ADAUSDT

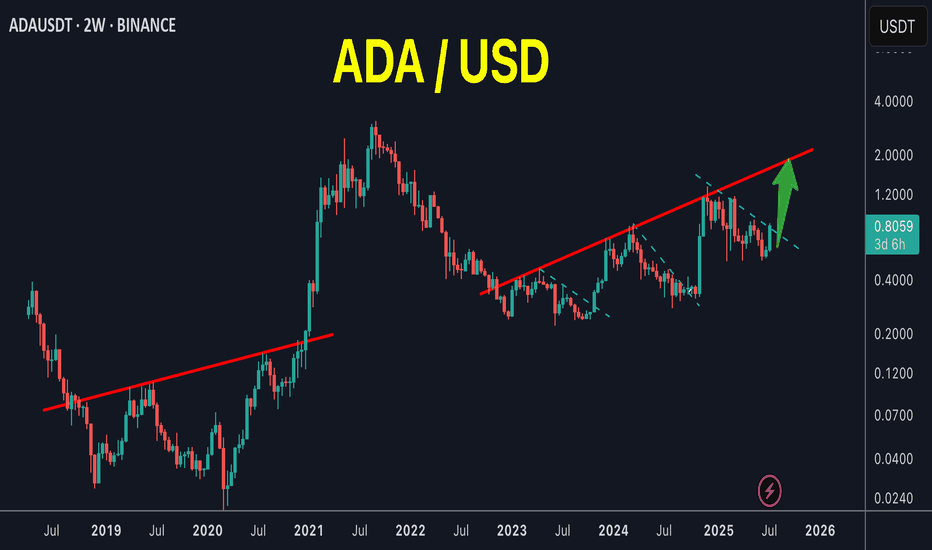

ADA, long term dubious speculationWARNING: This idea is highly dubious!

This is a logarithmic estimate of potential targets, in case Cardano moves in long logarithmic measures.

The real potential of this idea is strongly linked to the fundamentals evolution on time, i.e.: FED reducing the interest rate, for instance, but not only.

The plot features top and bottom limits drown by hand!, these are not perfect logarithmic measures, thus they certainly lacks of math accuracy. Beware.

There are zones in red and green, as transparent boxes, which depicts potential zones of buy and sell interest, of course, everything is in a log scale.

Everyone wish these kind of scenarios to be true. Only time and reality will show us the true face of it. In any case, in the total chaos of uncertainty that this market is, we try to make a sense of it.

Best of the lucks for everyone.

T.

DISCLAIMER: Do your own research! This idea is not a financial advice. All the information presented is highly speculative and cannot be taken as a reference in any circumstance.

ADA Setup – Eyeing Entry After 70%+ RallyCardano (ADA) has surged over 70% in recent weeks. A healthy pullback is underway, and we’re watching the key support zone for a potential long entry targeting the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.65 – $0.67

• Take Profit Targets:

o 🥇 $0.98 – $1.15

o 🥈 $1.50 – $1.60

• Stop Loss: Just below $0.62

Short Breakdown of Cardano (ADAUSDT) weekly/daily technicalsLooked over this for a friend. Rowland I would love your feedback in the comments 🫡

I will see my biggest expectation is for this to make it's way into the weekly imbalance range below the weekly Mother Candle we are existing within. The entire crypto market seems to want to revisit some key lows to correct some inefficiently delivered rally ranges (meaning too many pending orders left behind due to price not coming back to grab them, happens when HUGE money places--attempts to place/fill--bulk orders).

We are getting what I think is a temporary bullish correction due to taking of profits at key lows. It is my belief/observation that after correcting the newly minted bearish range (grabbing pending shorts above daily highs--turtle soup I think they call it), we will be able to drive down into the bullish imbalance weekly candle's range.

Let's see how we go! 😈

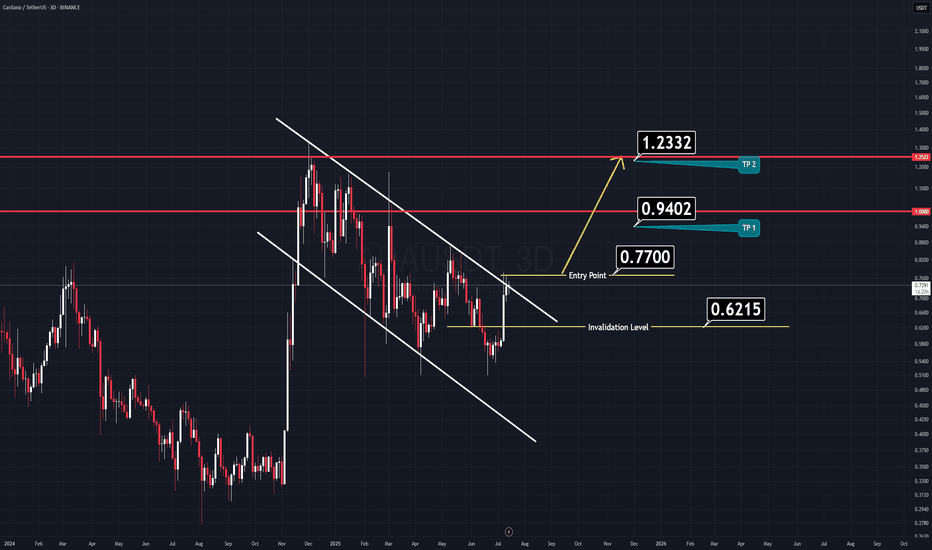

ADA/USDT | Pullback to Key Support – Can It Rebound Toward $1.32By analyzing the Cardano chart on the 3-day timeframe, we can see that after reaching $0.935, the price faced selling pressure and dropped by 18% to the $0.76 area. Now, the key is whether ADA can hold above the $0.75 level by the end of the week. If it succeeds, we could expect further bullish continuation. The next potential targets are $0.86, $0.93, $1.02, and $1.32.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

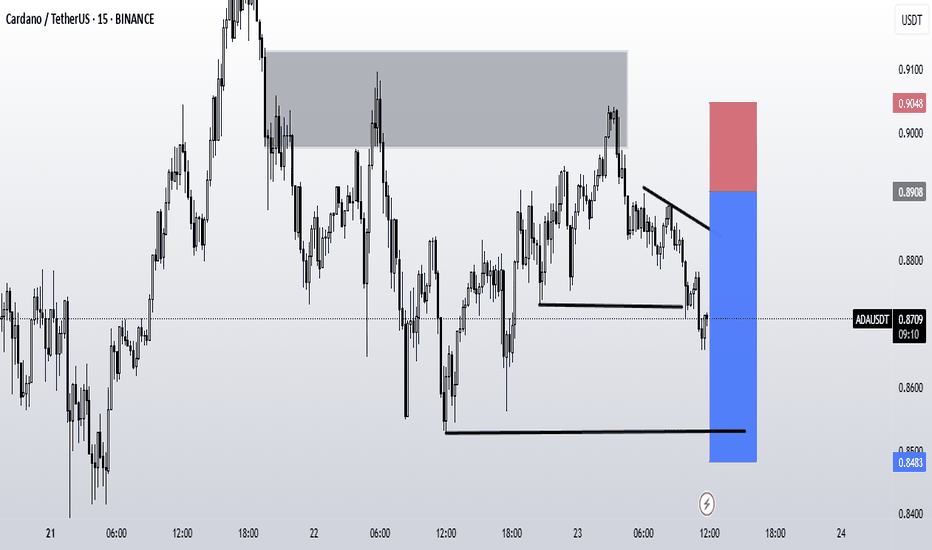

ADA SCALP TRADE IDEA WITH EXPLAINATION.1. Market Structure & Break of Structure (BoS):

The chart shows a bullish Break of Structure (BoS) marked by “X”, where price broke above previous highs with strong momentum, confirming a shift in structure from bearish to bullish.

This BoS indicates institutional buying interest and a potential continuation of the bullish trend after a retracement.

2. Retracement & Current Price Action:

After forming a short-term high around 0.8080, price began to pull back, forming lower highs and lower lows.

The current price is consolidating around 0.7948, signaling indecision or temporary relief before further movement.

3. Liquidity Engineering – Sell-Side Liquidity (SSL):

There is a cluster of equal lows (SSL) just above the 0.7870–0.7880 zone.

This liquidity has not been swept yet, and it’s likely that smart money will drive price below it to trigger stop losses and induce sellers, creating the fuel for a bullish reversal.

4. Key Demand Zone – OB + FVG:

Below SSL lies a powerful confluence zone:

A Bullish Order Block (OB), which represents the last down candle before the bullish move that broke structure.

An overlapping Fair Value Gap (FVG), indicating an imbalance that price has not yet filled.

This OB + FVG zone is marked in blue, approximately between 0.7850–0.7880, and serves as the primary Point of Interest (POI) for a high-probability long entry.

5. Anticipated Move:

Expected scenario:

Price is likely to sweep the SSL, tap into the OB + FVG zone, and then show bullish confirmation (such as a bullish engulfing or change of character).

If confirmed, we can look for a long position from the demand zone.

6. Entry Plan (SMC-based):

Entry: Inside the OB + FVG zone (0.7850–0.7880), after bullish confirmation.

Stop Loss: Below the OB zone (around 0.7830).

Target 1: Recent high near 0.8080.

Target 2: Extended TP near 0.8150 for a 1:2 or 1:2.5 RR.

✅

Summary:

ADA/USDT has broken structure to the upside, but price is currently in retracement. With SSL liquidity still intact and a clean OB + FVG demand zone below, we expect a sweep of lows followed by a bullish reversal. A high-probability long setup may form once price reacts from the demand zone with clear confirmation.

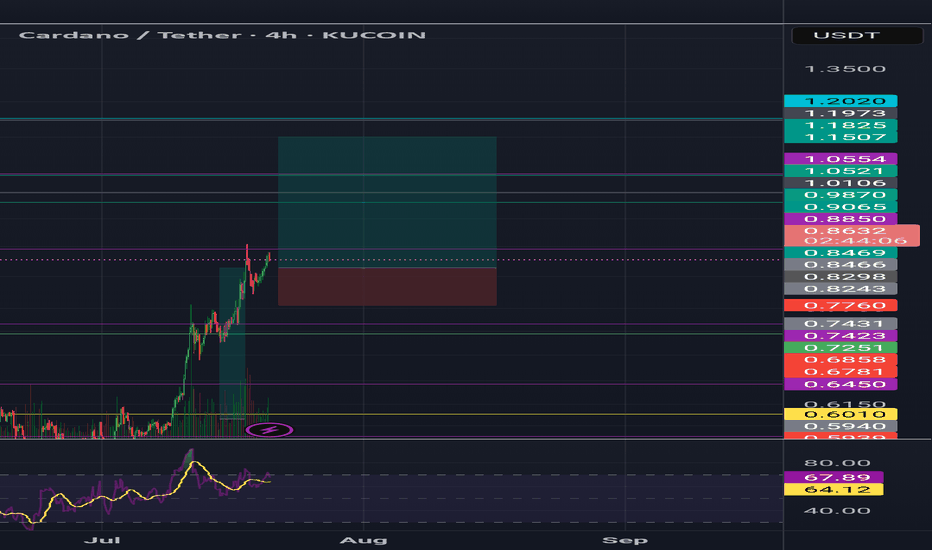

ADA - Time to buy again! (Update)The pattern has broken, and now I expect the price to rise to $1.20 . AB=CD.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

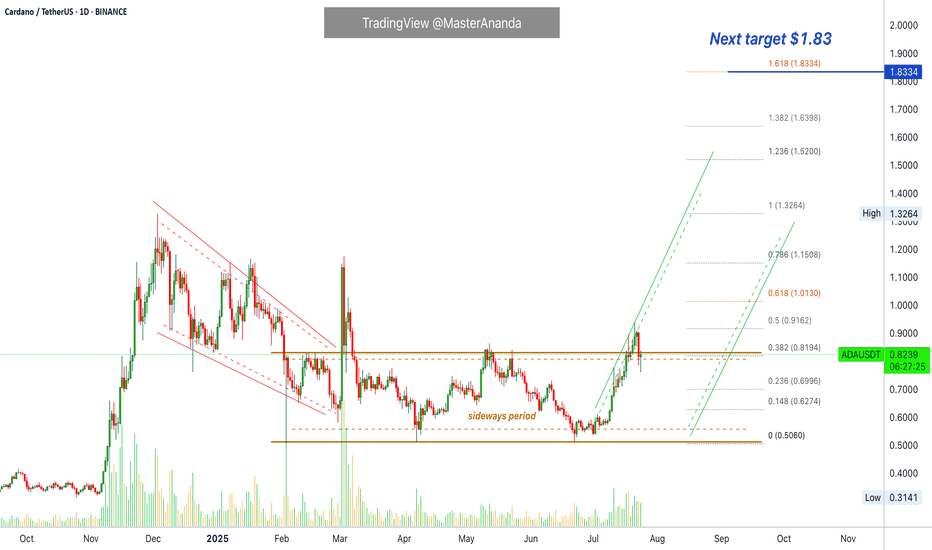

Cardano Update · Wait For New ATH Before Selling · Chart BullishI am using 3D candles. The last session is a Doji on ADAUSDT. There was a red session followed by a continuation with prices moving lower. That's last session, but it—the Doji—ended up closing green.

Sellers started to put pressure on the market and pushed prices lower (red day), by the next session, all selling was bought (Doji) and now ADAUSDT is back above 0.382 Fib. extension (0.8194). This is a bullish setup based on candlestick reading.

From here on ADAUSDT can grow to produce a higher high as long as it trades above this Fib. level, the continuation of the bullish move that started 21-June. So we had a small retrace and the action is recovering, right before bullish momentum grows, which means that this is a good setup to go LONG. It seems some positive event will develop soon and this will create a major wave, a major advance here and Cardano will see the highest prices in more than four years.

It can take a few days, not much longer; everything is pointing higher.

Here it is also wise to avoid selling too early. When we consider Cardano's potential for growth beyond $7, easily, we have to avoid paying attention to the temptation to sell when prices are still too low, the rise is only starting. It is ok to sell at major resistance levels if you have experience because there is always a stop before additional growth. If one is very active, it is easy to sell some at resistance and then buy more at support. But the easiest way is to buy and hold. If the entire bullish wave is set to produce 500%, this is always more than good enough so it is easy to hold thinking of the long-term.

We continue within the accumulation phase. While many pairs are already advanced and while prices are definitely growing, this is not it yet; things are about to go wild and it is better to be fully invested before the event. Everything Crypto. Buy Crypto. Hold Crypto. We are going up.

Namaste.

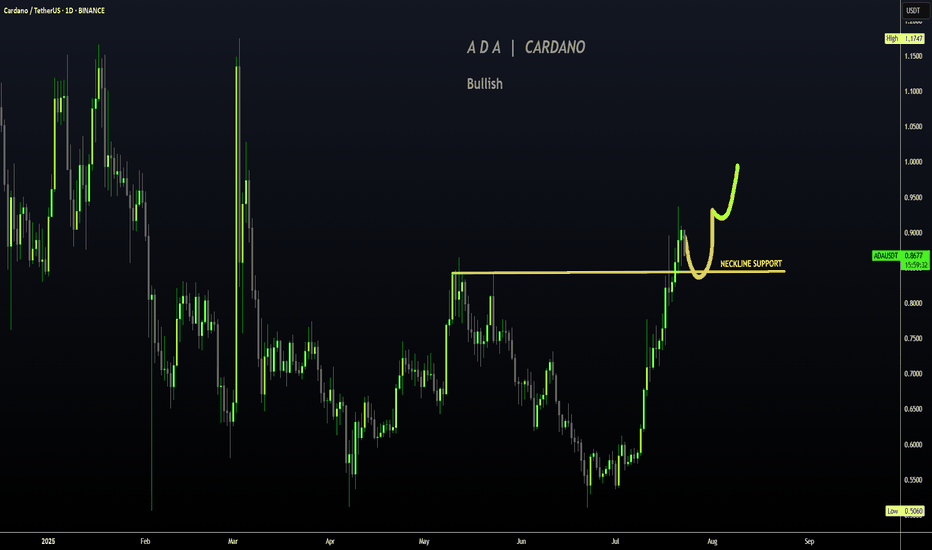

CARDANO | ADA Creeping UP to $1Cardano has made a big move in recent weeks, boasting a 77% increase.

If you were lucky enough to buy in around 30 or 40c, this may be a great TP zone:

Looking at the Technical Indicator (moving averages), we can see the price makes its parabolic increases ABOVE - which is exactly where we are currently beginning to trade. This could mean more upside is likely, and the 1$ zone is a big psychological resistance zone:

A continuation of the current correction may look something like this for the next few weeks:

_____________________

BINANCE:ADAUSDT

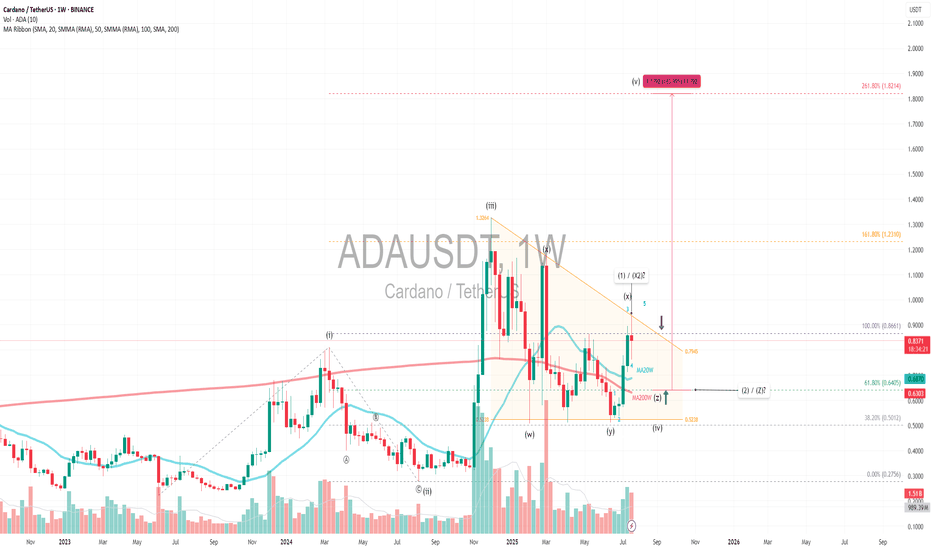

ADAUSDT|Triangle Setup WXYX2Z (1-2) +180% - Revisit $1.82 TargetPrimary Pattern: A contracting triangle within a larger corrective structure, likely wave 4.

Wave Count: A diagonal 5-wave impulse (i–v), followed by a WXY (X2) Z complex correction, suggesting wave 4 is still unfolding, possibly nearing completion.

Current Price: $0.83 with volume and SMA ribbon golden crosses showing bullish signal and near completion of accumulation phase.

Fibonacci Extension:

Targeting diagonal wave 5 at 261.8% extension from the base of wave 1 aligns with the projected target of $1.82, which matches the height of the triangle target. This also coincides with a +180% move from the possible upcoming wave Z or wave 2 —technically ambitious, but plausible if wave 5 kicks off with momentum.

Wave 4 Triangle Context:

The WXY(X2)Z structure implies a complex sideways correction which is typical of wave 4 behavior 1.6x - 2x wave 2 time extension

Key Support:

Entry: If X or 1 is nearing completion, and triangle support holds at key support MA20W Fibonacci 61.8%, the breakout into wave 5 could be explosive—especially with diagonal structure suggesting a leading diagonal pattern.

SL: Triangle Support is the last liquidity / smart money entry

Always trade with affordable risk and respect your stoploss!

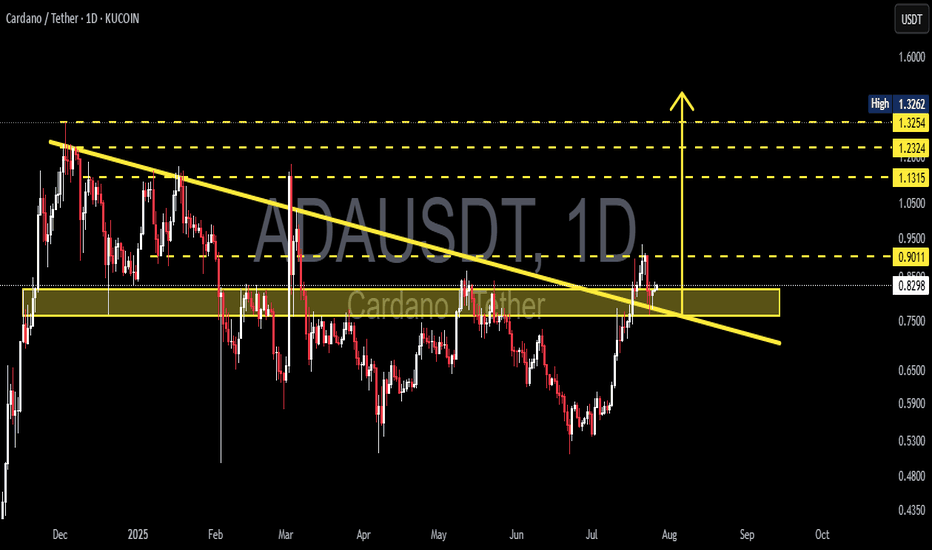

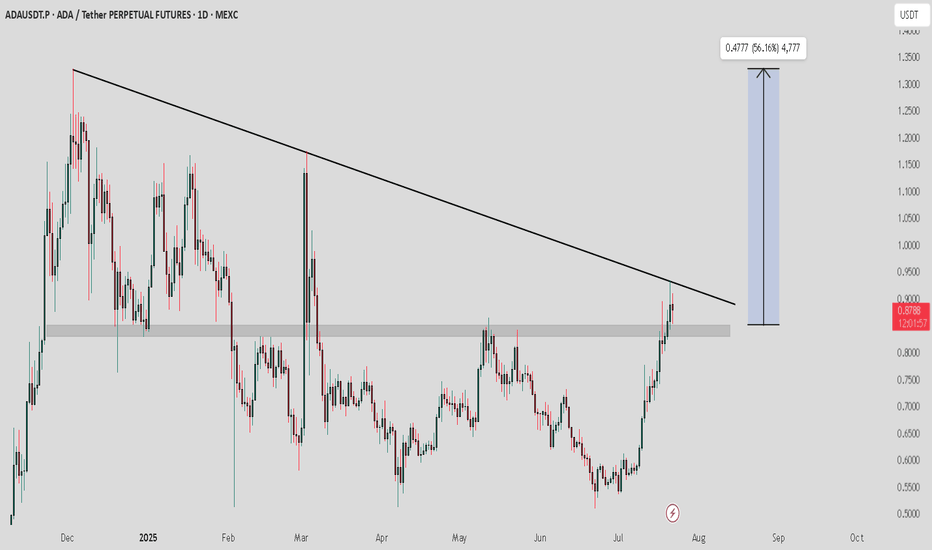

ADAUSDT Breaks Long-Term Downtrend – Critical Support Retest!The ADAUSDT pair is showing a compelling technical setup. The price has successfully broken out of a long-term descending trendline (yellow line) that had been acting as dynamic resistance since late 2024. This breakout came with strong momentum, signaling a potential shift from a bearish trend to a bullish reversal.

After the breakout, price managed to rally up to minor resistance around $0.90, but is now pulling back and retesting the key support zone (highlighted yellow box) — a previous strong resistance area now potentially flipping into support.

---

🟢 Bullish Scenario:

If the price holds above the $0.80 - $0.83 support zone, the break-and-retest structure will be validated.

A successful bounce from this area could push ADA back toward:

$0.90 (current minor resistance)

$1.13 (psychological and horizontal resistance)

$1.23 (previous supply zone)

$1.32 (recent local high)

A confirmed bullish continuation will be more convincing if the price forms a higher low and breaks above $0.90 with strong volume.

---

🔴 Bearish Scenario:

If ADA fails to hold the $0.8281 support and falls back below the descending trendline, then:

It may re-enter the previous range and test lower support around $0.75 or even $0.65.

This would suggest a potential false breakout and return to bearish territory.

Watch for bearish candlestick confirmations below $0.80 as an early warning.

---

📌 Pattern Insights:

Descending Trendline Breakout: Suggests a possible long-term trend reversal.

Break & Retest Structure: Price is currently testing the previous resistance zone as new support.

Layered Resistance Zones: Several clear resistance levels above provide logical targets for a bullish rally.

---

📊 Conclusion:

ADAUSDT has printed an early signal of a bullish reversal by breaking out of a long-standing downtrend. However, the sustainability of this trend depends heavily on the ability of price to hold the $0.80 - $0.83 support zone. Look for bullish confirmation candles in this area for a safer long entry.

#ADAUSDT #Cardano #CryptoBreakout #TechnicalAnalysis #Altcoins #BreakoutSetup #BullishRetest #CryptoChart #SupportAndResistance #PriceAction #TrendReversal

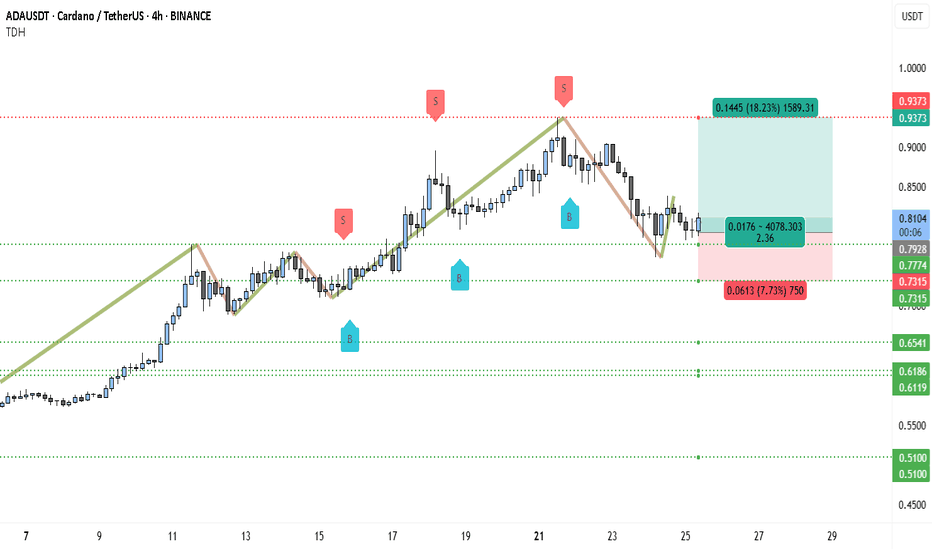

Cardano (ADA) Just Flipped Bullish — Next Stop: $0.9373?ADAUSDT is currently displaying a strong bullish structure on the 4-hour chart, bouncing from a critical support zone near $0.7774–$0.7315. After a healthy retracement, the pair appears to be regaining momentum, forming a potential higher low, which aligns with the continuation of the broader uptrend that started earlier this month.

Recent price action confirms that buyers are stepping in at key zones previously marked by blue “B” labels, and sell-side pressure seems to be weakening after the last swing top around $0.9373. The support zones, marked with dotted green lines, have held well, and the current structure suggests a rebound toward the previous high.

The most recent small leg up shows the formation of a bullish engulfing setup near $0.78, which could serve as a launch point toward the higher resistance. The candlesticks are also showing longer lower wicks — a sign that buyers are defending lower levels aggressively. With price currently floating near $0.81, there’s a good upside window available.

Here’s the trading setup based on the chart:

• Entry: Around $0.8106 (current price zone)

• Take Profit (TP): $0.9373 (previous swing high — +18.23%)

• Stop Loss (SL): $0.7315 (invalidates higher low structure — -7.73%)

• Risk-Reward Ratio: 2.36R (favorable for swing positioning)

If ADA can reclaim the $0.85 zone with strong candle closures, it would signal bullish continuation. Momentum indicators like RSI or MACD (not shown) would likely confirm the shift, especially if divergence was forming on recent dips.

Until ADA breaks below $0.7315, the bullish bias remains intact. The formation of higher lows and increasing buying interest at dynamic supports adds weight to the long setup. Price reclaiming the $0.85 zone may trigger a fast rally to $0.93, and possibly beyond if market-wide sentiment remains risk-on.

ADA/USDT | Multi-Month Breakout Brewing — a 10x play ?Cardano is quietly mirroring its previous macro cycle — but this time, the structure looks tighter, cleaner, and potentially more explosive.

The multi-month chart reveals a consistent uptrend forming off the 2022 lows, contained within a well-respected ascending channel. The price action shows strong similarities to the 2018–2020 accumulation phase, followed by the breakout that led ADA to its all-time high in 2021.

The current price structure is forming higher highs and higher lows within a channel — a strong bullish continuation pattern.

Volume has been increasing steadily during the up-moves, signaling real demand building underneath.

Fibonacci Extensions from the previous cycle highs and lows show key long-term resistance zones:

1.618 – $4.91

2.618 – $7.79

4.236 – $12.47

These levels could act as major psychological targets if the trend continues to evolve similarly to the last cycle.

⏳ Current Price (~$0.64) is still significantly below previous all-time highs and long-term extension zones — offering a potentially favorable risk/reward setup for patient investors.

⚠️ As always, nothing moves in a straight line — but if you're a macro-mind investor, you’ll start to notice more straight lines than most. Zooming out often reveals the patterns that noise hides.

Cardano Has Plenty of Room To Grow · Will Hit Beyond $4 EasilyCardano's all-time high is $3.10. Cardano is currently trading at $0.82. Pause. You will be a genius when ADA is trading at $4 if you decide to buy below $1. It is not too late. This is only the start.

Good afternoon my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

The first major advance for Cardano after the last bull market happened November 2024 and peaked December; we are still getting out of the consolidation that followed the correction of this bullish wave.

Only now Cardano is breaking a sideways channel and still trades below its December 2024 peak. Bitcoin is trading at a new all-time high and is preparing for a major move above $130,000. XRP is trading at a new all-time high and is not dropping. Ethereum is very close to a new all-time high and will certainly continue to grow, only days away. Cardano still has to break its March 2025 high, its December 2024 high; this is not bad, it only means that is still early for this amazing pair.

A bullish advance started 8-July and lasted only 13 days. We are seeing a small retrace now, three days with only one day red. Cardano will recover and continue growing. This growth will not be exhausted in a matter of weeks, it will go for months. Cardano has to grow straight up, daily, weekly, for a prolonged period of time to move beyond $4. But $4 is not the top, $7 and $8 are also possible.

The reason why the action might seen slow, is because this is only the start. Give it time, the market is giving us an opportunity to join. The market is giving everybody the opportunity to buy Cardano while prices are still low. You know how Crypto operates. When it starts moving, it goes so strong and so fast that there is no time to react. Act now and you will reap the reward.

The bullish cycle is confirmed. Just look around, what do you see?

Our sisters and cousins are rising. Our young children are growing; Crypto is going up.

Cardano is one of the main projects in this market and it will not stay behind. You will not be disappointed, you will be happy with the results.

Namaste.

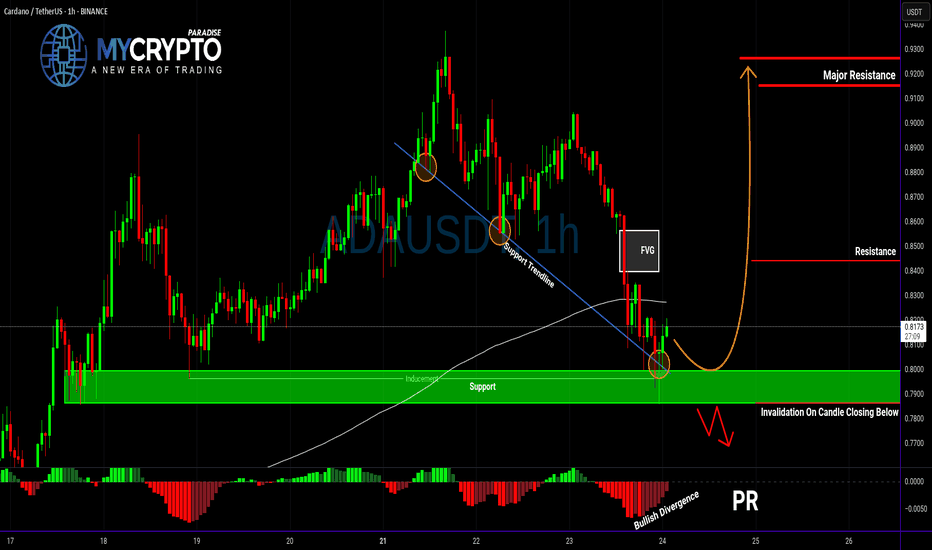

ADA About to Explode or Collapse?Yello Paradisers — is ADA gearing up for a breakout, or are we walking straight into a bull trap? After the recent pullback, the market is throwing mixed signals, but this setup is becoming too important to ignore. Here’s what we’re seeing right now on ADAUSDT.

💎ADA is currently showing positive signs of strength after a solid retracement. Current support zone is not only a historical price pivot, but it's also aligned with a supportive trendline, the 200 EMA, and a developing bullish divergence on the chart. All these factors combined are increasing the probability of a short-term bounce — but that doesn't mean we go in blind.

💎For aggressive traders, entering at the current price might make sense, especially if you’re targeting the first resistance level. However, it’s important to note that this entry offers a relatively limited reward compared to the risk — roughly a 1:1 risk-reward ratio — so it’s crucial to size your position accordingly and keep tight control over your stop loss.

💎If you're looking for a cleaner setup with a better risk-to-reward profile, patience is key. A more favorable scenario would be waiting for a proper pullback and a confirmed retest of the support zone. Ideally, you want to see a strong bullish candle at the support level to signal continuation — that’s when the setup shifts from average to high-probability.

💎But be cautious. If the price breaks down and closes a candle below our support zone, the entire bullish idea becomes invalid. In that case, it’s much wiser to step back and allow the market to develop more structure before re-engaging. Forcing trades in uncertain conditions is where most traders lose, and we don’t want to be part of that crowd.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. Be patient, Paradisers — only those who follow structured strategies and risk management will thrive in the long run.

MyCryptoParadise

iFeel the success🌴

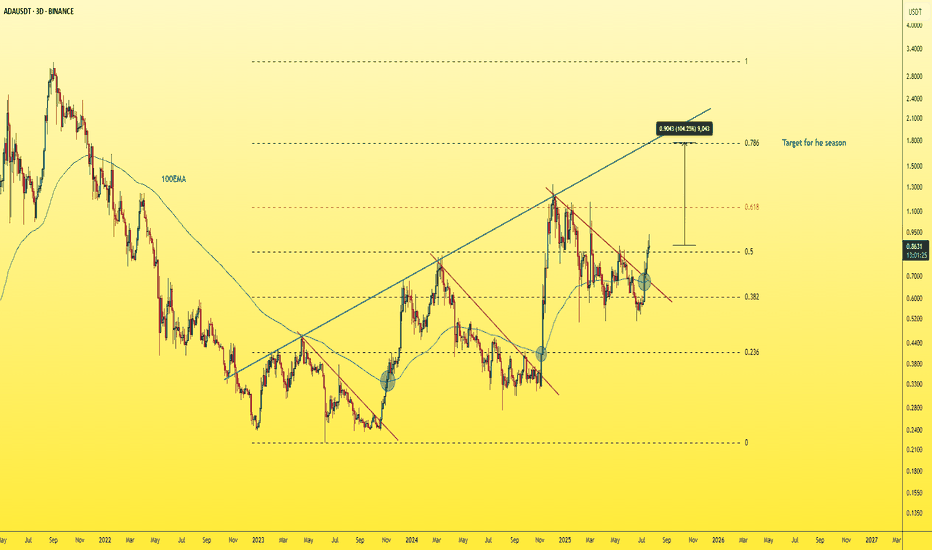

ADAUSDT - Buy or Regret!As clear and simple as the chart is… the target is just as clear and reliable.

ADA is showing strong bullish structure on the 3-day chart — breaking above the red trendline with a successful retest, and also breaking above the 100 EMA.

The blue trendline represents a strong hidden resistance level that many traders are overlooking.

The upside move is likely to end around the 0.786 Fibonacci level, which intersects with this blue trendline — in the $1.50–$1.70 range.

A strong project. A fundamentally sound coin that respects technical analysis.

A logical and high-probability target.

Best regards Ceciliones🎯

ADAUSDT.P m15 : a Short Position fot TP3The price, on its weekly upward path, reacted bearishly to the daily zone and seems likely to take out key lows to collect liquidity (whether for a future decline or rise).

Our trade will be activated after the liquidity Grab, based on trend and horizontal levels

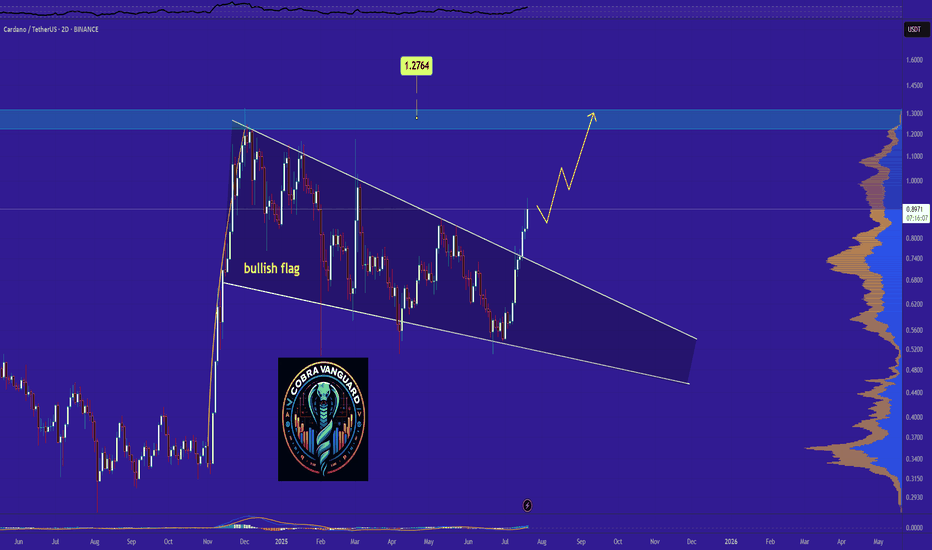

ADA Analysis (3D)Here’s another clean and straightforward chart, this time on Cardano (ADA).

ADA has formed a large flag pattern, which looks poised for a breakout soon.

Just like the previous setup, nothing complicated here.

✅ Entry Idea:

Consider entering when the price breaks above the previous daily candle’s high.

All the key levels are already marked on the chart for easy reference.

Keep it simple,

Good Luck.

Why ADA Remains Bullish and Its Next Potential Move !The pattern has broken, and now I expect the price to rise to $1.27 . AB=CD.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!