ALGN

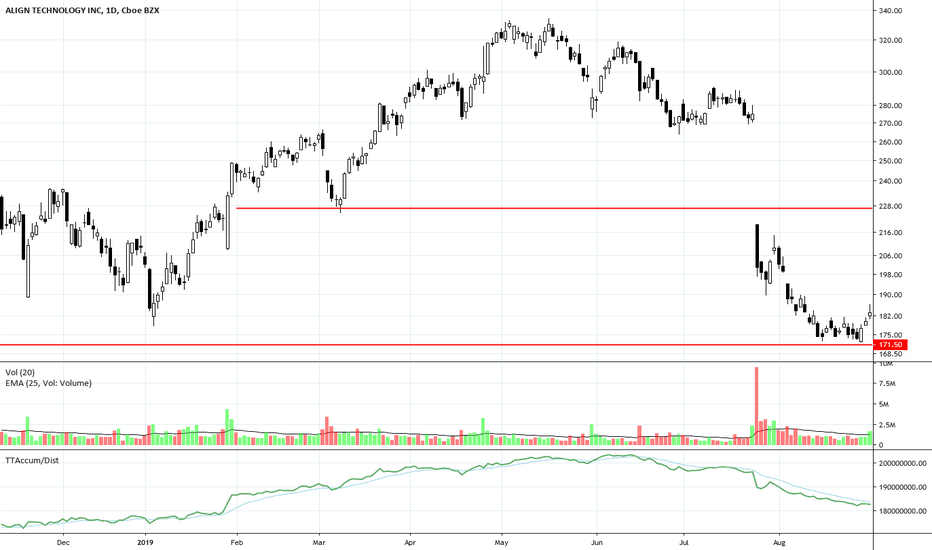

ALGN at Long-Term Support LevelALGN gapped down at the end of July on weak earnings news. It has now collapsed to a strong long-term support level. The final capitulation by Smaller Funds managers has ended. The consistency of the candlestick pattern with closely aligned lows and an early Shift of Sentiment™ pattern on the Balance of Power Indicator reveals some Dark Pool Quiet Rotation™ at this level.

$ALGN Oversold - Earnings After-Hours$ALGN Align Technology looking oversold on the daily chart, MFI appears to be bottoming. Based on earnings track record, expecting another strong beat when earnings are released post-close today. If poor overall market conditions continue to weigh post-ER, major support is just below around $285 - limiting risk.

*Take note this is a key holding of some major, well-respected hedge funds (i.e. Renaissance Technologies).

Targeting a return to $400 level by January.

Note: Informational analysis, not investment advice.

$ALGN Align Tech Breaking Out of Downtrend$ALGN Align Technology appears to be breaking out of its recent downtrend. Expecting continued follow through in the coming 2-6 weeks. It's worth noting that this stock is a top holding of some major hedge funds. Maybe crooked teeth are considered recession proof and a safe investment?

Near term target - $385

Medium term target - $400

Note: Informational analysis, not investment advice.

Crash is imminent: ALGNALGN has been going up very quickly and very drastically over the past several months. Those who bought this stock a while ago have made a lot, but a crash is on its way. Over the past few weeks, both a head and shoulders pattern and a clear RSI divergence are visible in the stock, yet it continues to surge upwards. Why? Because the RSI is approaching overbought conditions again with each passing day. By the end of the year, a huge crash is imminent. These kinds of patterns and divergences do not just "happen". Share your ideas below.

ALGN- H&S formation short from $259.33 to $173, $250 July Put ALGN seems forming a larger frame H&S formation and now falling down from its right shoulder. on the shorter frame it also seems breaking down an upward channel formation. It has great insider selling as high as 60% (11 million dollars). We think it has huge downside potential.

To paly this we could consider $250 July Puts

* Trade Criteria *

Date First Found- March 23, 2018

Pattern/Why- H&S formation short, Upward channel breakdown

Entry Criteria- $259.33

Exit Criteria- 1st Target $226.13 & 2nd Target $173.33

Stop Loss Criteria- $282.13

Indicator Notes- Twiggs money flow divergence

Special Note- Great insider selling as high as 60% (11 million dollars). Could consider $250 July Puts.

Please check back for Trade updates. (Note: Trade update is little delayed here.)

ALGN - H&S formation short from current level to $171.23ALGN seems forming a H&S formation along with decent insider selling. We think it has good downside potential from current lebel.

To trade this we Could consider the $230 July puts which are currently $13.50.

* Trade Criteria *

Date First Found- February 21, 2018

Pattern/Why- Possible H&S formation

Entry Target Criteria- Current price

Exit Target Criteria- 1st Target $222.13 and 2nd target $171.23

Stop Loss Criteria- $264.30

Indicator Notes- Twiggs money flow heading down

Special Note- Could consider the $230 July puts which are currently $13.50

Please check back for Trade updates. (Note: Trade update is little delayed here.)