ALLY

ALLY Ally Financial Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week,

I would consider purchasing the 36usd strike price Calls with

an expiration date of 2024-10-25,

for a premium of approximately $1.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Ally Financial's Credit Woes Deepen: Rising DelinquenciesAlly Financial (NYSE: ALLY) faced a steep decline as its Chief Financial Officer, Russ Hutchinson, highlighted worsening conditions within its auto loan portfolio. Rising delinquencies, heightened net charge-offs, and the ongoing struggles of its typical borrower amid a challenging economic environment have weighed heavily on investor sentiment, leading to a significant drop in the company’s stock.

Auto Loan Portfolio Challenges

Ally Financial's core business, particularly its auto loan segment, is under pressure as consumers grapple with inflation, high living costs, and a softening job market. Hutchinson pointed out that delinquencies in July and August were about 20 basis points higher than expected, while net charge-offs — loans deemed uncollectible — were 10 basis points above projections. These metrics reflect a broader trend of deteriorating consumer credit quality, signaling that many borrowers are struggling to keep up with their payments.

Hutchinson further noted that the issue isn't just a short-term hiccup; Ally anticipates net charge-offs to continue rising in the months ahead. The company’s analysis indicates a growing pool of borrowers with payments more than two months past due, underscoring the persistent nature of the credit issues.

Broader Economic Pressures

The struggles of Ally’s borrowers mirror larger economic pressures. The typical Ally borrower is increasingly burdened by inflation, elevated costs of living, and recent signs of a weakening employment landscape. This scenario has prompted Ally to adjust its expectations, raising concerns that these challenges could persist longer than initially anticipated.

Strategic Response: Reducing Exposure

In response to its mounting credit challenges, Ally has taken steps to reduce exposure. Earlier this year, the company sold its Ally Lending arm to Synchrony Financial (SYF), including loan receivables worth $2.2 billion. While this move was designed to bolster its balance sheet, the persistent issues within its core auto loan portfolio suggest that Ally’s financial health remains a concern.

Net Interest Margin Under Pressure

Adding to the pressure, Ally expects its net interest margin — a key indicator of profitability for lenders — to contract in the third quarter. With interest rates expected to remain elevated, the squeeze on net interest income presents another headwind for the bank. This shift marks a notable deviation from the expansionary trends observed in previous quarters, reflecting the increasingly tough lending environment.

Technical Analysis

Ally's stock plunged 17.67% on Tuesday, hitting its lowest level since January, reflecting investor anxiety over the company's credit outlook. However, the stock saw a slight recovery in premarket trading on Wednesday, up 0.12%, hinting at a potential short-term bounce. Despite this, the technical indicators suggest that the overall outlook remains bearish.

RSI and Oversold Conditions

The Relative Strength Index (RSI) currently stands at 35, indicating that Ally is in oversold territory. An RSI below 30 often signals that a stock is undervalued, and a reversal could be on the horizon. While Ally’s RSI isn’t quite there yet, it does point to increased selling pressure, which has pushed the stock to near critical support levels.

Bullish Flag Pattern Falters

On the chart, Ally recently formed a bullish flag pattern — typically a continuation signal for an upward trend. However, the pattern failed to materialize fully, with the stock unable to break above key resistance levels, indicating a lack of buying momentum. The failed breakout suggests that investors remain cautious, waiting for more concrete signs of improvement in the company’s fundamentals.

Key Support and Resistance Levels

Ally's stock is approaching critical support near the $25 mark, a level that has historically provided a floor for the price. A breach below this point could trigger further downside, with the next major support at around $22. Conversely, resistance lies at the $30 level, and a sustained move above this point would be needed to shift the technical outlook back to neutral.

Conclusion

Ally Financial ( NYSE:ALLY ) faces a challenging road ahead as it grapples with rising delinquencies, tightening credit conditions, and macroeconomic pressures weighing on its borrowers. While technical indicators show that the stock is oversold, signaling potential for a short-term bounce, the broader fundamentals suggest a cautious approach. Investors will be closely monitoring how the company navigates its credit challenges in the coming quarters, particularly as the Federal Reserve’s rate policy continues to evolve.

For now, Ally ( NYSE:ALLY ) remains under pressure, and while strategic steps like selling its lending arm provide some relief, the path to recovery will depend on broader economic improvements and a stabilization in consumer credit quality.

Synchrony's Strategic Move to Acquire Ally's Point-of-Sale

In a significant development in the financial sector, Synchrony (NYSE: NYSE:SYF ) and Ally Financial Inc. (NYSE: NYSE:ALLY ) have recently inked a definitive agreement for Synchrony to acquire NYSE:ALLY 's point-of-sale financing business, encompassing $2.2 billion in loan receivables. The move is poised to reshape the landscape of home improvement and healthcare financing, creating a powerhouse in the industry. This article delves into the intricacies of the deal, exploring its strategic implications, potential benefits, and the market's response.

Strategic Fit and Industry Differentiation:

The acquisition marks a strategic fit for Synchrony, propelling it into a position of strength by offering both revolving credit and installment loans at the point-of-sale in the home improvement vertical. This innovative approach sets Synchrony apart, providing a comprehensive suite of financing solutions for nearly 2,500 NYSE:ALLY Lending merchant locations. The deal also extends Synchrony's reach into high-growth specialty areas, including roofing, HVAC, and windows, further solidifying its position as a key player in these markets.

Economic Efficiency and Diversification:

Synchrony President and CEO Brian Doubles emphasizes the acquisition's potential to unlock value and operational efficiency by integrating products and teams. The expansion into Ally Lending's merchant base is expected to achieve attractive economies of scale, diversifying Synchrony's merchant portfolio. This move positions Synchrony to capitalize on growth opportunities in the home improvement and healthcare sectors, broadening its scope and bolstering its position as a financial services leader.

Financial Impact and Investor Sentiment:

Both Synchrony and Ally Financial executives express confidence in the financial impact of the deal. NYSE:ALLY anticipates an increase in its Common Equity Tier 1 (CET1) ratio by approximately 15 basis points upon closing, while Synchrony expects the acquisition to be accretive to full-year 2024 earnings per share. The positive outlook is reflected in the market, with NYSE:ALLY stock trading near the top of its 52-week range and above its 200-day simple moving average. Investors' enthusiasm and the stock's upward momentum signal confidence in the potential for value creation and enhanced returns.

Smooth Transition and Future Prospects:

Synchrony and NYSE:ALLY commit to working collaboratively to ensure a seamless transition for merchants, customers, and employees. The transaction is set to close in the first quarter of 2024, subject to customary closing conditions. As the financial landscape evolves, Synchrony's acquisition of Ally's point-of-sale financing business positions the company for sustained growth, establishing a strong foundation for success in the dynamic and competitive market.

Conclusion:

Synchrony's strategic move to acquire Ally's point-of-sale financing business represents a bold step towards industry leadership and innovation. The comprehensive suite of financing solutions, coupled with the anticipated economic efficiency and diversification, underscores the potential for long-term value creation. As the financial sector witnesses transformative changes, Synchrony's strategic foresight positions the company as a frontrunner in shaping the future of home improvement and healthcare financing. Investors, industry stakeholders, and market observers eagerly await further details during Synchrony's fourth-quarter 2023 earnings conference call on January 23, 2024, where additional insights into the acquisition's nuances are expected to be unveiled.

ALLY Ally Financial Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week,

I would consider purchasing the 31usd strike price Puts with

an expiration date of 2024-2-16,

for a premium of approximately $0.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

💳💹 Ally Financial (ALLY): Financial Outlook 📈📊 Fed's Influence:

Ally Financial (ALLY) positioned to benefit from the Federal Reserve's indication of multiple interest rate cuts in the latter half of 2024. This shift is expected to drive higher loan demand and boost net interest income.

💵 Interest Rate Dynamics:

Lower rates to depositors anticipated, stimulating increased borrowing.

🔍 Strategic Moves:

ALLY's focus on share buybacks in the last five years, reducing outstanding shares significantly.

Positive impact on earnings per share.

📈 Market Projections:

Bullish outlook suggests support levels above $30.00-$31.00.

Anticipated upside target in the range of $48.00-$50.00.

Exciting prospects for ALLY in the evolving financial landscape! 💻🌐

#AllyFinancial #FinancialOutlook #StockMarket 📰📊

ALLY Financial Options Ahead of EarningsLooking at the ALLY Financial options chain ahead of earnings , I would buy the $27 strike price at the money Puts with

2023-1-20 expiration date for about

$1.00 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

$ALLY WEDGE!Another wedge has presented itself and it looks almost ready for some more upside. Currently between the ATH VWAP and the 8MA after the large bearish reversal on the 28th, with price action right below the POC. Demand above should present itself above both key VWAPs that have begun to move closer together. With relatively low IV, a strong move will present itself soon if price trades above key levels on the chart.

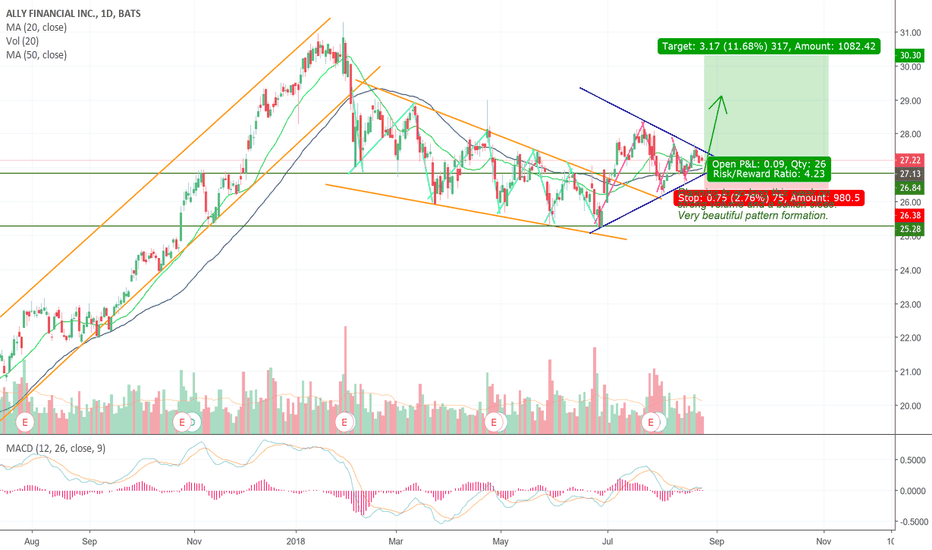

Long on ALLY.. possible breakoutALLY has recently been upgraded by Zacks.com to a rank 1 (strong buy). It has beaten earnings for the past 4 quarters. It is currently setting up for a possible break out. I will be looking to go long this week on the close above the upper trendline of the symmetrical triangle.