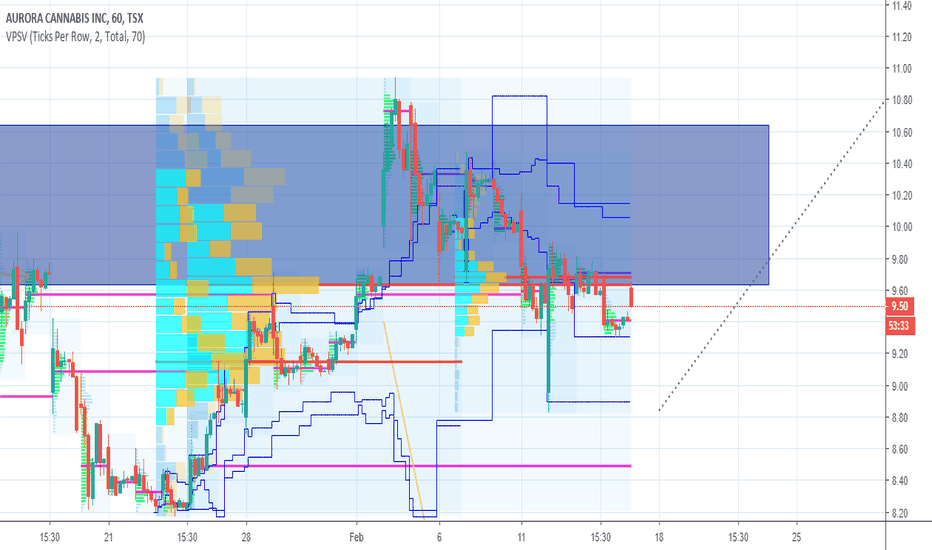

ACB Potential Reverse H & S

200 SMA held as support.

RSI has turned around.

MACD is above zero line.

A large inverse H&S is forming. Target of breakout would be 12.

ACB

Will Aurora Cannabis Reach ATH soon ?The volume was quite impressive last week, smashing through the 8$ resistance and closing very strong above the pink trend line. What's interesting about this trend line is that you can extend it back 2 years when the price was under 1$ and it's been tested again and again, acting both as support and resistance. Next weeks we might see some follow through with resistance around the 10$, 11$ and 12$ levels, but more importantly the all time high is in sight. I don't know what's driving this surge for the past 2 weeks and I must admit I'm a bit skeptical. If for some reason there's a pullback that bounces on the pink trend line, it could be a good opportunity to make an entry. Other than that, I'll be careful as this stock and this sector can drop quickly, so this chart is more to help look for an area where buying could happen IF there's a sudden drop.

Increased bull volume for RTI RTI gapped up on news of it obtaining a standard processing license, then dipped down, almost closing the gap until follow up news broke that RTI is now operational and starts to generate revenue. She broke clear of the $1 level, though she may of course consolidate below it again. Increased bull volume, however, tells me investors are aware of RTI's potential in the near term.

For those that think Valens is the play, in my opinion Valens WAS the play. Radient has disruptive extraction technology, living up to the expectations of big demand. What takes hours at Valens, takes only minutes at Radient, and the extracts are more potent. Hard to say what's next, but RTI is a clear long play, and once it starts to present deals and earnings, we'll see her up there in the $3 to $5 range.

Did you know that RTI will be extracting for Aurora? Did you know that Radient has enough extraction capacity to process about 10 times Aurora's full production capacity?

I see enormous upside for Radient.

I bought the dip. Did you?

Aurora Cannabis - Bullish outlook BUT....Good night everyone,

Quick look at ACB stock

As we can see on daily chart, bullish outlook, but we are reaching a resistance level and that huge volume bars concerns me.

I expect some drop on the next days and a good place to buy is at 7~7.50 zone (demand zone) IF price action shows rejection on it like a low test candle.

The suplly waves are weak so far (just check the volume on the down waves) so i believe this stock will touch 10.0 again soon and maybe a new ATH at 14.0 level.

This Trading Idea is to be used for educational purposes only. This idea does not represent financial advice and its NOT a signal. You should trade based only on your own technic and knowledge.

Targeting a +40% long on symbol $ACBAn ascending triangle forming as a name in the hot Cannabis sector sets to breakout to previous highs.

ACB: More opportunity to add - Swing TradeLast week I mentioned the valid upwards channel in ACB. We saw that ACB bounced off the channel as expected but unfortunately could not break the top of the channel. This week we may see another buy opportunity similar to the last.

What to watch:

- Only enter if candle does not break the 4 hr upwards channel.

- Watch in the lower time frame, 30 mins - 1 hour for confirmation (at least 2 few candles) before entry.

- Be patient for all time high take profit! we will get there soon.

Trade at your own risk.

ACB Breakout forming Ascending triangle patternACB breakout is forming, Ascending triangle pattern

So far the marijuana market has been dragged down by the SPY with analyst upgrades on ACB it's pulling in a lot of investors.

If the SPY recovers from this point even for a brief period of time we may be heading back up to $13-14 levels.

Analysts like ACBI'm in this for the long term, but I can't help but to think that the last analyst that liked the stock in late February caused a price pattern that looks nearly identical to this recent one. I traced the previous pattern and placed it below the current one, they look slightly related. In the absence of more news, I expect it to fall to the trend lend around 7~.22. However, any slightly relevant news or pullback/advance of SPY can greatly change this.

*Not financial advice, purely educational.

AC

WEED STOCKSSS: ACBMy other favorite, view my CRON play posted earlier for more info on the weed stocks. Very self explanatory, load up and have fun in this shaky market my potheads :)

ACB ready for the next step up >8.50We know how fast weed stocks move when they hit proven support lines.

One more trading day to prove 6.90-7.00 support will likely bring ACB >8.50 by 3/1. It's possible we'll see a little lag, but expected move should happen by 3/8.

Peak-to-peak, ACB has averaged 10%-20% leaps. 10% leap from previous peak of 8.34 brings us >9.00

ACB trading at 6.93 while posting this.

"Panta Rhei"Watching for the short. RSI and the pivot points are the key indicators that stick out to me. They arrested the CFO of Huawei, one of the biggest telecom companies in the world. Not a minor event. May seem like old news to us, but in China, it's still fresh in their memory. I don't expect these trade talks to go well.

ACB in descending channelIf it cannot break out of the descending channel we will retest lows in the next 24-48 hours.

Short play with $6.22-$6.12 target price