Yellow Ket Gearing For A Breakout Amidst Symmetrical Triangleyellow ket coin ($KET) a token created under the Avax ecosystem is set for a breakout move amidst a symmetrical triangle pattern on the 4-hour price chart.

Should the asset break from the Ceiling of the symmetrical triangle, a bullish campaign will be materialise with a 100% surge in sight albeit $KET has to be listed on major exchanges to fuel the hype of the memecoin.

Similarly, on a bearish scenario, a break below the symmetrical triangle could also send $KET to a nosedive- leading to a selling spree.

About yellow ket

YellowCatDAO sets itself apart by integrating cutting-edge AI-driven trading mechanisms with a community-centered governance model. At its core, the project leverages an AI agent capable of executing trades across multiple blockchain networks, making it a pioneer in cross-chain AI trading. Unlike typical trading bots, this AI agent not only focuses on profitability but also strategically reinvests gains into the project’s treasury to ensure sustainable growth and support ongoing initiatives.

yellow ket Metric

The live yellow ket price today is $0.184953 USD with a 24-hour trading volume of $5,874,478 USD. Yellow ket is down 3.78% in the last 24 hours, with a market cap of not available. The circulating supply is not available and the max. supply is not available.

Altcoin

LTO - Two Potential Longs!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 LTO has been rejecting a massive weekly support and the key $0.02 round number.

🛡️ As long as this level holds, I'm eyeing a potential 5x move towards the upper bound of the falling channel and the $0.10 round number.

🚀 From a macro perspective, a break above $0.10 could trigger a continuation towards $0.30 — unlocking major upside potential!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

bnb sell midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Breaking: $BUTTCOIN Spikes 50% Gearing Up For 100% Surge The price of "The Next Bitcoin" ($Buttcoin) broke out of a bullish symmetrical triangle pattern soaring 50% and setting sail for 100% voyage amidst build-up momentum and increase hype.

Based on the 4-hours time chart, the asset broke out of a presumed symmetrical triangle pattern albeit the crypto market was overall consolidating yesterday.

The 4-hour price chart depicts a typical three white crow pattern, a pattern generally seen as a continuation of a current trend with ($BUTTCON) gearing up for a 100% surge as hinted by the Relative Strength Index (RSI) at 77.

What is The Next Bitcoin?

Buttcoin (BUTTCOIN) is a playful twist on the cryptocurrency landscape, embodying the spirit of a meme while functioning as a real token. Launched on January 30, 2025, on Pump.fun, it’s a community-driven memecoin on the Solana blockchain. The concept was inspired by a humorous 2013 YouTube video by James D. McMurray, which satirized Bitcoin's complexities and introduced Buttcoin as a simpler alternative.

The Next Bitcoin Price Live Data

The live The Next Bitcoin price today is $0.024262 USD with a 24-hour trading volume of $14,482,140 USD. The Next Bitcoin is up 50.31% in the last 24 hours, with a live market cap of $24,241,574 USD. It has a circulating supply of 999,151,679 BUTTCOIN coins and a max. supply of 1,000,000,000 BUTTCOIN coins.

CRO - Building Block!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Let’s keep it simple!

📈 Short-Term Bullish:

CRO is currently hovering around a key weekly support level. As long as the $0.07 support holds, we can look for short-term long opportunities.

With bullish momentum picking up, the next target/resistance is around $0.11 (marked in blue).

🚀 Long-Term Bullish:

For the bulls to fully take control and aim for the next major resistance at $0.163 (marked in red), a confirmed breakout above the $0.115 level is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin Prediction - Crypto MarketBitcoin has broken the weekly structure to the downside, and we’ve been bearish since then.

However, the monthly chart still looks bullish, and I expect the price to return to the monthly demand zone and get a reaction from there.

I believe the crypto market could turn bullish again by the end of summer 2025.

Possible scenario:

We short from the current levels down to the monthly demand zone, sweeping the engineered weekly liquidity (by 'engineered,' I mean a level designed to push price higher). That level is around $67,000.

I’ll be watching for LTF confirmations to take longs from that zone.

Most likely, the monthly demand zone will hold and send us toward new all-time highs.

TradeCityPro | BTC.D: Predicting Alt Seasons with Bitcoin Domina👋 Welcome to TradeCity Pro!

In this analysis, I want to discuss an important crypto index that can significantly impact our trading, known as BTC.D. First, I'll provide some explanations for those unfamiliar with this index, and then we'll dive into the analysis.

🤔 What is Bitcoin Dominance?

Bitcoin Dominance is a major indicator in the crypto market. It does not directly represent supply and demand and is not tradable; the chart you see is calculated by TradingView and does not exist physically.

⚡️ This index represents the strength of Bitcoin in the crypto market. It shows the amount of money in Bitcoin divided by the total money in the crypto market.

100x(Bitcoin MarketCap / Total MarketCap) = Bitcoin Dominance

✔️ For example, if the total money in crypto is 1 trillion dollars and 500 billion dollars of that is in Bitcoin, then Bitcoin's dominance would be 50%.

✔️ Or, if the total money in crypto is 1 trillion dollars and 300 billion dollars of that is in Bitcoin, then Bitcoin's dominance would be 30%.

Now that we know what Bitcoin dominance is and how it is calculated, let's see how it can help us in trading and where it can be useful.

🤔 How is Bitcoin Dominance useful?

When we trade, we often encounter situations where both Bitcoin and an altcoin (for example, Ethereum) are triggered simultaneously according to our strategy. There are several ways we can open positions in these situations. Some open positions simultaneously on both, increasing the risk of the trade and doubling the potential loss if the market moves against us. Others may randomly choose between the two positions, which could result in taking a position on Bitcoin and hitting a stop-loss while Ethereum moves towards your target. But how can we determine which one is likely to be more profitable?

🔹 As mentioned, Bitcoin dominance indicates the strength of Bitcoin relative to the rest of the market, and there are three scenarios to consider for its analysis.

📈 In the first scenario, if the market is bullish, Bitcoin dominance can be bullish, bearish, or range-bound. If Bitcoin dominance is bullish, it means more money is entering Bitcoin, so if both Bitcoin and Ethereum are triggered simultaneously, Bitcoin is likely to rise more than Ethereum. If Bitcoin dominance is bearish, less money is entering Bitcoin relative to altcoins, so altcoins like Ethereum are likely to rise more. If Bitcoin dominance is range-bound, we analyze the market candle by candle and pay more attention to short-term momentum, deciding based on the current trend of Bitcoin dominance.

📉 In the second scenario, if the market is bearish, Bitcoin dominance can again be bullish, bearish, or range-bound.

✔️ Before explaining this scenario, let me tell you how it's possible for the market to be bearish while Bitcoin dominance increases even though Bitcoin's price is also falling. As I mentioned, Bitcoin dominance is a ratio and is shown in percentage terms, so if the market is crashing, it might be that Bitcoin is selling less than altcoins. For example, Bitcoin might sell for 10 million dollars and altcoins for 20 million dollars. Even though Bitcoin is being sold and its price is falling, it is being sold less than altcoins, so its dominance increases.

🔹 Now, let's examine the second scenario. If Bitcoin dominance is bullish, less Bitcoin is being sold compared to altcoins, so altcoins like Ethereum will have a greater drop and are better for short positions. If Bitcoin dominance is bearish, Bitcoin is being sold more than altcoins, so a short position on Bitcoin would be more suitable. Lastly, if Bitcoin dominance is range-bound, like in the first scenario, we analyze candle by candle and focus on short-term momentum.

📊 In the third scenario, if the market is range-bound, I first suggest not opening any positions because many strategies do not work well in range-bound markets, and it's better to wait for a breakout of the range's floor or ceiling before opening a position. However, if you do decide to open a position in this phase, short positions fall under the second scenario, and long positions fall under the first.

⭐ So, with Bitcoin dominance, we can optimize the positions we open and choose the best option between Bitcoin and the selected altcoin. If we look at Bitcoin dominance in higher time frames and not just as a confirmation for futures positions in lower time frames, we can identify alt seasons.

🤔 How to identify alt seasons and alt parties with Bitcoin Dominance?

So far, we've seen how dominance in different states and positions can help us in trading. Now, if we analyze Bitcoin dominance over a longer term, we can determine whether the money in the market will move more towards altcoins or Bitcoin in the coming weeks or months.

✔️ For example, if Bitcoin dominance is bullish in the weekly time frame and has a strong upward trend, naturally, more money will enter Bitcoin over time, making Bitcoin a better investment than altcoins. However, if Bitcoin dominance undergoes a correction for a few days or weeks during this bullish trend, altcoins can experience significant growth during that short time frame, which we call an alt party.

💥 On the other hand, if Bitcoin dominance completely changes trend and is bearish for several weeks or months, altcoins will naturally grow much more and will be a better investment option until Bitcoin dominance turns bullish again, which we call an alt season.

🔹 An important note about alt seasons is that Bitcoin's trend during this time must be bullish or range-bound; if Bitcoin is bearish, neither an alt season nor an alt party will occur. So, be sure to first understand the overall market trend using indicators like Total and Total2, and then look for an alt party.

Now that we've examined how this index works, let's move on to a technical analysis of the chart.

📅 Monthly Time Frame

As you can see in the monthly time frame, Bitcoin dominance had a very long range above the 95% area between 2015-2017, which was because the crypto market was still very small at that time, and many investors thought it was a scam. Thus, if anyone wanted to invest in crypto, they only bought Bitcoin.

✨ But in 2017, during Bitcoin's bull run when it reached the 20k ceiling, altcoins also entered the game, and Bitcoin dominance began to fall, spreading the crypto money among other coins. This downward movement continued down to the 40% area, and after it consolidated around this area, Bitcoin dominance started rising again, correcting the severe downturn it had experienced.

🔍 At the start of the next bull run in late 2020, Bitcoin dominance reached its peak and formed a range between 57.13 and 71.04 until the end of the bull run. After Bitcoin's bull run, in the second leg when the price moved towards the 69k area, Bitcoin dominance broke the 57.13 support and moved down to the 40% support, leading to a major alt season.

🎲 In early 2023, coinciding with the start of Bitcoin's bullish trend from the 16k bottom, Bitcoin dominance broke the 47.80 area, which was the ceiling of its box, and its upward movement restarted. Currently, Bitcoin dominance has also broken the 57.13 area and is near 64%. As long as Bitcoin dominance remains bullish, Bitcoin will still be a better buy, and altcoins will not be able to grow significantly.

💥 If Bitcoin dominance finally confirms a trend change and turns bearish, if Bitcoin's trend remains bullish, we will witness another major alt season like in 2021. For now, we confirm the change in trend in Bitcoin dominance on the monthly chart by breaking 57.13, and for a better and more accurate analysis, it's better to move on to the weekly time frame.

📅 Weekly Time Frame

In the weekly time frame, after breaking the 47.46 area, an ascending trend has formed within an ascending channel, and the price has been in this channel for about two years.

🧩 The next resistance for Bitcoin dominance is 65.59, which it is moving towards, and the main ceiling for Bitcoin dominance is 71.04. If the upward trend continues, more money will enter Bitcoin, and altcoins will not be good investment options.

🔽 For a trend change and a bearish turn in Bitcoin dominance, breaking the 60.50 area is suitable, and if Bitcoin dominance records lower highs and lows below this area, we will confirm the trend change. Breaking the channel will also be one of the most important confirmations.

📅 Daily Time Frame

In the daily time frame, we can analyze the price movement with more detail.

💫 Currently, the 62.23 area has been broken, and Bitcoin dominance is performing another bullish leg, having reached the channel ceiling. If the channel ceiling breaks, we can expect a move to the 65.59 area.

📉 For a trend change in this time frame, it's better to wait for the channel to break, but besides the channel, the 62.23 and 60.50 areas are also significant, and breaking them will confirm it.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Breaking: $PTGC Coin Set For 700% Surge Amidst Market BloodbathCreated and deployed on the Pulsechain, $PTGC is set for a 700% surge as it is gearing up to break out from a falling wedge pattern. The altcoin has already formed a solid support point for a reversal and with the RSI at 39.90, this proffers more room for a trend reversal.

While the general crypto landscape is in a blood bath, $PTGC stand out to be different as technical charts hints at an impending breakout with 700% surge in sight.

Trading below key moving averages, and momentum brewing should the crypto market stabilize , this altcoin might be the next big play as there isn't any CEX listings yet but already sitting on a market cap above $50 million.

What is The Grays Currency about?

The Grays Currency is the first truly decentralized DAO on Pulse Chain. It allows users to collect rewards simply by holding, with the option to earn double the rewards by staking without any time lock.

Ethereum (ETH) Forecast with NEoWave1M Cash Data Chart

Based on the price size of wave-B, it appears that a flat pattern with a regular wave-B is forming. In this pattern, wave -C typically retraces the entirety of wave -B, though a flat with a C-failure may occur at times.

Our primary scenario suggests that wave -C could conclude within the 1000–1200 range, indicating a flat with a C -failure. However, if the price breaks strongly through the 1000–1200 range and consolidates below this level, wave-C might extend to the 700–807 range.

Just In: $CORE Surges 15% Becoming The Top Performing AltcoinAlbeit the bloodbath besieging the crypto market, one asset stood tall defying market odds surging 15% today with about 86.58% increase in 24 hours volume. "CORE" or Satoshi Core is a L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps).

With increased volatility today, MIL:CORE stood different surging 15%. The asset still has room for a continuation trend as hinted by the RSI at 59.

In the case of cool-off, the 38.2% Fibonacci retracement level is a suitable point for consolidation further selling pressure could push it lower to the 1-month low axis. Similarly, should MIL:CORE break above the 1-month high pivot, the $1 resistant will be feasible, therefore, attainable.

Core Price Live Data

The live Core price today is $0.476759 USD with a 24-hour trading volume of $71,813,902 USD. Core is up 13.98% in the last 24 hours, with a live market cap of $476,107,555 USD. It has a circulating supply of 998,633,921 CORE coins and a max. supply of 2,100,000,000 CORE coins.

LTO - Shift in Momentun in Action!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 LTO is a perfect practical example of a momentum shift in action.

It’s clear that the bears are losing steam — the impulse moves marked in red are becoming flatter and smaller, forming a wedge pattern.

Moreover, LTO just tapped into a key weekly support zone near the $0.03 round number, making it a prime area to look for potential long setups.📈

🚀For the bulls to confirm this momentum shift in their favor and aim for the $0.05 round number as the first target 🎯, a break above the last major high marked in green at $0.0345 is essential ✅.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Ripple May Face Another Rally This YearRipple with ticker XRPUSD hit all-time highs for the final blue wave V as expected, so we should be aware of limited upside this year. However, despite recent slowdown, which we see it as an ABC correction within red subwave (IV), there can still be room for another rally this year, at least up to 4-5 area to complete final subwave (V) of V of an impulse on a daily chart.

BITCOIN | 1 DAY | '' Bitcoin will fall to $72,000 ''Hey everyone 💙

In the long run, I expect BINANCE:BTCUSD to drop to around $72,000. But don’t worry—this could actually be a sign of a massive rally ahead. If you're holding spot positions, there's no need to panic!

Big moves up often come after strong corrections. In my opinion, this dip is just a profit-taking phase, and the whales are setting the stage to push Bitcoin above $100K in the long term.

If you enjoy these insights, don’t forget to hit that like button🚀

DOT - Strong bounce from the ultimate low ?Bounced each time for consequent gains around 3.75, so I expect the same now

placed a SL a bit wide, a good fuel could be the 2.0 update of Polkadot but didn hear any news about it to be honest

In the other hand, lower would means I'll quit this asset for a mid/long term hehe,

Cheers

BTC 4H – Weak Bulls, Range Breakdown Ahead?Trading gets much easier when you understand the strength and weakness of trends and the market cycle. Right now, BTC is showing us clear signs of bull exhaustion.

🔍 Technical Breakdown:

Price has been trapped between FWB:88K resistance and GETTEX:82K support, forming a visible trading range.

Recently, BTC failed to even reach the middle zone of the range, which reflects weak buying momentum.

With multiple rejections and bearish pressure building, the GETTEX:82K support is likely to be broken soon.

🧭 Next Target: If the breakdown occurs, expect price to fall below $80K, targeting the liquidation zones highlighted on the chart.

💡 The structure is shifting bearish—prepare accordingly.

📊 Stay sharp and follow for more accurate market insights! 🔔

LTO - Massive Support => Bullish Potential!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

⚔️ LTO is retesting a massive zone , which marks the intersection of two key rejection points:

1️⃣ The $0.02 support level and psychological round number

2️⃣ The lower red trendline, acting as an oversold area

📚 According to my trading style:

As #LTO hovers around the blue circle zone, I’ll be watching for bullish reversal setups (such as a double bottom pattern, trendline break, and so on).

🏹 Moreover, from a medium-term perspective:

For the bulls to shift momentum in their favor, a break above both the upper red trendline and the blue structure is required.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

TIA | Next Altcoin to MOON ??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

In an earlier publication, I made an update about the ideal entry point for TIA:

A key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around. It is a bullish sign to see the gradual higher lows.

Moving Averages:

LAYERUSDT – Patience Wins the Trade📌 Green Box = Key Support Zone – This is where smart money might step in.

🚨 No Need to Rush Shorts!

Waiting for Price to Reach the Target → Jumping in too early is gambling, not trading.

LTF Confirmations are Everything → If we see a reaction + CDV confirmation, then we evaluate.

Break Below? → If price slices through support without demand, we shift the plan.

📊 Discipline beats impulse. Most lose money chasing trades—we wait, we execute, we profit.

✅I keep my charts clean and simple because I believe clarity leads to better decisions.

✅My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

✅If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

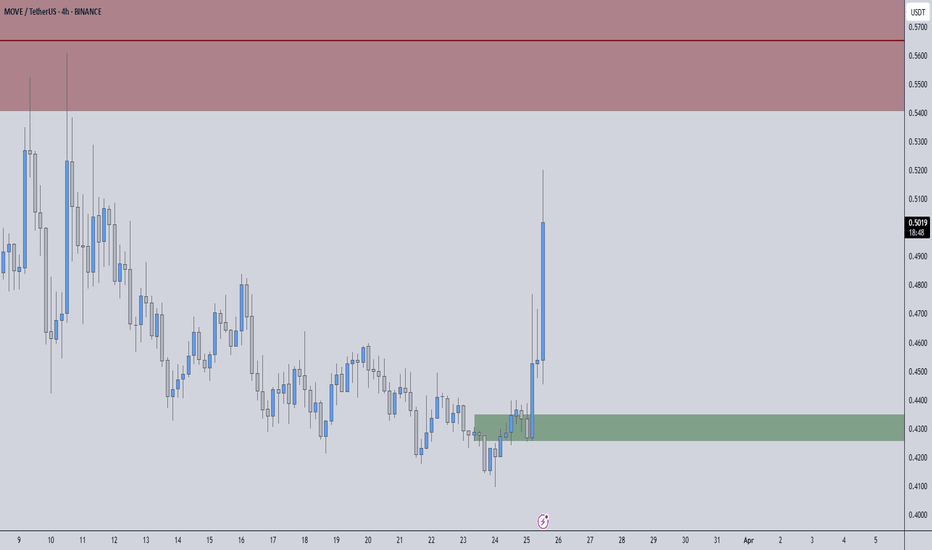

MOVEUSDT – High-Probability Setup, Stay Sharp📌 Key Levels Mapped Out – Now It’s About Execution.

🟢 Green Box = Strong Support – Buyers are showing interest, but confirmation is key.

🔴 Red Box = Major Resistance – A reaction here could lead to a solid rejection.

How We Approach This:

Support Holds? → We wait. LTF breakouts + CDV confirmation = high-confidence long. No guessing, just data.

Resistance Rejected? → No blind shorts. LTF shift bearish + CDV confirmation = strong setup.

Breakout? → We don’t chase. Retest + volume confirmation = real trade opportunity.

Most traders get caught in emotions—we don’t. We move with structure, volume, and confirmation.

Stay disciplined, execute the plan, and let the market do the work.

✅I keep my charts clean and simple because I believe clarity leads to better decisions.

✅My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

✅If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

BTC - 1H Clean Liquidity Hunt & Bearish Continuation BINANCE:BTCUSDT - 1H Update

Bitcoin remains in a bearish trend on the 4H and daily timeframes. After hunting the liquidity above the resistance zone, price began to drop exactly from our shared short entry at 83,700—and it's now on the move toward deeper targets.

🔹 Key Insights:

BTC grabbed liquidity just above resistance before reversing.

Price is now likely heading toward the liquidation zone below the support, aligning with the broader downtrend.

This setup offered a perfect short opportunity from $83,700, with clearly defined targets and risk.

🎯 Last Target: 80,200

💡 Congrats to all who followed our signal! The move is unfolding as expected.

📊 Stay locked in for the next big setups—follow for precise, real-time trade ideas! 🔔