TOTAL3 – Still Bullish, But Waiting for Clarity

In my previous analysis on TOTAL3, I mentioned the high probability of a correction, but also noted that I didn’t expect the 925–940B zone to be reached.

And indeed, price reversed early — finding support around 975B before moving higher.

However, after a push up to 1.07T, the market has started to pull back again.

📊 Current Outlook – Two Scenarios I’m Watching:

Bullish Triangle:

Price may continue to consolidate into a symmetrical triangle, then resume the uptrend from there.

Deeper Pullback into Support:

The market could retest the 925–940B zone, a key support area, before bouncing back up.

⚠️ Bearish Reassessment?

Of course, if price breaks back below 925B and stays there, we’ll have to reconsider the bullish case.

But for now, the trend remains intact, and there’s no technical reason to panic.

📌 My Plan:

I already hold a bag of alts, and I’m not adding for now.

I’ll wait until the pattern becomes clearer — whether it’s a triangle breakout or a dip into support.

Until then, I’m sitting comfortably on what I already hold.

Altcoinsignals

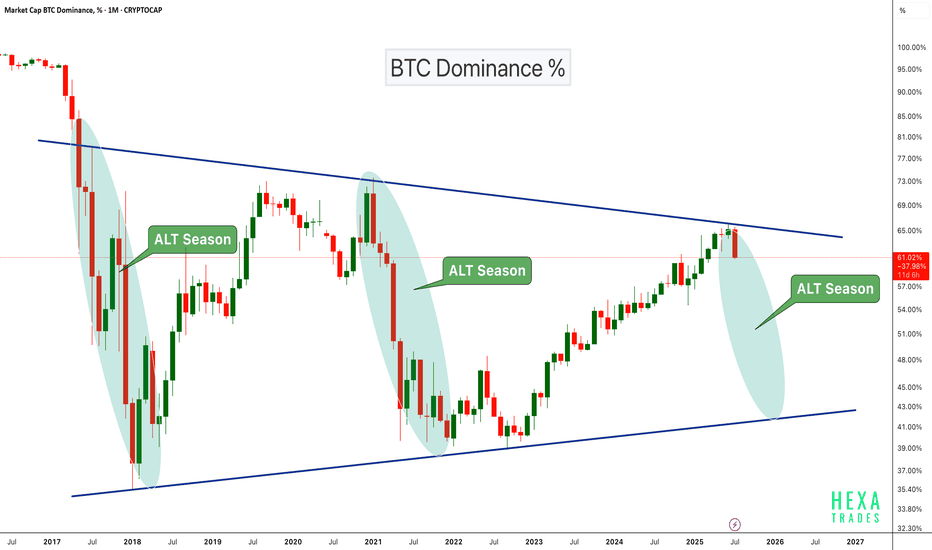

Altseason Loading?BTC Dominance chart has once again respected the long-term descending trendline resistance, showing a sharp monthly rejection. Historically, similar rejections have marked the beginning of ALT seasons, where capital flows out of Bitcoin into altcoins, boosting their performance significantly.

Chart Highlights:

-Major triangle pattern since 2017

-Clear rejections from the upper trendline coincide with previous ALT seasons (2018, 2021)

-Current rejection resembles those past cycles

-A move down in dominance could fuel strong altcoin rallies

If BTC dominance continues to decline, we could be entering another powerful altcoin season in the coming months.

Cheers

Hexa🧘♀️

CRYPTOCAP:BTC.D BINANCE:BTCUSDT

Your Guide to Token Trends & Market Action – With My AnalysisHey everyone! Hope you're all enjoying a great weekend !

If you'd like a Token analysis , please drop your request in the comments using the format below:

Request Format :

Project Name: Bitcoin

Token Symbol: BTC

Please Note:

I’ll be analyzing up to 10 tokens only .

One request per person — make it count!

Your analysis will be posted directly as a reply to your comment .

If you find this helpful, don’t forget to ✅ Like ✅ and Share it with your friends.

Wishing you health, wealth, and massive success!

ALTSEASON is here!The Crypto Total Market Cap (excluding the Top 10 coins) broke above the 1D MA200 (orange trend-line) and is consolidating on an overbought 1D RSI (>70.00).

Since October 2023 when this set of conditions emerge, the long-term Channel Up starts a rally (technically its Bullish Leg). This is what in the crypto world is known as 'Altseason',which is when the lower cap coins see enormous gains relative to the top 10.

The last Bullish Leg (2024) rose by +200%. The previous one, even more. If it 'just' repeats the +200% Leg, we are looking at a market cap of $525 Billion.

The time to invest in alts is now!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

The chart #MANEKIUSDT looks strong📉 LONG BYBIT:MANEKIUSDT.P from $0.002990

🛡 Stop loss: $0.002772

🕒 Timeframe: 1H

📢 Market Overview:

➡️ The token broke out impulsively after consolidating above the Point of Control (POC) at $0.002253 — a strong bullish sign.

➡️ The BYBIT:MANEKIUSDT.P stop-loss is set just below the key accumulation zone, at $0.002772 — a logical support level.

➡️ The volume profile shows heavy interest below current levels, indicating buyer support.

➡️ Current price ($0.002915) is slightly below the entry zone but testing resistance around $0.002944.

➡️ A breakout here could quickly push price to TP1 and TP2.

🎯 TP Targets:

💎 TP 1: $0.003100

💎 TP 2: $0.003210

💎 TP 3: $0.003300

📢 Watch for confirmation above $0.002944 — this would open the way toward TP1.

📢 Weak breakout may trigger a retest of the entry area.

🚀 The chart BYBIT:MANEKIUSDT.P looks strong — bullish momentum could continue!

Stockholm Syndrome in Crypto Trading: Why We Stay LoyalLet’s be honest: altcoins haven’t been performing as well as many would like.

As I’ve started pointing this out through posts and videos, I’ve received a fair share of criticism. Whenever I mention the possibility of a market decline, I’m met with hate, while others who claim the market is heading to the moon are celebrated.

What’s baffling is that no one seems to ask, “Hey, you’ve been saying ‘altcoin season’ is coming for a year, yet we’re still stuck around the same prices. What’s going on?”

This got me thinking: Could this be a form of Stockholm Syndrome in trading?

________________________________________

What is Stockholm Syndrome in Trading?

Stockholm Syndrome is a psychological phenomenon where hostages develop positive feelings towards their captors. In trading, it’s a bit like this: traders grow emotionally attached to a losing market, even when all signs point to the fact that things aren’t going well.

Instead of cutting losses and accepting reality, they keep holding on, hoping things will change – just like a hostage hoping for their captor's kindness.

In trading, this manifests as traders continuing to support a market (like coins or certain stocks) that isn’t performing, even when the evidence suggests it’s time to move on.

They become attached to the idea that a specific asset will turn around and deliver massive profits – even when the price action doesn’t back that up.

________________________________________

The Comfort of Familiarity

Many traders are caught in the cycle of constant hope and “what ifs.” It’s much easier to stay attached to the narrative that specific coins will eventually “take off” than to admit that their portfolios might be stuck sideways or even bear market.

It's also easy to get drawn into the excitement of “moonshots” and grand promises of big returns. The altcoin season, the bull run, the new innovations – these ideas are comforting, even when the market isn’t cooperating.

But here’s the catch: sticking with a market that’s not performing well out of loyalty is dangerous. It stops you from adapting, from making the necessary moves to protect your capital, and from taking advantage of more promising opportunities elsewhere.

________________________________________

The Reality of the Market

Altcoins have been on a rollercoaster. The hope for altcoin season has been building up for over a year now, yet many traders are still facing stagnant or even declining prices. When faced with this reality, we often see two types of responses:

1. The Blind Optimist:

Some traders will continue to hold and buy into altcoins, even when it’s clear the market isn’t moving in their favor. They believe that the next big move is just around the corner, and they refuse to let go of the dream.

2. The Critic:

Others, like me, will point out the slow or negative price action, urging caution and suggesting that a pullback or continued consolidation is more likely. But when we do, we’re met with anger, disbelief, or even accusations of “fear-mongering.”

It’s frustrating to see those who remain hopeful get so emotionally attached to a failing asset, while others who try to see things more clearly get met with hostility.

________________________________________

The Dangers of Stockholm Syndrome in Trading

When traders fall into this “Stockholm Syndrome,” they stop questioning their strategies and beliefs. They become too emotionally involved with a market that isn’t giving them the results they want.

This prevents them from making the tough decisions they need to make to protect their portfolios – whether that’s cutting losses or re-allocating capital to more promising assets.

It’s also a trap that keeps you stuck in an echo chamber of hope and denial, rather than facing the market with logic and clear-headed analysis.

The longer you stay loyal to an asset that’s underperforming, the more you risk watching your portfolio sink further.

________________________________________

Breaking Free: A Rational Approach to Trading

The key to successful trading is learning to let go of emotional attachment. Don’t hold onto an asset simply because you’ve been told it will perform or because you’ve invested a lot of time and money into it.

Here are a few ways to break free from the Stockholm Syndrome in trading:

1. Focus on the facts:

Look at the actual price action and market conditions, not the narrative you’ve built around it. If the market isn’t moving, don’t force a belief that it will soon.

2. Admit when it’s time to move on:

It’s not about being right or wrong – it’s about protecting your capital. If an asset isn’t performing, consider cutting your losses and finding new opportunities that align with your trading strategy.

3. Stay flexible:

The market is dynamic, and you need to be able to adjust your strategy based on current conditions. Don’t get stuck in a “one-size-fits-all” approach.

4. Let go of the need to be loyal:

Trading isn’t about loyalty; it’s about profits and risk management. Sometimes, moving on is the best decision for your financial health.

________________________________________

Conclusion

If you’ve been stuck in the cycle of hoping that altcoins will suddenly surge, or waiting for the long-awaited altcoin season, it might be time to reconsider your approach. It’s important to recognize when you’re emotionally attached to a market that isn’t performing, and break free from that attachment.

By focusing on logical analysis, cutting losses when necessary, and staying flexible in your approach, you can avoid the dangers of Stockholm Syndrome in trading and move towards more profitable opportunities.

Remember: Trading isn’t about loyalty to a coin or a narrative – it’s about making smart, objective decisions that will help you grow your capital.

ALTSEASON Merry Christmas with the biggest Buy Signal out there!First let's start this post by wishing Merry Christmas to the whole community!

It's yet again the total crypto market cap (excluding the top 10 tokens) that we are looking at as this time we have the strongest possible buy signal on the 1M chart! The 1M MA20 (blue trend-line) has completed a cross above the 1M MA50 (orange trend-line). The last time this happened was during the previous Bull Cycle on the most symmetric time possible, December 2020. In the meantime, the 1M CCI was almost at the same level (around 180.00).

This sense of highly cyclical repetition, indicates that the following months could be as aggressive as January - May 2021 for the market, when it topped on the 1.618 Fibonacci extension from the Cycle bottom. If that feat is repeated, we look towards a 1.65 Trillion market cap in 2025. We can't be more bullish for an upcoming Altseason than that!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ALTCOINS to the moonCRYPTOCAP:BTC.D

* Since 9 September 2024 and the chart still following the pig picture & the big plan as well .( please check the post below here).

* It was so nice entries & it was altcoins bottoms.

* Retest for the reversal range breakout is already done and you could see that in the altcoins chart.

* Now the BTC. Dominance need to break 53.71% and close 1W Candle below.

* Then re-test to continue dumping.

* I think the next wave for the altcoin is so huge , if you missed the bottoms you still have another opportunity with this correction.

* May be some coins will give you nice entry by the end of this month.

* This plan may take long weeks to be done.

* I was expecting BTC price is going to dump before going to 100K but it worked against my plan but in the end BTC price broke the high so ( BTC price now is in the market maker hands & under their control).

*I did mistake because the chart was showing that BTC is going up but i thought it is a trap because i was emotionally controlled by the media & i did not believe the chart.

*To review the previous post for BTC. Dominance check it below...............

______________________________________________________________

Golden Advices.

********************

* This is my expectation for next weeks & may be i am completely wrong, Please do your own plan.

* Please calculate your losses before entering any trade.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

@Crypto_alphabit

________________

Token name from you, Analysis with meHi everyone, I hope you have a great weekend .

Please write the Project name and Token symbol in the comment section, and I will then share the token analysis with you.

Please pay attention to the conditions.

For example, write Bitcoin(BTC) in the comment.

Project name: Bitcoin

Token symbol: BTC

A maximum of 20 tokens will be analyzed for you .

For each follower, please register only 1 analysis request in the comment section.

Your token analysis will be shared below your comment .

If you found this helpful, please Hit the ✅ Like Button ✅ (It fuels my energy) 💪 and Share it with your friends! Let’s grow together! 🙏😊

Wishing you health, wealth, and success! 🚀💸

NEAR: The Next Coin Poised for a MoveAfter observing the strength in UPCOM:FTM and LSE:TIA , I decided to focus more on some previous coins that showed resilience and were among the early movers, like $SOLANA.

AMEX:NEAR is now in play, as it was one of those coins that experienced positive growth.

I entered the trade close to $4 and will allow it enough space to move. Tomorrow’s events seem to be priced in, with a 25bps cut almost certain and a 50bps still unlikely based on my view of the Fed’s actions.

AVAX SWING LONG IDEA - ALTCOIN SEASON 2024-2025AVAX is one of the most well-known coins, backed by strong fundamentals. I believe it will perform well during the 2024-2025 bull run.

The price is currently coming from a monthly demand zone, showing solid rejection and strength. It has also broken the diagonal trendline that signaled the previous bearish trend. Both weekly and daily momentum are strongly bullish, further supported by Bitcoin's strength.

I expect a retracement to the weekly demand zone and the maximum discounted area, with a possible retest of the broken bearish trendline. From there, I anticipate a move up toward the targets.

LTF confirmations will be needed to initiate the trade.

The new ALTSEASON is starting. Will you miss the train?We see many indicators both technical and fundamental this week that point out the alt coin market may be on the verge of a price explosion, what we most commonly refer to as 'Altseason'. So far on this Cycle we've had the 1st from June 2023 to March 2024. The 2nd however that completes the Bull Cycle, tends to be more aggressive.

On this chart we view the Crypto Total Market Cap excluding the Top 10 on the 2W time-frame. As you can see, the price found support on the MA50 (blue trend-line) for 4 consecutive candles and now with higher closings, looks ready to make the decisive break-out.

Relative to the previous two Cycles, it appears that we are on the exact part on the 0.382 Fibonacci retracement level, where both final Parabolic Rallies (altseason) started. The RSI and MACD in particular showcase significant resemblance with December 2016. A MACD Bullish Cross, is the only indicator left to confirm the rally.

Since both of those historic rallies reached at least the -1.5 Fibonacci extension, there is no reason yet to expect otherwise. As a result, a 3T target towards the end of 2025 appears to be feasible.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Omni price targetsOmni one of not so many coins which I follow for accumulation!

One of the main reasons for this, next unlock will be only in April 2025

Till that time we will not see any new coins in circulation BINANCE:OMNIUSDT

Possible Targets and explanation idea

➡️IAP model for Omni. Marked 2 zones for accumulation

➡️Tagets where more than ok withdraw initial deposit or fix % profit also marked

➡️Im more than sure we will see new ATH for Omni, matter of time 2024-2025

➡️Money power indicator, money inflow step by step at 17.75

➡️Would be good to see drop in first zone to buy and new money inflow

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

FRIGHTENING DEVELOPMENT ON MARKETIn the 4-hour logarithmic chart, the Dollar index has completed a 'head and shoulders' (Tobo) formation and a horizontal resistance breakout. It is currently retesting. If it closes the week like this, there could be a deepening correction in BTC and Altcoins next week.

We will follow up.

This is not investment advice.

AUCTION - Altcoin Will Moon

MartyBoots here. I have been trading for 17 years and I am here to share my ideas with you to help the Crypto space. The Bull market is here.

There is a huge difference in accumulation between accumulation and distribution. Auction is in accumulation.

This is a moon structure. Be prepared to make large gains from this pattern.

Please watch the video for more information

Have a great evening.

Long trade setup for CYBERUSDT.PFor the BINANCE:CYBERUSDT.P Long Trade Setup, the following values are suitable for our interval trade:

Entry: 5.835

Target: 6.530 (+%11.91)

Stop: 5.490

Cost Reduction: -

The profit is reasonable relative to the risk.

*This is not investment advice; you can lose money. Crypto AI Signals is not responsible for any trades. 🚫💰

ALTSEASON about to break-out aggressively!TOTAL3 which measures the Crypto Total Market Cap excluding Bitcoin (BTCUSD) and Ethereum (ETHUSD), is essentially a metric of the altcoin market. It's movement in relation to previous Cycle is indicative of what we call an 'Altseason', when this market segment rises disproportionally to the rest.

The price tested the 1W MA100 (green trend-line) last week for the 1st time since May 2022 but failed to break it and closed the week below it. With the rejection also being on the (dashed) top of the Ascending Triangle (bottom formation pattern), it appears that the market is replicating the sequence of January 20 2020. Even the 1W ROC patterns are identical.

As a result, a candle closing above the top of the Ascending Triangle, will be a buy signal for us, targeting initially the 0.5 Fibonacci level at 570B (as it did in July 27 2020 and wouldn't have done earlier if it weren't for the COVID crash). Then the 0.618 Fib should be targeted, which should give the final +/- 1 month consolidation before new All Time Highs.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Long trade setup for WLDUSDFor the BINANCE:WLDUSDT.P Long Trade Setup, the following values are suitable for our interval trade:

Entry: 5.6427

Target: 6.062

Stop: 5.3825

Cost Reduction: -

The profit is reasonable relative to the risk.

*This is not investment advice; you can lose money. Crypto AI Signals is not responsible for any trades. 🚫💰