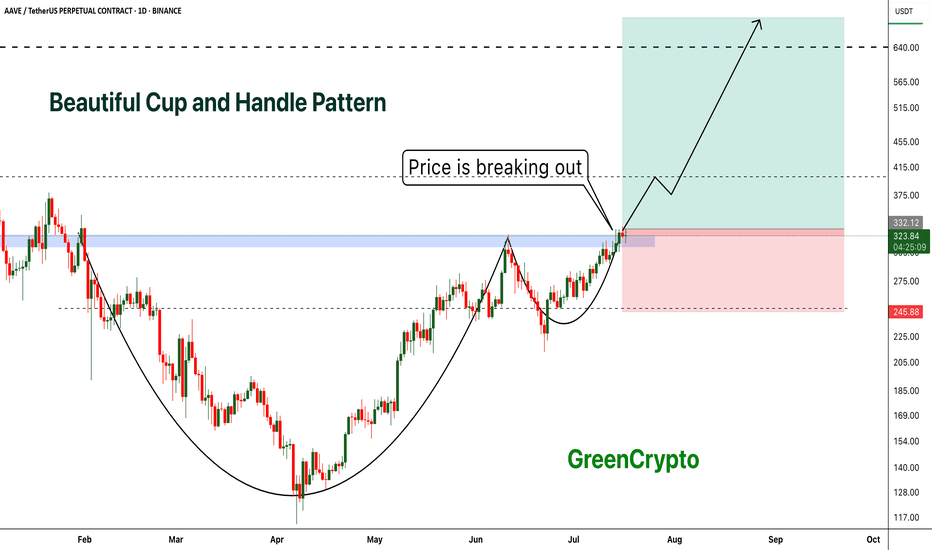

AAVE - Beautiful Cup and Handle Pattern Breakout- AAVE is breaking out from cup and handle pattern finally

- Cup and handle pattern breakout usually results in perfect trend continuation

- A huge long trade opportunity from this

Entry Price: 335 Above

Stop Loss: 245

TP1: 381.89

TP2: 429.16

TP3: 525.94

TP4: 628.78

TP5: 712.89

Max Leverage 5x:

Don't forget to keep stoploss

Cheers

GreenCrypto

Aavebtc

#AAVE/USDT#AAVE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 268, acting as strong support from which the price can rebound.

Entry price: 277

First target: 285

Second target: 296

Third target: 307

AAVEUSDT 📊The current price BINANCE:AAVEUSDT is trading in a range between 275 and 240 dollars, and it’s likely we’ll see a fake breakout to 300 dollars. After this move, the price is expected to correct to 240 dollars and then head for a bigger move toward 320 dollars and higher.

📈If the 240-dollar level breaks, the next support levels at 210 and 175 dollars should be watched.

🔼Support Levels: 240, 210, 175 dollars

🔽Resistance Levels: 275, 300, 320 dollars

Last Chance to Catch AAVE Before Liftoff! Retest Almost CompleteYello, Paradisers! Are you ready to catch the next big mover before the herd wakes up? #AAVE is now setting the stage for a potentially explosive move, and this retest might be the last stop before liftoff!

💎After forming the low of the inverse head and shoulders, AAVE has been riding an ascending channel, a structure that usually supports sustained bullish trends. Recently, price broke through the neckline of that pattern and is now retesting it, offering us a textbook technical setup.

💎#AAVEUSDT has been holding the neckline supports strongly at $275 to $265 levels. This is the critical area to watch. If bulls successfully defend this zone, we could see price push back up toward $310, which aligns with the midline of the ascending channel and represents the first resistance.

💎If momentum carries through and that level is cleared, AAVE has open skies toward the $370–$400 range. That’s the 52-week high zone, and it coincides with the top of the channel, making it a magnet for price if bullish momentum continues.

💎Adding to the bullish momentum, the EMA-50 and EMA-200 have just formed a golden cross. This alignment often leads to sustained upward moves, especially when backed by a strong structure like the ascending channel we're in now.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

AAVEUSDT Analysis: Retracement Opportunity AAVEUSDT has been trending upward without significant retracement for a long time. With a 63% volume/market cap ratio , any meaningful retracement could offer an excellent opportunity. At this point, I see no reason to ignore such a setup if it aligns with key demand zones. This is a Spot Buy.

Key Points:

Lack of Retracement: AAVEUSDT has been on a strong run without a pullback.

Volume/Market Cap Ratio: 63% indicates healthy liquidity and interest.

Retracement Potential: A good pullback could provide a favorable entry.

Confirmation Indicators: I will use CDV, liquidity heatmaps, volume profiles, volume footprints, and upward market structure breaks on lower time frames for validation.

Learn With Me: If you want to master how to use CDV, liquidity heatmaps, volume profiles, and volume footprints to pinpoint accurate demand zones, just DM me. I’d be happy to guide you!

Reminder: Be aware of the market's current state and approach it with caution. Successful trading relies on meaningful levels and robust confirmations.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you! Wishing everyone success in their trades.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

AAVE/USDT – First Support in the Blue BoxI’ve been watching AAVE/USDT for a minute and there’s one zone I’m eyeing — that blue box. Moving in before you see real proof down there is a fast track to getting stopped out. Picture price drifting into that area, you buy on hope alone, and then it slices through without warning. That’s how shorts hunt liquidity and leave you scrambling.

What I need to see before I pull the trigger is clear confirmation: a CDV-volume spike that shows smart money stepping in, a quick low-timeframe break below then reclaim that zone, even an order-flow flip with aggressive bids coming in. Anything less, and I’m happy to stay on the sidelines. When that setup finally lights up — the volume lines up with the CDV divergence, the chart on the one- or five-minute frame prints a break-and-retest, and order flow shifts to the buy side — that’s when I lean in. Miss it if you want, but when it fires, waiting too long feels a lot worse than being a bit early.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

AAVEUSDT – The DeFi Season ?AAVE is showing early signs of accumulation. Buyers are present in blue box but the pressure from sellers remains quite strong.

Although I personally don’t see high-risk trades as ideal in these conditions, the potential reward here might justify a calculated attempt.

If the price can reclaim the blue box with confirmation, this could offer a strong opportunity. Still, always remember to act based on confirmations and manage your risk carefully.

These kinds of early signals can either be the start of something big or a trap for impatient entries.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

AAVE Longterm pickNot going to dive too deep, but I genuinely believe DEFI is set to explode in the future! AAVE is definitely one of my favorites, along with UNI and a couple of others that are on my radar. Anyway,

Looking at the long-term Fibonacci targets, they suggest (850-1300-1750) will happen eventually. I’m not sure how long it will take, but I’m all about keeping my eyes on the prize!

What are your thoughts? Let’s get a discussion going! Don’t forget to like and share! 🚀💥

Buy and SellBuy and Sell Signal for AAVEUSDT

📌 Buy Signal:

Buy if the price breaks $267.

Stop-loss: $247

Bullish targets:

$284.23

$314.29

📌 Sell Signal:

Sell if the price breaks $246.

Stop-loss: $267

Bearish targets:

$229.58

$206.04

🔹 Risk Management: Considering support and resistance levels, an appropriate stop-loss should be set.

This Coin Is A POWERHOUSE MartyBoots here , I have been trading for 17 years and sharing my thoughts on AAVE here.

AAVE is looking beautiful , very strong chart for more upside

Very similar to XRO which mooned from this structure

Do not miss out on AAVE as this is a great opportunity

Watch video for more details

57% pumpAAVE/USDT Chart Analysis 📊📈

Current Price Action:

The current price of AAVE/USDT is around $349.58. The price has been moving inside a symmetrical triangle pattern, indicating a potential breakout soon. 📉📈

Key Support Levels:

$293.23: Strong support zone that has held previously. 🛡️

Ascending Trendline: Price is respecting the upward trendline, suggesting bullish momentum. 📈

Key Resistance Levels:

$390.94: The next resistance level that needs to be broken for further upward movement. 🚧

$530.80: Major resistance target after a confirmed breakout. 🎯

Breakout Scenario:

A breakout above the $390.94 level could trigger a bullish rally towards $530.80, marking a potential 57% gain. 🚀📊

Technical Indicators:

Symmetrical triangle pattern forming. 📐

Price holding above the ascending trendline. 📈

Volume could confirm the breakout direction. 📊

Summary:

AAVE/USDT is approaching a critical breakout point. A successful breakout above $390.94 could lead to a bullish surge toward $530.80, while failure to hold the trendline support may see a retest of the $293.23 level. ✅

⚠️ Risk Management Tip: Always use stop-loss and manage risk accordingly!

AAVE to 400$📈 Trend: The chart shows an upward trend within a channel.

🛑 Resistance: Key levels appear around $200 (🔍 "Wait for break $200"), $251.69, and $360.28.

🟢 Support: The highlighted level at $175.55 acts as a significant support zone.

⚠️ Breakout Watch: A breakout above $200 could signal further upward momentum.

🔺 Targets: Next potential resistance levels after $200 are $251.69 and $360.28.

Summary: 🚀 Wait for confirmation of a breakout above $200 before entering a long position. If it holds, watch for movements toward the higher resistance levels. 🛡️ Protect against drops near $175.55.

AAVEUSDT | The Blue Box: A Demand Zone Worth WatchingAAVE is currently hovering around a potential demand zone, marked by the blue box on the chart. This area has all the hallmarks of a strong entry point, offering a favorable risk-to-reward ratio for traders with an eye for precision. Here's why this zone deserves your attention:

Why the Blue Box Matters:

Historical Demand Zone: This level has acted as a springboard in previous sessions, with buyers stepping in aggressively to push the price higher. The same could happen again.

Volume Congestion: The blue box aligns with a region of high trading activity, signaling that it’s a zone where market participants find value.

Fibonacci Confluence: The zone may also overlap with key Fibonacci retracement levels, further increasing its significance as a high-probability entry point.

Bullish Confirmation: Watch for reversal patterns or strong bullish candlesticks within this zone, such as pin bars or engulfing candles, as confirmation of buyer strength.

What to Do:

If price dips into the blue box, this could offer an ideal entry point for a long position.

Always wait for confirmation—keep an eye on volume spikes and momentum indicators to avoid false signals.

Set tight stop-loss levels just below the box to minimize risk while allowing for potential upside.

This setup presents a textbook example of demand zone trading. Keep your focus sharp, and let’s see if the blue box delivers another successful bounce!

When it comes to trading, I’m all about confidence backed by experience. I’m not claiming to be the best (yet), but my results do most of the talking. Keep an eye on these levels—sometimes the charts quietly suggest what the markets will shout later. Let’s see how this ride unfolds together! 🚀

My Previous Hits

🐶 DOGEUSDT.P | 4 Reward for 1 Risk (or more if you’re bold).

DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P | HTF Sniper Precision

RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P | Buyer Zone So Accurate You’ll Double Check

ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P | Buyer Zone Mastery (CZ vibes).

BNBUSDT.P: Potential Surge

📊 Bitcoin Dominance | Called it Like a Pro

BTC Dominance: Reaction Zone

Now sit back, relax, and watch the market do its thing. Or don’t, FOMO is real. 😉

Is AAVE the next big DeFi token in crypto?The Aave token pumped 44% over the past 4 weeks, with its price climbing from $94 to $134 This impressive increase outpaced the performance of other leading cryptocurrencies by market value, such as Bitcoin and Ethereum.

Its 100% up since our first analysis and Im sure you add couple of Lambos to your Car collection so lets where we going now

Recently we stumbled upon an intriguing chart showing AAVE’s price compared to ETH

We tried our best, but we couldn’t ignore it! Something big is brewing… and it seems like the market is yet to catch on.This surge isn't the result of a few people buying in here and there it takes significant buying pressure to outperform ETH this dramatically.

Not only that, but Aave’s revenue is on the rise.

We're loving this uptrend in quarterly revenue also we've heard about new proposals for updated tokenomics and activating the fee switch yet another reason this setup is impossible to ignore!

But hold on sometimes short term hype or incentives inflate revenue. Is that the case with Aave, or is it a genuinely solid investment opportunity?

That’s the focus of our analysis, along with other key questions like:

Is Aave still the market leader in the lending and borrowing sector?

What are the key support and resistance levels to watch for?

Is the revenue growth driven by incentives?

Can Aave compete with Goldman Sachs?

Where are Aave's 1M users coming from?

wait a sec, Im new to crypto WHAT IS AAVE? ok! lemme explain

Aave, a respected pioneer in DeFi, first launched as ETHLend in 2017.

In 2020, it rebranded to Aave and has been on quite a journey since (that's what we are exploring today)—a remarkable one at that. Aave is a decentralized lending platform that connects lenders and borrowers, functioning similarly to a bank.

Users can deposit their money to earn yield, while others can borrow funds. To borrow, users must deposit collateral that exceeds their debt, ensuring repayment.Aave keeps the difference between the interest paid by borrowers (higher) and the interest paid to lenders (lower).

But unlike traditional banks, Aave relies on smart contracts to handle everything—no need for grumpy loan managers asking why 100% of your net worth is in crypto. People and degens love the permissionless, 24/7 access Aave offers for lending and borrowing. No KYC, no approvals, no waiting. It’s a massive improvement over traditional banking!

So let's tap into Aave's potential

Over the years, Aave has attracted substantial liquidity, further cementing its place in the DeFi space. Just take a look at the TVL, which shows the amount of money currently deposited in the protocol.

Aave currently holds around $12.3 billion in Total Value Locked aka TVL, which may seem small compared to major US banks like JPMorgan ($2.2 trillion) or Goldman Sachs ($363 billion).

But this ain’t a bug, it’s a feature! One that highlights the enormous market Aave could tap into but how can a crypto protocol look to compete against global financial giants like JP Morgan and Goldman Sachs? In a single word: efficiency

Aave has 30 times less TVL than Goldman Sachs, but it also has 750 times fewer employees. Just take a look at the number of employees needed per $1 billion in TVL:

Aave: 5 employees

JPMorgan: 115 employees

Goldman Sachs: 123 employees (Did you check thier new logo! its more of a Goldman Sucks)

See the difference in efficiency?

We certainly do, and that's why we believe Aave could eventually disrupt these giants.

Now, let’s dive into how Aave’s business works.

AAVE BUSINESS MODEL

Aave's business model is relatively straightforward: They offer yield to lenders, charge borrowers a higher interest rate, and the difference generates the protocol's revenue—essentially the same way banks make money.

Currently, you can lend CRYPTOCAP:USDC on Aave for 5.8% and borrow it for 7.6%. These percentages vary based on usage. if a bunch of CRYPTOCAP:USDC is borrowed and there's not much left in reserve, the yield and interest rates will increase to attract new depositors, while discouraging additional borrowing and vice versa

whales accumulating again ?

On chain data reveals that AAVE's Open Interest and daily active addresses are on the rise, indicating a sustained bullish trend. AAVE's OI grew from $107 million on Monday to $191 million by Thursday, marking the highest OI level since the beginning of the year and currently, AAVE’s open interest is at $175 million

Investor interest in the Aave token gained momentum in late July, spurred by a proposal from Aave-Chan Initiative founder Marc Zeller to allocate a portion of the platform’s net earnings to key participants in the ecosystem and to adjust fees for repurchasing AAVE from the secondary market. Another catalyst for the AAVE rally was the ‘Umbrella’ Initiative, which proposed shifting from a 'seize and sell' liquidation mechanism to a 'seize and burn' model.

the Umbrella project is designed to ease market pressure from selling AAVE while managing risky loans. The initiative aims to use a variety of assets to settle outstanding debts during liquidations, especially when the collateral is insufficient, rather than relying solely on AAVE.

next targets for Aave is 149 , 160 and 170$

Are you bullish on Aave?

#AAVE/USDT#AAVE

The price is moving in a descending channel on the 12-hour frame and is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 134

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 152

First target 164

Second target 182

Third target 203

AAVE looks bearish (4H)After the recent pump, AAVE has reached the premium range of the previous wave and hit a supply.

We have a bearish CH on the chart, which is preferable to a bullish iCH.

AAVE can drop to the specified targets on the chart.

Closing a daily candle above the invalidation level will violate the analysis

Note that the financial market is risky, so:

Do not enter a position without setting a stop and capital management and confirmation and trigger.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

AAVE best time for accumulation in 2023

Possible Targets and explanation idea

➡️Weekly chart. BearMarket over 2 years. Since April 2021.

➡️Fib came in -0.27 zone. Accumulation zone

➡️Trade under fundamental price (real value) of this coin (yellow last line)

➡️First main target for AAVE - 193$ take profit line. Over 0 level by FIB

➡️Bellow Market Mood indicator represent the best time for accumulation. White colour zones. Even if you use DCA strategy.

➡️Look on a chart and you can count in average price if you buying in white mood zones.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

AAVE short setupThe basic structure of AAVE is bear. This pullback can be considered an internal pullback.

A good supply range in this permanent area

The targets are marked on the chart.

Closing a daily candle above the invalidation level will violate the analysis.

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

AAVEUSDT Bullish Chart!AAVEUSDT Technical analysis update

The AAVEUSDT price is breaking the trend resistance line on the daily chart. The price could be retested before moving up. Additionally, the price is trading above the 100 and 200 EMA, which is a bullish sign for AAVE.

Buy Level: Above $95.00

Stop Loss:$83.00

Regards

Hexa

AAVE ANALYSIS (1D)It looks like a bearish triangle is forming. Now it seems we are in wave e of this triangle

We are looking for sell/short positions in the red box.

The targets are clear on the chart.

Closing the daily candle will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

AAVE - Support is holding strong, where is next ?BINANCE:AAVEUSDT (1D CHART) Technical Analysis Update

AAVE is currently trading at $86.5 and the price has reached the support zone, this support was held strong multiple times and price bounce back from it multiple times. Im expecting the price to bounce back from this support zone again and we have nice trade opportunity.

Entry level: $ 86.57

Stop Loss Level: $ 73.27

TakeProfit 1: $ 93.44

TakeProfit 2: $ 99.16

TakeProfit 3: $ 109.96

TakeProfit 4: $ 125.15

TakeProfit 5: $ 142.44

Max Leverage: 5x

Position Size: 1% of capital

Don't forget to keep stop loss.

Follow Our TradingView Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

Cheers

GreenCrypto