USDT Dominance – Potential Wave F Reversal?

We are tracking a NeoWave Diametric formation (7-leg corrective structure: A–B–C–D–E–F–G) on the USDT Dominance chart. Recently, price reached the projected resistance zone of wave E, and early signs of reversal are emerging.

⸻

🧠 Structural Analysis:

• The structure has developed with alternating legs in price and time, consistent with the symmetrical diametric rules.

• Wave E has likely completed, reacting from prior supply and resistance.

• A pullback from here can mark the beginning of Wave F, which in diametrics tends to retrace significantly toward the internal balance of the structure.

⸻

🔍 What to Watch:

• Confirmation of bearish intent via a break of internal supports or lower-timeframe BOS.

• Possible retracement targets: 4.2% → 3.95%, depending on momentum.

• A decisive break below 4.00% would reinforce the wave F scenario.

⸻

⚠️ Implications for the Crypto Market:

A drop in USDT Dominance typically indicates rotation into risk assets (alts/BTC/ETH). However, context matters — if the drop happens during a general market sell-off, it may reflect risk-off unwinding into fiat, not risk-on rotation.

⸻

🔄 Strategy Note:

• Avoid premature shorts or longs; wait for structure to confirm.

• Watch for smart money traps (e.g., false breakouts or liquidity grabs) around the recent highs.

⸻

📌 This is a high-risk zone for entering long USDT.D — be cautious with stablecoin bias.

📊 Analysis by CryptoPilot – Precision through structure.

Altcoin

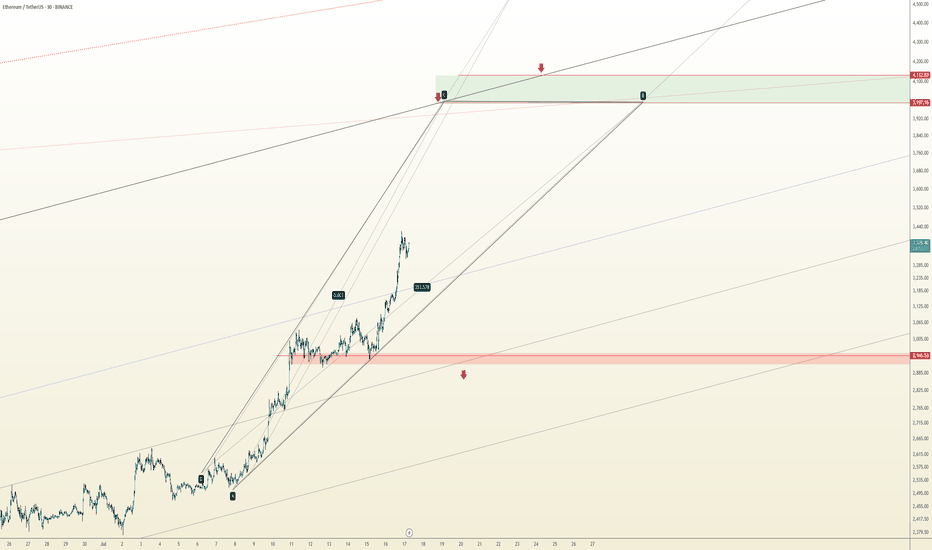

Ethereum Quick Outlook – Potential Trap Before Drop?ETH is moving within a rising channel, but momentum is fading. Price failed to break above the midline and is now testing lower support.

A fakeout to the upside toward the $4,015–$4,050 supply zone is possible before a deeper drop. The projected path suggests a short-term bounce, final liquidity sweep, then potential reversal.

🟡 Key Resistance: $4,015

🔻 Breakdown trigger: Below $3,620

🎯 Bearish Targets: $3,250 → $3,100

Structure hints at a possible Ending Diagonal (Neowave), or a Trap-Wave E inside a Complex Correction.

⚠️ Watch for manipulation near highs – confirmation needed for short entry.

The Loudmouth Pattern: It Yells, We Trade!

On the 30-minute chart, ETH is forming a classic Broadening Formation – or as some traders like to call it, “The Big Mouth Pattern” 😄. It’s noisy, unpredictable at first glance, but when it speaks, you’d better listen.

Right now, price is moving through the bullish leg of this setup, and if momentum holds, we’re eyeing the $4,000 psychological level, followed by the $4,120 – $4,170 supply zone.

🔹 Bullish Scenario (our expected outlook):

🎯 Target 1: $4,000

🟩 Main Resistance: $4,120 – $4,170

❌ Invalidation: Confirmed close below $2,946

If price breaks and holds below that red support zone, this setup gets thrown out the window.

📊 Risk Management:

Scale in on pullbacks – if structure remains valid

No chasing without confirmation

Keep risk under 1% of total capital

📈 The market’s big mouth is open – and until it closes below $2,946, we’re listening for bullish signals. 🤑

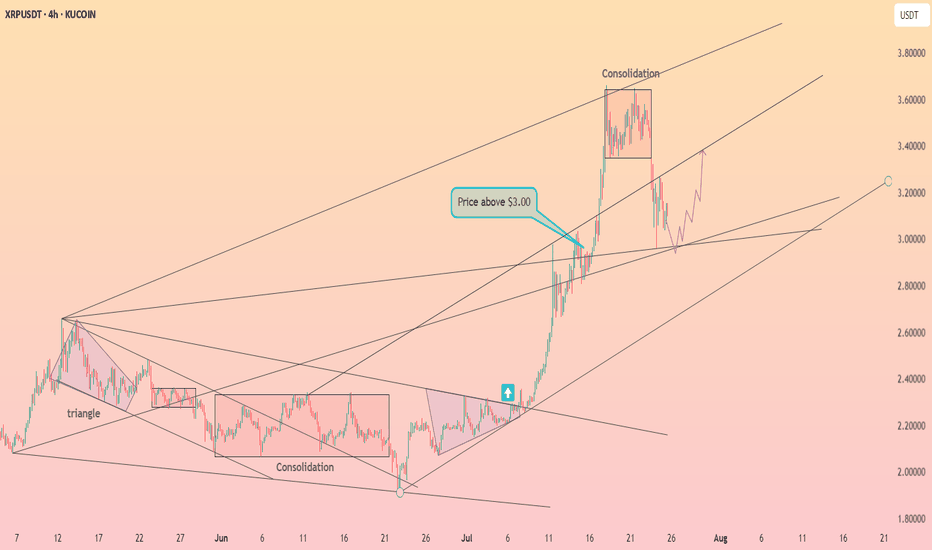

XRP is testing a support ┆ HolderStatBYBIT:XRPUSDT recently broke out of a long consolidation and triangle setup, rallying into the 3.60 region. It is now forming a falling channel — a common bullish continuation pattern. Price must hold the 3.10–3.20 support area for a renewed move toward 3.80–4.00. The broader structure remains bullish until invalidated.

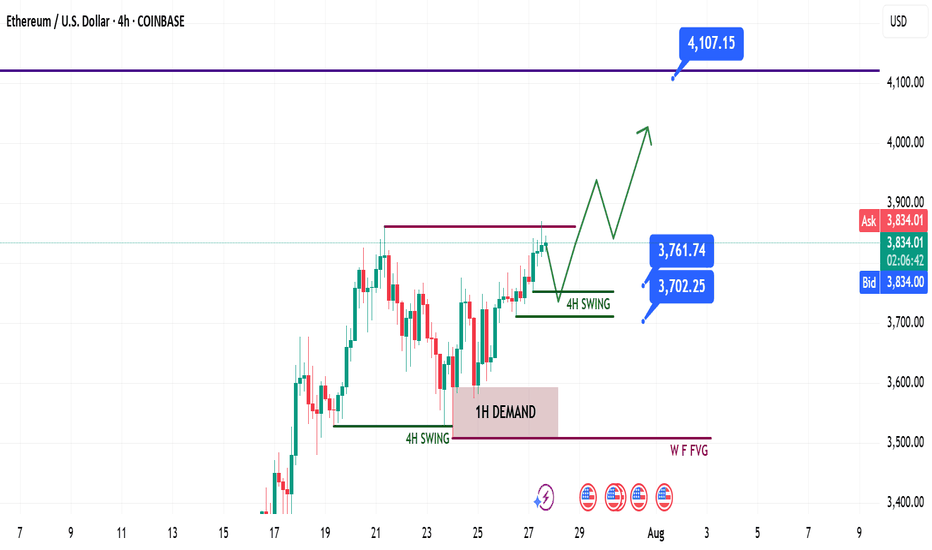

Ethereum Mid Week Update - Swing Long Idea📈 Market Context:

ETH remains in a healthy bullish structure. Despite the recent retracement, price action is still supported by strong demand zones on higher timeframes. No change in the overall sentiment from earlier this week.

🧾 Weekly Recap:

• Price rejected from the Fibonacci 0.5 EQ level — a discounted zone in my model.

• While doing so, it also ran 4H swing liquidity.

• After taking liquidity, ETH formed a 1H demand zone — a sign to look for lower timeframe confirmations for long setups.

📌 Technical Outlook:

→ Price has already tapped into the 1H demand zone.

→ From here, we have two possible scenarios:

Black scenario (ideal):

• Wait for 15M bullish break of structure (BOS).

• Enter after confirmation for long setups from 1H demand.

Blue scenario (deeper retrace):

• If no bounce from 1H demand, expect price to dip toward 0.75 Fib level (max discount).

• Watch for another liquidity run & 1H–4H demand formation.

🎯 Setup Trigger:

✅ 15M bullish BOS inside 1H or 4H demand zones

→ This would be the entry confirmation trigger for longs.

📋 Trade Management:

• Stoploss: Below the swing low of the 15M BOS

• Target: 4090$

💬 Like, follow, and drop a comment if this outlook helped — and stay tuned for more setups each week!

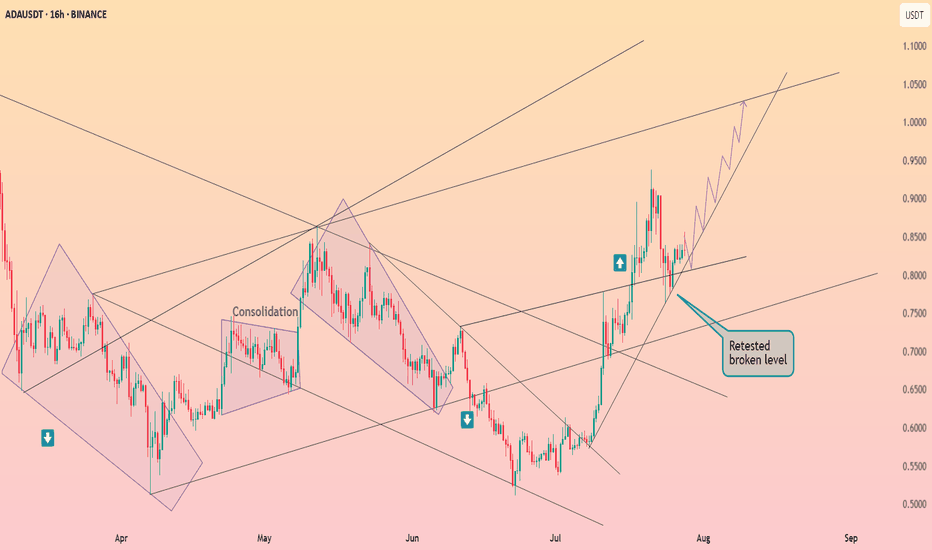

Cardano has successfully completed retesting ┆ HolderStatBINANCE:ADAUSDT is trading inside a symmetrical triangle near support at $0.445. Price continues to coil tightly with lower highs and higher lows, building pressure. A breakout above $0.465 would confirm bullish momentum toward the $0.49–0.50 zone. Key support remains intact and buyers are stepping in at every dip. A major move looks imminent.

Long-Term Technical Outlook: Critical Decision Point Approaching

The chart illustrates a long-term technical structure where the price has been following an ascending channel after a prolonged bearish trend. However, recent price action indicates a breakdown below the green ascending trendline, raising concerns about a potential shift in market sentiment.

Currently, the $117 level is acting as a pivotal support zone. A sustained breakdown below this level — and more critically, below the red lower trendline — would validate the bearish scenario. This could trigger a deeper correction phase, with downside targets aligned along the red projection path. Such a move may lead to significantly lower price levels in the medium to long term.

🔽 Bearish Scenario:

If the price fails to hold above $117 and breaks below the red trendline, this would confirm the start of a bearish leg. Based on historical structure and projected trajectories, this could result in a descent toward the $93 level initially, with the possibility of extending further downward depending on market conditions.

🔼 Bullish Scenario:

On the other hand, if the price manages to reclaim the green trendline and more importantly, stabilize above the $204 resistance zone, it would signal renewed bullish strength. Such a move would open the path toward higher highs, potentially re-entering the previous upward channel and continuing the macro uptrend.

🧭 The price structure is now approaching a decisive zone, where either a confirmation of bearish continuation or a bullish recovery will likely unfold. Both scenarios have been visually outlined — green lines indicating bullish continuation, and red lines representing bearish momentum.

📌 Note: This analysis is for educational purposes only and should not be interpreted as financial advice.

Binance coin has fallen below the resistance line ┆ HolderStatBINANCE:BNBUSDT continues to form clear higher highs and higher lows, trending inside a steep ascending channel. After breaking out of a bullish triangle, momentum remains strong as price eyes the 900 mark. Buyers are clearly in control unless key support levels break.

Ethereum destroyed resistance at the $3700 level ┆ HolderStatBINANCE:ETHUSDT remains stuck between $3,260 and $3,320, forming a tightening range with bullish undercurrents. Price is holding a higher low and consolidating under resistance, hinting at re-accumulation. A breakout above $3,325 could send ETH toward $3,400+ in short order. Bulls remain in control above $3,260.

XRP held the support line ┆ HolderStatBINANCE:XRPUSDT is holding above $0.685 support after a correction from recent highs. Price is stabilizing inside a horizontal channel, with buyers defending the bottom of the range. A clean push above $0.70 would reopen the path toward $0.75. The market is at a decision point with strong reactions at both ends of the range.

Act Bust on My Radar: Long-Term Vision, Short-Term Target!Hey folks 👋

I’ve put together a solid analysis for a promising token: **Act Bust**.

Whether it hits my entry level or not, I’ll be holding this token long-term.

Right now, the target is set at **0.10146**—once we get there, I’ll update you all.

Stay tuned, and trade smart 💼🚀

INJ - Back Bullish!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈INJ has been overall bullish trading within the rising wedge pattern marked in blue.

This week, INJ has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and green demand.

📚 As per my trading style:

As #INJ approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

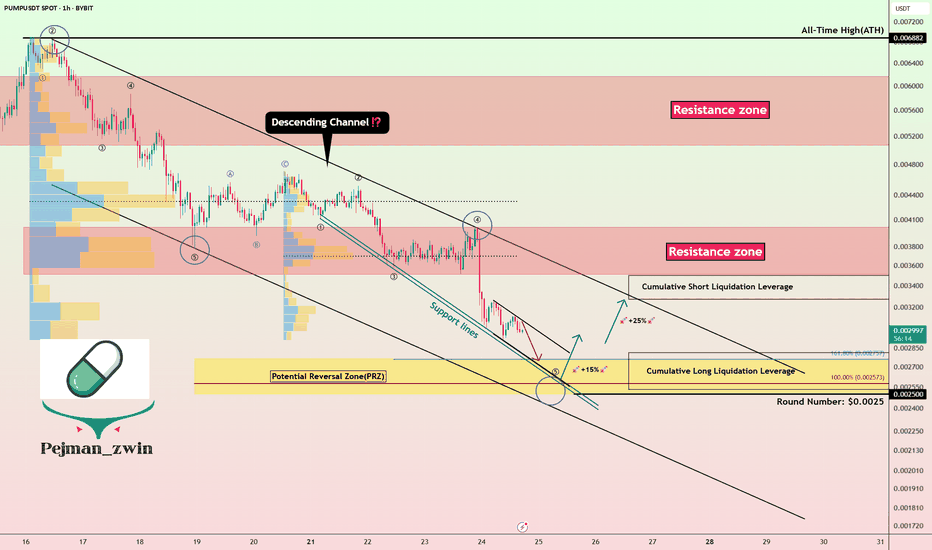

From Hype to Hesitation: What’s Next for Pump Fun ($PUMP)?Today, I want to break down the recent developments and fundamentals of Pump fun ( BYBIT:PUMPUSDT ) and its token PUMP — a project that initially launched with strong hype but is now facing serious investor concerns .

What is Pump fun?

Pump fun is a memecoin launchpad that allows users to launch and trade memecoins in a gamified, simplified environment. The idea was to create a frictionless way for anyone to generate and speculate on meme tokens, leveraging viral growth and community culture.

Its native token, PUMP , was introduced via an ICO priced at $0.004, with 12.5% of the total 1 trillion supply offered during the sale.

Latest Updates – Past 24 Hours Recap

PUMP Crashes Over 50% After ICO :

The token initially spiked to $0.0068 on launch day (July 16) , but has now dropped over 50%.

This is roughly 14% below its ICO price , creating concerns for short-term investors.

Founder Confirms No Airdrop Anytime Soon:

In a livestream with ThreadGuy , project founder Alon Cohen confirmed:

“ The airdrop is not going to be taking place in the immediate future. ”

While the team still plans to deliver an airdrop, Alon emphasized it must be well-executed and meaningful, not rushed for hype.

The current focus is on long-term growth and ecosystem sustainability, not short-term incentives.

Mixed Investor Sentiment:

High-profile trader Machi Big Brother ( Jeffrey Huang ) reportedly increased his long position in PUMP — even though he’s down over $5.8M on his position.

Meanwhile, two wallets linked to private sale investors dumped over 1.2B PUMP at $0.003 , taking a combined loss of $1.19M.

Declining Volume and Market Cap:

Trading volume has dropped significantly.

PUMP has lost over 40% of its value in the past 7 days.

Short-term holders appear uncertain, while the project team asks for patience and long-term vision.

Fundamental Outlook:

Pump fun’s future now heavily depends on:

The real utility of the platform as a meme coin incubator.

The team’s ability to regain trust after delaying the airdrop.

Whether new features or hype can revive volume and user engagement.

-------------------------------

Now, let's examine the PUMP token from a technical analysis perspective

From the outset, I must say that due to the small number of candlesticks that create the PUMP token, technical analysis may be a bit difficult , but we will use technical analysis tools to analyze this token.

The PUMP token seems to be moving in a descending channel since the beginning of its correction (over -50%) until now, we need a second price bottom to confirm the descending channel.

I expect the PUMP token to rise from the Potential Reversal Zone(PRZ) and near the Support lines to $0.0029(+15%) . PUMP Token increase can also be from the bottom of the ascending channel .

Second target: the upper line of the ascending channel.

Cumulative Long Liquidation Leverage: $0.002810-$0.002530

Cumulative Short Liquidation Leverage: $0.003498-$0.00327

Note: Stop Loss(SL): $0.002391

Please respect each other's ideas and express them politely if you agree or disagree.

Pump fun Analyze (PUMPUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

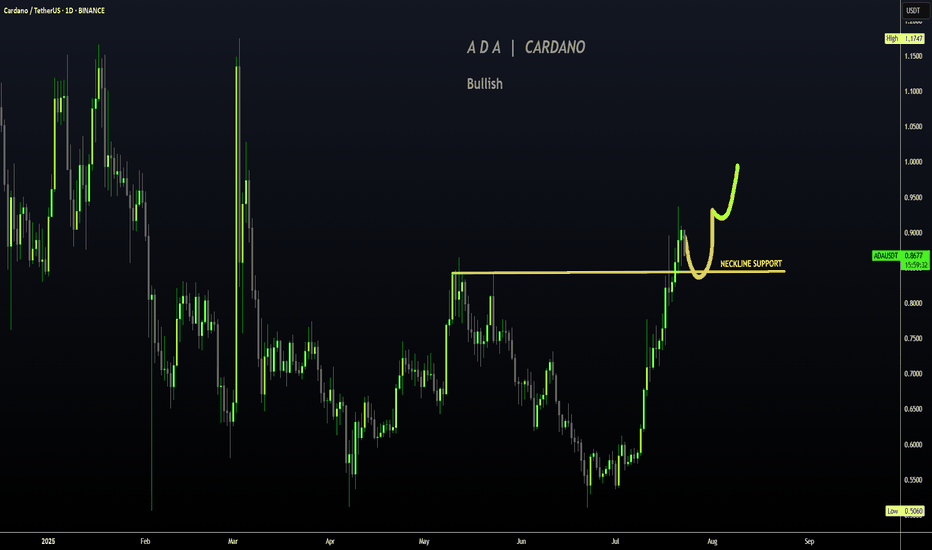

CARDANO | ADA Creeping UP to $1Cardano has made a big move in recent weeks, boasting a 77% increase.

If you were lucky enough to buy in around 30 or 40c, this may be a great TP zone:

Looking at the Technical Indicator (moving averages), we can see the price makes its parabolic increases ABOVE - which is exactly where we are currently beginning to trade. This could mean more upside is likely, and the 1$ zone is a big psychological resistance zone:

A continuation of the current correction may look something like this for the next few weeks:

_____________________

BINANCE:ADAUSDT

Ethereum Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

ETH followed the broader crypto market momentum led by Bitcoin, supported by institutional demand and positive macro policies in the U.S.

Last week’s plan played out cleanly — we saw strong gains from the 1H demand zone.

🧾 Weekly Recap:

• Price swept 4H swing liquidity and formed a 1H bullish BOS

• Created a solid 1H demand zone, from which price bounced strongly

• Momentum remained bullish as forecasted in last week’s post

📌 Technical Outlook:

→ Expecting a short retracement into 4H liquidity levels around 3761$ or 3702$

→ Then a continuation move towards ATH zone

🎯 Setup Trigger:

What I’m watching:

✅ Sweep of 4H liquidity

✅ Bullish BOS on 15M–30M

→ This will serve as the confirmation for long entries

📋 Trade Management:

• Stoploss: Below the confirmation swing low

• Target: 4100$

💬 If you found this helpful, don’t forget to like, comment, and follow — I share setups like this every week!

Bitcoin Dominance – Critical Breakdown on the Horizon

Bitcoin dominance is currently testing a major long-term resistance zone formed by the upper boundary of a multi-year wedge. After months of steady climb, the structure is now showing the first signs of exhaustion

If dominance loses the key 60% support zone, that would mark a major structural shift — historically followed by downtrends in dominance and strong capital rotation into altcoins.

Until dominance reclaims the upper trendline or regains bullish momentum, the risk-reward now favors altcoins. Momentum is shifting. Altseason might just be around the corner.

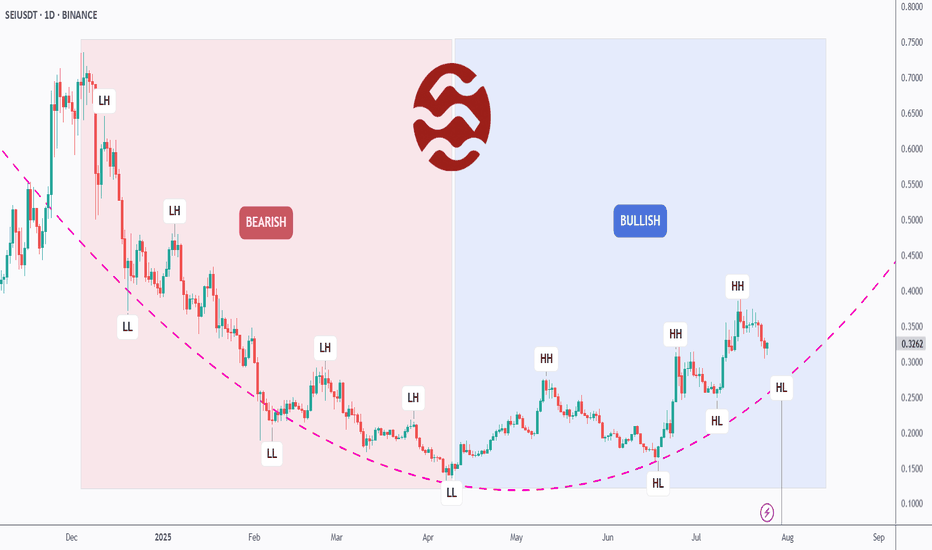

[Deep Dive] SEI – Edition 2: From Pain to Power: A Bull Cycle?SEIUSDT may have just flipped the script.

After months of consistent lower highs and lower lows, SEI has officially broken its bearish structure and is now printing clear higher highs (HH) and higher lows (HL) — a textbook sign of a trend reversal.

📉 Left Side: Bearish Breakdown

From late 2023 to Q2 2025, SEI was stuck in a painful macro downtrend. The structure was brutally clean: LH → LL → LH → LL. Each bounce was weaker than the last, reflecting exhausted buyers and relentless supply.

But something changed in late Q2…

📈 Right Side: Bullish Rebuild

Since its final low around April, SEI began to carve a new path. What started as a subtle accumulation quickly morphed into a solid structure of higher highs and higher lows.

The arc-shaped pink trendline tracks this momentum shift — and we’re now watching a potential continuation of the bullish cycle.

The most recent HL is forming exactly on that curve — a critical moment where bulls may step in for the next impulsive move.

🔥 What’s Fueling the Shift?

SEI is gaining traction as a high-performance Layer 1 designed for trading apps, with native parallelization and a focus on speed and throughput.

Its recent ecosystem growth — including projects in DeFi, gaming, and infrastructure — has started to attract both retail and VC attention.

On-chain metrics are showing increased activity, and whispers of upcoming protocol incentives could be the spark that pushes SEI toward the $0.45–$0.50 range.

🧠 What We’re Watching

- The current HL zone — will bulls defend this level?

- If SEI can break above the previous HH, the bullish structure strengthens.

- A failure to hold this HL would suggest a range or even deeper correction — so risk management is key.

Let’s recap:

- Structure has flipped bullish ✅

- SEI is riding a fresh higher low ✅

- Fundamental momentum is building behind the scenes ✅

It’s now up to the market to decide if this was just a bounce — or the beginning of a much bigger move.

💬 What do YOU think: Is SEI building steam for a breakout, or just teasing us with a fakeout?

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

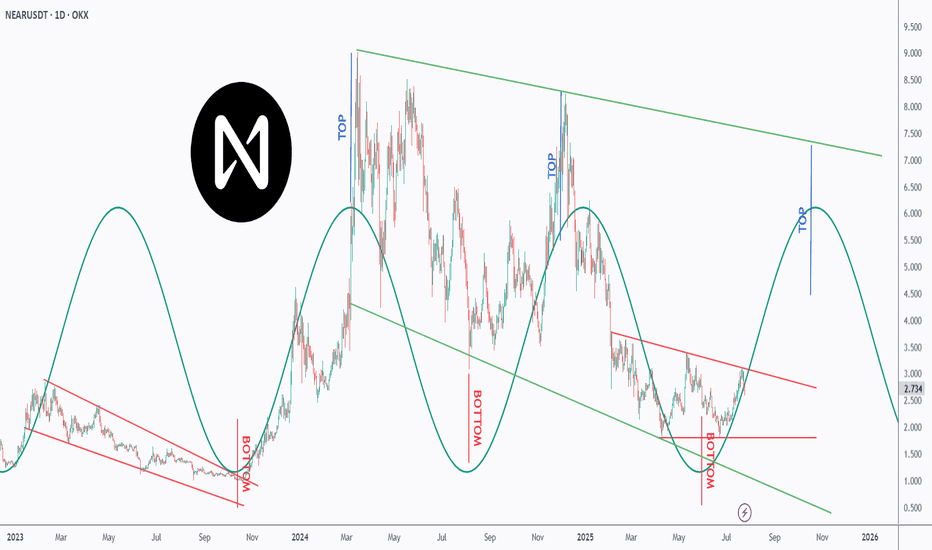

Is NEAR NEARing Its Next Explosion? Watch This Perfect Pattern!NEAR is dancing to a powerful rhythm — and it’s all in the cycles 🔁

This chart uncovers a repeating top-bottom cycle that has held since early 2023, with precise peaks and valleys emerging every few months 📉📈.

After bouncing off a major bottom at ~$2, NEAR is now approaching the mid-line of the descending red channel, suggesting a potential trend reversal is underway 🔄.

Each previous “BOTTOM” aligned with strong recovery waves 🚀, while the projected “TOP” now points toward the $6–7 zone — aligning perfectly with the upper green trendline resistance 🎯.

If the pattern continues, we could be looking at another macro push before year-end 2025 📆.

📊 Will NEAR ride this wave to new local highs — or is it just another lower high in the making? Either way, the rhythm of this chart is too clean to ignore.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

5/Altseason Live Psychology:My Core Principle,Learned Over Years

This experience is built on analyzing every previous altseason. And here is the main takeaway: altseasons are always short, but incredibly rapid. In this chaos, most people, driven by emotion, make the same mistakes:

- They open too many trades.

-They close a position on the first small move, hoping to "re-enter" another project that's "about to explode."

-They shift capital from a growing asset to one that hasn't moved yet. And it still doesn't move.

The problem is the mindset. You don't invest in what's falling or bet on "dark horses." You invest in what is already growing.

This might sound new to some, but the most important principle in trading, and in life, is to REINFORCE STRENGTH.

This is an attention market. And attention is captured by the speed and power of growth. Everyone is looking at what's pumping. That's where the money flows. Your job is to be in that flow, not to try and catch a falling knife.

And one more thing, the most critical rule for the next two months. I AM BEGGING YOU, DO NOT OPEN SHORT POSITIONS. Any 15-25% correction on a strong project is not a reason to short; it is your buying opportunity. Measure from the peak, and you will see these entry points. The strongest projects will correct even less. This system works.

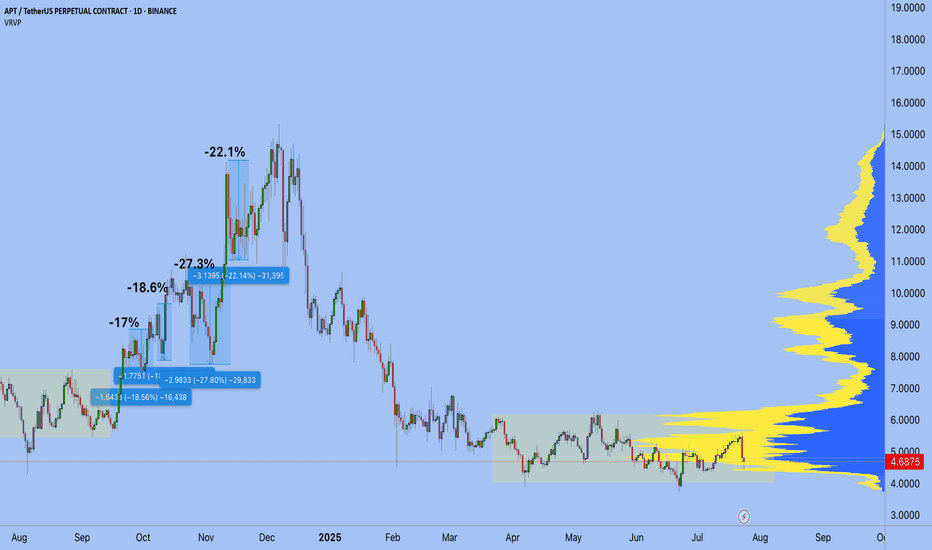

Of course, this doesn't mean blindly buying everything that's green. You need to understand the narratives. But if your project is old and showing weakness while others are flying, maybe it's time to switch to a leader. As a subscriber wrote in the comments of my last post: in the previous cycle, SUI did a 10x, while APTOS did a 4x. This clearly shows where the market's attention was focused, and consequently, where the results were.

Best regards EXCAVO

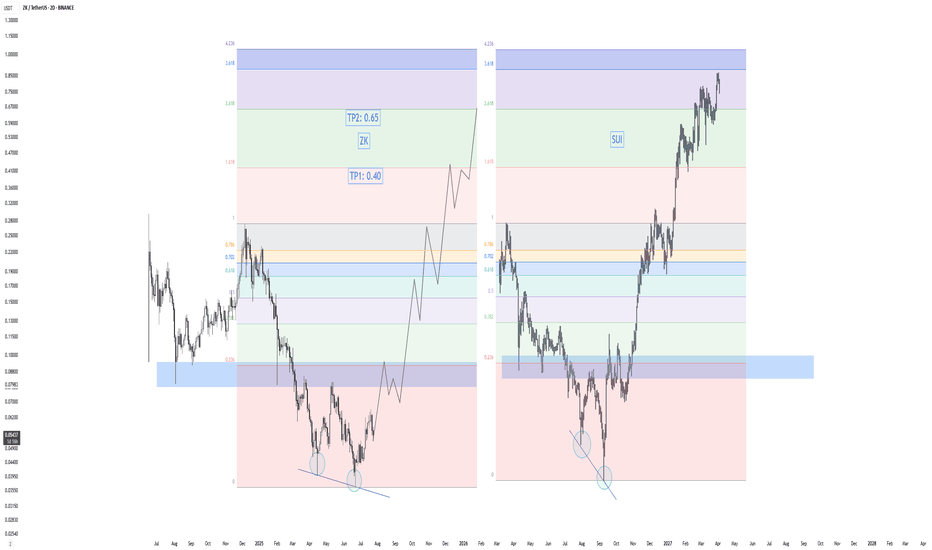

ZK - Golden opportunity? 0.40? Hello everyone, here’s my new analysis on ZK.

Recently, the price surged nearly 80%, followed by an 18% pullback over the last two days. From its all-time high, ZK is currently down about 80%, which in my opinion presents a golden opportunity.

Based on my research, the peaks of altseasons often occur between December–January or April–May. After analyzing the Others Market Cap dominance chart, I believe we’re setting up for a strong altseason in the next 5 months. Over the last few years, BTC has significantly outperformed altcoins—but recently, I’ve noticed a major shift in market dynamics, indicating that capital might be rotating back into alts.

On the chart, ZK is showing a classic crypto crash-recovery pattern. For example, SUI dropped around 80–85% before rallying over 1000% in just 4 months. I see a strong structural similarity between the bottoming pattern of SUI and the current structure of ZK.

If ZK breaks the resistance zone at 0.080–0.095, I expect a rapid move up toward 0.22–0.26. After that, a healthy correction around the previous ATH would be expected—before potentially heading to 0.40 as Take Profit 1 (TP1).