ABC

04/04-2020: XAUUSDLets start off with taking a look back at this chart from October 2019:

Heres how the weekly chart currenty looks:

On the 4h timeframe red trendlines highlights both regular and hidden divergences appearing all over this market. ''C'' is a 261.8% extension that was followed by a 15% decline! Considering the huge drop, im expecting this trend to continue and another dip in this market is anticipated.

A trade with stops above the highs targeting the lows would not be a bad idea IMO.

Whats your view on XAU/USD?

Share your comments in the section below

Thank you for reading

USDCAD | Descending Channel..!USDCAD (Update)

In 4h chart Pattern USDCAD forming a Descending Channel Pattern..

Right now it'll become down, and it'll hold the support and then become bullish form..

But aftar a few hr's it'll breakout the Descending Channel..

if breakout the channel then expected target is 1.45285..

Friends, please hit the like button, and write any comment, this will be the best thanks from your side..!!

BTCUSD Elliott & Fractal Theory Abtin00We can say we are completed Wave A of correction and we are ready to make Wave B

We can take long position to 61.8 F2 of Wave A then take short position to or normal Zigzag area

But dont forget stop loss that shown on chart

And for some learning ( we are completed Terminal wave before this correction )

If you wanna learn it cm it for me i will teach you guys some useful method and technic

GBPCAD Fake breakout ??Hello guys

Everything is shown on chart , We should be wait to watch what happen to trendline

If it can be strong pullback above trend line and break highest price of few days ago we can take long position to yellow area

If it cant do stong pullback it can fall down to yellow area at down

Be patient and enjoy profit

BTCUSD ABC CorrectionHello guys

Thanks all of you for supporting us

We are forming ABC Correction Of .3.W3 but we are in micro wave of it

After completed wave 5 of A you can take long position for B and Short position after B for Wave C

But be careful maybe it can do Anti cycle

Dont forget stop loss

And with our estimate day that finish downtrend , its about 100 to 115 days

Be patient and enjoy your profit

follow us and share us

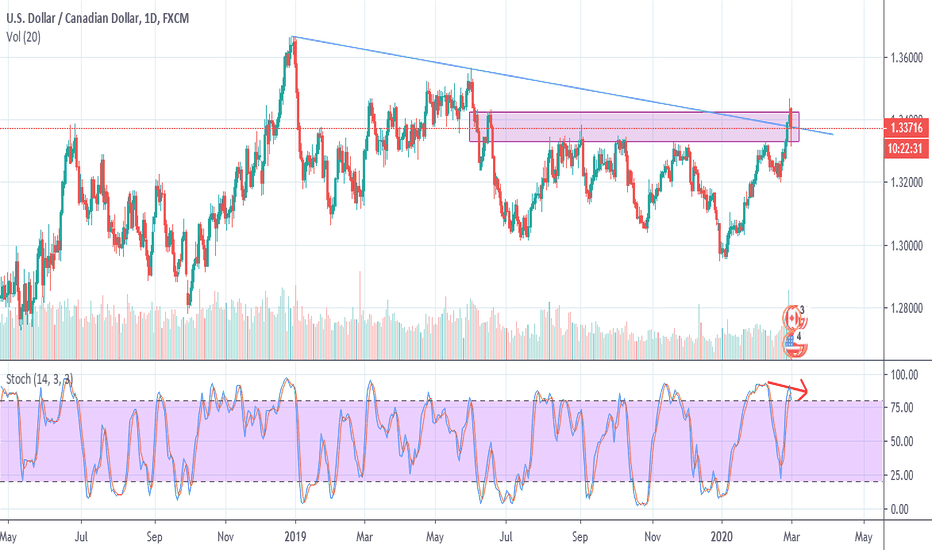

FAKEOUT: Markets are deceiving usUSDCAD is under a trendline in daily chart, on Friday price broke the resistance area and the trendline but today it has come back again under that area, so it is clearly a price manipulation. Stochastic shows a divergence and I think price will have an ABC CORRECTION till wave 4 bottom in h4 ( I m talking about 1.3200 area).

Fundamentals suggests a probable rate cut for FED on 18th of march due to Coronavirus, instead on 4th of march Bank of Canada could even avoid a rate cut (analysts say that the chance is about 40%).

If you open a short trade set a stop loss about 50 pips over the high of today and a first take profit at 1.3200.

IMW may bottom out in mid-MayFor context please note we are dealing with weekly candlesticks here, I'm pointing that out b/c people are used to seeing shorter time frames and I don't want anyone to be confused. Overall I think we are in the beginning stages of a large degree C-wave in an ABC correction. I am neutral on the Russell as of now b/c I think we need a smaller degree B-wave up in the ABC pattern of the C-wave itself. Also note that a curved arrow in my chart represents a huge gap that must be filled sooner or later.

Once IWM starts to dip again I am targeting the 123 region in May of this year, price is based on the notion that the large degree C-wave may be roughly equal in length to the initial A-wave and duration may be similar as well, Obviously this is a rough guide and once she starts to bottom we may take note of bullish divergences and/ or volume patterns indicating it may be time to reverse up. Again, I am bullish short term and bearish months out. Please ask any questions and share any thoughts, thanks.

DAILY SAM TECHNICAL ANALYSIS MONDAY 2 MAR 2020

SAM HAS MADE AN ABC CORRECTION IN BETWEEN APRIL 2019 AND SEP 2019

@3.9000 PRICE HAS TESTED SEVERAL TIMES FORMING A HEAD AND SHOULDER PATTERN

PRICE HAS BROKEN THE 3.3855 INDICATING A FURTHER DECLINE WITH PROJECTION TARGET:

@ 3.0605 1.618% FIBONACCI EXTENSION WHERE PRICE WILL ENCOUNTER JUN 2016 LOW @ 3.0980 AT THIS POINT PRICE COULD GIVE A POSITIVE REACTION BACK TO 3.9000

BREAK BELOW THE 3.0605 NEXT PRICE PROJECTION:

@ 2.8290 200% FIBONACCI EXTENSION

FURTHER BELOW ON A WEEKLY CHART:

@1.7500 THERE IS A 100% SYMMETRY FROM NOV 2007 AND MAR 2009 AT THIS POINT THE SPANISH BANK COULD GIVE A STRONG POSITIVE REACTION

NOTES:

THE SPANISH BANK HAS FILLED ALL GAPS UNTIL THE 25 JUL 2011,

UNFILLED GAPS BELLO:

25 JUL 2011 @ 7.3015

9 DEC 2014 @ 7.1240

14 APR 2014 @ 68900

RESISTANCE @46820

SUPPORT @3.0980

ABC (D) (E|A)Note: this is not backtesting, just an observation of some pairs in the last week.

All of these can be seen as ABC, but I like to chart it as ABCDE and see that E is not coming in the way. I spotted this behaviour on various pairs and time frames, but the last week provides nice summary to be put in one place. They provide nice RR, but require patience :) And of course this is not the every time winning case - you also have to take in account trend on larger time frame and support/resistance levels.

Anyway, hope somebody will find this useful and will benefit his/her trading.

ABCDa rising

AUDCHF:

AUDNZD:

ABCDa falling

USDCAD:

Failed ABCDE = ABCDEA

USDCHF:

Or just ABC with breakout and pullback

USDCNH:

Disclaimer: this idea is solely for my own purposes, to satisfy the ego, if it will work out ;)

BTCUSD Third Wave ElongationHi guys

In here we have third wave elongation and Because the fourth wave passes through the fibo (38.2) surface, the fifth wave is less likely to form

We are making an ABC and i think AB completed And we are in third to fourth micro wave of C

And Due to Indicator we can say we are ready to change this downtrend and ready to start ABC of Fourth wave

But in general, we have a downfall in the coming days

ETHUSD ELLIOTT FLAG FRACTAL 12345Hello guys

As you see on chart

We had the third wave elongation and that we had noticed from the second correction wave

And because of third wave elongation , We expect the Fourth Wave to do no more

Tp is shown on chart you can take position after break and pullback and wait to make sure is not fake breakout and pullback then you can take long position and take profit

DONT FORGET STOPLOSS FOR ANY POSITION

GBPAUD - Huge Downside PotentialDisclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach.

The sharing of this idea is neither necessarily indicative of nor a guarantee of future performance or success.

GBPAUD - ShortAlready short on this pair. But i think a lot of further downside is incoming.

Going to see what happens and what kind of reaction we get at the trend support.

Once we reach the trend support i will bring my SL to break even and hopefully we get a corrective pattern at the support then continue lower, if that doesn't happen then i can only see it moving higher.

Lets see how it all plays out