/3.5 The Winner's Psychology & The Hunt for Trade

Introduction: The Dangerous Time of Euphoria

I want to start by thanking you for the phenomenal support for the "Altseason: Live" experiment. We closed Round 1 with a +92% profit on the initial capital from just two trades.

But I need to be brutally honest with you: the most dangerous time is just beginning. Let's be clear: for these two months, I won't be chasing a conservative 3% per month. I will be trading quite aggressively.

That's why, in the coming weeks, you will see various coins "pump" without any logic. Your inner FOMO will be screaming at you: the feeling that you're late, you're in the wrong coin, you've missed out. In this frenzy, many will jump on a moving train. And my forecast remains: sometime around July 17th to 21st, the market will brutally shake out these passengers.

My Philosophy: The Battle with the Main Enemy—My Own Euphoria

After a huge win like +92% on the portfolio, it's very easy to get caught up in the "winner's high." A dangerous confidence appears, the feeling that you've figured out the market and that it will always be like this. This is a trap.

That is why I did something that might seem illogical: I cut my position size for the next trades by a factor of four.

Why? To tame that euphoria. To prove to myself that discipline is more important than elation. To remember that my win rate is not 100%, and a single losing trade on a wave of overconfidence can wipe out all the previous hard work. The most important thing is my inner calm.

Of course, when I talk about "calmness" in the context of futures, leverage, and altcoins, it sounds ridiculous. I get that. But striving for inner composure is the only shield a trader has.

My core principle remains unchanged: Fear losing more than you fear missing out on gains.

The Hunt for Leaders: My Methodology for Picking the Next Trade

Rebranding and New Tokenomics:

When a project undergoes a rebrand, it almost always means the team has a plan. The pressure from old sellers decreases, and the probability of a subsequent rally is high.

' Smart Money' Footprints (Accumulation):

This is my favorite pattern. Long periods of accumulation at certain levels, anomalous volumes, and candles with long wicks—all of this indicates that a major player has entered a position and is preparing for a breakout.

New Listings and Unique Patterns:

Projects recently listed on top exchanges don't have the "baggage" of disappointed holders. Over the years, I've noticed certain unique patterns in their charts that have a high probability of leading to growth.

The Art of the Entry: Hunting for the Entry Point

I try to enter positions with limit orders, and I always wait for a pullback. I look for an entry on a local correction when panic is shaking out the random passengers.

Hunt for your entry point. That is the most important thing.

The Golden Rule: Not a Single Step Without a Stop-Loss

Trading without a stop-loss is suicide. Accepting a small, planned loss is not a weakness but a part of the professional game.

What's Next?

I've already missed one coin I wanted to trade—it took off without me. I didn't chase it. Now, I am patiently waiting and searching for the next setup that meets ALL of my criteria.

The "Altseason: Live" experiment continues. You can watch everything in real-time on my streams. The hunt is on.

Thank you for your attention.

Best Regards EXCAVO

Alt-coins

That's the Way the Bitcoin TumblesWhy I Think the Sell-Off Isn’t Over Yet

Bitcoin is already in the middle of a sharp sell-off, but at least half the market seems convinced the worst is over and that a recovery is underway. I don’t see it that way. Bitcoin has been grinding sideways into the Bollinger Bands on the weekly chart, and now that it’s finally colliding with the basis lines, I think it’s about to plunge straight through them. This doesn’t look like a market that’s ready to bounce—it looks like one that’s about to take another leg down. Maybe I’m wrong, maybe I’m early, but in my experience, when people start celebrating too soon, things tend to get a whole lot worse.

CRYPTO:BTCUSD

CRYPTOCAP:BTC

CME:MBT1!

CME:BTC1!

CRYPTO:MOBILEUSD

COINBASE:RNDRUSD

CRYPTO:SHPINGUSD

CRYPTO:FXUSD

CRYPTO:ALEOUSD

CRYPTO:HONEYUSD

COINBASE:ACSUSD

CRYPTO:ASMUSD

CRYPTO:BATUSD

CRYPTO:FILUSD

CRYPTO:VTHOUSD

CRYPTO:B3USD

As always, this is not investment advice, any trade you make is on you, because good golly Miss Molly, I got my own things to worry about.

bitcoin 8h overview of key s/r levels tp 23 000 usd🔸previously recommended shorting BTCUSD / short selling rips/rallies. Since August

not much progress, we are stuck near 26/27k with extreme low volatility conditions.

🔸Bitcoin remains prone to further losses, since bulls failed to break overhead

resistance near 28 000 usd, expecting limited upside beyond golden pocket level

and therefore recommend to short selling rips/rallies near golden pocket.

🔸The price structure on the chart is weak we got a weak bounce off key s/r

near 25 300 usd, however not much progress therefore expecting more losses

and bears will likely take over soon. fresh overhead supply at 28 400 usd, bears

will immediately target re-test of recent lows near 25 300 usd and subsequently

after breakdown of key s/r level will hunt stops near 23 500 usd.

🔸Recommended strategy bears: focus on short selling rips/rallies near golden pocket,

TP1 bears is 25 300 usd TP2 bears is 23 600 usd. good luck traders!

🎁Please hit the like button and

🎁Leave a comment to support our team!

RISK DISCLAIMER:

Trading Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

Weekly Analysis BTC via Ichimoku by TheSocialCryptoClubHappy midweek,

As usual, here is our analysis of the week looking at a glance at the daily chart of BINANCE:BTCUSDT using the Ichimoku Kinko Hyo indicator with traditional settings. We used in support other indicators that we developed and released Open Source, you can find them at the end of the analysis.

Trend:

Kumo has been consistently red for 12 days and expanding (about 6%). The Ichimoku pattern indicates a general downtrend with a sideways bias over the very long term.

The Kijun Trend indicator continues to indicate looking for short positions.

Heikin-Ashi:

Heikin-Ashi confirmed the bearish price movement: almost always red candles since the top of the Kumo was touched.

Supports and resistances:

- 25000.00 by Fibonacci

- 24600.00 Tenkan Weekly

- 23400.00 Chikou cusp level or flat zones of Kijun and Tenkan

- 22400.00-22600.00 Chikou cusp level or flat zones of Kijun and Tenkan

- 20200.00 Chikou cusp level or flat zones of Kijun and Tenkan

- 20000.00 psychological threshold

- 19100.00-18900.00 level cusps Chikou or flat zones of Kijun and Tenkan

- 17080.00level cusps Chikou or flat zones of Kijun and Tenkan

- 12700.00from the waves of Hosoda

- 11000.00-13000.00 level cusps Chikou or flat zones of Kijun and Tenkan

For the various static price structures, you can refer to the chart where the structures identified by the flat moments of Tenkan, Kijun, Senkou Span A and Senkou Span B on different timeframes, also Chikou for the daily time frame, are plotted.

Also, recall that the various Ichimoku lines serve as dynamic price structures: the Tenkan Sen (short term), the Kijun Sen (medium term) as well as the Senkou Span A and Senkou Span B (long term).

Fibonacci:

The Fibonacci levels on the Daily still show us a positive long-term sentiment and places the 0 to the upside on 75000.00. Price is moving away from the 1 level.

Conclusion:

Since the 25000.00 level was touched The situation has changed considerably and a clear downtrend is present.

Hosoda waves indicate a downtrend target in the last ABC pattern found: 19252 (target reached), 18463.75, 18196.25, 17140.

From a fundamental point of view, and in general markets, the situation is of general downtrend considering the FED's economic policy, the European energy crisis, and a slowdown in the Asian market.

It is important to assess the close of the week and during the week on the following price structures:

- Bullish/Lateral: 21800.00

- Bearish: 18100.00

Altcoin Cycle:

For Bitcoin Dominance and Altcoin Cycle we can consider the weekly variation:

- Total cryptocurrency market capital: Decreased

- Dominance of BTC: Decreased.

- Price of BTC: Decreased.

- Alt cycle expectation: Stable.

Thanks for your attention, happy to support the TradingView community.

Indicators used:

Analysis Tool

Kijun Trend Indicator

Ichimoku Support and Resistance

Chikou Support and Resistance

Weekly Analysis BTC via Ichimoku by TheSocialCryptoClubGood weekend,

As usual, here is our analysis of the week looking at a glance at the daily chart of BINANCE:BTCUSDT using the Ichimoku Kinko Hyo indicator with traditional settings. We used in support other indicators that we developed and released Open Source, you can find them at the end of the analysis.

Trend:

Kumo has been red for 91 days and is stable (now at about 21%). The situation is always uncertain but mainly sideways on the medium to long term. Senkou Span B and Kijun are flat, indicating a sideways moment in the downtrend. The price continues to be above the Kijun, but it is still below the Kumo and below the important level of 22500.00.

The Kijun Trend indicator continues to indicate looking for long positions, even though the Kijun is flat. Price continues to be very close to the Kijun and may make contact with the Kumo shortly.

Heikin-Ashi:

For the week the Heikin-Ashi indicates a change in trend for the past week that allowed the Kijun to break through and is now on the Tenkan.

Supports and resistances:

- 25000.00 from Fibonacci

- 22400.00-22600.00 Chikou cusp level or flat zones of Kijun and Tenkan

- 20200.00 Chikou cusp level or flat zones of Kijun and Tenkan

- 20000.00 psychological threshold

- 19100.00-18900.00 Chikou cusp level or flat zones of Kijun and Tenkan

- 12700.00 from the waves of Hosoda

- 11000.00-13000.00 Chikou cusp level or flat zones of Kijun and Tenkan

For the various static price structures you can refer to the chart where the structures identified by the flat moments of Tenkan, Kijun, Senkou Span A and Senkou Span B on different timeframes are plotted, also Chikou price for the daily time frame.

Also, recall that the various Ichimoku lines serve as dynamic price structures: the Tenkan Sen (short term), the Kijun Sen (medium term) as well as the Senkou Span A and Senkou Span B (long term).

Fibonacci:

The Fibonacci levels on the Daily still show us positive long-term sentiment and places the 0 upside on 75000.00. Price is still below the 1 level, should it stay it will update accordingly.

Conclusion:

BTC shows a bullish trend on the short term, but the situation is rather uncertain. There are important levels to overcome such as 22400.00-22600.00 and the Kumo itself.

The well known exponential moving averages often used in the Crypto market on the 200, 50 and 20 periods are aligned in downtrend but still the price is exceeding the 200.

The Kijun trend is indicative of looking for long positions, but the Hosoda waves continue to indicate downtrend targets even though the V and NT targets are rising from last week:

- V/NT: 12600.00

- N: 7750.00

- E: 2845.00

It is important to assess the close of the week and during the week on the following price structures:

- Bullish/Lateral: 22400.00-22600.00

- Bearish: 20000.00-20700.00

Altcoin Cycle:

For Bitcoin Dominance and Altcoin Cycle we can consider the weekly variation:

- Total cryptocurrency market capital: Increased.

- BTC Dominance: Decreased.

- Price of BTC: Decreased.

- Alt cycle expectation: Stable.

Thanks for your attention, happy to support the TradingView community.

Indicators used:

Analysis Tool

Kijun Trend Indicator

Ichimoku Support and Resistance

Chikou Support and Resistance

Weekly Analysis BTC via Ichimoku by TheSocialCryptoClubGood weekend,

As usual, here is our analysis of the week looking at a glance at the daily chart of BINANCE:BTCUSDT using the Ichimoku Kinko Hyo indicator with traditional settings. We used additional indicators that we have developed and released Open Source, you can find them at the end of the analysis.

Trend:

The Kumo has been green for 19 days and the expansion is slightly decreasing (below 7%) but the uptrend sentiment of last week is no longer current, at least in the short term. A sideways bias is reinforced and there is no common agreement between the lines: indecision. We are back in the channel between two price structures and we are still approaching the Tenkan Weekly and moving away from the Kijun Weekly, where the sideways and downtrend sentiment remains.

The Kijun Trend indicator continues to indicate the search for long positions but the price has been below the Kijun for two candles and today it might return to indicate short positions.

Heikin-Ashi:

The Heikin-Ashi are always above the Kumo but they are always red since a week now and only today they present the maximum above the close, indicating a potential slowdown of the downtrend.

Supports and resistances:

- 75000.00 from Fibonacci

- 67000.00 from historical high

- 66001.41 from historical high of Chikou

- 51800.00-52600.00 from Ichimoku Flat/cusp areas of the Chikou

- 49000.00-51000.00 Fibonacci, Psychological Threshold and Kijun Weekly

- 44400.00-45600.00 by areas Ichimoku Flat/Chikou Cusps

- 40200.00-40800.00 from Ichimoku Flat/Chikou Cusp areas

- 30300.00 from Ichimoku Flat/Cuspid Chikou areas

- 37000.00 from Ichimoku Flat/Cuspid areas of Chikou

- 35000.00 from Ichimoku Flat/Cuspid areas of Chikou

- 33500.00 by Ichimoku Flat/Cuspid areas of Chikou

For the various static price structures it is possible to refer to the chart where the structures identified by the flat moments of Tenkan, Kijun, Senkou Span A and Senkou Span B on different timeframes are plotted, also Chikou price for the daily time frame.

Also, recall that the various Ichimoku lines serve as dynamic price structures: the Tenkan Sen (short term), the Kijun Sen (medium term) as well as the Senkou Span A and Senkou Span B (long term).

Fibonacci:

The Fibonacci levels still show us a long-term positive sentiment and puts the 0 on the upside at 75000.00. The price is back below the 0.618 level.

Conclusion:

The BTC has stopped its ascent and is now in a sideways moment and in the price channel between 44500.00 and 41000.00 approx., the Kijun Trend Indicator could return to indicate the short if the price does not touch even with a spike the Kijun. From a fundamental point of view we have the evolution of the Russian-Ukrainian conflict.

Furthermore, referring to the well-known exponential moving averages often used in the Crypto market on the 200, 50 and 20 periods, the price is on the 50 period.

It is important to evaluate the closing of the week and during the week on the following price structures, with emphasis on the sideways momentum:

- Bullish: 46100.00-49100.00

- Bearish: 44650.00-45563.00

Altcoin Cycle:

For Bitcoin Dominance and Altcoin Cycle we can consider the weekly variation:

- Total cryptocurrency market capital: Decreased

- BTC dominance: Decreased

- Price of BTC: Decreased

- Expectation of Alt cycle: Stable.

Thanks for your attention, happy to support the TradingView community.

Indicators used:

Analysis Tool

Kijun Trend Indicator

Ichimoku Support and Resistance

Chikou Support and Resistance

Bitcoin Dominance - Elliot Waves count Sample Elliot wave structure count of the Bitcoin Dominance. Based on this rough estimate, we do not see any kinda alt-season run till mid summer June - July, now this is clearly no prediction on time since that cannot be predicted in any way, but this is a best-guess basis on the Elliot waves drawn out with the subwaves.

This would also subside with the fact that we would see BTC gain some dominance in the next few months as it makes it's retrace to the 0.786 level fibs from the ATH of BTC, at this moment we expect that once BTC makes that retracement, we enter the bear market and if the alts did not run during that phase, then it is when I will be considering dumping my bags as we enter long term bear market.

This is NOT financial advice, this is only my opinion.

Short Term Play 4- XBTUSDIntro: My name is Hugo, I am 25 years old and trading crypto currencies since late 2017. English is not my main language, however, I will try to explain everything brief and clear. Be aware that I am still in the learning curve. Every idea I post is not financial advice and is only meant for entertainment purposes only.

Max lev recommended: 3x

Goodluck,

Doctor Hugo

POLCWETHLong POLC, nibbled at the bottom or the range. News coming out at the end of the month and in Dec

SHIBA INU INVERSE HEAD & SHOULDERS (BASED ON CLOSING) #BULLISH

SHIBA INU INVERSE HEAD & SHOULDERS (BASED ON CLOSING) #BULLISH

Since May 10, 2021 opening to today, formed a beautiful setup to explode!

I have a feeling we could moon a good distance! upwards to .00004 the previous high

I would guess then hit that resistance to fall down and form the handle, back up headed towards moon!!!

This isn't over its just getting started!!! Previous high of .00004 4 times higher then current price @ .000009

SHIBA INU currently has a market cap of 4,500,000,000...

When SHIBA INU hits . 01 it will have a market cap of 450,000,000,000 with a Big B

Which would put it at the #2 spot above Ethereum currently.

Forget the nay sayers, MASS ADOPTION IS REAL!

COINBASE, CRYPTOCOM, KUCOIN, WEBULL, ROBINHOOD...

Some of your favorite utility use coins, don't even have a spot on all 5 of these exchanges

. 01 is Inevitable Thats x1000 times my current Investment, The Risk to Reward is Phenomenal here!!!

Long - $BAL - 38 Price Target $BAL has rallied above POC (point of control). If that holds next stop is the 200 day SMA @ 38.

CARDANO-ADA/USD Bullish SwingVery simple idea based on ew an fibs. This move will take some time to complete so be patient. We also could stay around this level/range and correct for a "B & C" wave which I'm not sure at this time whether or not this correction has completed a,b, and c. Either way it will not negate this setup and i will be prepared to add more to my position in the event we take another trip back down to the bottom of the range @$1 dollar level

FTM BTCFantom's last cycle wasn't completed due to the sooner correction of BTC, so we are able to say that a cycle still remains & we should wait for the pullback •

⚠️ my technical analysis are mostly based on the e-waves plus Fibonacci and price action, you may not see them in my charts because it is hard to see the overall charts and candles

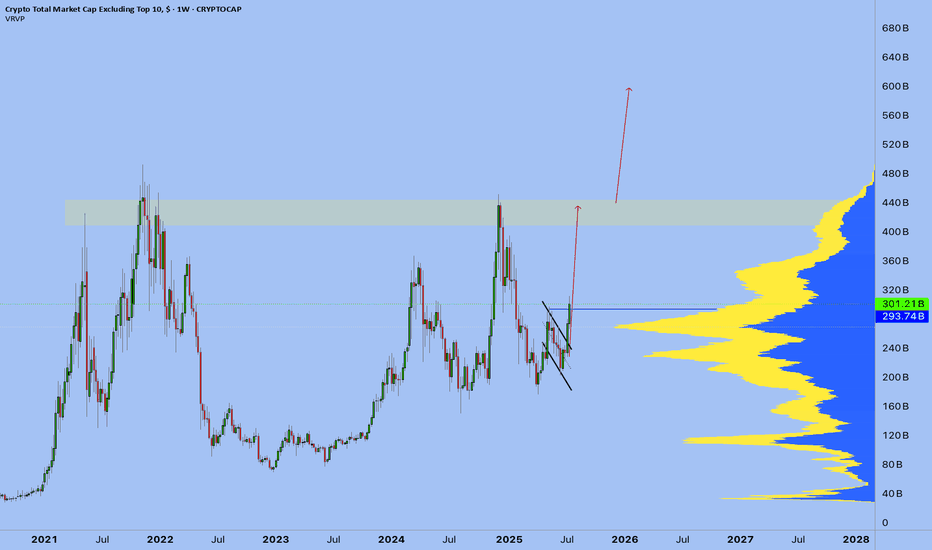

Alt coin bottom here?It still appears to me that we still have an upward sloping support spanning many years for the alt coins. The FA is looking better than ever and I still hold out hope for these coins. Also as you can see I little fractal idea. The red lines tend to be broken after capitulation. Remember these red days when we make it out alive and well.

BTC Dominance - Came Down. Satoshi's Went UPA little obvious on the title but ultimately sometimes you find when the dominance drops it's because of a Bitcoin drop. However, over the last 48 hours, satoshi values have gone up a little as Bitcoin dominance went down. We may find that more of that, people will get more into alt-coins and create further moves.