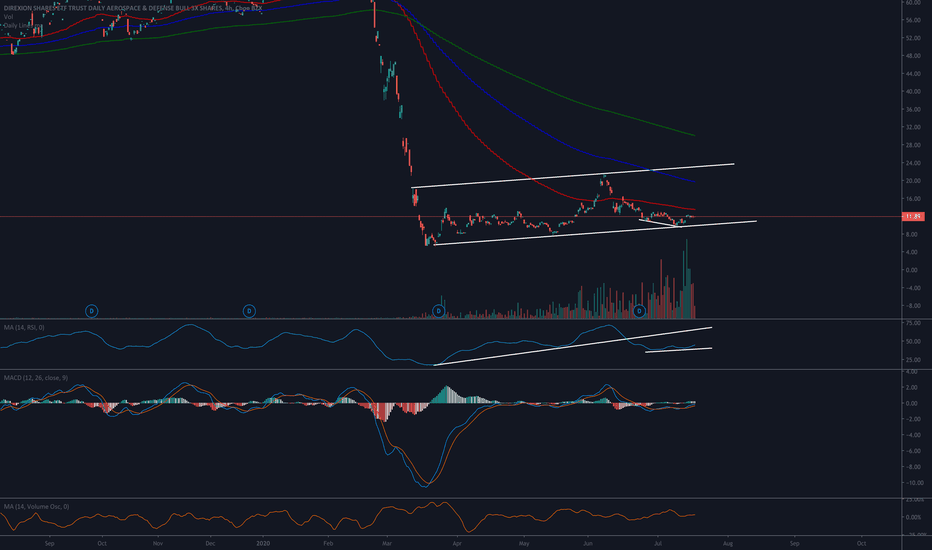

Boeing finally showing a trendTechnical analysis

Boeing showing support at the trend-line forming since the march lows.

A close below $152 is a break of the lower highs trend

Sentiment, technicals, and fundamental views for Boeing are weak. However:

risk-reward-ratio is very attractive

Still a global duopoly (Boeing and Airbus)

Heavy support from the government to help it succeed

Aerospace

UAV TechHoneywell is expanding their drone technology services. Growing their satellite network and increasing the services which they provided geared towards drones.

boeing hot hot hot so, no one is telling you this but me. you buy ba calls going into freedom day. this bad gyal takes out 181 we get a screamer

buy because im smart

181-220

naked calls monthlies

pick whichever fits your risk profile

if you are a degenerate like me i have the july 10 2020 $200 call strike

Drone sales up 68% for RCATRCAT just recently acquired Rotor Riot which is a street drone company. Creating custom drones with upgradable parts and systems. They recently had experience a surge in revenue in the last month and are attributing that to the increased interest towards FPV drones.

Buy Lockheed (NYSE:LMT), Entry 361.30 SL 354.80,valid till 17JunLike other stocks (check out idea published on Boeing NYSE:BA by visiting our ideas) in Aerospace and Defense industry, LOCKHEED (NYSE:LMT) also has some path to move further up.

Coordinates are:-

Entry: 361.30

SL: 354.80

Target: trail the price

Valid till 17th June 2020

$AIR can rise in the next daysContextual immersion trading strategy idea.

AAR Corp. provides products and services to commercial aviation, government, and defense markets worldwide.

The company has a good potential to rise — www.directorstalkinterviews.com

The demand for shares of the company looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $24,96;

stop-loss — $22,28.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Air Lease profitable in Q1As airlines continue to struggle to find their footing in today's current market Air lease is in a great position to provide aid to the airlines while also generating revenue. Their business model of owning over 300 aircraft that are being leased out to commercial and private airlines ensure that they are able to generate consistent cash flow while holding many of the assets on their on books.

Taking Advantage of Cargo movementCargo Airlines are taking over the skies. As commercial routes are no longer able to meet the demands of the logistics and transportations supply chain, cargo airlines are filling the gap.

In the end of last year Atlas air looked at ground 3 of its aircraft due to lack of demand with trade war tension and covid-19. As demand for cargo freighter remain high the reintroduce one of their B747 to take advantage of the opportunity.

As the price of the stock has rallied quickly looking for a retest towards previous supply zone would be a key target to secure an ideal entry price

Holding Long on EmbraerLast month We looked at the potential of putting on out of the money calls for a small premium cost with an expiration date for late in the year.

As the price of ERJ hits the low of just $4 we are starting to see a bit of strength and support be met at that level. As we start to move up from the all time low looking to follow the trend line will be a strong indicator that momentum is on our side.

Spirit AirlinesWhile many international flights have been cancelled domestic carriers are continueing to operate essential routes within the united states.

As traveller look to potentially travel more the projections for domestic travel are higher for the short term than international travel as many borders still remain tight with restrictions.

$RGR can rise in the next daysContextual immersion trading strategy idea.

Sturm, Ruger & Company, Inc., together with its subsidiaries, designs, manufactures, and sells firearms under the Ruger name and trademark in the United States.

The share price rose after good earnings. I see some preconditions the share price will continue growing.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $60,54;

stop-loss — $57,52.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!