeks of the year in comparison? I'd like to think I'm not wrong here and we will get a spill before anyone gets an expected blow off top. Be careful out there, volatility remains present and the VIX was above the 50DMA last time I checked. If we can get this gap fill and start moving back up, I will be confident in the gap fill being bottom. Seeing as $593 AMEX:SPY alert for bottom never filled, I will have to assume it's still a possibility. Taz out.