ACB

APHA, interesting how that worksJust like its peers, no higher high just yet. Look at the way these peaks line up with past performance. ACB's earnings are likely to have a bearish impact on the broader market. I'm thinking we'll see APHA turn to the downside again. For now.

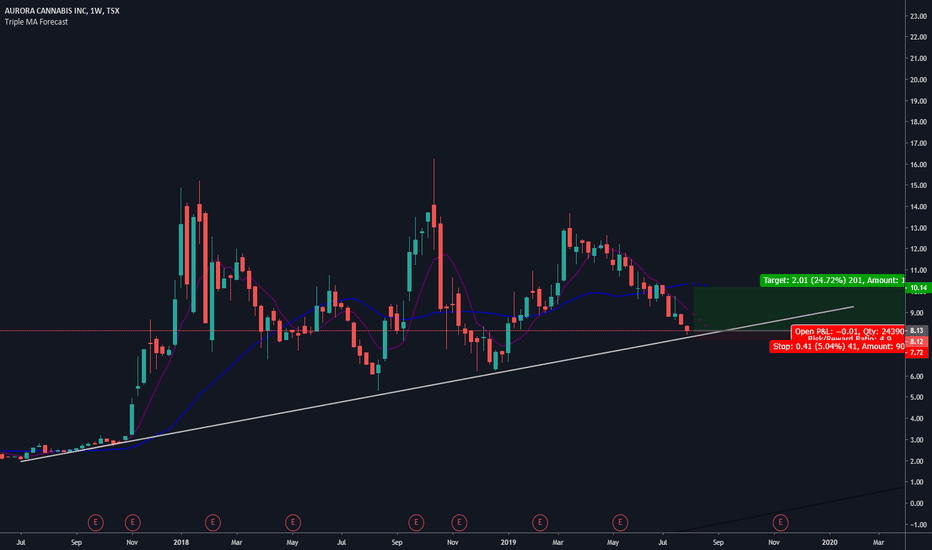

ACB RESPECTING TRENDLINE ! Hello Traders,

Today’s chart will be on ACB – AURORA CANNABIS INC, respected trend line perfectly!

Points to consider,

- Trend overall bullish

- Broke resistance, now potential support on re-test

- EMA’s turning bullish

- Stochastic showing upwards momentum

- RSI broke its resistance

- Volume starting to increase

- Next local resistance areas are the .382 and .618 Fibonacci Zones

ACB has perfectly respected the upwards trend line and has broken local resistance now turning potential support upon retest.

The EMA’s have turned bullish upon this break signifying that further upwards is more probable. The RSI is quite bullish at given time too, it has broken its major resistance line thus has further upside potential; this will allow bulls to push price into next local resistant zone (.328 Fib).

Furthermore, the stochastic's are showing upwards momentum, however it’s starting to look over extended, we may see it cool of, this will allow for price to retest support before heading back up…

Volume is starting to pick up, very healthy in this break from resistance, we need to see the volume maintain a steady increase for this area...

Bulls can potentially test next resistant zone at the .382 Fib, posting a gain of around 18.64%, if a break of this zone comes to fruition, then a test of .618 Fibonacci is probable, posting a 50.81% gain!

What are your thoughts on ACB? Will bull have the momentum to push through local resistances?

Please leave a like and comment

And remember,

“It’s not whether you’re right or wrong that’s important, it’s how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

ABCDE consolidation on ACBIt looks like we are at the end of a complex consolidation. I think we might continue to see some sideways momentum as the cannabis sector continues to get slammed. However, the chart suggests we are at the bottom. Looking for a breakout and beginning of the next leg up.

ACB Moving into Earnings todaySlight bearish convergence on the Stoch, and also RSI indicating a possible hourly pullback. Earnings are guided, so the revenue figures are not very likely to drive the price upward. We're looking for profitability. ACB predicted Q4 profitability. The press release issueing earnings guidance only mentioned that they are moving closer to achieve positive EBITDA. Any disappointment on that front will see ACB retest key support at $5.89, and possibly the lower $5 range.

ACB is currently at the top of its downtrend channel, after a nice bounce. Bulls are looking to break $6.30 on large volume to see the price move back up to test $6.65 and $6.83.

Regardless of all the positive news and change in broader market sentiment, not a single pot stock has posted a higher high above a long term downtrend. I feel that all of the past few days' moves, has been correctional, and not neccessarily bullish.

I do feel, however, personally, that the current price levels present excellent buying opportunities for long term investments. If your time span is 4 to 5 years, then ACB, APHA and CRON are buys. CGC, on the other hand, could still have significant downside. I think that the King of Cannabis is about to be de-throned.

Has anybody considered Creso Labs, btw. No debt, pure USA play, excellent pressence, and much worth a closer look.

Please share your thoughts?

Aurora Cannabis. (ACB) Time to Start Buying?! Hey guys. So I have always been a fan of marijuana stocks and who can love trading the devils lettuce, but not trade ACB!?

Over the summer we had a big sell off in the sector, but that was expected after the run we had that winter. The market is starting to catch some support and we are seeing more consistent green days for the green good. At this point in time you could do one of two things... you could wait it out, or what I personally do for longer term investments.. Start accumulating. We could bleed a little more, but to be honest... I dont see it falling much more. Another option for people who prefer less risk exposure could be to wait for earnings. Earnings is only a few weeks away and should provide a significant outlook for Auroras future.

Aurora dump potentially creating buying opportunityFirst Daily was broken only by few pennies, but I don't believe it will hold

Would start scaling in on last 3 supports with ideally Daily oversold RSI

I lost 3k on TGOD before, as I had a long term position. Was watching it bounce from 2 dollar range already a few times.

Also, I think without Aurora ownership TGOD is better off.

Not a financial advice.

My own thoughts for personal reference.

ACB what is it going to be?The smartest company in the game, still in charge of their own board. Guided earnings, moving closer to positive EBITDA, I think we can safely say that Aurora is not burning through a Billion $ per quarter. We won't see $250.000.000 losses per quarter either. ACB doesn't 'deserve' to be dragged down by broader market fears. By now, it is clear that ACB SHOULD really be the biggest cannabis company by market cap. I believe this will happen before long, but until that time comes, we still need to look at the daily charts for short term direction.

Personally, I think ACB is stuck between key support $5.50 and key resistance $6.20. Buyers will get on board above $6.20, but if bulls can't hold $5.50, we'll see a continued move down, to $5.35 and perhaps even $4.80.

Not the strongest stock to hold in case a recession sets in, but that could still be months away, and may in fact never happen.

Just my 2 cents, its free...

ACB close to weekly trendlineACB price on weekly trendline. It has chance to go long. wait for daily trend line breakout for long trade. If the price breakout weekly strong trendline then wait for 123 patterrn for short trade. Also watching this one .

ACB Trendline Bounce TradeACB appears to be in a good buy spot here- This stock along with many of the marijuana names have been beaten up in the last few weeks/months.

The price is on/near the diagonal bullish trendline it has respected for a long period. Although it is not the strongest of trendlines with only 3 real bounces. I do think the risk meets tbe reward here.

Im looking at a trade just under 5:1.

Close any weekly candle close below the trendline. Take profit at the moving average. If it breaks the moving average in a strong way I will update my price targets.

Happy Trading :)

DMF vs Aurora Cannabis (NYSE:ACB) - A Two Week Performance StudyHey Traders!

Today we're looking at how the Directional Momentum Flux (DMF) strategy performed against Aurora Cannabis Inc (NYSE: ACB) during a two-week study period. Overall performance of ACB was not very strong during the period (7/15 to 7/31/2019), but DMF was able to identify many momentum inflection points and capture quite a decent return of around 44%. Check out the video and join the discussion below!

Happy trading!

Links:

Directional Momentum Flux Strategy

ACB death crossWith the 50MA crossing the 200MA, and the price just registering lower lows and lower highs, I'm still staying clear of ACB. CGC is a great example of a play falling below the so cherished 'bottom trend line'. With a diluted float, we should move the bottom trend line lower, accordingly.

I do feel that $5.85 was a great price though. Right now, it looks like that level will be tested again soon.

Levels on watch, trade safe!

ACB is a BUY! TD SEQUENTIAL '9' on DAILY - Reaching 78.6What else can I say, RSI oversold, TD sequential 9 on daily, 78.6 touch almost. I like the chances of a short term relief bounce here of around 16% increase to go test the 61.8. Be weary as more supply could dump. This is not financial advise.

$OGI Showing Signs of a Bottom Despite Continued Sector Rout$OGI has held the 200DMA as support the last two trading sessions & on July 15th. Hammer candle was put in on 7/29 followed by a bullish engulfing signal today.

OGI current trades at a 10x P/E 2019 revenue and a 3-4x P/E on FY2020 revenue estimates. We see several near-term catalysts for $OGI and feel the stock will benefit immensely once the current industry chaos settles down (CTST, APHA, HEXO, etc)

The company announced July 15th, it developed a Rapid-Onset Nano-Emulsification Technology for Cannabis Beverages with an initial onset of 10-15 mins vs 60-90 mins on average. The company also clearly told the market they're actively seeking a beverage partner & is for sale.

Management has proven they can execute with positive adjusted EBITDA 4x Qs in a row, minimal dilution to shareholders vs peers, disciplined w/ expenses (No $600M losses here), and a very transparent with investors. $OGI management won't pump the stock & give unrealistic guidance like some of its peers, $OGI is focused on building an operationally sound profitable cannabis company in Canada & Internationally.

We expect $OGI to get a lot of attention from institutional & retail investors state-side in 2H 2019 as investors begin to pay more attention to market caps, margins, profit/loss, etc. The industry is maturing very quickly and we believe investors will begin to see $OGI as a Top 3 LP.

Time will tell...

***Disclaimer: I am long $OGI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.***

Critical SupportACB is now trading at an area of critical support. I am playing this area long however if it closes a 3day candle below the 200ema it would be in danger of entering a bear market cycle. The last several months have just been a long period consolidation and that trend is likely to continue.

(Not financial advice)*

ACB July 30th 2019

Just my prediction on ACB.

Looks like it's going up. Could keep climbing until around the time of the earnings report.

Earnings report on September 9/23.

Perfect spot for fib retracement61.8% fib retracement (golden pocket) is the best spot for a bounce. ACB was also selected as the only winner to supply Italy's medical MJ as a catalyst.

ACB Bounce play - Swing Trade IdeaLooking to swing ACB from the $6.3 range up to that mid point of the downward trend @ around $7.4-7.6 - Small play but something to help get us to earnings season!

Cannabis industry has been tough lately - watch positions closely.

GLTA

Aurora Cannabis got two new cultivation licenses.1. RSI looks good

2. Trendline looks good

3. Look to touch 61% Fib retracement

4. Look for cross of MACd