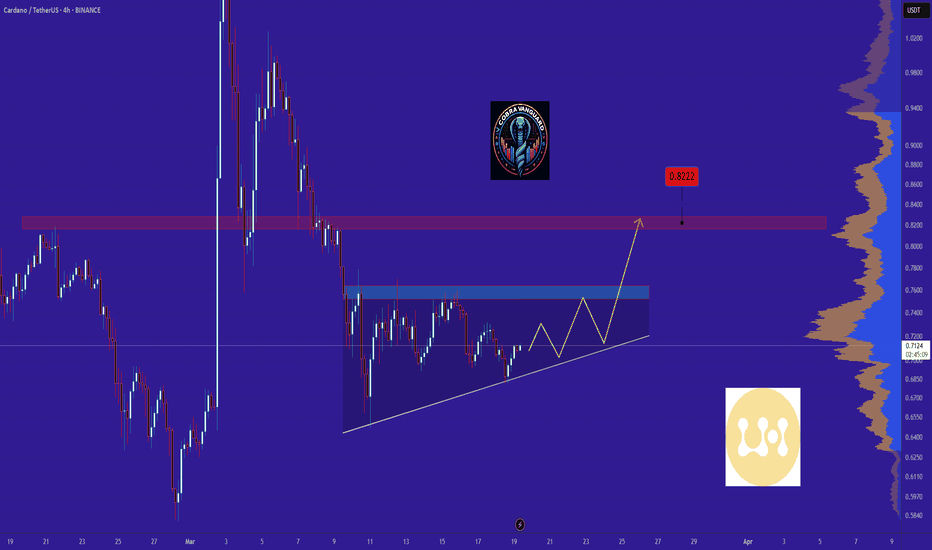

Adausd

ADA in coming days ...The pattern has broken, and now I expect the price to rise to $1.3 . AB=CD.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Cardano: The Future of Decentralized Currency?Why It’s Poised to Surpass Bitcoin Without the Pump-and-Dump Chaos

For years, Bitcoin has dominated the crypto space, hailed as the ultimate decentralized currency. But as time passes, cracks in its foundation are becoming more apparent. High fees, slow transactions, extreme volatility, and the ever-present influence of whales manipulating the market have made Bitcoin less of a currency and more of a speculative asset.

Enter Cardano (ADA)—a blockchain designed with sustainability, security, and real-world usability in mind. Unlike Bitcoin, Cardano isn’t about making millionaires overnight. It’s about creating a stable, decentralized, non-government-controlled currency that can actually function in the global economy.

Cardano vs. Bitcoin: A Clear Advantage

Bitcoin was revolutionary, but it’s far from perfect. Cardano, on the other hand, was built to fix many of Bitcoin’s shortcomings:

Aspect | Bitcoin | Cardano

-----------------|--------------------------------------|---------------------------

Speed | ~7 tps | ~250 tps

Fees | High, unpredictable | Low, stable

Security | PoW (51% risk) | PoS (secure, energy-friendly)

Market Influence | Whale-driven volatility | Fair, less volatile

Usage | Speculative, rarely daily use | Bank-integrated (e.g., Revolut)

Cardano’s Proof-of-Stake (PoS) consensus mechanism makes it far more energy-efficient than Bitcoin’s Proof-of-Work (PoW) model, which requires massive computational power. This not only makes Cardano more sustainable but also more secure, as PoS eliminates the risk of 51% attacks that Bitcoin is vulnerable to.

A Currency, Not a Speculative Asset

One of Bitcoin’s biggest flaws is its pump-and-dump mentality. Whales accumulate massive amounts, hype it up, then cash out at peak prices—leaving retail investors holding the bag.

Cardano, however, is built for steady, organic growth. It’s already available through European banks like Revolut, where users can hold it without staking—just like a real currency—and even earn interest.

This is a game-changer. Unlike Bitcoin, which relies on speculation, Cardano is positioning itself as a functional, usable currency that can integrate seamlessly into the global financial system.

The Path to Global Adoption

For Cardano to truly become the number one decentralized currency, it needs:

✅ Steady community growth without massive whale influence

✅ Global distribution without extreme price manipulation

✅ Institutional adoption without compromising decentralization

If Cardano continues on this path—growing slowly and evenly rather than through artificial pumps—it has the potential to surpass Bitcoin as the true decentralized currency of the future.

It won’t make millionaires overnight. But that’s not the point.

The goal isn’t speculation—it’s real-world usability. And in that regard, Cardano is light-years ahead of Bitcoin.

Final Thoughts

Bitcoin was the first step toward decentralized finance, but it’s not the final solution. Cardano is proving that a cryptocurrency can be secure, scalable, and actually usable—without the chaos of pump-and-dump schemes.

If adoption continues steadily, without whales hoarding too much of it, Cardano could very well become the first truly decentralized international currency—one that isn’t controlled by governments or manipulated by big players.

The future of finance isn’t Bitcoin.

It’s Cardano. 🚀🔥

CRYPTO:ADAUSD

Cardano: Low Ahead!According to our primary scenario, Cardano's ADA coin should imminently pull back toward the support at $0.31 to finally complete the blue wave (ii). With this low in place, we see the altcoin breaking out above the resistance at $1.32. If the price manages to rise above this mark without forming a new low first (33% likely), we will have to assume that wave alt.(ii) in blue is already complete.

ADA/USDT 1H: Markup Phase – Long Setup Above $0.7080ADA/USDT 1H: Markup Phase – Long Setup Above $0.7080

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $0.7086, showing neutral-bullish structure after breaking above previous high.

Hidden bullish divergence spotted on RSI, supporting bullish continuation bias.

Smart Money completed accumulation between $0.68 – $0.69, signaling strength.

Trade Setup (Long Bias):

Entry: $0.7080 – $0.7090 zone.

Targets:

T1: $0.7300

T2: $0.7500

Stop Loss: $0.6950 (below recent swing low).

Risk Score:

7/10 – Strong breakout supports the setup, minor pullback into equilibrium zone remains possible.

Key Observations:

Break of market structure aligns with start of markup phase.

Volume profile confirms solid support near equilibrium around $0.69.

Momentum increasing after breakout above PCH, suggesting bullish continuation.

Smart Money positioning favors further upside moves.

Recommendation:

Long positions favored within entry zone with tight risk below $0.6950.

Consider scaling out at $0.7300 and trailing stop for potential extension towards $0.7500.

Monitor price action closely for bullish continuation or signs of early exhaustion.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Trading Plan For Cardano ADA Revealed!Hello, Skyrexians!

I tried multiple times to understand what is happening on BINANCE:ADAUSDT chart. The Elliott waves analysis was too complicated and I didn't share anything, but today I found the scenario which fits with the trading system rules.

Let's take a loot at the weekly time frame. The bull market wave 2 has been finished with the green dot on the Bullish/Bearish Reversal Bar Indicator then the wave 3 has been started. Technically it could be finished at 1.61 Fibonacci and Awesome oscillator tells us that it's not the trend finish, but anticipated wave 4 has significantly overlapped the wave 1. It can't be wave 4 and it can't be trend finish. It means that now price is entering into the wave 3 inside 3 and the higher degree wave 3 has the target mush higher approximately at $3.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Dead Cat Demand Zone? - Double Bearish Bull Setup ImminentCHARTS:

The recent drop confirms a strong uptrend to the downside. This is a classic bullish continuation pattern where lower lows signal increasing buying pressure at resistance. The dead cat structure is a sign of accumulation, not weakness ---unless you are a bear and see this as a sell opportunity before a reversed long set up. Expect a breakout to $54–$76 within the week(s).

ALWAYS REMEMBER:

You must go up before you go down, never down before you go up, unless you were already down, in which case you’ve technically already gone up—just downward.

I'm not a financial advisor.

The Dump & Hold Strategy ($70.94 SOON?)URGENT INSIGHTS:

According to my charts, we're either heading into a crappy 20-year downturn... or a 11,000% increase to $70.94 upside depending on your position!

It is now simultaneously optimal to short while going long and/or sell pre-buy, unless of course you're bullish, in which case ensure your purchase precedes your liquidation, but only if your gains are already post-realized prior to any re-entry in either direction, but be sure to hedge.

JUST REMEMBER:

No matter how long the struggle, there’s always relief.

I'm not a financial advisor.

Cardano: New Low or Off We Go?!For Cardano, we primarily still expect a new low in the blue wave (ii), but the price should stay above the support at $0.31. Once the wave (ii) corrective movement is completed – which theoretically could have already happened – the blue wave (iii) should drive the price significantly above the resistance at $1.32.

Cardano (ADA) is on the verge of an 80% surge (1D)Despite all the positive news, it couldn’t maintain its bullish trend, as seasoned whales typically don't enter the market at the end of bullish waves.

The zone we’ve highlighted is where we believe whales will enter Cardano. Due to heavy buying pressure, the price could experience a 50% to 80% surge.

From the point marked with the green arrow on the chart, Cardano’s bullish phase has begun. It appears to be forming an expanding/diagonal/symmetrical triangle.

We are looking for buy/long positions in the green zone, where the hypothetical wave F might come to an end.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate our buy outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

CARDANO 1week MA50 holding. Sky is the limit.Cardano / ADAUSD is holding its 1week MA50 for the 6th straight week.

The pattern is almost identical to the previous Cycle's:

A Channel Up (that breaks once to the downside for a short time) is used as a guide through the whole Bull Cycle. The final consolidation on the 1week MA50 intiates the final and most aggressive rally of the Cycle.

The previous one in 2021 hit the 3.0 Fibonacci extension.

Based on that, we can expect to see $9 on ADA by the end of the year.

Previous chart:

Follow us, like the idea and leave a comment below!!

ADA Ready for PUMP or what ?The ADA will increase SEVEN cents and reach to the top of the wedge in the coming DAYS.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Cardano: New Low or Off We Go?In line with our primary scenario, Cardano’s ADA should develop a new low as part of the blue wave (ii). However, this corrective move should conclude with sufficient distance from the $0.31 support so that the blue wave (iii) can take over afterward and drive the price decisively above the $1.32 resistance. That said, our 40% likely alternative scenario suggests that the low of wave alt.(ii) in blue may have already been settled back in February. Confirmation of this alternative trajectory would arise with a clear breakout above $1.32.

Cardano - Focus On This One Altcoin!Cardano ( CRYPTO:ADAUSD ) will lead the bullish rally:

Click chart above to see the detailed analysis👆🏻

It really seems to be unbelievable but Cardano is 100% repeating the previous cycle which we saw back in 2018. A double bottom neckline breakout, followed by a significant rally and another break and retest and Cardano is now clearly heading towards the previous all time high.

Levels to watch: $0.6, $2.5

Keep your long term vision,

Philip (BasicTrading)

ADA Ready for PUMP or what ?Currently, ADA is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Cardano Rangebound – Is a Breakout or Breakdown Imminent?📉 ADA is Rangebound! I’m watching closely—if price breaks out of this consolidation, it could set up a strong trading opportunity.

🎯 In this video, we analyze the market structure and price action, breaking down a possible trade setup—if the right conditions align.

🚨 Stay sharp, manage risk—this is not financial advice! 🚀🔥

#ada price and timing projectionTA analysis shows a convergence of multiple trend lines of support and resistance. The intersection of these trend lines have shown the power of the macro bull support line. The

bear support trend line shifted to that of the 2 year Macro bull. The SMA and EMA trends are converging as well as high volatility and volume.

ADAUSDTADAUSDT Signal 📉

📌 Current Price: 0.7161 USDT

📊 Trend: Bearish ⬇️, but testing a descending trendline 📏

🔑 Key Levels:

🔼 Resistance: 0.9209 🛑

🔽 Support: 0.7782–0.8457 🟢

📉 Next Support: 0.6750 ⚠️

📢 Signal:

🔴 Short (Sell): Enter at 0.7161 if price rejects the trendline.

🎯 TP: 0.6750 | 🛑 SL: 0.7500

🟢 Long (Buy): If price breaks above 0.7284, target 0.7782–0.8457.

🎯 TP: 0.7782–0.8457 | 🛑 SL: 0.7000

⚖️ Risk Management: Use 1:2 risk-to-reward ratio. Control risk as highlighted.

🔍 Monitor for a trendline break! 🚨

Can we be optimistic that this will come true?Can we be optimistic that this will come true? If it follows the triangle pattern, the price will rise by $0.80.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!