TNY is bouncing off of DMA. Bullish Flag...TNY appears to be trading in a bullish flag and bouncing off of the DMA which is inherently bullish.

Lots of speculation around this stock becoming involved with AB-InBev due to new BOD members.

Interesting timing considering DEA re-scheduling and federal reform in America.

Speculation is speculation, but the chart is indicating an upswing.

And the company is expanding in 3 emerging markets.

One to watch.

Abinbev

ABINBEV ready to break up and beyond to 76.38Scallop pattern has formed on the daily.

It hasn't created the pattern fully and a breakout is important to wait for.

The problem is before the Scallop there was an extended Rectangle pattern with a little range.

This box formation could take place again as companies tend to have their own trading personality.

Until the breakout occurs, it's a risky position to be in.

7>21>200

RSI>50

Target 76.38

ABOUT THE COMPANY

AB InBev (Anheuser-Busch InBev) is a multinational beverage and brewing company headquartered in Leuven, Belgium.

The company was formed in 2008 through the merger of Belgium-based InBev and American-based Anheuser-Busch.

AB InBev is the largest beer producer in the world, with a portfolio of over 500 beer brands sold in more than 150 countries.

Some of the company's most well-known brands include Budweiser, Corona, Stella Artois, and Beck's.

The company has a market capitalization of over HKEX:160 billion (as of April 2023).

AB InBev has 155,000 employees worldwide and operates 170 breweries across the globe.

The company is known for its aggressive acquisition strategy, having acquired several major beer companies over the years, including SABMiller in 2016.

ABI at support levelAB Inbev

Short Term

We look to Buy at 47.28 (stop at 46.18)

Previous support located at 47.10. Price action has posted a Doji candle and confirms a possible stall in the recent move. We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher. Expect trading to remain mixed and volatile.

Our profit targets will be 50.60 and 52.56

Resistance: 54.00 / 55.30 / 57.56

Support: 47.00 / 44.50 / 36.20

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

ABI look out below! AB Inbev

Short Term - We look to Sell a break of 52.48 (stop at 54.15)

Further downside is expected and we prefer to set shorts in early trade. A break of bespoke support at 53.00, and the move lower is already underway. We look for losses to be extended today. Expect trading to remain mixed and volatile.

Our profit targets will be 48.86 and 47.38

Resistance: 55.00 / 60.00 / 70.00

Support: 53.00 / 48.00 / 45.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

ANH showing upward momentumJSE:ANH has recently bounced off a strong support level and seems to be moving upwards for the time being. The stochastic and the MACD both crossed upwards on the 21st of October and the two EMA's crossed over yesterday. These are all signs of upward momentum. I think we can see a move to at least the 90000 resistance level.

Big Brewer Shares in Coronavirus Hangover168 = Tsingtao Brewery Group

600573 = Beijing Yanjing Brewery

SPX = S&P 500

CARL = Carlsberg Group

HEIA = Heineken N.V

TAP = Molson Coors Brewing

ANH = Anheuser-Busch InBev --- owns Corona beer brand

(This list excludes mixed drink companies like Diageo (DGE).)

As can be seen in the chart above, the US and European brands all significantly underperformed the S&P 500 as a benchmark. Only the two China-based brewers have outperformed but like most share prices globally, are still down on the year.

Possible opportunities --

Opportunity A: Corona beer

Whether Corona beers retain popularity or not following the pandemic could determine whether the AB InBev share price is fairly-valued.

Opportunity B: Asia growth

Long term growth potential in Asia could be a factor in the share price performance of China-based brewers.

Asia-Pacific is the largest and one of the fastest-growing market for beer consumption, which accounts for about one-third of the global market share. Business Wire, April 9 2020

Opportunity C: Microbrewery takeovers

The pandemic could mean more microbreweries are acquired by the big brewers, giving brewers more popular brands and reduced competition.

What do you think about the future of beer and the brewing industry? Share your thoughts with your account manager or join a live LCG webinar.

AB INBEV (ABI): Bearish Forecast

AB INBEV has recently broken below a key level of support.

after a retest, the price shows its unwillingness to go higher.

I believe that now we can expect a bearish continuation with you,

taking into consideration a long term bearish bias.

key levels to consider:

63.0

57.0

Please, support the idea with like! thank you!

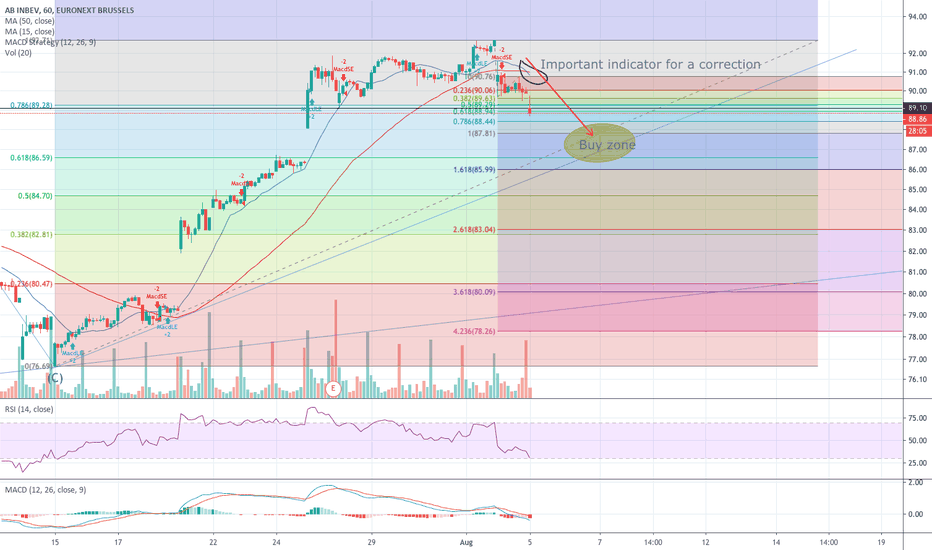

Correction on AB Inbev ongoingthe MA15 and 50 were already strating to go closer together the last 2 weeks and after the red day on the BEL20 index last Friday they finally crossed.

Last time this happened a correction came, so I expect the same to happen now.

Looking at the fibo levels we might go to the 85-86€ level

AB InBev: breaking the red resistance lineAB InBev's share price drops since a few weeks. Now we see that the share price recovers by breaking a declining line a in main indicator that follows the track of stocks. But more interesting is the positive divergence, indicating the negative momentum turns to a positive momentum supported by hammers. Nevertheless an inverted hammer can delay the advance of the share price. The first targets are the 100.95, 102.70 and the 104.43. The bulls are in the best position to begin an uptrend.