ETH | Either OR Scenario | ALTSEASONThe previous update was on the current low that ETH hit a couple of days ago, and what happened the previous time we hit that price:

POTUS Donald Trump signed a bill that exempts DeFi platforms from reporting on their clients' taxes, unlike traditional brokers. This may explain the bullish sentiment we're observing across the market currently.

💥 ALTS Part 1 and 2 below, stay tuned for Part 3 ! 💥

____________

BINANCE:ETHUSDT

ALTS

XLM/USDT Secondary trend. 14 04 2025Logarithm. Time frame 3 days. After a big pump "with a stick" (so that the "waiters" who want "a little cheaper" would not have time to buy) +8.5X from the accumulation zone of 2.4 years, now a descending wedge is forming on the rollback, similar to 2017. Breaking through its resistance (breaking the downward trend) - the second wave of price growth:

1) through consolidation and sideways movement (cutting the zone, dumping "in waves").

2) aggressive pump as in 2017 "with a stick" and entry into the main distribution zone (late autumn 2025)

The previous idea of the secondary trend was published on 14 01 2024 Exactly when the position was being collected in the horizontal channel in the 4 zones shown, as well as the reversal zone and the percentage of this first strong pump (under XRP).

XLM/USDT Secondary trend. 14 01 2024

XLM/USD Main trend. Timeframe 1 week. Channel. Publication in 2022.

Local wedge breakout zone.

STRK Main Trend 12 04 2025Time frame 1 week for clarity.

Descending channel is the main trend.

Descending wedge is a secondary trend.

Showed the mid-term percentage for targeting potential profit within the channel after breaking through the wedge.

The price reached the lower zone of the descending channel of the main trend -96%.

This is conditionally the bottom for similar assets of such liquidity -95-98% . You can even say the minimums of minimums, beyond which there is only a complete scam, which is probably not distributed as an asset. Throughout the history of the formation of the descending channel, the trading volume was supported, many buybacks. The same volume is also pressuring to buy with “discounts”, what was previously poured "investments for billions of dollars" on Twitter during the listing.

Secondary trend, descending wedge and bearish trend break zone.

Time frame 3 days.

ALTS may be starting an explosive rally.This chart shows the Crypto Total Market Cap (excluding top 10) dominance trading inside a Megaphone pattern that just bottomed. The bearish wave is identical to the first that made a double bottom LL on August 5th and kickstarted an altcoin surge that peaked on December 7th 2024. The first target of this setup is 9.20%.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Ethereum Failing against BITCION ? Here is a valid reason why.

In a world being thrown upside down and sideways and Markets Rising and falling and Rising again on a few words and actions, there is one Shining Light in the world of Crypto

Ethereum - And its constant DROP when compared to BITCOIN

It is possibly the Only coin in the top 10 that has failed to rally at least once, to any significant degree since 2023, when nearly everything else took off.

It currently sits at the same price it was in May 2020 !

It reached its ATH in Nov 2021 and ever since then, has fallen in what is becoming a parabolic reverse curve;

All this despite coins like BASE, Coinbases Crypto, being based on that ETH Layer.

This is pretty well ALL down to the adoption of BITCOIN by corporate ventures, keeping the Bitcoin Dominance high.

I mentioned in a post back in 2023 ( maybe here but certainly on X) how BTC could be used in the "Financial Wars" to come, as a means to weaken and scupper ALT coins.

They tried to Destroy crypto, they failed and so, by allowing Bitcoin ETF's etc, BTC dominance remains High and ALTS Fail

And that is EXACTLY what we have seen so far. As Corporations continue to Buy Bitcoin, Dominance remains high..... It isd as simple as that.

And this ETH BTC chart shows that very clearly.

The REAL question is why the ETH ETF's failed so much.

Maybe that is because MANY people realised the "energy behind Ethereum" - The American crypto , Protected by Gensler and predecessors. The Not really Descentralised structure and power if you hoold a LOT, something not many independants can do

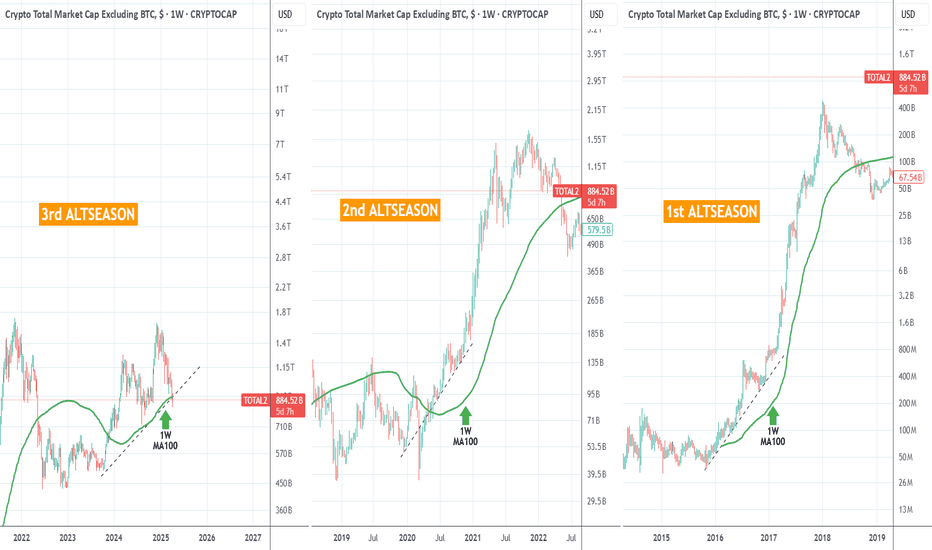

Is there any chance for an ALTSEASON now??Just some chart fun. Do you think the pattern will be completed and the current altcoin Bull Cycle will follow the previous two? Do you think there will be a new Altseason amidst the tariff chaos?

Whatever happens, the 1W MA100 (green trend-line) has to hold (close 1W candles above it) if that would be the case and it just got breached.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

FIFA WORLD CUP HISTORIC ROARING 20s QE Restart ScenarioBenjamin Cowen has been truly amazing with his analysis. As per monetary policy it's definitely too early to call the start of QE but we're on the right track.

it almost feels like the true Altseason will start when the FIFA World Cup starts. Every single scenario matches that theory. If you also pay attention to Algorand for instance, it's mimicking the early days of XRP. XRP is also mimicking the early years of Apple.

Can you imagine a scenario where XRP hits 120 dollars and Algorand 1200 dollars? I know I know the market caps etc. But so far it does feel like the markets are brewing for a truly historic roaring 20s scenario that could last for years.

Big question is, who has the first mover's advantage now and needs to catch up in the mean time?

I'm looking at tiny caps like Metastrike, and institutional coins like VeChain. China has already started QE so you may want to play around with VET while the entire market is boring.

JasmyCoin I can't tell yet, it could be but it has that annoying monitoring tag and in my case I've already survived 7 delistings already (dock, ooki, troy, gifto, gemie, kingdomverse, dreamsquest), so not touching it for now.

Looks very promising to be honest. Gotta have a long term vision here.

Is BTC Dominance about to reverse and start an Altseason?Well its undoubtedly what the crypto investor wants and what the market would have technically given in February if it wasn't for the tariffs trade war. Bitcoin's Dominance (BTC.D) is trading within a Triangle and February's test of the 0.786 Fibonacci retracement level was the technical level that should have given a rejection.

That rejection technically starts the Altseason which was dominant via a Bearish Leg both in 2017 and 2021. So far though both February's and March's 1M candles closed below the 0.786 Fib and April has an opportunity to even test the monthly body candles Lower Highs, which is the top of the Triangle. This is the last level that a rejection can be technically given.

Can this start an Altseason?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

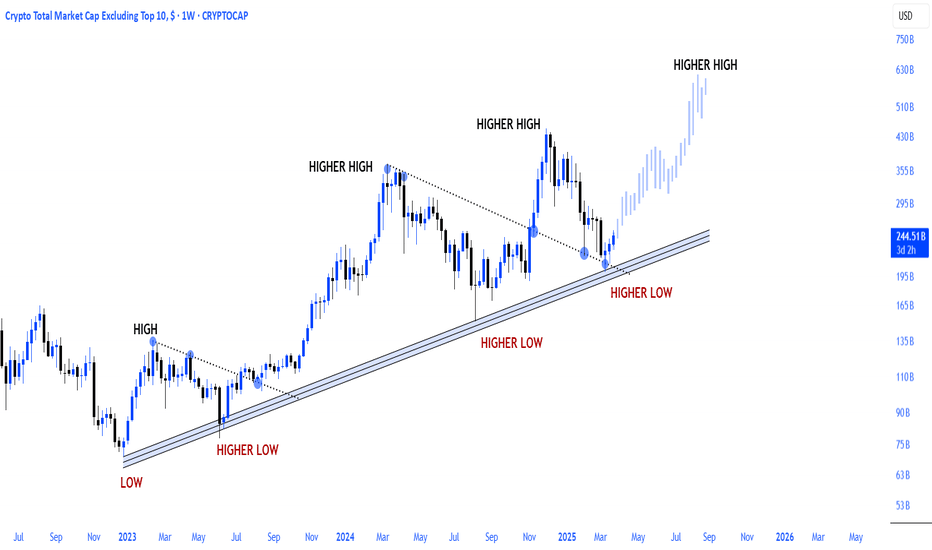

ALTCOINS has already started the new parabolic rally.Altcoins (excluding top 10) are repeating the 2015-2017 market structure.

Based on the 1week RSI we are at levels similar to July 2017 when the market kickstarted the final parabolic rally of the Cycle.

We expect the market to reach the $1 Trillion market cap mark before the end of 2025 and peak the Cycle there.

Follow us, like the idea and leave a comment below!!

SNTUSDT Analysis: Avoid Getting Stuck in Mid-RangesI don’t want you to get lost in the mid-range areas . For SNTUSDT, I believe the blue box is a high-value demand zone . Given that overall market conditions are weak , I’ve identified a lower entry point that aligns with a safer and more strategic approach.

The blue box holds significance from multiple perspectives . I used heatmap , cumulative volume delta (CVD) , and volume footprint techniques to determine this precise demand region where buyers could potentially regain control.

Key Points:

Avoid Mid-Ranges: Focus on clear demand zones to avoid indecision.

Blue Box: A critical demand zone identified as a potential buyer area.

Techniques Used: Heatmap, CVD, and volume footprint for accuracy and precision.

If you'd like to learn how I use these tools to pinpoint such precise demand zones, just DM me!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

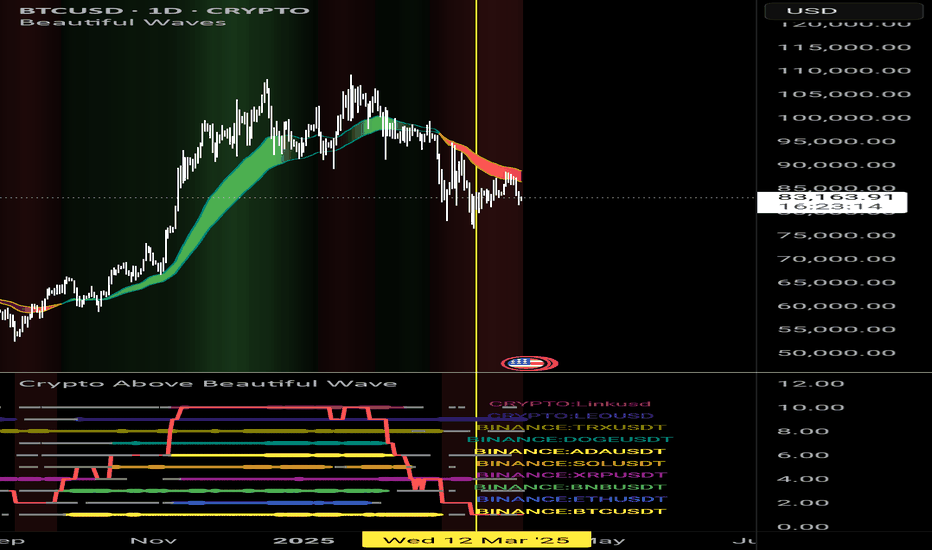

Good r:r on alts.I have made market watch baded on indicator on main screen. It aggregate view on main alts. Fat dot is bullish. Thin coloured dot is signaling possible entry. Gray dot is bearish. No dot is just downtrend. Solid line is showing how market is performing. Now its valie is 1. In the recent past it was good place to enter long trades. Marked with yellow lines. Be aware. If this is entry into bear market there will be dead cat bouces so manage your risk.

XRP in BIG TROUBLE | BearishXRP is known as the "PUMP and DUMP" alt for a reason.

If you look at this chart from the macro timeframe, it clearly shows how XRP dumps hard after every parabolic increase - and this isn't even the entire price history..

The lower highs and lower lows we currently observe are not helping its case, either.

Pulling up the technical indicator in the weekly timeframe and we see a clear SELL - indicating that the price/trend has turned bearish.

And from what we know of XRP - it's likely that the price will drop ALL the way back to the lows, aka the beginning of the parabolic rally - possibly even further down.

______________________

BINANCE:XRPUSDT

ALTSEASON: Is it really just around the corner?The Crypto Total Market Cap (excluding the Top 10) seems to agree. And it's simply because the price has already broken past the Cycle's Triangle and despite the correction, remains supported on the HL bottom trendline. According to the 1W CCI we are currently well in line with the previous two Cycles and even though the market is unlikely to reproduce the strong returns of especially the first Cycle, it does suggest that there is one last (All Time) High left. A mere 1.382 Fibonacci extension test, will give us the much sought 1 Trillion USD target.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ALTSEASON 2025Dear investors and traders, members of the Horban Brothers community!

Today I come to you not with a warning of an impending crisis, but with the certainty that we are on the threshold of significant changes. The cryptocurrency market, which has been wavering in uncertainty for a long time, is finally entering a phase of active growth. Yes, you heard me right - from this moment, from today, we see all the signs that cryptocurrency is ready to take off.

All the data points to this: institutional investment in cryptocurrency is up 400% year-on-year, regulation is becoming clearer, leading to increased confidence among the big players, and most importantly, technological innovation in blockchain continues to convince even the most skeptical.

Make no mistake, the volatility of the cryptocurrency market will not go away, but those who are willing to accept these risks can expect rewards that are rarely seen in traditional markets. I'm not suggesting you rush out to buy everything, but carefully analyze those assets that show fundamental strength and technological resilience.

Now is not the time to be passive. Check your portfolios, reassess your strategies. If you're still standing on the sidelines of cryptocurrencies, now is the time to get in on the action. But remember, this is not for the faint of heart - this is a game for those who are willing to study, analyze and act.

This market, like any other, requires discipline and knowledge. Don't get caught up in emotions, don't fall for the hype, evaluate each project critically. But if you see that the project has potential, do not be afraid to invest.

Remember that cryptocurrencies are not just tokens; they are the foundation of the future financial world. And that world is already beginning to take shape.

Regards CFO Horban Brothers,

Alex Kostenich

Altcoins Can Explode In 2025 [READ CAREFULLY]Hello, Skyrexians!

It's time to update our CRYPTOCAP:OTHERS.D idea. In fact nothing changed still. We don't have the growth confirmation, but let's put together all facts which tell us that this growth can happen soon.

Let's take a look at the weekly time frame. We can see that Bullish/Bearish Reversal Bar Indicator gave us the green dot signal. This signal is unconfirmed. For confirmation we need breakout of 9% level. Much better if candle will be closed above it. This fact can finish the huge ABC correction which has been started after the previous altcoin season. This reversal bar has the great angle with alligator which is another one sign of soon trend change. All these signals can bring the dominance above 20%. In this case we will see massive gains on altcoins.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ACXUSDT – Resistance Zones Marked on the Chart!

“Key levels ahead—will resistance hold or will we see a breakout?”

🔥 Key Insights:

✅ Resistance Zones Clearly Defined – Watch for strong reactions.

✅ Rejection = Short Setup – Only with LTF breakdown + CDV confirmation.

💡 The Smart Plan:

Focus on LTF (15M & 1H) Price Action – Breakout or rejection will be clear there.

Use CDV & Volume Profile – Don’t trade blindly, follow the data.

Let the Market Show the Way – We react, not predict.

“Patience + Smart Entries = Winning Trades—watch the chart, trade the plan!” 📉

A tiny part of my runners:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ALTSEASON Party like 2021 is about to start.This is the unique ratio of the crypto total market cap excluding the top 10 against Bitcoin.

The market is consolidating for 7 straight weeks after rebounding on the top of the former Triangle of the previous Cycle.

Basically it this bearish leg is almost identical to October-December 2020. This kickstarted the Altseason of 2021.

We expect a similar altcoin rally to start as in 2021.

Follow us, like the idea and leave a comment below!!

TIAUSDT – Weak at Key Weekly Level! More Downside Ahead?TIAUSDT – Weak at Key Weekly Level! More Downside Ahead?

“This chart looks weak—momentum favors the downside. But is there a bounce first?”

🔥 Key Insights:

✅ Sitting at a Critical Weekly Zone – A breakdown here could be brutal.

✅ Momentum Looks Bearish – No real strength from buyers.

✅ Only Considering Low-Risk Buys – Fibonacci Green Zone (0-0.5) is the ideal cheap area.

💡 The Smart Plan:

Looking for a Break & Retest Downward – If support cracks, shorts become clear.

Small Risk Buys from the Fibonacci Zone – Only for aggressive traders.

CDV & Volume Profile Must Confirm – No buyers? No trade.

“Weak price action, heavy risk. Only the right levels matter here—watch closely!” 📉🔥⚠️

A tiny part of my runners;

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

INJ | ALTCOINS | Bottom Likely CLOSEIn the previous cycle, INJ made a near full retracement after the bullish cycle.

This would put us round here, to which we are already fairly close:

To make it a little easier to reference, I'll use the Elliot wave tool (although these are not Elliot waves).

In short, the bottom is likely very close for INJ - but accumulation / sideways phase may take another while.

_______________________

BINANCE:INJUSDT