ALGOUSDT Forming Bullish WaveALGOUSDT is currently demonstrating a Bullish Wave Pattern, a strong technical signal that often precedes a significant upward price movement. This pattern typically forms in trending markets, suggesting a series of higher highs and higher lows that indicate sustained buying interest. With this wave structure unfolding, the market appears to be favoring a continuation of the current uptrend, making ALGO an appealing candidate for mid-term gains.

The volume profile is showing a steady increase, which supports the pattern’s validity and hints at rising momentum. A strong volume base during the formation of bullish wave patterns is often an early indication of institutional accumulation or renewed retail participation. With key support levels holding firm and resistance levels gradually weakening, the setup points to a potential price surge of 50% to 60% or more if bullish momentum continues.

Algorand’s fundamentals are also contributing to growing investor interest. Known for its scalable blockchain technology and low transaction fees, ALGO has seen increasing adoption in DeFi and enterprise-level blockchain solutions. This growing utility, combined with the current bullish technical setup, enhances the coin’s attractiveness for both swing traders and long-term holders.

In summary, ALGOUSDT’s bullish wave pattern coupled with rising volume and positive sentiment could signal the start of a powerful upward move. Traders should keep an eye on breakout zones and confirmation candles to capitalize on this emerging opportunity.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ALGOUSDT

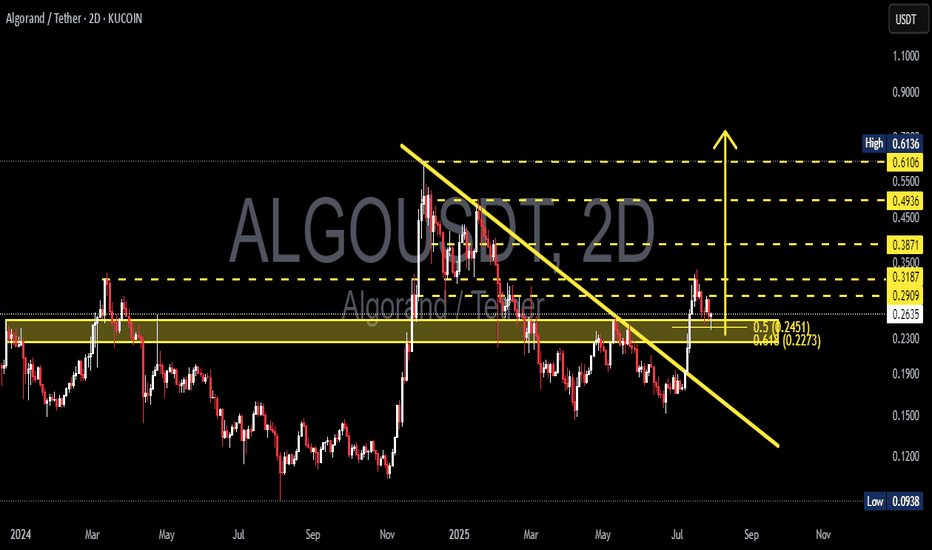

ALGOUSDT Break Downtrend – Reversal in Progress or Just a Retest📊 Technical Analysis Overview:

The Algorand (ALGO) / Tether (USDT) pair has shown a notable technical development by successfully breaking above a medium-term descending trendline that has acted as resistance since early 2025.

---

🔍 Pattern & Structure:

A clean breakout above the descending trendline (yellow sloped line) indicates a potential shift in trend from bearish to bullish.

Price is currently undergoing a retest of the breakout zone, aligning with the Fibonacci retracement levels 0.5 ($0.2451) and 0.618 ($0.2273).

The yellow horizontal zone ($0.25–$0.29) has been a significant support/resistance flip zone, showing strong historical reaction throughout 2024 and early 2025.

A higher high and higher low structure is starting to form — an early signal of a potential bullish reversal.

---

📈 Bullish Scenario:

If the price holds the support zone between $0.2451 and $0.2273, we could see a continuation of the upward move toward the following resistance levels:

$0.2909 (current minor resistance)

$0.3187

$0.3500

$0.3871

Mid-term targets: $0.4936 and $0.6106

A daily or 2D candle close above $0.3187 with strong volume would confirm a bullish continuation.

---

📉 Bearish Scenario:

On the other hand, failure to hold above the $0.2451–$0.2273 support zone could lead to a renewed bearish move with potential targets at:

$0.1900 (weekly historical support)

$0.1500

Extreme support: $0.0938 (2024 cycle low)

A break below $0.2273 would invalidate the breakout and may signal a bull trap.

---

📌 Summary:

ALGO is at a key inflection point. The current pullback could be a healthy correction after a breakout or a failed retest. Watch for price action and volume reaction near $0.2451–$0.2273 to confirm the next move.

#ALGO #Algorand #ALGOUSDT #CryptoAnalysis #TechnicalAnalysis #Breakout #BullishReversal #Fibonacci #SupportResistance #Altcoins #CryptoSetup #PriceAction

ALGO Swing Trade – Waiting for Pullback to Key SupportAfter a 100%+ surge, ALGO is now retracing and approaching a critical support zone. A dip into this area could offer a strong entry for the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.22 – $0.23

• Take Profit Targets:

o 🥇 $0.28 – $0.33

o 🥈 $0.45 – $0.50

• Stop Loss: Just below $0.19

ALGOUSDT Forming Bullish Flag ALGOUSDT is currently trading inside a well-defined bullish Flag pattern on the 4-hour chart, a structure known for its bullish breakout potential. The price recently tested a significant demand zone, which previously acted as a base for a strong upward move earlier in July.

Key Points:

Bullish Flag Structure: Price is compressing within converging trendlines, forming lower highs and lower lows a classic bullish flag pattern.

Support Zone: The $0.24 – $0.255 area has acted as a strong demand zone, providing reliable support.

Bounce Potential: A bullish reaction from the lower flag boundary and demand zone could lead to a move toward the upper trendline and potentially trigger a breakout.

200 EMA Support: The 200 EMA is currently providing dynamic support, reinforcing the bullish setup.

Breakout Confirmation: A breakout above the flag resistance with strong volume could initiate a rally toward the $0.30 – $0.40 zone.

Cheers

Hexa

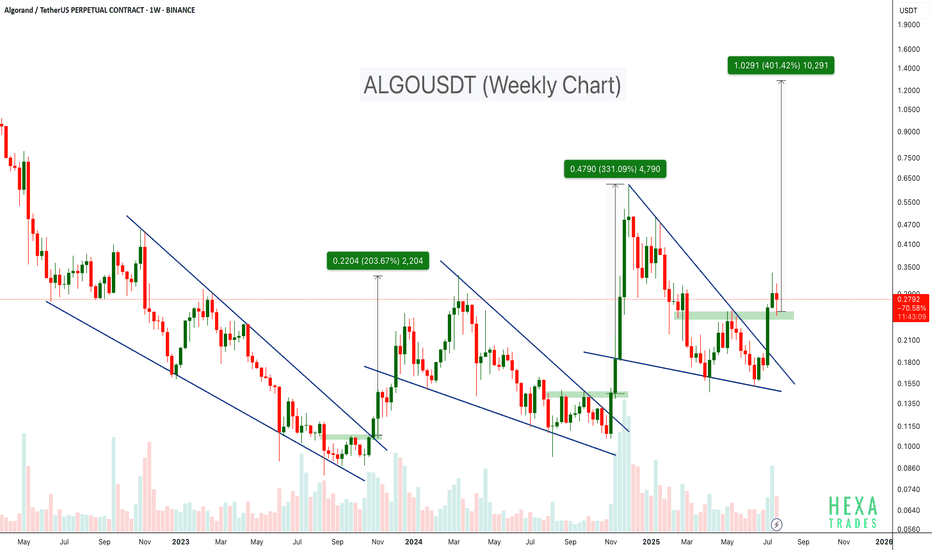

ALGO Breaks Out of Falling Wedge – 400% Target Ahead?BINANCE:ALGOUSDT has consistently followed a bullish pattern on the weekly timeframe. Each major rally has been preceded by a falling wedge breakout, as shown by the three highlighted instances on the chart.

- First breakout: ~200%+ move

- Second breakout: ~300%+ move

- Current breakout projection: Potential target up to +400%

The price has just broken above the wedge and is currently retesting the breakout zone. If history repeats itself, ALGO may be poised for a strong upside move from its current levels.

Cheers

Hexa🧘♀️

COINBASE:ALGOUSD EURONEXT:ALGO

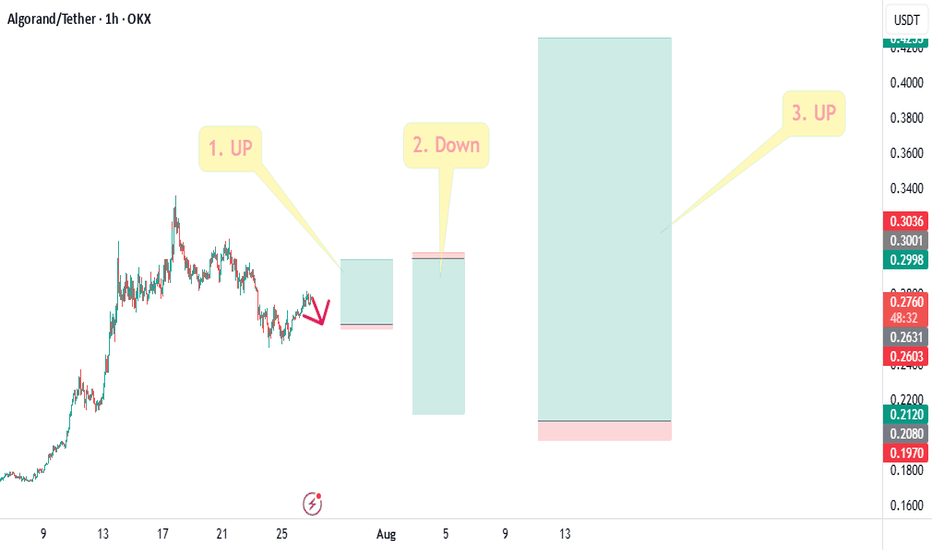

#ALGO Moves of 3 trades in a single chart.#ALGO Moves of 3 trades in a single chart.

In this, the first trade represents a long position on a short-term time frame. Then, a short position can be opened for the retracement. After that, the final third move could be an upside move of more than 100%.

Join Us For All Updates.

@Namaste@

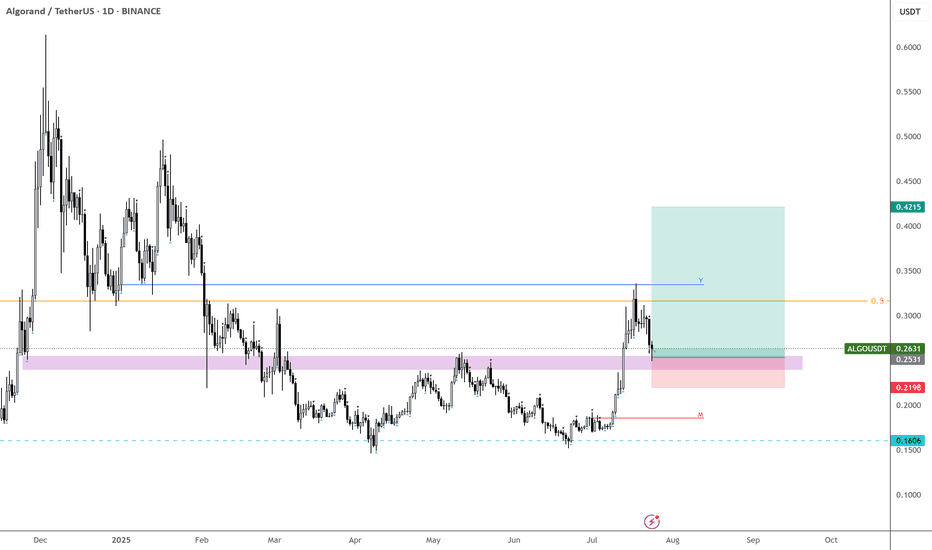

ALGO – Finally Getting the Retrace

Back at EURONEXT:ALGO —missed the lows, but finally seeing the retrace I’ve been waiting for.

Should’ve entered alongside CRYPTOCAP:HBAR , but this is the next best spot.

If this level doesn’t hold, we’re likely heading back below 20c, and many alts could retrace their entire impulse moves.

Starting to bid here—let’s see if it holds. BINANCE:ALGOUSDT

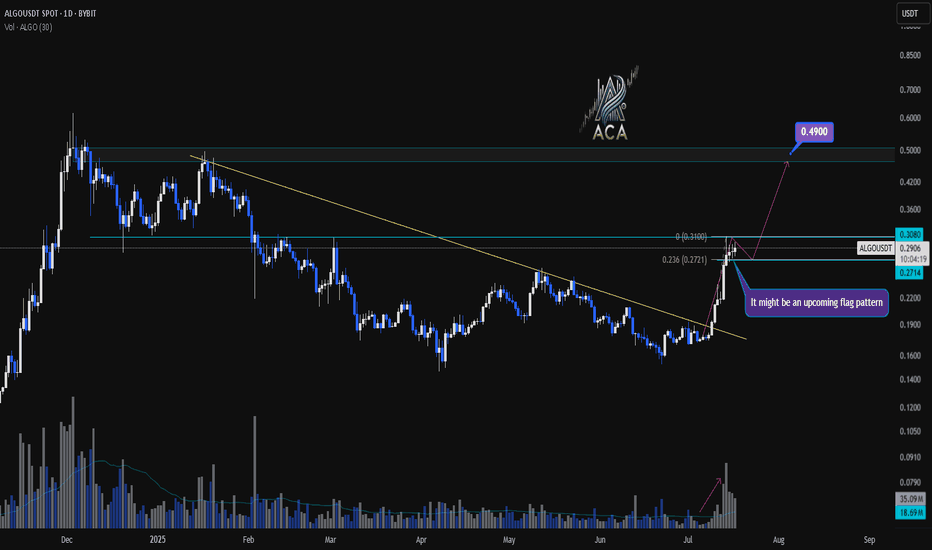

ALGOUSDT Daily Chart Analysis | Continuational patternsALGOUSDT Daily Chart Analysis | Momentum Picks Up on Higher Timeframe

🔍 Let’s break down the latest ALGO/USDT daily chart, highlighting a shift in market structure and key bullish signals.

⏳ Daily Overview

A decisive breakout above the long-standing descending trendline has flipped the narrative for ALGOUSDT. Increased volume during the breakout points to robust bullish momentum, suggesting buyers are regaining control at this multi-month inflection point.

🔔 Flag Pattern & Chart Structure

- Bullish flag pattern is emerging after the recent breakout, as price consolidates in a tight range—a classic continuation formation.

- Former trendline resistance is now acting as support, confirming a notable shift on the higher timeframe.

📐 Fibonacci & Target Levels

- The 0.236 Fibonacci retracement at $0.2771 is providing immediate support, with price consolidating above this anchor level.

- Upside targets:

- First resistance at $0.3080, which aligns with horizontal supply and previous pivot highs.

- If the flag pattern resolves upward, the next Fibonacci extension points to $0.4900, marking a significant confluence and potential for further gains.

📊 Key Highlights

- Strong daily candle and surging volume confirm momentum shift.

- Watch the developing flag pattern for breakout confirmation.

- Major trendline break on the daily signals structural reversal.

- $0.3080 is the immediate target; $0.4900 is the extended objective from the flag/Fibonacci alignment.

🚨 Conclusion

ALGOUSDT is setting up a compelling bullish scenario—keep a close eye on price behavior at the flag and $0.3080 level. A breakout may trigger the next impulsive move toward $0.4900.

ALGOUSDT Approaching Breakout!BINANCE:ALGOUSDT is showing a potential trend reversal after bouncing from a strong historical demand zone around $0.15. Price action is testing the descending trendline for a breakout, which could trigger a bullish continuation move. Similar to the previous breakout in late 2024, this setup hints at a possible repeat rally. A weekly close above the trendline would confirm strength, opening targets at $0.32 and $0.70+.

COINBASE:ALGOUSD

Algorand ALGO price analysis#Algo price is being held back from a deep dive, as far as it is appropriate to say that about altcoins right now.

The price decline on reduced volumes is similar to the previous two times on the OKX:ALGOUSDT chart.

🙂 A risky purchase from $0.15, if they hold the price there, it will be very cool.

📈 And if not, then “buckets” for buying in the $0.10-0.11 range, if you believe in the prospects of the #Algorand project

👊 And keep your fingers crossed, because there is a hypothetical chance that the price of #ALGO will rise to the $1.35-1.41 range by the end of this year, but everyone will have to be very lucky)

____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TradeCityPro | ALGO: Bearish Pressure Builds Near Key Support👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the ALGO coin for you. The Algorand project is one of the Layer 1 and RWA projects.

⚡️ The coin, with the ticker ALGO, currently holds a market cap of $1.63 billion and ranks 53rd on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see in the 4-hour timeframe, after the price reached the 0.2505 resistance level, a bearish phase began, and with the breakdown of the 0.2123 level, the first bearish leg extended down to 0.1912.

✔️ After this drop, the price retraced up to the 0.382 Fibonacci level and now has returned to the 0.1912 zone. Given the strong bearish momentum in the market, the probability of breaking this level is quite high.

✨ If 0.1912 is broken, the extension wave could begin. According to Fibonacci projections, the targets for this position are 0.1780, 0.1732, and 0.1602.

💥 An entry of RSI into the Oversold zone would serve as a very strong momentum confirmation for this position. If that happens, the price may reach the 0.1602 target.

📊 Volume also plays a key role. Currently, the selling volume isn’t very strong, which might result in a fake breakout of 0.1912. I suggest waiting to see whether sell volume increases, because without volume, price movement is unlikely.

📈 For a long position, the first trigger we currently have is the 0.2023 level, which is a significant high and overlaps with the 0.382 Fibonacci retracement level. Breaking this level could resume the long-term bullish trend.

💫 The momentum confirmation for a long position would be the RSI breaking above the 50 level. A breakout here could kick off a bullish trend in the higher timeframes.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ALGOUSDT making its way for journey towards 0.35$Here is the idea about ALGOUSDT.

The price is currently trading at daily support DS1.

The price was rejected from weekly resistance WR1 before coming back to daily support zone DS1.

I believe this daily support is very likely to provide support and make the price bounce from here.

The likely trajectory of the price is depicted in the chart.

The price is likely to aim for weekly resistance WR1 next on this bounce.

At WR1, the price is likely to face some pullback before ripping this resistance and target the next strong resistance which is quarterly resistance 3MR1.

Lets monitor this one as we go and adjust our expectations. But for now this is what I see as the likely path for ALGOUSDT.

Whats your thought?

Algorand 5X Lev. Full PREMIUM Trade-Numbers (PP: 1500%)This is an unusual pair for us to approach with leverage, the last time we opened a LONG on ALGOUSDT was in August 2023. Market conditions are different today.

Back then, prices were trading at the bottom before the recovery, so we were predicting the trend reversal and bullish breakout. Today, the bottom pattern is already in, a rounded bottom coupled with a long-term higher low (April 2025 vs August 2024). So we are only predicting a continuation.

Needless to say, I believe the bulls have the upper-hand. The action right now is happening above the 3-Feb. low, and after more than a month of rising prices there is still no rising volume, which means that there is plenty of room available for growth.

We are doing an easy wave, easy targets. The final wave can go much higher than what is shown on this chart. Since we are not greedy, we are happy with 465% and 1,500%.

The 1,500% is a mild target and high probability.

The rest is up to you.

Thank you for reading.

Full trade-numbers below:

_____

LONG ALGOUSDT

Lev: 5X

Entry levels:

1) $0.2355

2) $0.2200

3) $0.2000

Targets:

1) $0.2564

2) $0.3247

3) $0.3800

4) $0.4352

5) $0.5138

6) $0.6139

7) $0.7243

8) $0.7926

9) $0.9031

Stop-loss:

Close weekly below $0.1900

Potential profits: 1502%

Capital allocation: 3%

_____

Namaste.

How To Spot The Next Big Algorand Crypto Move!In the fast-paced world of crypto trading, many traders gravitate toward intraday and scalping strategies, chasing quick profits while often ignoring the powerful signals presented by higher timeframes. Yet, the smart money — institutional players, whales, and seasoned swing traders — operate differently. They focus on bigger timeframe supply and demand imbalances to enter high-probability trades with calculated risk and substantial reward potential. One such opportunity is currently setting up in Algorand ( BINANCE:ALGOUSDT ).

Why Higher Timeframes Matter in Crypto Trading

Most crypto traders operate on the 1-minute to 15-minute charts. While this can be effective, especially with crypto intraday strategies, it often leads to overtrading and emotional decision-making. In contrast, higher timeframes — such as the daily and weekly charts — provide clearer market structure, show major supply and demand imbalances, and are less noisy.

These timeframes reveal where whales and institutions place large orders, creating impulsive moves that leave behind clues for patient traders. Ignoring these clues is akin to trading blind.

The Weekly Demand Imbalance on BINANCE:ALGOUSDT

BINANCE:ALGOUSDT is currently showcasing a textbook example of a solid and strong weekly demand imbalance around the $0.1380 level. A few months ago, this zone sparked a massive bullish impulse — a series of consecutive large-bodied white candlesticks that broke through resistance with conviction.

Such moves don’t happen randomly. They’re often the result of institutional accumulation — smart money stepping in with size. These large players create imbalances where demand far outweighs supply, causing prices to rally aggressively. The key for retail traders is to identify the origin of these moves and wait patiently for the price to return.

ALGOUSDT Short Scalping Opportunity – 4H Chart AnalysisThe ALGOUSDT pair is presenting a promising short-term setup for scalpers favoring a bearish outlook. After a short-lived bullish push, the price has failed to break above a critical resistance zone and now shows signs of weakness on the 4-hour chart.

The market structure remains fragile, with recent candles rejecting higher levels around $0.2314, indicating that sellers are regaining control. This resistance was previously a support zone, and the price is now struggling to reclaim it, suggesting a potential reversal point ideal for a short scalp setup.

Key Technical Zones

The most recent rejection confirms the $0.2314 level as a strong supply area. This price acted as support in early May but flipped into resistance after the sell-off on May 16. The zone has been tested again and rejected, further validating it as a solid barrier.

Meanwhile, two demand zones sit below the current price, offering logical targets for the upcoming move.

• Entry (Short): $0.2221 – $0.2223

This is the mid-range zone where the current rejection pattern is unfolding, and it aligns well with the last lower high.

• Stop Loss: $0.2314

Placed above the key resistance. If price breaks and holds above this level, the trade idea becomes invalid.

• Take Profit 1: $0.2105

This is the nearest recent support on the 4H timeframe and a reasonable level for short-term profit-taking.

• Take Profit 2: $0.1908

The second support zone sits lower, offering a more extended reward for traders holding longer or managing partial exits.

Price Action and Trend Behavior

The market has been forming a series of lower highs since May 12. The most recent bounce into resistance was weak, failing to establish new momentum. This confirms the idea that the bulls are running out of steam and sets up the conditions for a bearish continuation.

Volume and momentum indicators have also shown divergence from price, hinting at reduced buying pressure. Price is currently hovering just below the resistance, a typical behavior before a breakdown.

Risk and Reward

This setup provides a good risk-to-reward ratio:

• Risking approximately 91 pips from entry to stop loss

• Potential gain of 118 pips to TP1 and 215 pips to TP2

• RR ratio ranges from 1.29 (TP1) to 2.36 (TP2)

These figures make the trade suitable for scalpers looking for quick moves as well as short-term swing traders who can hold for deeper downside targets.

Trade Outlook

This short scalp aligns with the broader bearish sentiment forming in the altcoin space. ALGO is currently in a retracement phase and is reacting to resistance cleanly on the lower timeframes. If the pair remains below $0.2314, we could see increased selling pressure over the next few sessions.

Short-term traders may consider taking partial profits at TP1 and move the stop to breakeven if price reaches $0.2150 to lock in gains. Should the price fail to break below $0.2105, it may consolidate or retest resistance, in which case patience and discipline are key.

TradeCityPro | ALGO: Key Levels in RWA Coin’s Bullish Revival👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the ALGO coin for you. This project is one of the RWA (Real World Assets) crypto initiatives, which saw significant growth during the recent hype around this category.

💫 Currently, the market cap of this project stands at $1.99 billion, placing it at rank 47 on CoinMarketCap among crypto projects.

📅 Daily Timeframe

As you can see in the daily timeframe, ALGO has had a notable bullish leg that started from the 0.1085 level and continued up to 0.5138, marking a significant upward move.

💥 However, after reaching that level, the first corrective phase took place down to the 0.3267 support. After breaking this zone, the price continued falling to the 0.1602 support, which also overlaps with the 0.786 Fibonacci level.

🔍 After finding support there, a new high formed at 0.2147, and thanks to the strong buying volume and bullish candles, this resistance has been broken, and price is now heading upward.

📊 The RSI oscillator is currently very close to the Overbought zone, and if it enters that area, we might see some high-volatility moves, increasing the likelihood of sharp bullish candles.

📈 The next resistance levels above are 0.2553 and 0.3267, which align with the 0.5 and 0.382 Fibonacci levels respectively. If price can break through these levels and return to 0.5138, the chances of breaking that top will be significantly higher this time.

✨ On the other hand, if this breakout turns out to be a fake move and price falls below 0.2147, heavy bearish momentum could enter the market, greatly increasing the risk of breaking the 0.1602 level.

🎲 If the market continues to drop, the next major support to watch is 0.1085, which stands as the most critical support for ALGO.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ALGO/USDT Technical Analysis Deep Dive! Let’s break down this ALGOUSDT chart step-by-step — it’s a perfect example of trading patterns in action!

🏄♂️ Timeline (Aug 2024 - April 2025):

▸ Accumulation (Aug - Nov 2024): ALGO consolidates between $0.1050 and $0.1450, showing low volatility. This is a classic accumulation phase where buyers are quietly building positions.

▸ Breakout & Uptrend (Nov - Dec 2024): Boom! The price breaks above $0.1300 with strong momentum, climbing to $0.6100.

▸ Pause in a Symmetrical Triangle (Dec 2024 - Jan 2025): After the surge, ALGO takes a breather, forming a Descending Triangle (a neutral pattern). This signals market indecision — traders are waiting for the next big move.

▸ Breakout & Downtrend (Jan - Mar 2025): The price breaks below the triangle, dropping to $0.1480. This aligns with a "Descending Wedge" (reversal) from the cheat sheet , confirming the downtrend and reversal structure of the Wedge.

▸ Consolidation (Mar - Apr 2025): ALGO stabilizes between $0.1400 and $0.1600, setting the stage for the next move.

▸ Breakout & Uptrend (Apr - April 2025): Another breakout! The price surges above $0.1600, reaching $0.2200 again. It might reach higher levels like $0.2400 and $0.3000 in next weeks.

This chart shows how patterns like Descending Triangles, and Wedges can guide your trades. Spotting these using my Trading Patterns Cheat Sheet can help you time your entries and exits like a pro!

✉️ What’s your next move on ALGO? Are you buying the dip, waiting for confirmation, or taking profits? Drop your thoughts below — I’d love to hear your strategy!

Algorand NLP & Higher High & 619% Profits PotentialThis is a very nice chart. Algorand is solid strong on the weekly timeframe (long-term).

There are two main signals; Long-term growth in the form of a rising channel, higher highs and higher lows. Short-term bullish based on a recovery.

Notice the "magic blue line" I drew on the chart. This is a bottom signal. You can draw an inverted head and shoulder here or a v shaped bottom. This week strong move seals the deal. A massive higher low compared to early August 2024.

Ok. How are you doing today my friend in the law?

I hope you are having a wonderful day.

You see...

Hear me out; listen!

Can you feel me?

Do you understand?

Do you grasp what I am trying to share with you?

Can you see what I am doing?

These are all different representational systems, people use difference senses to understand reality. Some are primarily visual, others auditory, kinesthetic, digital, etc.

So, you are likely the feeling type, then, can you grasp what I am trying to say? Are we on the same wavelength? Does it resonate with you?

Yes? Then Algorand is bullish and going up. Why?

Because the chart says so. Because that is exactly what is doing and that is exactly what it will continue to do long-term.

The main low happened in August 2023 and we have the higher lows without question, a higher high comes next.

For your convenience, I mapped this chart with the main target for this bullish wave. It can go higher.

Namaste.

Short ALGO/USDT🔥 #ALGO/USDT

🔴 SHORT

🎲 Entry Zone 1: 0.1870

🎲 Entry Zone 2: 0.1890

✅ Take Profit 1: 0.1838

✅ Take Profit 2: 0.1775

✅ Take Profit 3: 0.1667

✅ Take Profit 4: 0.1551

(Extended if Momentum Persists)

❌ Stop Loss: Above 0.1985

💱 Recommended Margin: 2.5% – 5%

🧳 Recommended Leverage: 5X – 15X

🧠 Narrative: ALGO is testing a supply zone at 0.1870 – 0.1890. A rejection here could trigger a move toward the lower support levels identified as TPs.

📈 Market Context: Monitor overall crypto sentiment and BTC action; a broad rally may invalidate this short bias, while continued weakness could accelerate downside targets.

⚠️ Risk Management: Place stops above 0.1985, size positions carefully, and be ready to adapt if price shows unexpected strength.

⚠️ Take Care of Risk Management for Your Account