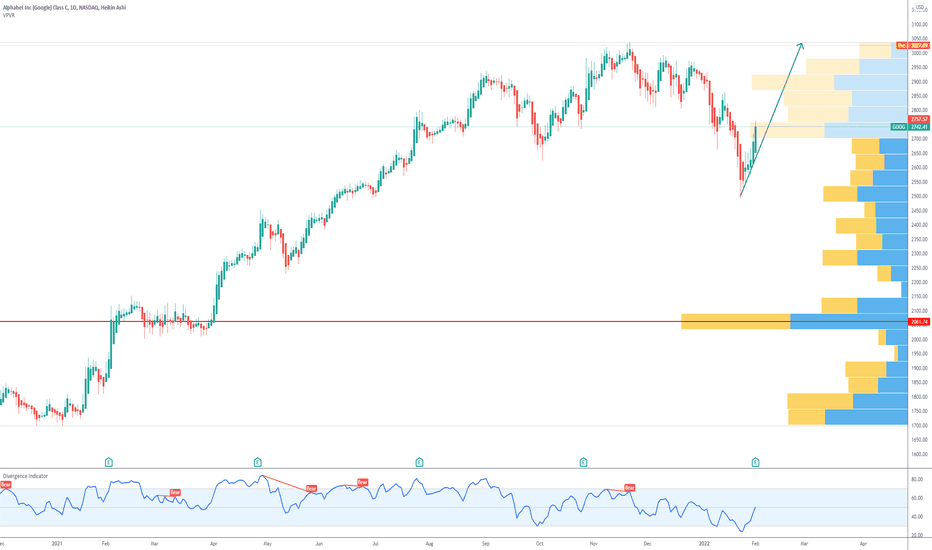

Google Ready to Bounce?Alphabet

Short Term - We look to Buy at 2524.87 (stop at 2472.74)

We look to buy dips. Previous support located at 2500.00. The medium term bias remains bullish. Although this gives the medium term bias a mild bearish edge, we expect intraday trading to continue to be mixed and volatile. Trading close to the psychological 2500.00 level.

Our profit targets will be 2677.46 and 2826.06

Resistance: 2700.00 / 2850.00 / 3000.00

Support: 2500.00 / 2400.00 / 2220.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Alphabet

alpha retest inalpha looking good here after retesting breaking the down trend

could see a big move soon

Third Series of STOCKS Buying Areas!Hi followers and other TradingView users,

To discover new and exciting stocks for you, for me, for everyone then please name five stocks that interest you and describe them - why!?

So, I would like to know FIVE of your favorite stocks, criteria to get your mentioned stocks into the list:

1) Name FIVE of your favorite stocks - full name and ticker. For example, Apple ( AAPL ), Tesla ( TSLA )...or just ticker, the ticker is a must-have!

2) Hit the "like" button of this post.

3) Hit the "follow" the get the update as fast as possible.

TOP10* most mentioned stocks get analyzed. My technical analysis will point out some possible breakout opportunities to buy the strength and corrections to watch - pointing out some lower levels where your alerts should be set!

* if it is not possible to identify logical buying areas from the graph, then I choose the ones (from the list) that have them.

Stay healthy,

Vaido

GOOG Potential for Bullish Bounce | 1st April 2022Price is near buy entry level of 2763.02 in line with 38.2% fibonacci retracement and 78.6% fibonacci projection. It can potentially bounce to the take profit level of 2877.41 in line with 161.8% fibonacci extension. Our bullish bias is supported by price trading above ichimoku cloud indicator.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Alphabet Trend Briefing - 24th March. 2022When looking at a combination of indicators on the 15-minutes chart that best represents Alphabet's recent volatility, Mutiple kind of resistance line was found. When examining the minimum threshold for MACD and RSI, it shows strong support at the $2518 level. Using the red line as a stepping stone, stock prices are currently active around the yellow line at the $2674. Additionally, It is speculated that the first downside is not the real downside on the indicator.

Apple struggling to maintain the uptrendLike many tech stocks, NASDAQ:AAPL is flirting with the idea of breaking down. The stock hasn't made a move up in a while, although it traded above the 40EMA for a while compared to its peers like NASDAQ:AMZN & NASDAQ:FB . Last Friday is closed at the 40EMA level, this is a key support level that must hold if the stock want to continue to be in an uptrend. The small consolidation, or better, distribution, above this level paints a grim picture.

Few of our long trades failed in the past few weeks, we chose to stay on the side until a clear direction is taken, for long position that would be a close above $183. Given tech weakness, and now Shenzhen challenges, we wouldn't be surprised if the 40EMA fails and the stock trade lower. That would be bad news for TVC:NDQ as NASDAQ:AAPL , NASDAQ:MSFT & NASDAQ:GOOG were among the few tech stocks that still traded above the 40EMA level. Interesting week ahead, keeping an eye on these names.

Alphabet Inc. (GOOG) bullish scenario:The technical figure Triangle can be found in the US company Alphabet Inc. (GOOG) at daily chart. Alphabet Inc. is an American multinational technology conglomerate holding company. It was created through a restructuring of Google on October 2, 2015, and became the parent company of Google and several former Google subsidiaries. It is one of the Big Five American information technology companies, alongside Amazon, Apple, Meta and Microsoft. The Triangle has broken through the resistance line on 10/03/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 8 days towards 2 815.67 USD. Your stop loss order according to experts should be placed at 2 517.22 USD if you decide to enter this position.

Google is in talks to buy cybersecurity consultancy Mandiant, which two years ago discovered the infamous SolarWinds hack, according to a person with knowledge of the discussion. A deal could bolster Google’s cloud computing business, which generates more than $19 billion annually but has been losing billions of dollars a year, and help it compete with bigger rival Microsoft, which also is reportedly interested in buying Mandiant.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

GOOGLE Excellent long-term buy opportunity for a $5000 target. GOOG has been trading around its 1W MA50 (blue trend-line) for the past weeks. The Ukraine - Russia war has managed to keep the stock on those low levels, longer than it should but this is a position Google is familiar with.

Ever since the beginning of its trading, the stock has been experiencing phases of growth and then pull-backs to the 1W MA50. Only during the peak of the U.S. - China trade war and the COVID crash, did the price manage to break considerably lower (still the 1W MA200/ orange trend-line supported).

As you see on the chart, every time the 1W RSI prints a Lower Highs sequence, GOOG posts the same Channel Down pattern to the 1W MA50. In all past cases, the price recovered and expanded rapidly to make new Highs on the next Fibonacci extension. The most recent All Time High (ATH) was just below the 4.0 Fib ext. Technically next to fill is the 5.0 Fib which is around the $5000 mark. That is our target for the next expansion cycle that should peak within 2023.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

Alphabet / Google (GOOGL) - DCF Model - Intrinsic ValueThis valuation analysis is based on a base case scenario DCF model.

Google DCF Model Assumptions:

Tax Rate = 16.2%

Discount Rate = 8.4%

Perpetual Growth Rate = 2.0%

EV/EBITDA Multiple = 12.5x

Transaction Date = 05/02/2022

Fiscal Year End = 31/12/2022

Current Price = 2,865.86

Shares Outstanding = 662

Debt = 26,206

Cash = 20,945

Capex = 24,640

Base Case Scenario:

In addition to the above assumptions, the below DCF model is based on our base case scenario, which assumes a revenue growth over the next five years of 18%, 16%, 14%, 13%, 12%. These revenue growth assumptions are slightly below the analysts' forecasts at the time of analysis.

DCF (5Y) EBITDA EXIT MODEL:

Terminal Value

Final Forecast EBITDA (m) = $196,262

EV/EBITDA Multiple = 12.5x

TERMINAL VALUE (m) = $2,453,270

Intrinsic Value:

Enterprise Value (m) = $1,986,779

Plus: Cash (m) = $20,945

Less: Debt (m) = $26,206

Equity Value (m) = $1,981,518

EQUITY VALUE / SHARE = $2,992.69

DCF (5Y) GROWTH EXIT MODEL:

Terminal Value

Final Forecast FCFf (m) = $119,494

Perpetual Growth Rate = 2.0%

TERMINAL VALUE (m) = $1,902,831

Intrinsic Value

Enterprise Value (m) = $1,616,256

Plus: Cash (m) = $20,945

Less: Debt (m) = $26,206

Equity Value (m) = 1,610,995

EQUITY VALUE / SHARE = $2,433.09

DISCLAIMER:

All information and analysis are based on the author's views, opinions, and assumptions at the time of writing. Bull Headed Bear makes no guarantees of the information's reliability and accuracy. The information is to be used for entertainment and informative purposes only. Bull Headed Bear and its authors reserve the right to change their views, opinions and assumptions due to many influencing factors.

Any actions taken based on this information is strictly at your own risk. All investments carry a risk of loss, and you could lose all your money. Consider seeking professional advice from a financial advisor. Bull Headed Bear and its authors will not be liable for any losses or damages from the information here or its website.

DISCLOSURE:

I/we have open long positions in GOOGL. We do not intend on altering this position in the coming weeks.

NASDAQ:GOOGL

Predicting further drops on Google. GOOGGoals 2504, 2359, 2279. Invalidation at 2955 .

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

Alphabet | Fundamental Analysis |LONG| MUST READ !There is no denying that Alphabet has become a force to be considered with. Indeed, not many companies can boast that their branded product or service has become a verb: "google it." Beyond search, Alphabet is a leader in digital advertising, smartphone operating systems led by Android, and cloud computing with the rapidly growing Google Cloud.

Recently, the tech giant informed about a historic 20-for-1 stock split, reducing the size of its stake for the first time in eight years. Now investors who have been considering buying the stock are encountered with a bothersome question: should they buy the stock now or wait until after the split?

It's been a long time since Alphabet held its last stock split. In fact, the last time it happened was when the company was still called Google. That was in 2014, and Google didn't change its name to Alphabet until late 2015.

What's notable about the previous stock split is that it created non-voting Class C shares of Google, while Class A shares maintained the standard one vote per share. In April 2012, a shareholder lawsuit was filed alleging that co-founders Larry Page and Sergey Brin orchestrated the stock split to maintain control of the company to the detriment of shareholders. As a result of the split, the company increased the number of shares without a commensurate increase in voting rights. The lawsuit was eventually settled, allowing the split to proceed with shareholder compensation.

In the nearly two years between the announcement and the actual stock split, Google stock was up about 74%.

Typically, a split does not change the overall economic value of the company that is doing the split. One share of Alphabet worth $2,800 is worth as much as 20 shares worth $140 (20 x $140 = $2,800). As with pizza, the number of slices does not change the overall size of the pie. Nevertheless, some argue that the underlying effect is positive for investor psychology.

That's exactly what happened when several well-known companies made headlines over the past couple of years as investors rushed to buy shares after the stock split announcement. Apple stock rose 34% in a month after announcing a 4-for-1 stock split in July 2020. Tesla followed suit less than two weeks later, announcing a 5-for-1 stock split. Between the announcement and the completion of the split, the stock jumped 81%.

A similar situation occurred in May 2021, when The Trade Desk announced a 10-for-1 stock split and Nvidia unveiled plans for a 4-for-1 stock split. The Trade Desk and Nvidia stock rose 27% and 24%, respectively, between the day of the announcement and the day the split was completed.

Aptus Capital Advisor senior analyst and portfolio manager David Wagner opined on the situation, "We all know the split doesn't boost the fundamental value of the company. ... but from what we've seen in the market with Tesla and Nvidia, people like to chase splits."

There are many reasons to think that Alphabet will continue on the same upward trajectory that led to that famous stock split.

Google's dominance in search remains unchallenged, with about 92 percent of the global search engine market. Alphabet is using this advantage to gain a leadership position in digital advertising, which accounts for about 29% of global digital ad spending. Nor should we forget Google Cloud, which has quietly risen to the top three, behind only Amazon Web Services and Microsoft Azure.

These factors drove Alphabet's strong performance. In the fourth quarter, revenues of $75.3 billion rose 32% year over year, and operating margins improved, boosting earnings per share (EPS) to $30.69, a 38% increase.

For investors who are optimistic about Alphabet, there's no reason to hesitate to buy the stock, unless, of course, your financial situation allows you to shell out almost $3,000 per share. If that's the case, and your broker doesn't offer the option to buy fractional shares, a stock split will make them much more affordable over time.

If you plan to buy Alphabet stock now, keep in mind that it may require additional record keeping. Those who are buying the stock now (at about $2,800) need to remember to adjust their records to reflect the revised cost base by dividing it by 20 to account for newly issued shares ($2,800 / 20 shares = $140). This will become important when you eventually sell your stock and settle with the tax authorities. Fortunately, brokerage firms know how to do this, so it shouldn't be too difficult.

Given Alphabet's market dominance, great execution, and continued outlook, it doesn't matter if you buy the stock now or wait until after the July 18 split-adjusted trading. What matters is that you buy them.

Wait before entering Alphabet GoogleThere will be absolute volatility as Fed's Hawkish stand. Best place to invest will be India more than US.

Regarding Alphabet. If I was you I would wait for it to cool down till 2646-2655 levels Or You can buy after it gives a break out above 3037 levels. Right now it will stay range bound and keep fluctuating with action of FED.

If important support level of 2646 is broken Alphabet can go to 2483 or below. So we should wait for it to form a bottom. Let it bounce from there then make your moves.

Other thing you can do is let it give a Break out above 3037. If it gives a closing above 3037 Alphabet (Google) can go to 3366 levels. That's the target for medium term.

Closing below 2190 should be the Stop loss.

GOOG - Daily Impulse Failure AheadAlphabet stock @ $3,000 provides entry after the 20:1 Spilt @ $150 - Round Numbers

appear to be favored.

The Daily Impulse will fail, although to can move higher this week, the Gaps will be filled.

If we were to own a FANG it would be GOOG and GOOG Only.

_______________________________________________________________________________

Now is not that entry.

GOOG Alphabet Inc. 20-to-1 Stock SplitRuth Porat, Alphabet CFO: “The reason for the split is it makes our shares more accessible”

Alphabet Inc . 20-to-1 Stock Split on July 15 could lead to Alphabet’s listing on the Dow Jones Industrial Average , the indexs that holds 30 blue-chip companies.

And you all know how appealing were Apple , Tesla and Nvidia for retail investors after the stock splits!

My short term price target is the all time high, $3037.

Looking forward to read your opinion about it!

Breakout Play on GOOGL The share price of GOOGL rose in after-hours trading yesterday after Google's parent company Alphabet posted robust earnings for the fourth quarter. This entails the opportunity for catching the newly emerging uptrend.

The upswing commenced following the completion of the last 1-5 Elliott impulse wave pattern at the lower limit of the descending channel.

The price action is to test the 100-day MA (in blue) after today's open. If it manages to break it, the next target would be the 61.8 per cent Fibonacci retracement level at 2817.87, which is currently converging with the 200-day MA (in orange) and the upper limit of the channel; both factors making this last Fibonacci threshold a more significant barrier.

Conversely, a failed breakout could potentially lead to a dropdown to the 38.2 per cent Fibonacci at 2693.62, which is about to converge with the 50-day MA (in green). Traders could potentially use such a dropdown to buy the dip of the correction.

Alphabet (NASDAQ: $GOOG) Drops Stock Split + Strong Earnings!🤓Alphabet Inc. provides online advertising services in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. The company offers performance and brand advertising services. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube, as well as technical infrastructure and digital content. The Google Cloud segment offers infrastructure and data analytics platforms, collaboration tools, and other services for enterprise customers. The Other Bets segment sells internet and TV services, as well as licensing and research and development services. The company was founded in 1998 and is headquartered in Mountain View, California.

Alphabet | Fundamental Analysis | SHORT Alphabet, Google's parent company, has returned about 800% to its investors over the past 10 years, more than double the return of the NASDAQ, which was nearly 400%.

Alphabet also remained resilient during the COVID lockdown, as an increase in its cloud business compensated for a transient deceleration in ad sales. The company also avoided a post-localization slowdown as its advertising and cloud businesses increased in tandem. As a result, Alphabet's stock is up 65% in 2021, well ahead of the NASDAQ, S&P 500, and even the growth-oriented ARK Innovation ETF Cathie Wood.

Can Alphabet continue to achieve such heights, outperforming the market? To find out, let's evaluate the long-term potential of its core as well as nascent related businesses.

In the first nine months of last year, Alphabet made 81% of its revenue from Google ads (including YouTube). Google's sprawling ecosystem, which creates targeted ads based on a user's personal data and browsing habits, allows it to share a near duopoly in the digital advertising market with Meta's Facebook and Instagram.

But Google's market share could gradually shrink over the next few years as Amazon and other smaller ad platforms shrink the market. For instance, eMarketer predicts Google's share of the U.S. digital advertising market to decline from 28.6 percent in 2021 to 26.4 percent next year.

Nevertheless, the global digital advertising market could still grow at a compound annual growth rate (CAGR) of 15.3% from 2020 to 2025. The research firm also expects the market to continue growing at a CAGR of 13.7% from 2025 to 2030.

Thus, the growth of the broader digital advertising market, led by high-growth emerging markets, could easily offset any loss of market share to Google by other advertising platforms. Google's advertising business could easily match the rate of market growth if it takes care of its near-term headwinds, including antitrust investigations, Apple's privacy changes in iOS, and a plan to block all third-party cookies in Chrome by the end of 2023.

These adaptations could push Google to decrease its dependence on targeted ads and rely more on first-party data and contextual advertising. This transition may be bumpy, but Google is likely to remain the leading advertising platform for businesses as long as it dominates the online search and video markets.

The other major growth driver for Alphabet is Google Cloud, which brought in 7% of the company's revenue in the first nine months of 2021.

As per Canalys, Google Cloud controlled only 8% of the global cloud infrastructure market in Q3 of last year, putting it a distant third behind Amazon Web Services (AWS) (32%) and Microsoft Azure (21%).

Google Cloud is still growing rapidly. Its revenue grew 46% to $13.1 billion in 2020 and another 48% year over year to $13.7 billion in the first nine months of 2021. Its share of 8% in the third quarter also improved from 7% a year ago and 6% in the third quarter of 2019.

According to Report Ocean, the global cloud computing market will grow at a compound annual growth rate of 17.3% from 2021 to 2027. Google Cloud is likely to equal or even surpass that growth rate if it just doesn't fall behind Amazon and Microsoft in the cloud infrastructure race.

Investors are not currently paying much attention to Alphabet's other divisions, which include hardware products (Pixel, Home, Nest, and Fitbit), subscription services, life sciences divisions, and the Waymo drone division.

But over the next decade, these small businesses could start generating a much larger percentage of Alphabet's revenue. Its hardware devices could benefit from the continued expansion of the smart home and Internet of Things (IoT) markets, its Calico and Verily science divisions could launch innovative medical procedures and devices. Waymo could launch more robo taxis or license its unmanned driving technology to major automakers.

The estimates for these next-generation markets are staggering. According to experts, the global IoT market will grow by 25.4 percent from 2021 to 2028. The same company expects the driverless car market to grow 31.3% from 2021 to 2028.

If Alphabet's CAGR grows by 15% over the next ten years, annual growth will amount to an increase from $254 billion in 2021 to more than $1 trillion in 2031. This growth could be interrupted by antitrust threats, a platform change, or an economic downturn, but Alphabet still has a path to many times more profits over the next decade-even for those investors who missed its last 10-year growth.

Alphabet: Lower Prices Incoming? Google - Short Term - We look to Sell at 2782.42 (stop at 2865.00)

We look to sell rallies. Previous support level of 2800.00 broken. Trading volume is increasing. The bias is still for lower levels and we look for any gains to be limited. Closed below the 20-day EMA. We look to set shorts in the early trade.

Our profit targets will be 2624.41 and 2500.00

Resistance: 2800.00 / 2900.00 / 3000.00

Support: 2700.00 / 2600.00 / 2500.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Alphabet Inc completing a flat. GOOGLThis is one due for a bit more of a drop. It almost reached a pivot and we are pretty confident this one is going to cross the line. The rest of the picture is looking far too typical for a running floor.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

Google: Lower Prices Incoming? Alphabet - Short Term - We look to Sell at 2807.00 (stop at 2861.00)

We look to sell rallies. Previous support level of 2800.00 broken. Trading volume is increasing. The bias is still for lower levels and we look for any gains to be limited. Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 2800.00, resulting in improved risk/reward.

Our profit targets will be 2630.00 and 2460.00

Resistance: 2800.00 / 2900.00 / 3000.00

Support: 2700.00 / 2600.00 / 2500.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.